NASDAQ futures are coming into Wednesday gap up after an overnight session featuring elevated range and volume. Price worked higher overnight, pressing up into the 09/04 (the first full trading day of September) range before settling into balance. As we approach cash open, price is hovering up above yesterday’s high.

On the economic docket this morning we have a few medium impact events—new home sales at 10am followed by crude oil inventories at 10:30am. The major event happens at 2pm when the FOMC releases their rate decision. There is currently a 95% probability of a 25 basis point lift in interest rates, and a 5% probability of a 50bp lift. This is a live meeting and there is a Fed Chair Jerome Powell press conference scheduled after the announcement, at 2:30pm.

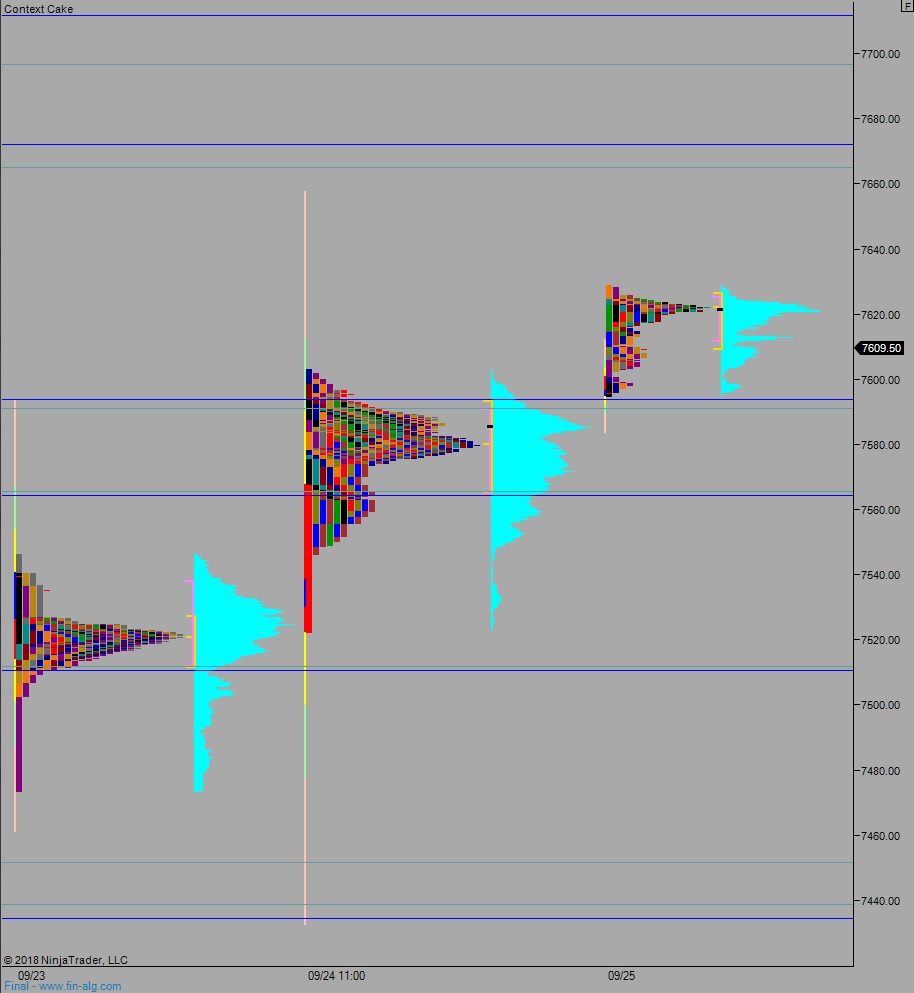

Yesterday we printed a neutral extreme up. The day began with a gap down and choppy open. Sellers made a move down-and-away from the initial balance, putting us range extension down. They were met by responsive buyers down near the Friday close, and we spent the rest of the session auctioning higher. After initially pusing range extension up and neutral, a rotation back to the mean occurred but then buyers stepped back and and worked back up near session high by the close.

Neutral extreme.

Heading into today my primary expectation is for a gap and go higher. Buyers defend ahead of the Tuesday high 7596.75 setting up a move to take out overnight high 7629. This sets up a move to close the gap up at 7640 before two way trade ensues. Then look for the third reaction after the FOMC rate hike to drive direction into the close.

Hypo 2 stronger buyers drive off the open, take out overnight high 7629, close the gap 7640 and tag the weekly ATR band at 7650.50 before two way trade ensues. Then look for the third reaction after the FOMC rate hike to drive direction into the close.

Hypo 3 sellers work into the overnight inventory and close the gap down to 7595.50. Sellers continue lower, down through overnight low 7588. Look for buyers down at 7566 and two way trade to ensue. Then look for the third reaction after the FOMC rate hike to drive direction into the close.

Levels:

Volume profiles, gaps, and measured moves: