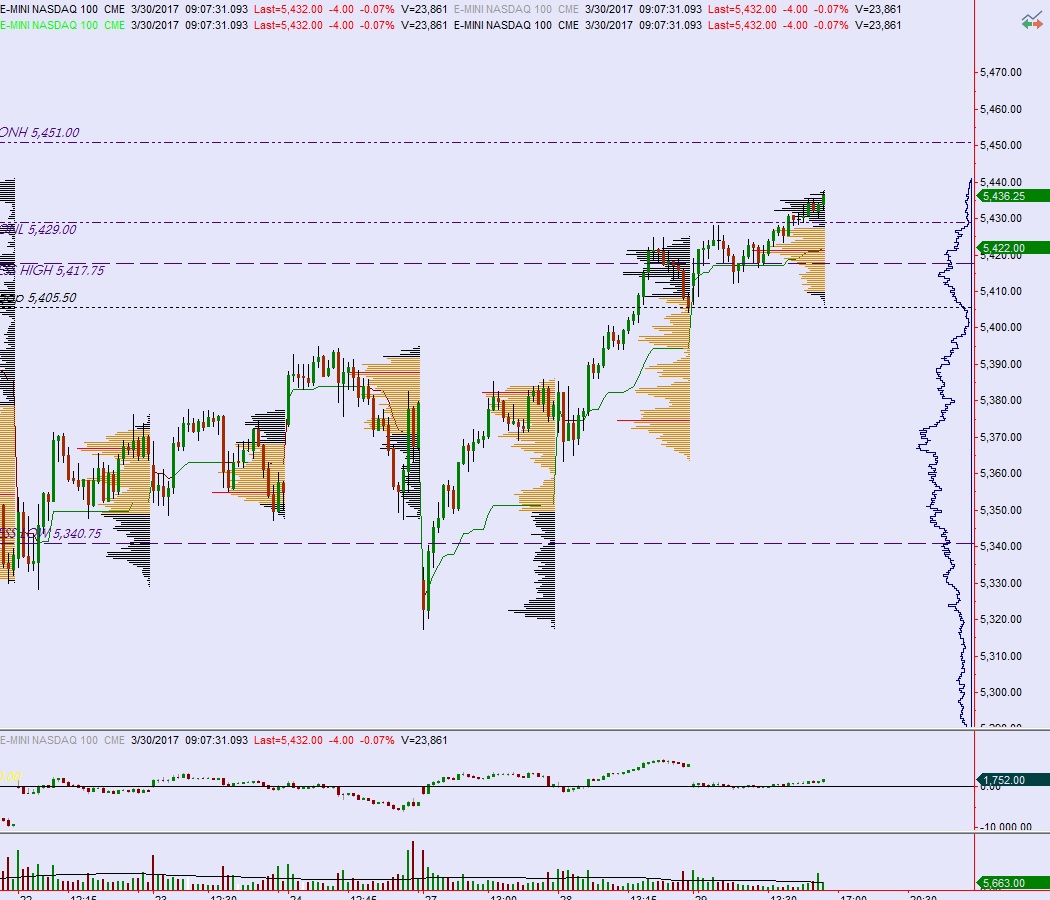

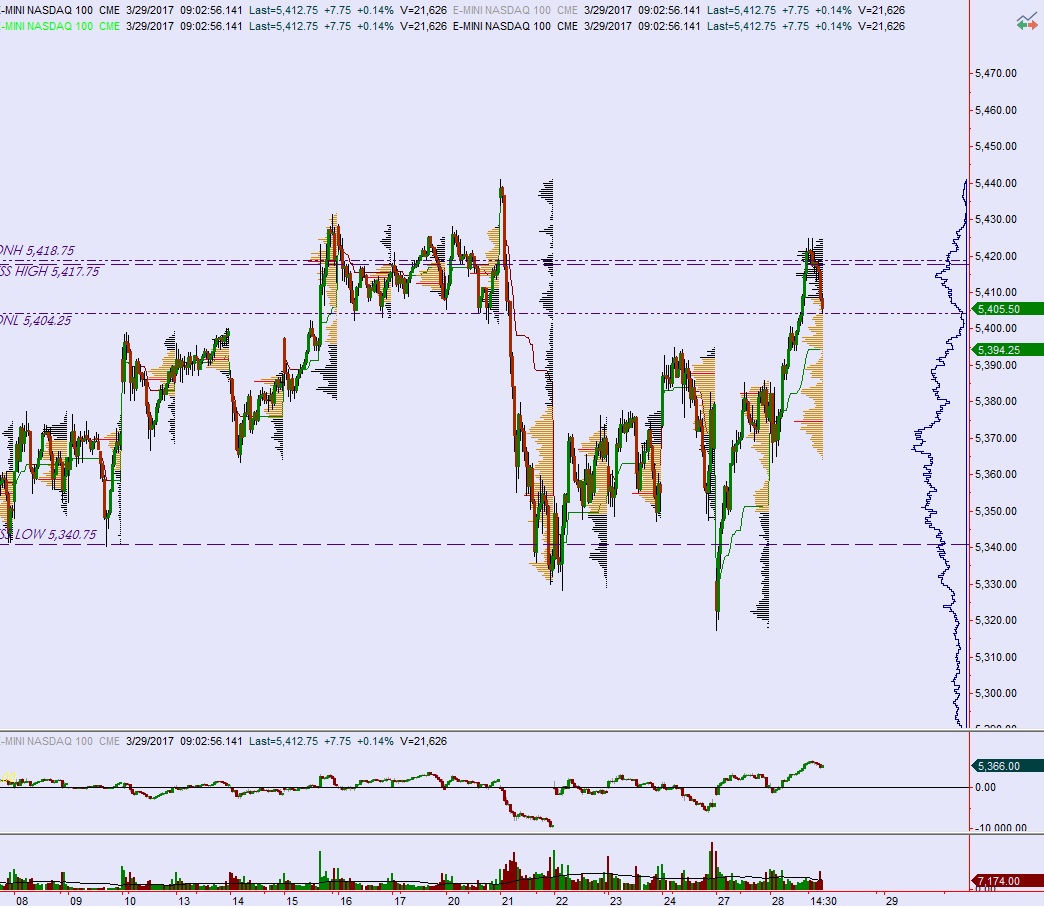

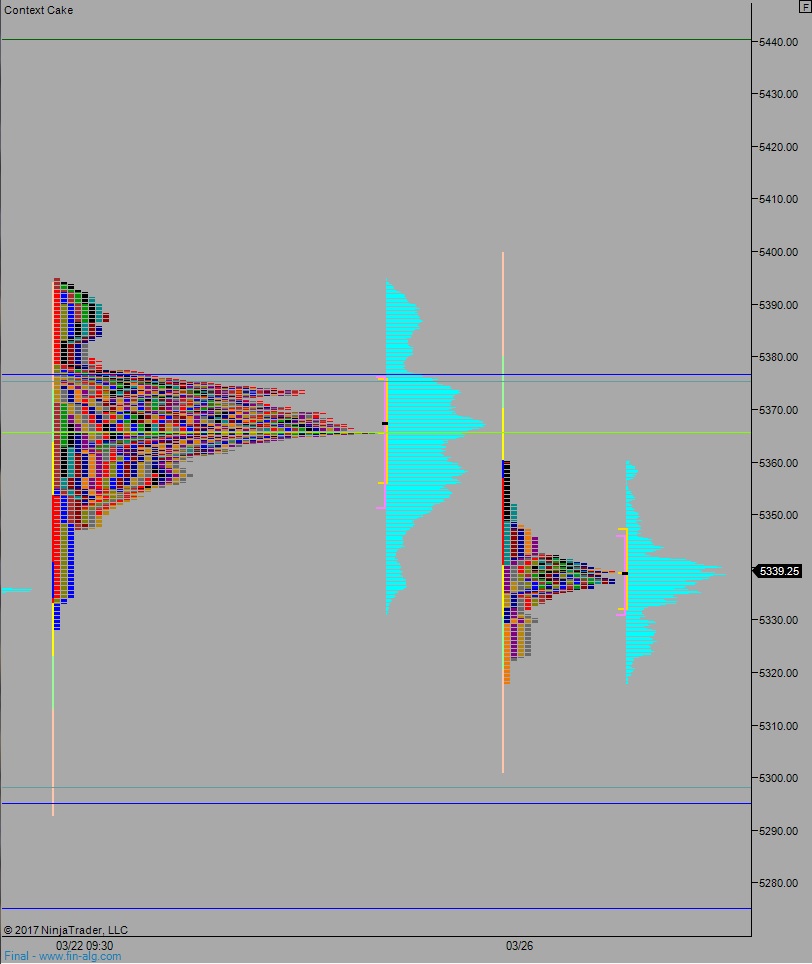

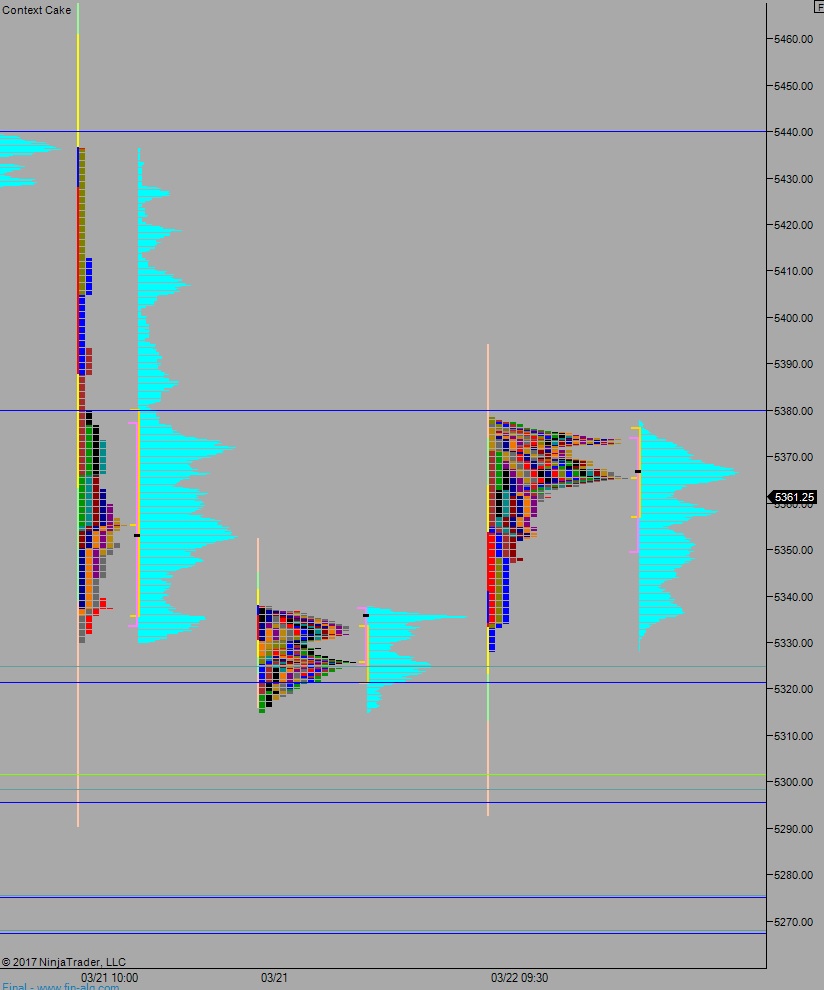

NASDAQ futures are coming into Friday gap down after an overnight session featuring elevated range and volume. Price made a sharp move lower around 9:13pm after the U.S. military launched nearly 60 Tomahawk missiles against a Syrian air base. The reaction pushed down to prices not seen since Tuesday of last week before establishing a bid and worked higher, reversing the entire reaction. At 8:30am Non-farm payroll data was mixed. The initial reaction is a slight move lower.

Also on the economic docket today we have Wholesale Inventories at 10am, the Baker Hughes rig count at 1pm, and Consumer Credit at 3pm.

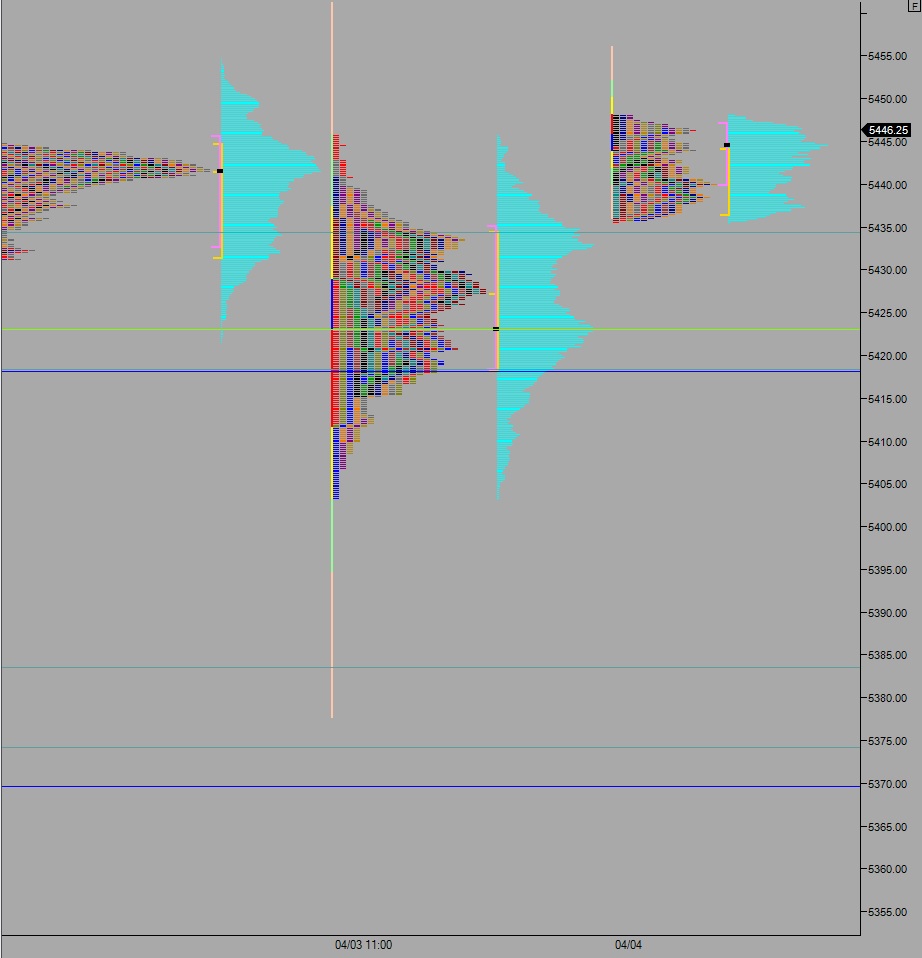

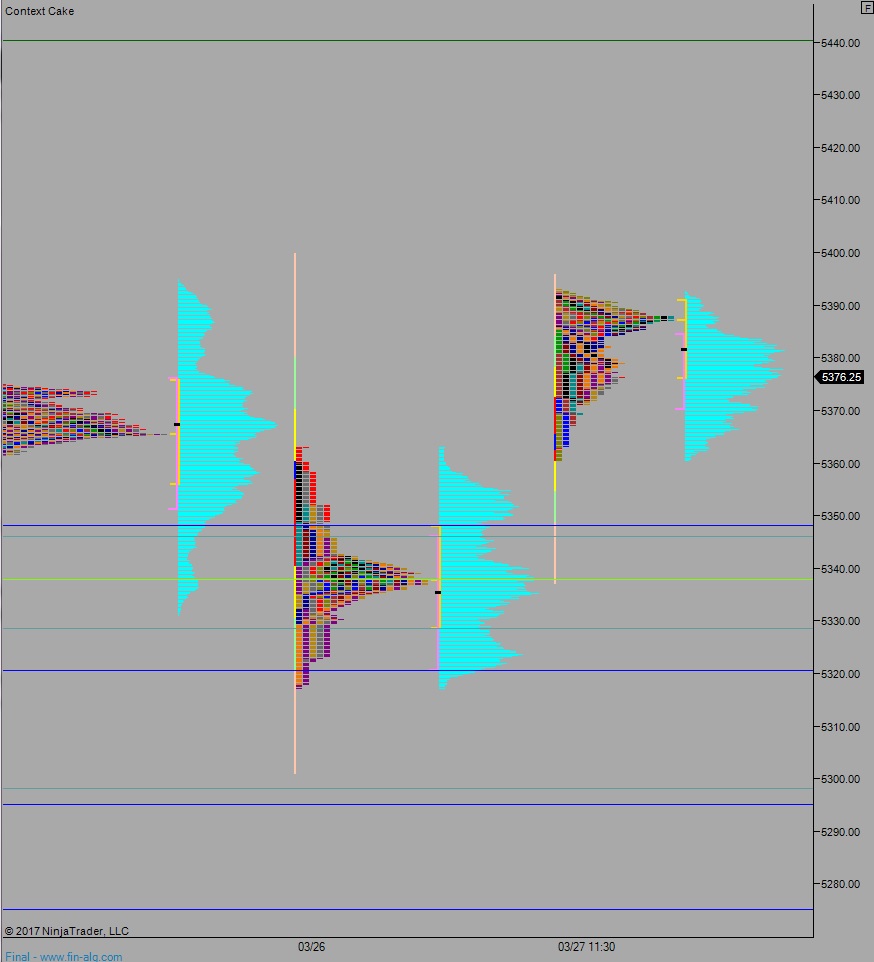

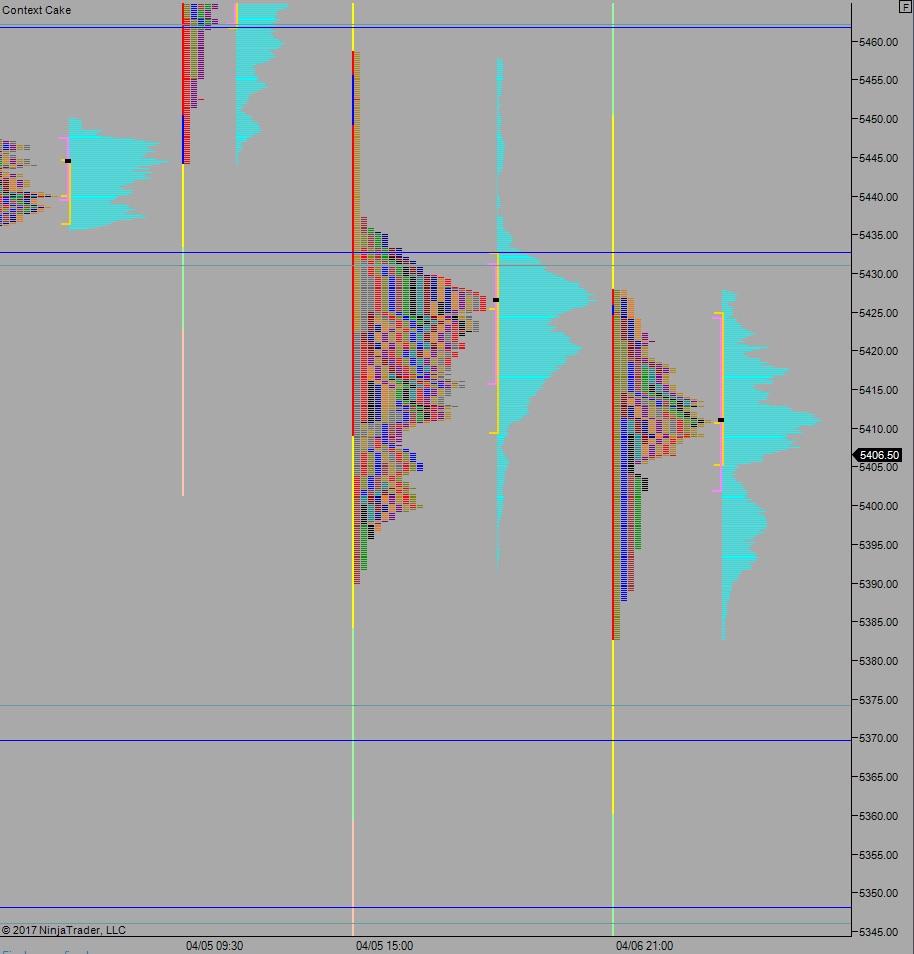

Yesterday we printed a neutral day. A gap up Thursday morning was quickly sold into but sellers failed to take out the Wednesday low, initially. Instead price worked range extension (RE) up before reversing the entire daily range and going RE down, briefly trading below the Wednesday low before two-way trade ensued.

Heading into today my primary expectation is for sellers to work back toward overnight low 5382.75, trading down to 5374.50 before two way trade ensues.

Hypo 2 buyers press into the overnight inventory and close the gap up to 5422.50. From here they continue higher, up through overnight high 5429.75, trading up to 5431 before two way trade ensues.

Hypo 3 stronger sellers push down to 5348.25 before two way trade ensues.

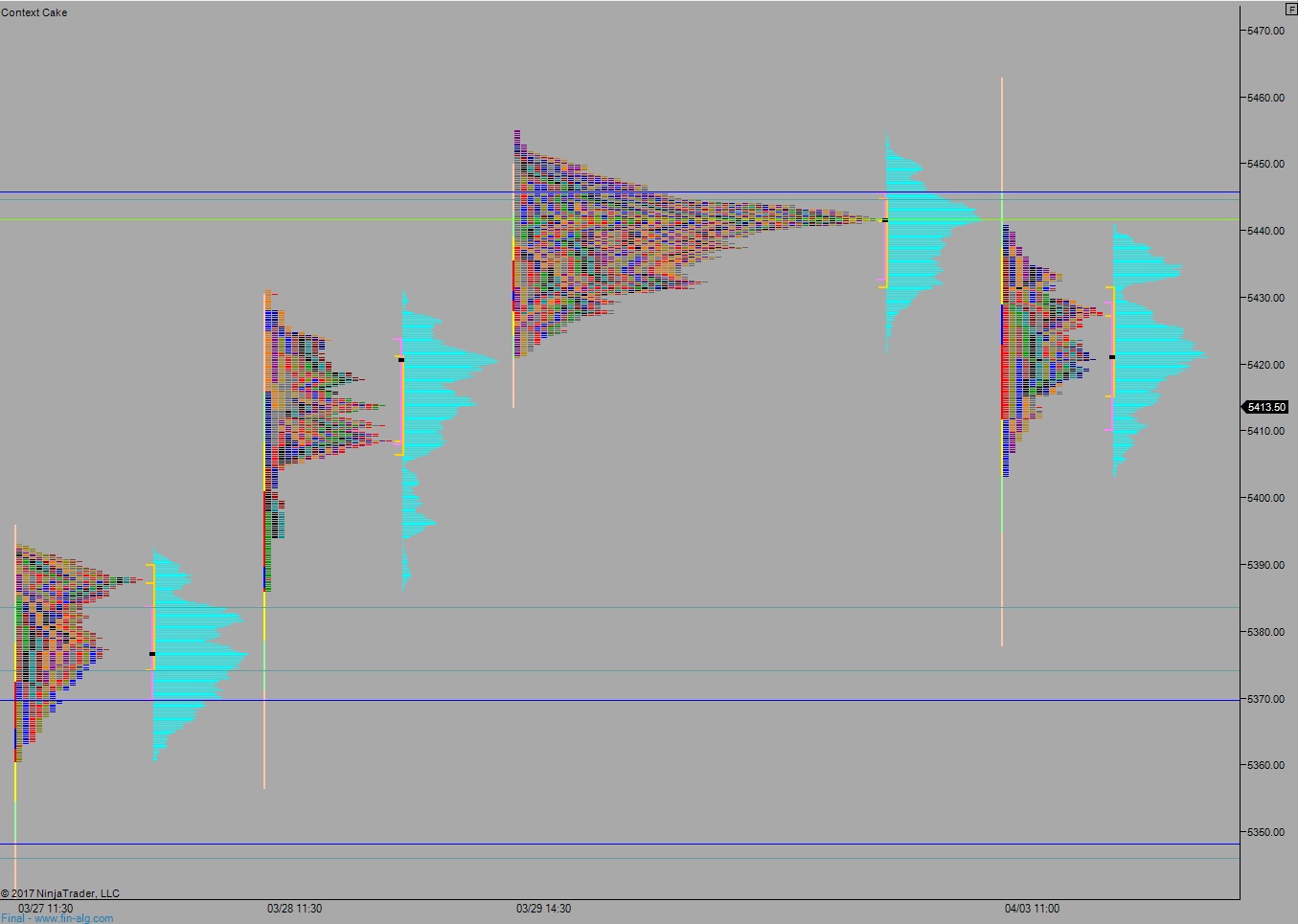

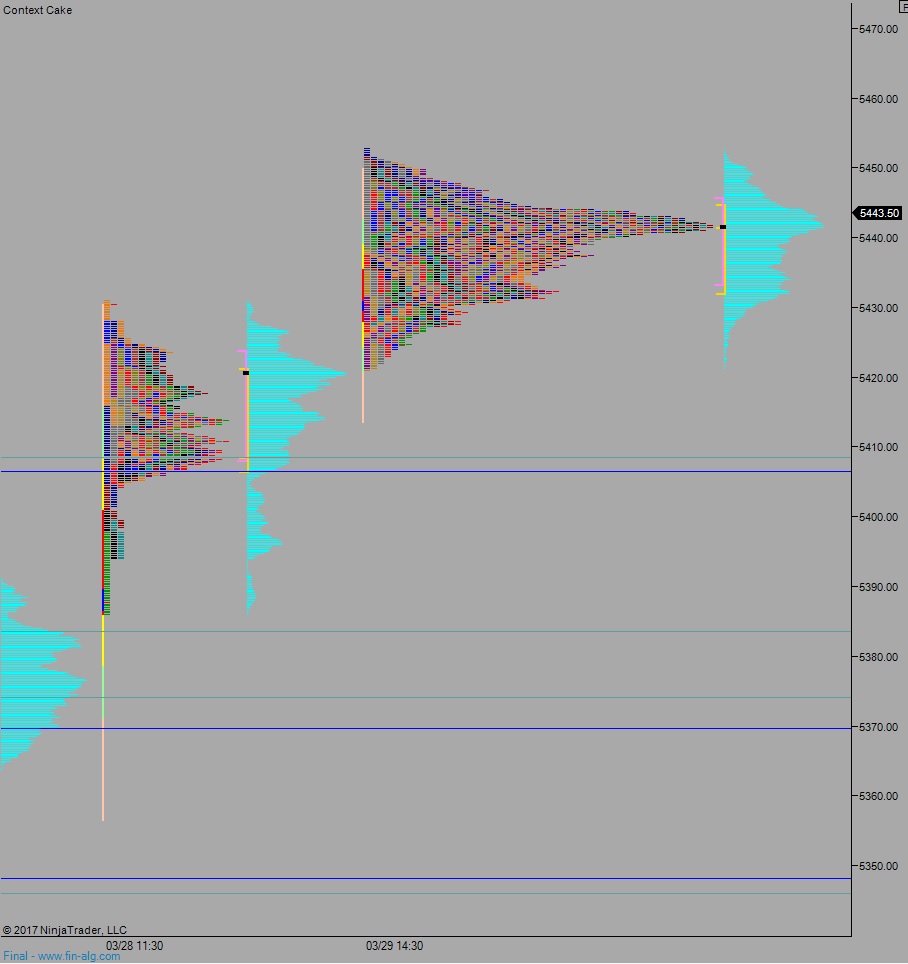

Levels:

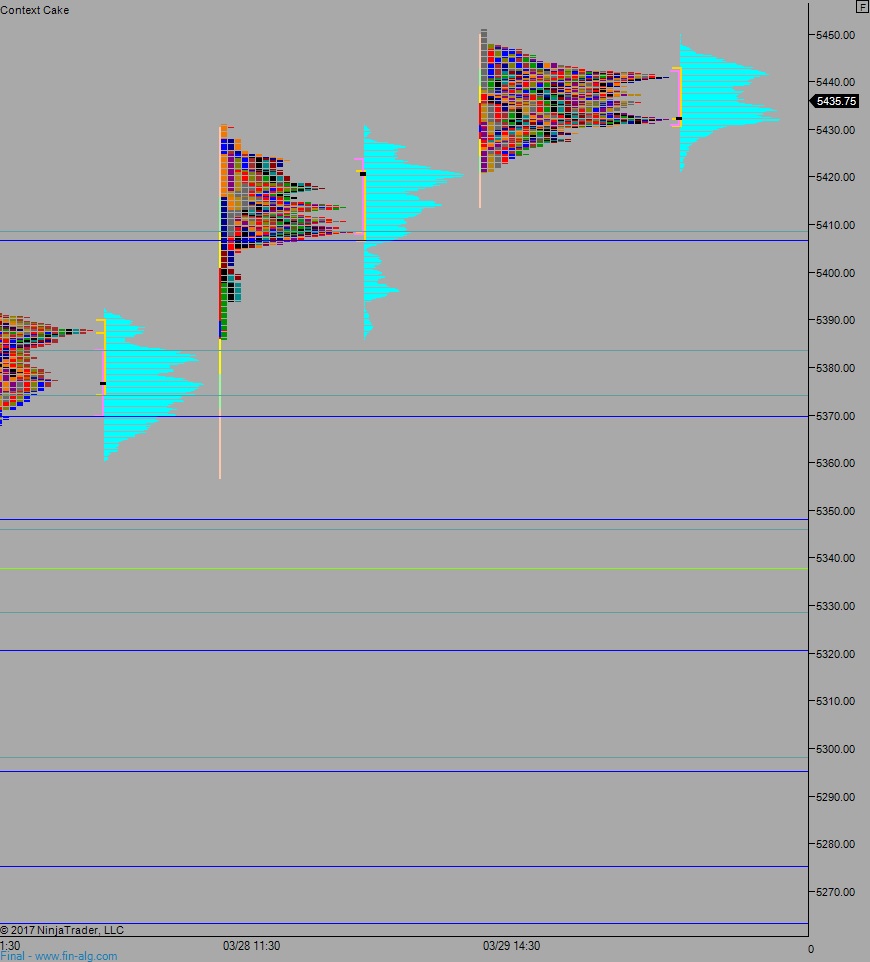

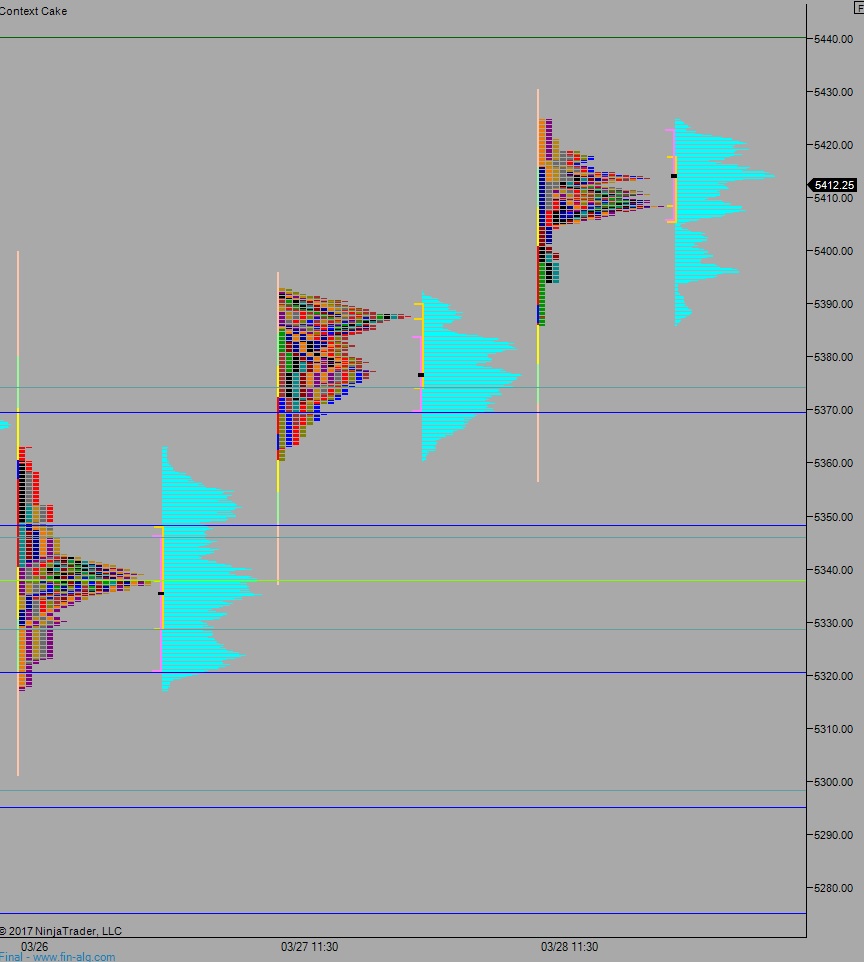

Volume profiles, gaps, and measured moves: