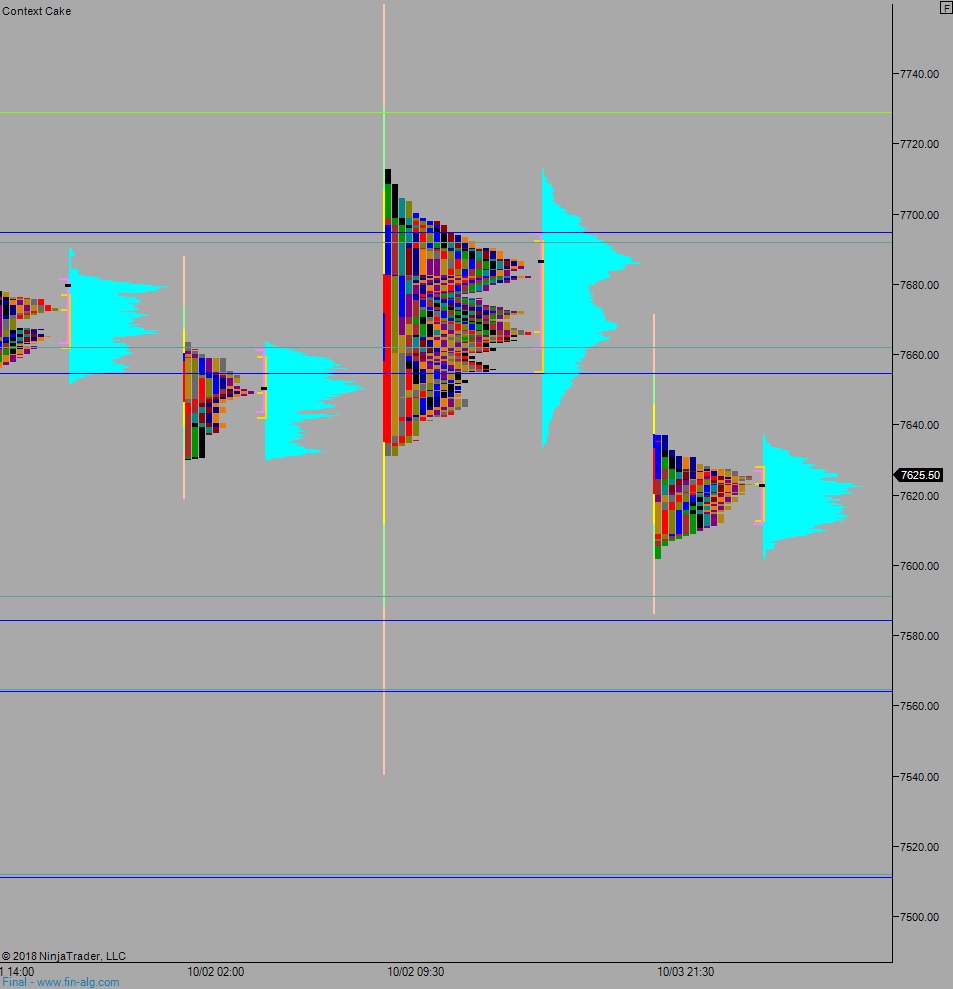

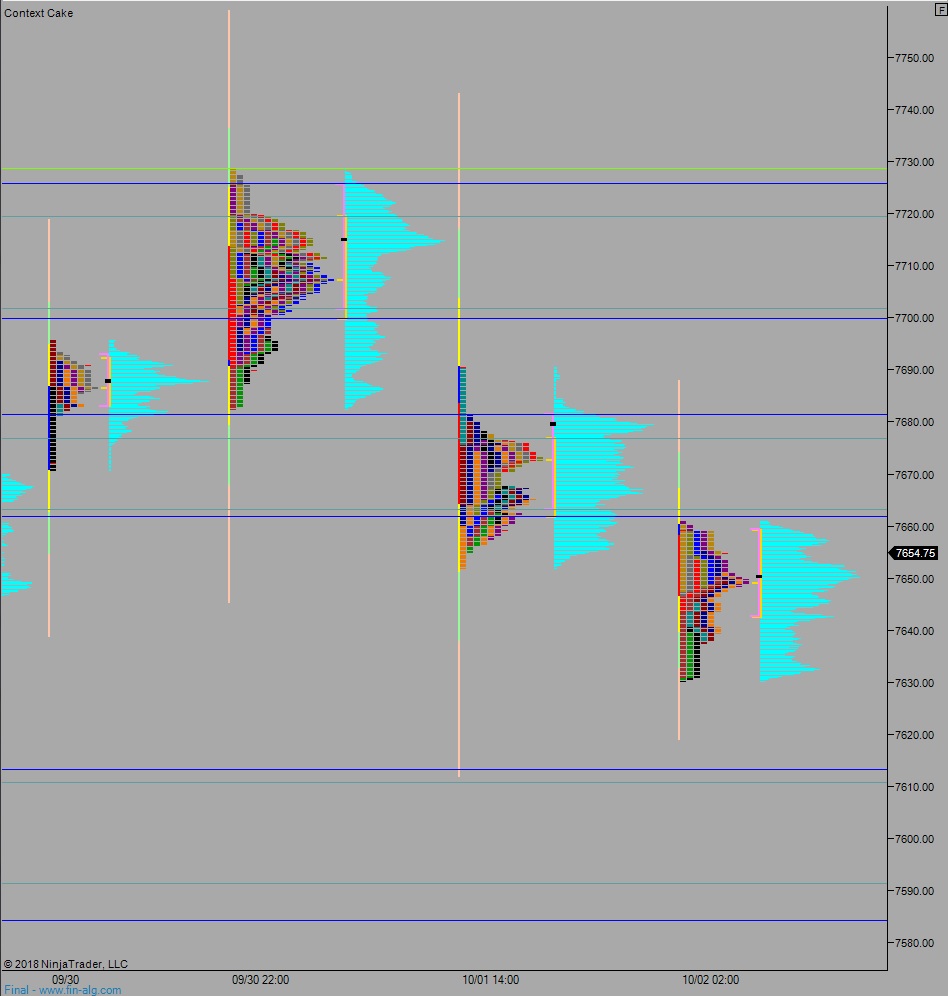

NASDAQ futures are coming into Monday gap down after an overnight session featuring extreme range and volume. Price was in balance overnight, chopping along the Friday midpoint for much of the Globex session before making a downward rotation around 4am. Since then price has bounced back up to the low-end of that overnight balance.

There are no economic events today. Federal workers have today off in celebration of Christopher Columbus.

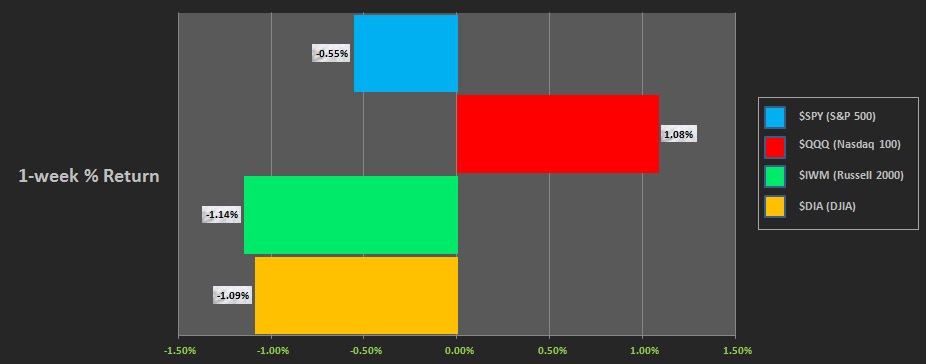

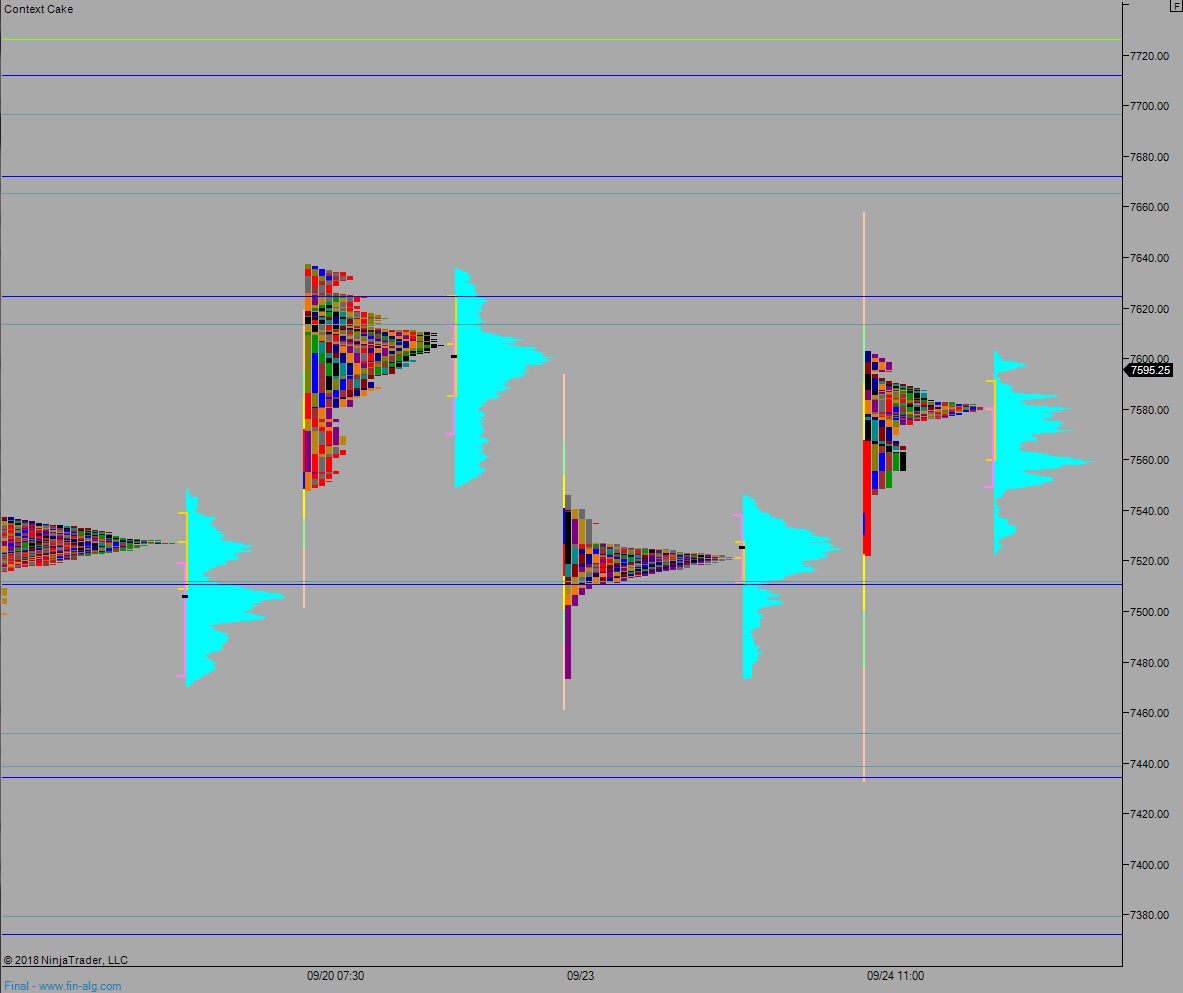

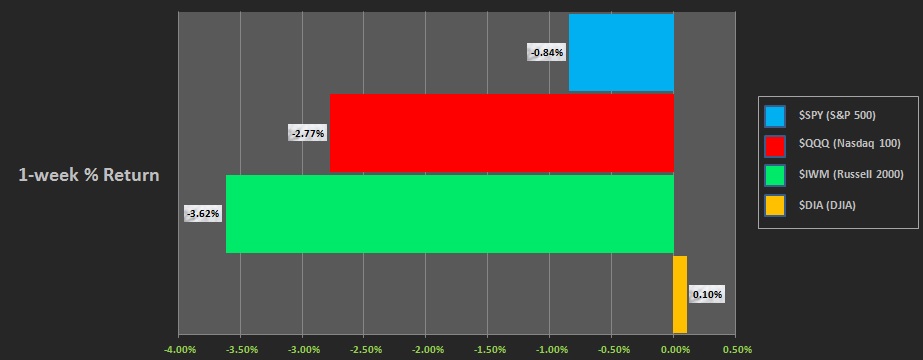

Last week markets were gap up into Monday then essentially marked time through end of Wednesday, with the days starting strong and ending weak. Then Thursday saw a gap down and away from that three day range then a drive lower. The drive lower continued through Friday until a responsive bid stepped in late Friday afternoon. The last week performance of each major index is shown below:

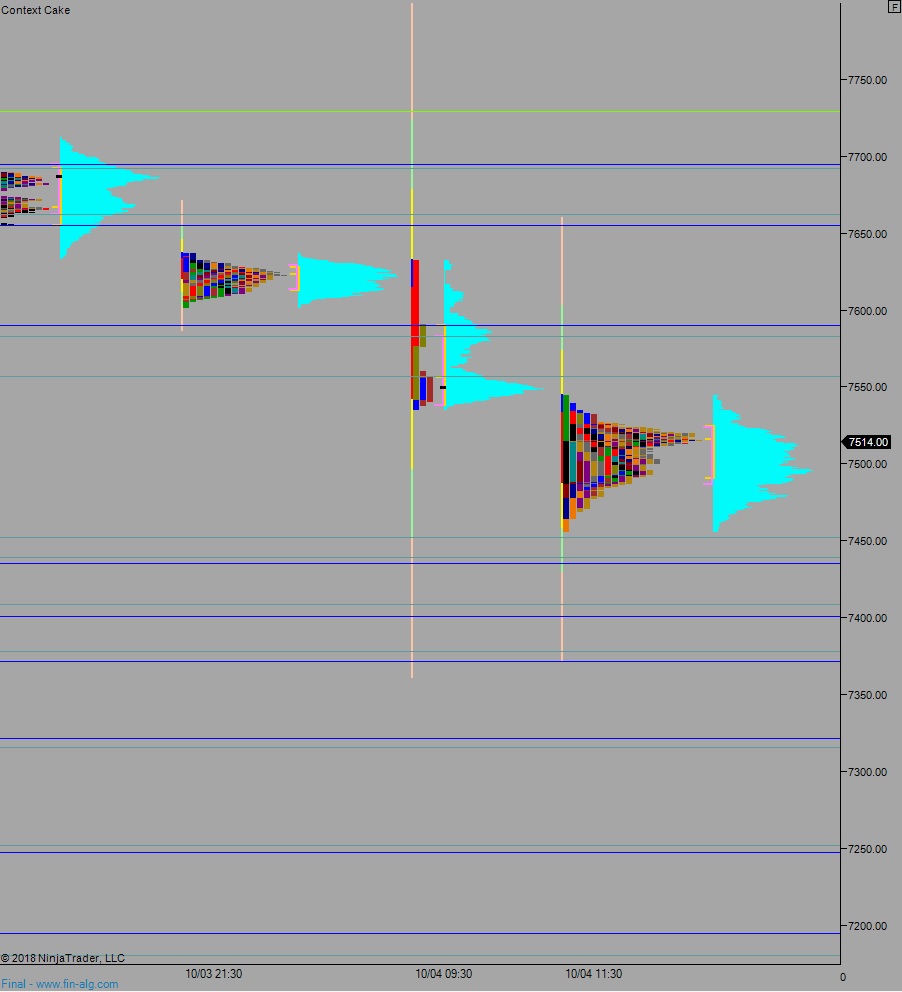

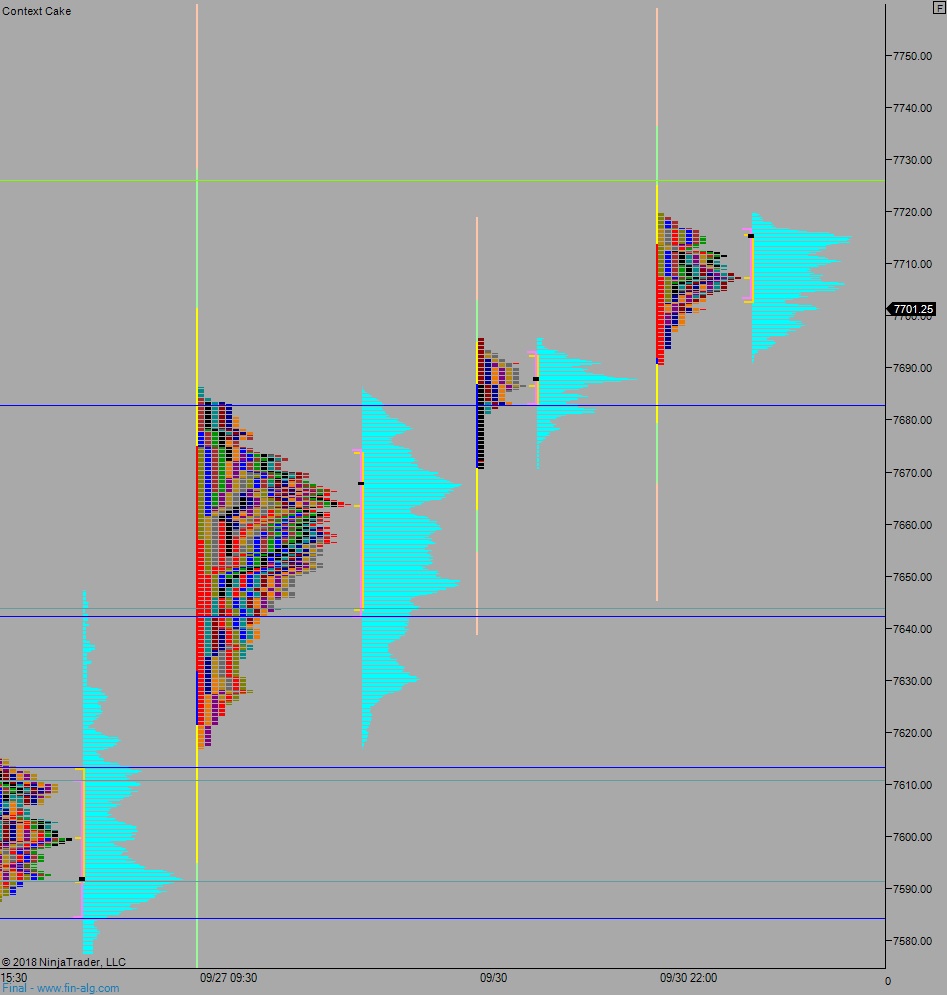

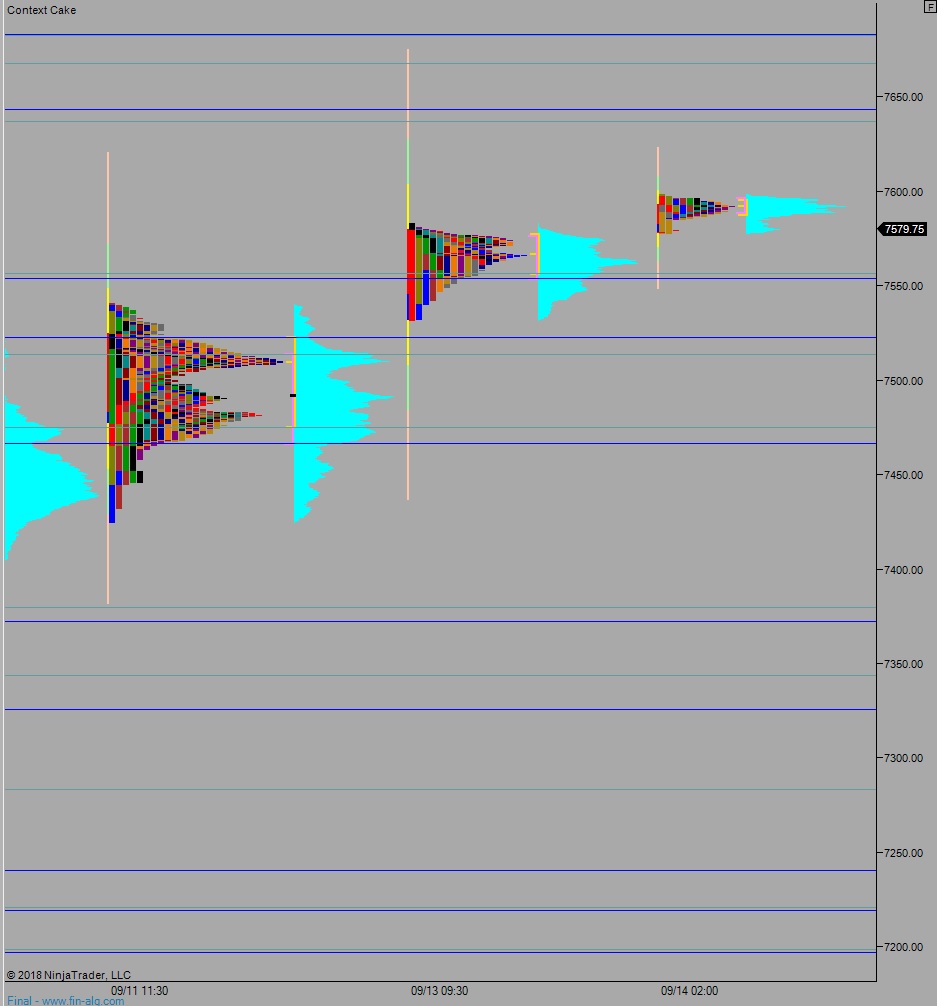

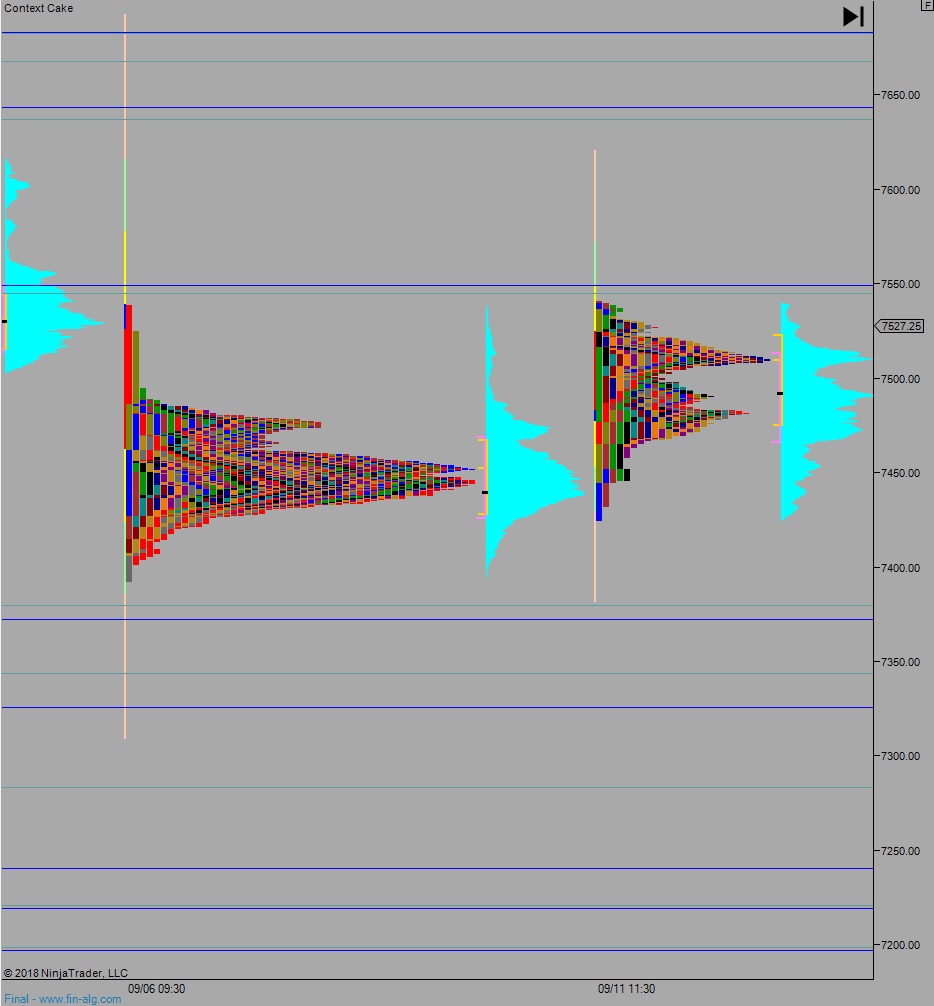

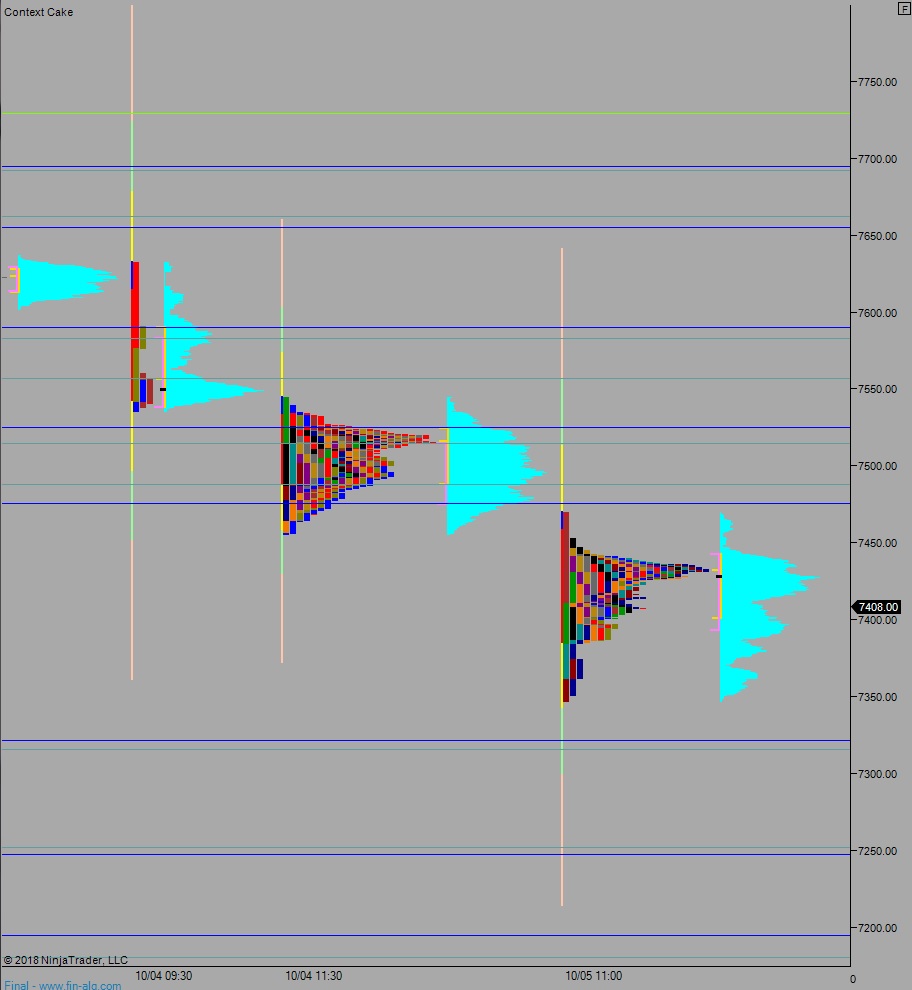

On Friday the NASDAQ printed a normal variation down. It was an aggressive normal variation down but I am not labeling it a trend day or even a double distribution trend day. However it was more dynamic then our usual normal variation down. But the VPOC settled just below the daily midpoint. The day began flat and with a wide open auction that eventually gave way to sellers who worked down through the Thursday low then accelerated to the downside. Price below through the 7400 century mark by lunchtime and continued lower through the early afternoon. Late into the afternoon, after probing into price levels untouched since late August, a responsive bid stepped in and ramped price back to the daily midpoint by end of day.

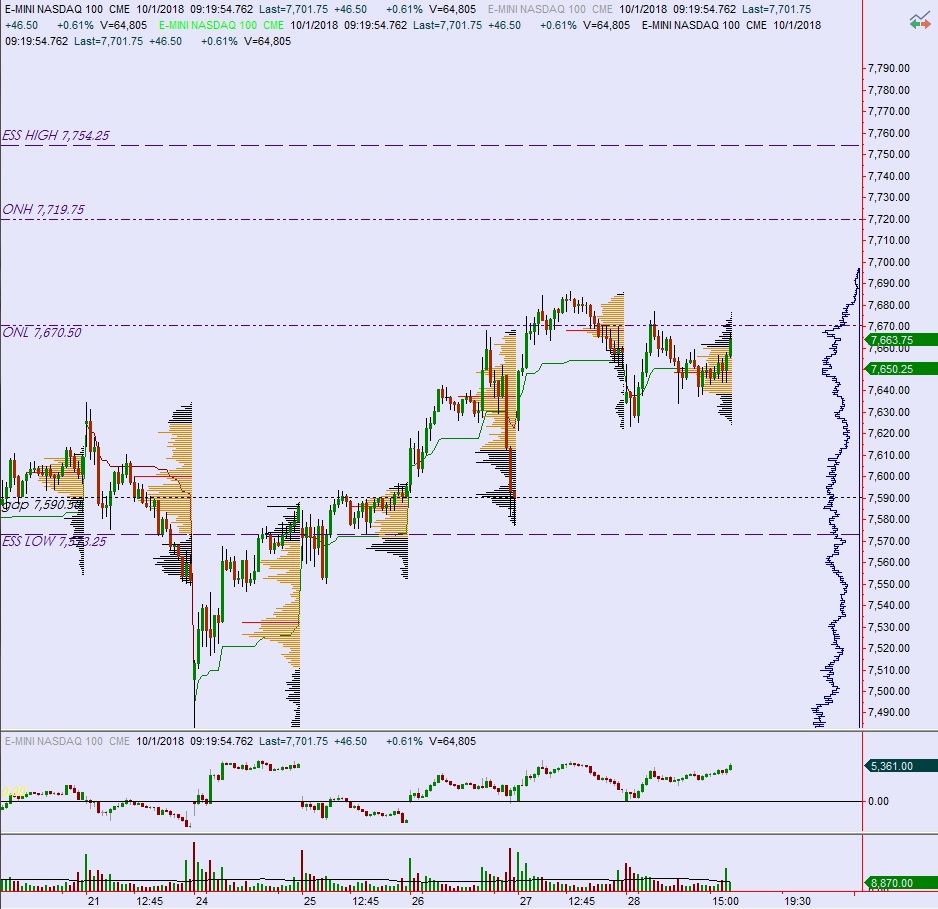

Heading into today my primary expectation is for sellers to gap-and-go lower, trading down through overnight low 7387 to set up a move to test below Friday’s low 7347. Look for buyers down at 7321.25 and two way trade to ensue.

Hypo 2 buyers work into the overnight inventory and close the gap up to 7436.25. Buyers continue higher, up through overnight high 7453.25. Look for sellers up at 7475.50 and two way trade to ensue.

Hypo 3 stronger sellers drive down through 7321.25 and tag the 7300 century mark. We chop here for a bit then continue lower, down to 7251.75 before two way trade ensues.

Levels:

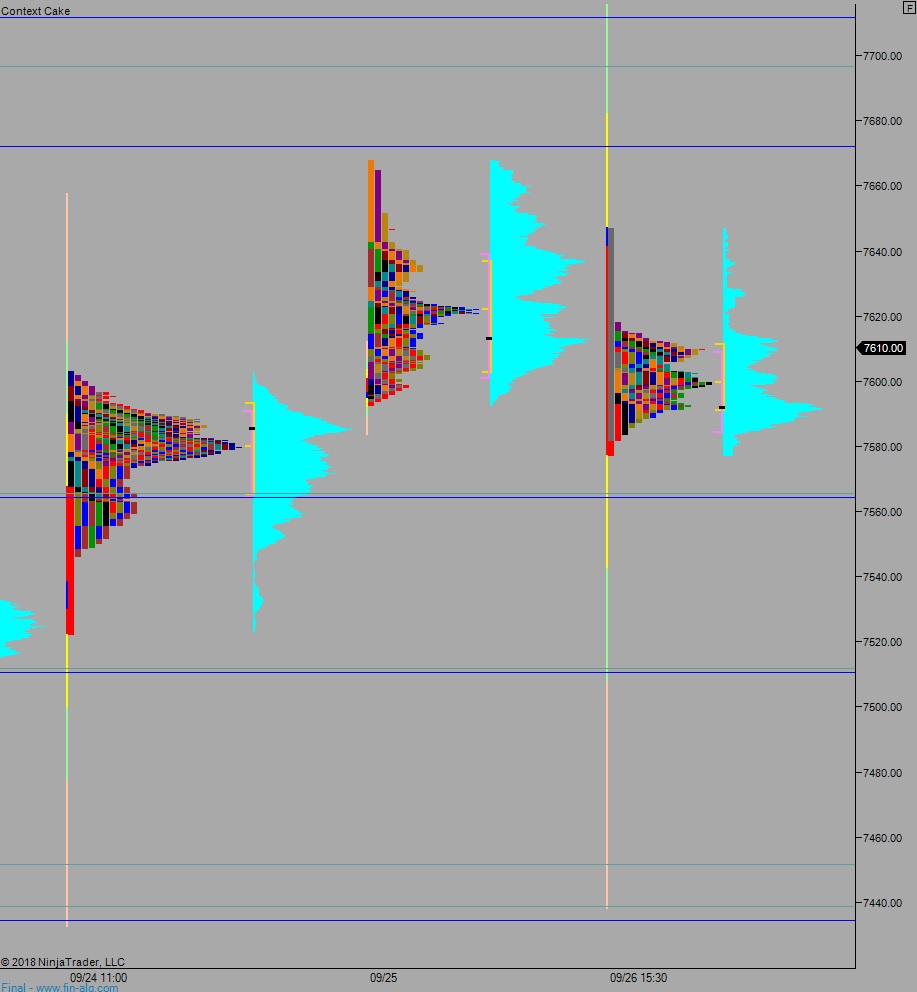

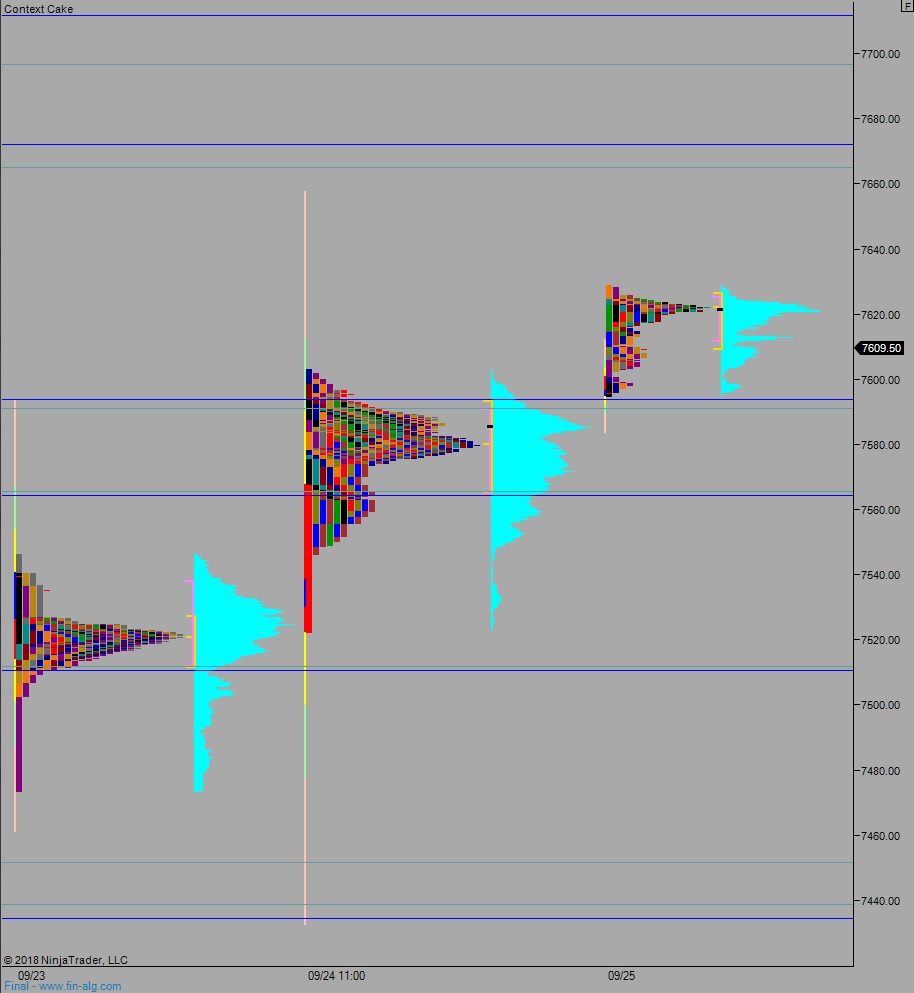

Volume profiles, gaps, and measured moves: