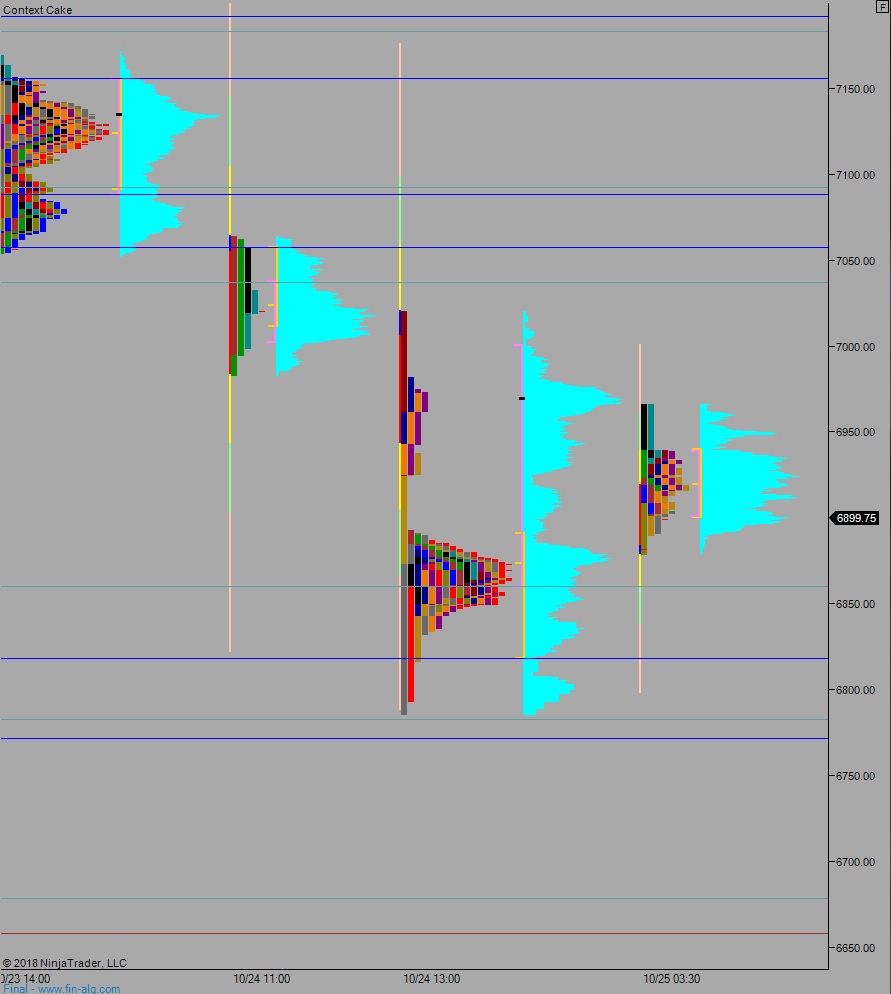

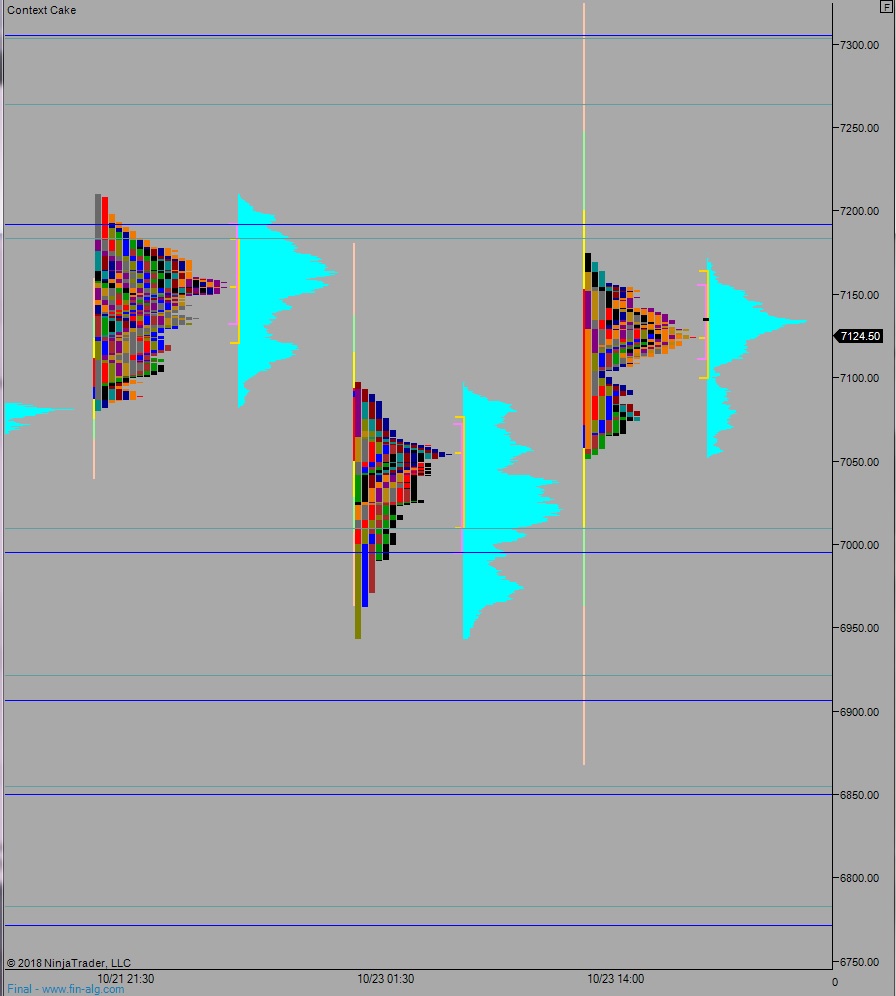

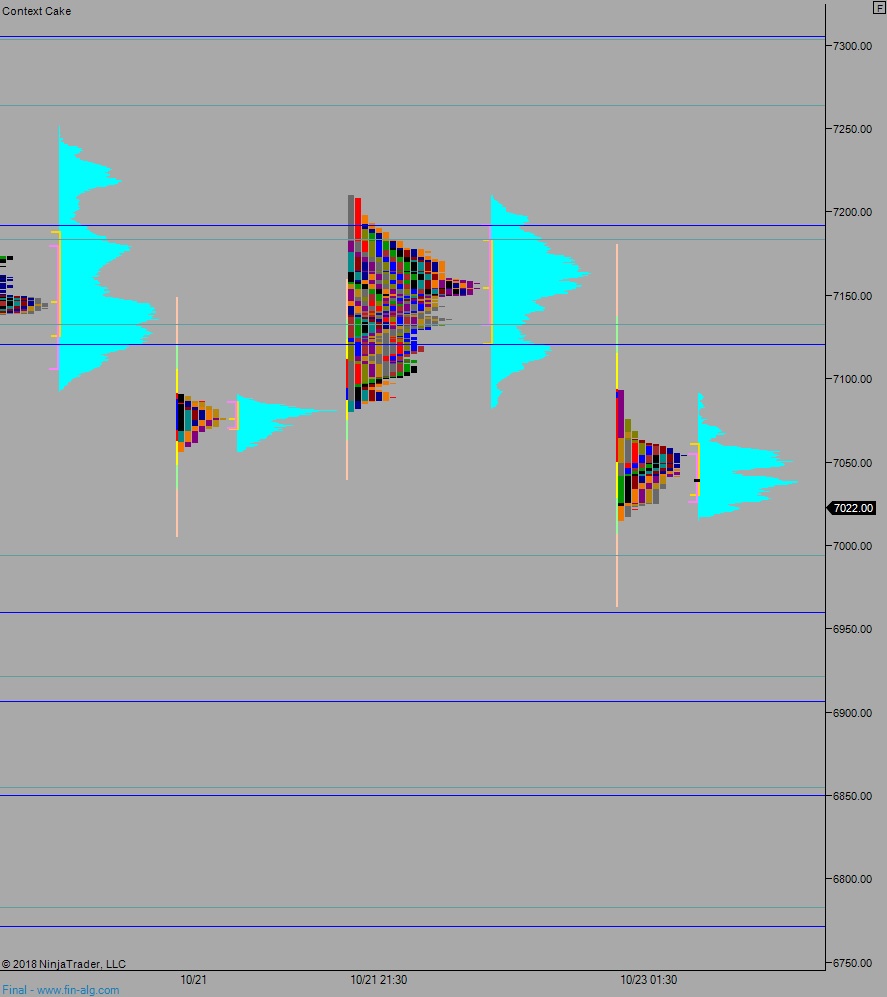

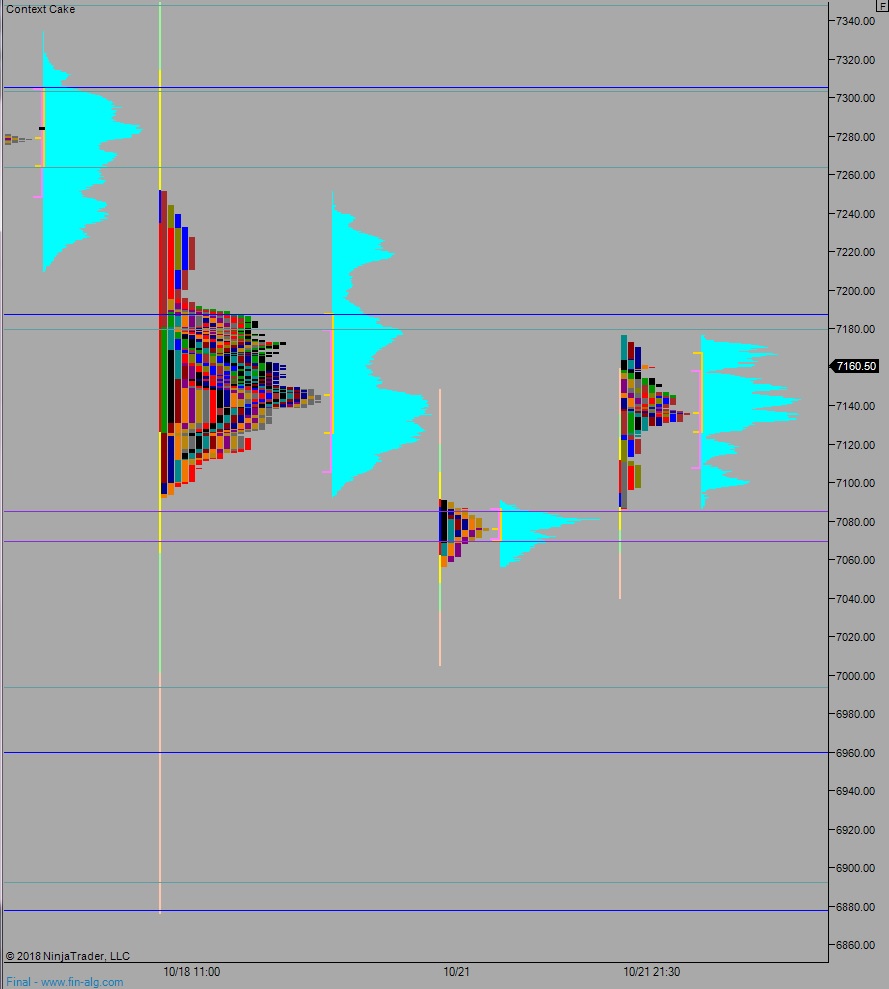

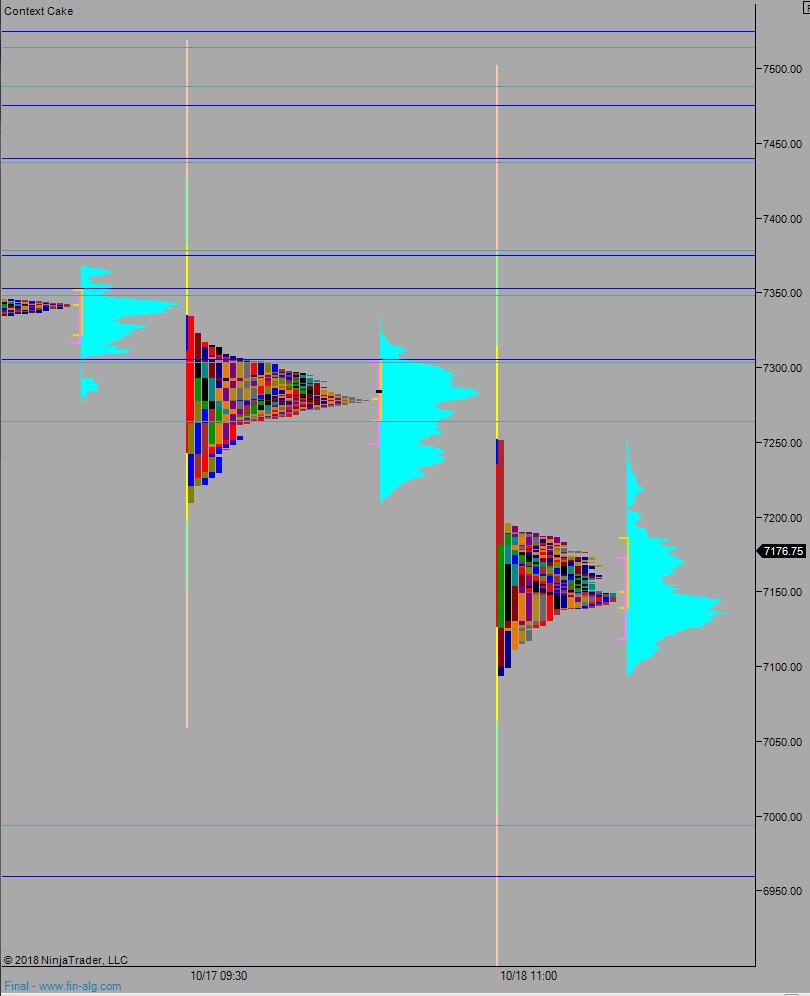

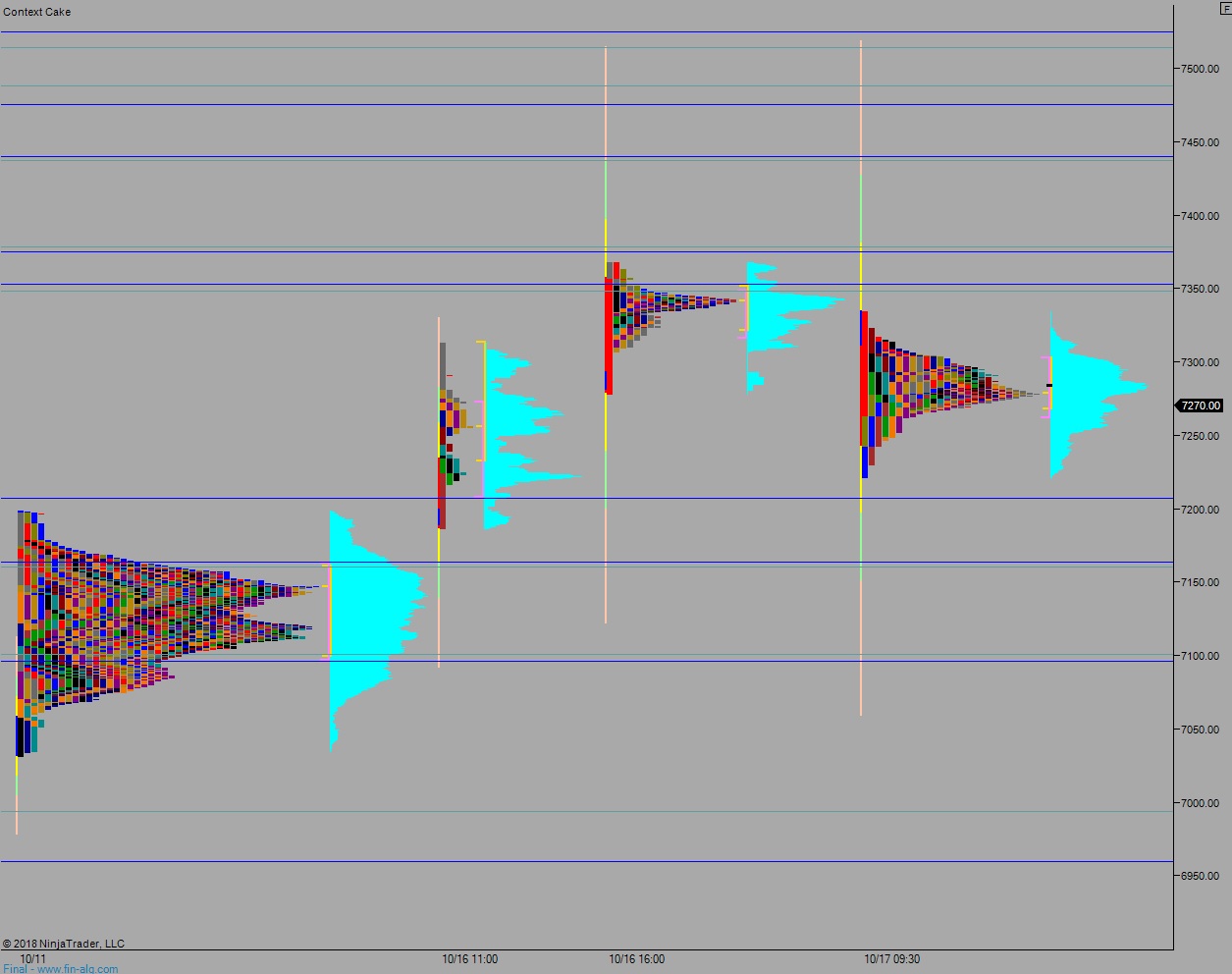

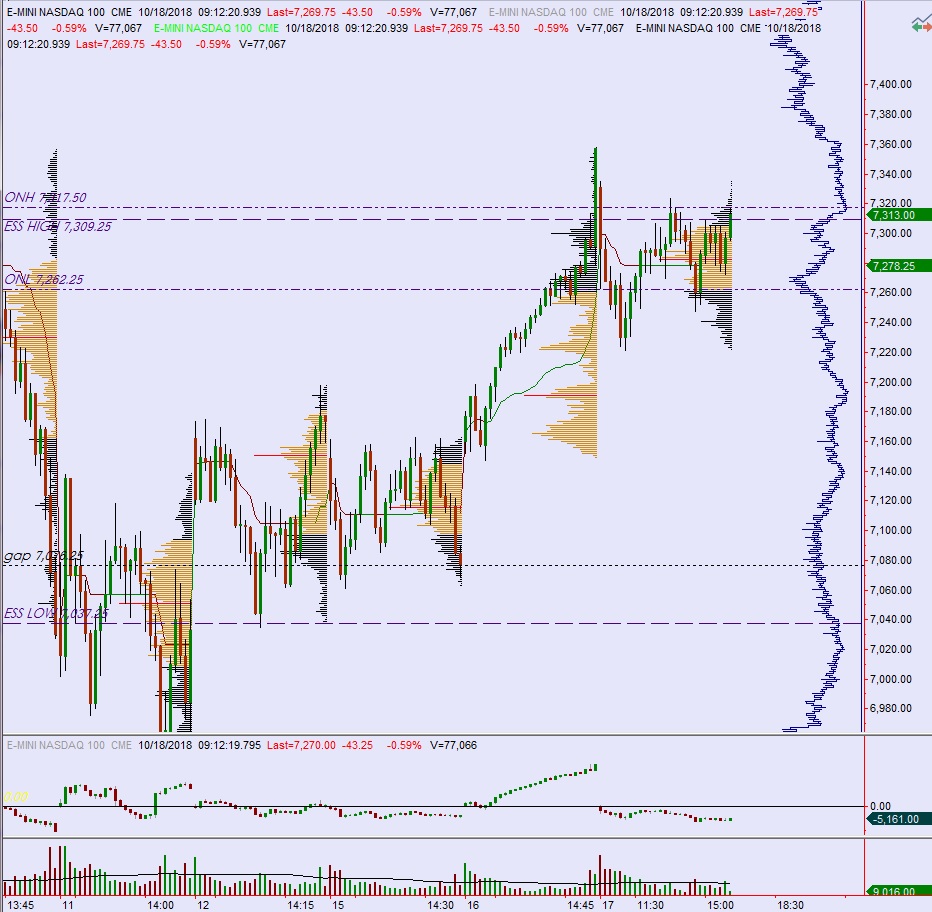

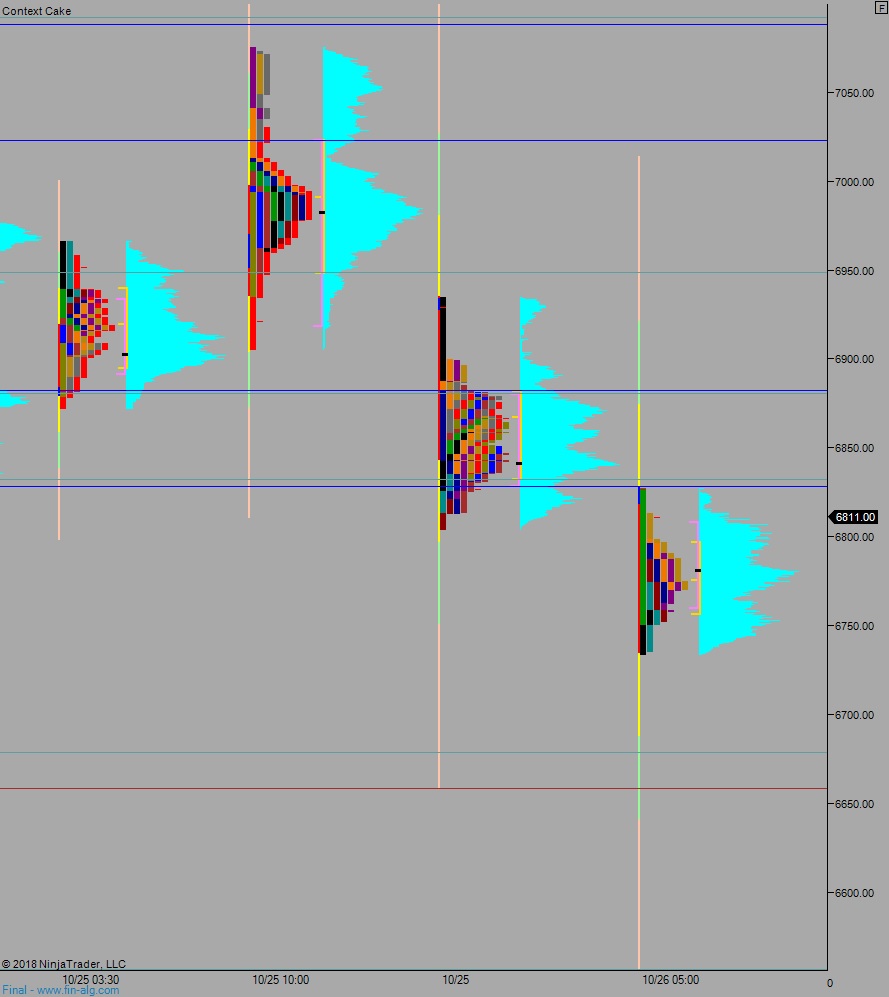

NASDAQ futures are coming into Friday gap down after an overnight session featuring extreme range and volume. Price worked lower overnight via three sequential rotations down. The first came right around settlement when Amazon and Google parent Alphabet reported solid earnings but guided lower. The second rotation lower came just before midnight, then a third hard move took hold around 4am. All together the action took prices to levels unseen since May 4th, a conviction trend day up. As we approach cash open, price is hovering right along the weekly low (set late Wednesday around 6800). At 8:30am GDP data came out stronger than expected.

Also on the economic agenda today we have University of Michigan’s final reading of October sentiment at 10am.

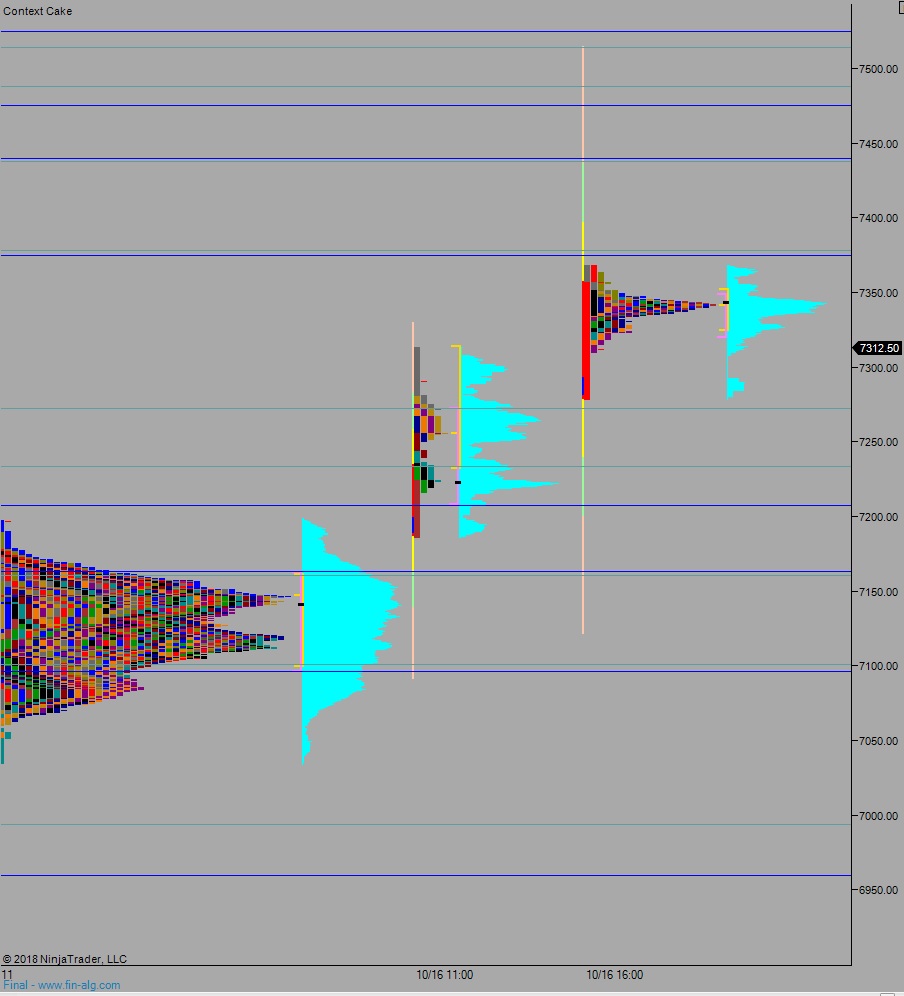

Yesterday we printed a normal variation up. The day began with a gap up, inside range of the prior day trend down. Buyers rejected an attempt lower during the opening auction and we instead drifted just up beyond the Wenesday VPOC and chopped and balanced along it. Then, late in the session we ramped higher before seeing a sharp spike lower during settlement to press prices back near where they opened in the morning. Overall it was an inside day and a normal variation up.

Heading into today my primary expectation is for buyers to reclaim the weekly low and sustain trade above 6800 setting up a move to target 6881. We chop here for a bit before continuing higher to take out overnight high 6934.25. Look for sellers up at 6948.50 and two way trade to ensue.

Hypo 2 sellers reject us down and away from 6800 setting up a move through overnight low 6734.25. Look for buyers down at 6700 and two way trade to ensue.

Hypo 3 stronger sellers trade us down to 6678 before two way trade ensues.

Levels:

Volume profiles, gap, and measured moves: