NASDAQ futures are coming into Thursday gap up after an overnight session featuring extreme range and volume. Price worked higher overnight after spending a good portion of the evening globex session in balance. As we approach cash open price is hovering above the Wednesday high and just below the weekly high. At 8:30am consumer price index data came out worse than expected and initial/continuing jobless claims data came out better than expected.

Also on the economic agenda today we have a 30-year bond auction at 1pm and a monthly budget statement at 2pm.

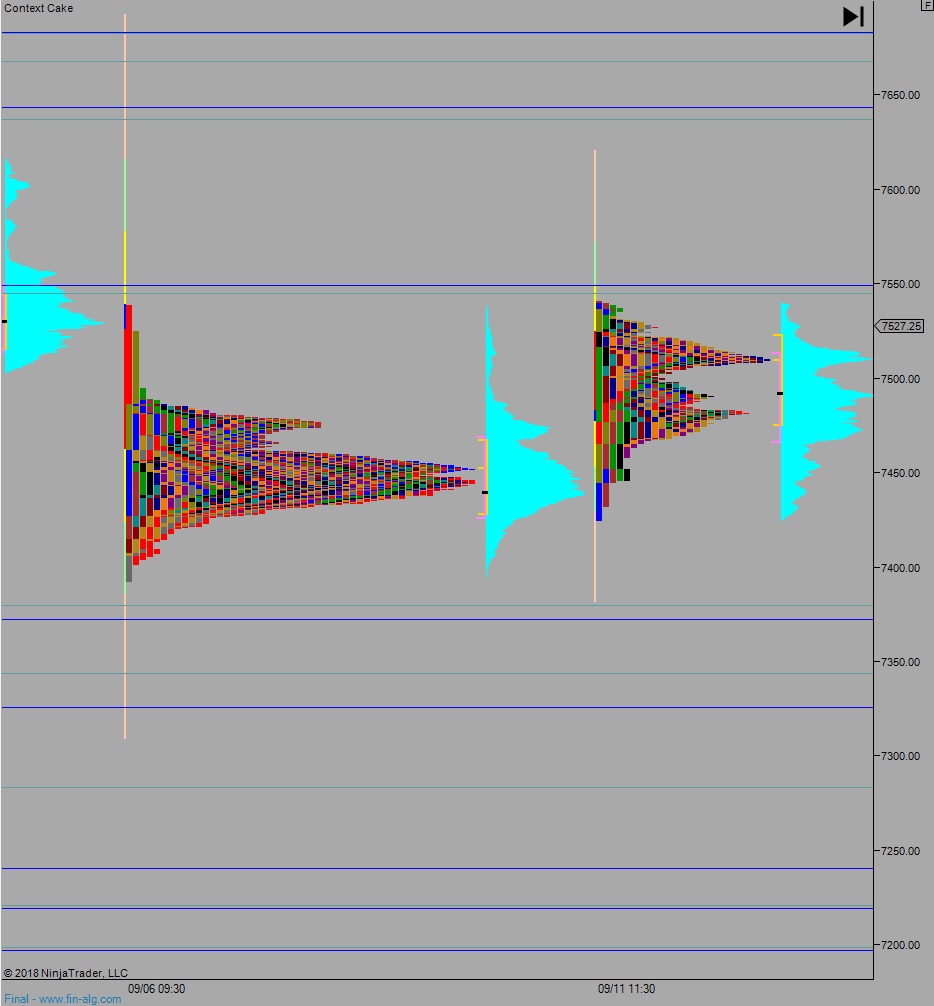

Yesterday we printed a normal variation down. The day began with a gap down and drive lower. Sellers were unable to drive beyond the Tuesday low, instead encountering a strong responsive bid and printing a sharp bounce. We then rotated to the 61.8% retracement of the bounce before a secondary buy ramp carried us into the close.

Heading into today my primary expectation is for buyers to gap-and-go higher, sustaining trade above 7550 setting up a move to target 7600 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory and close the gap down to 7485.75 we then continue lower, down through overnight low 7470 before two way trade ensues.

Hypo 3 buyers trade up beyond the weekly high 7541 but cannot trade up beyond 7550 and two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: