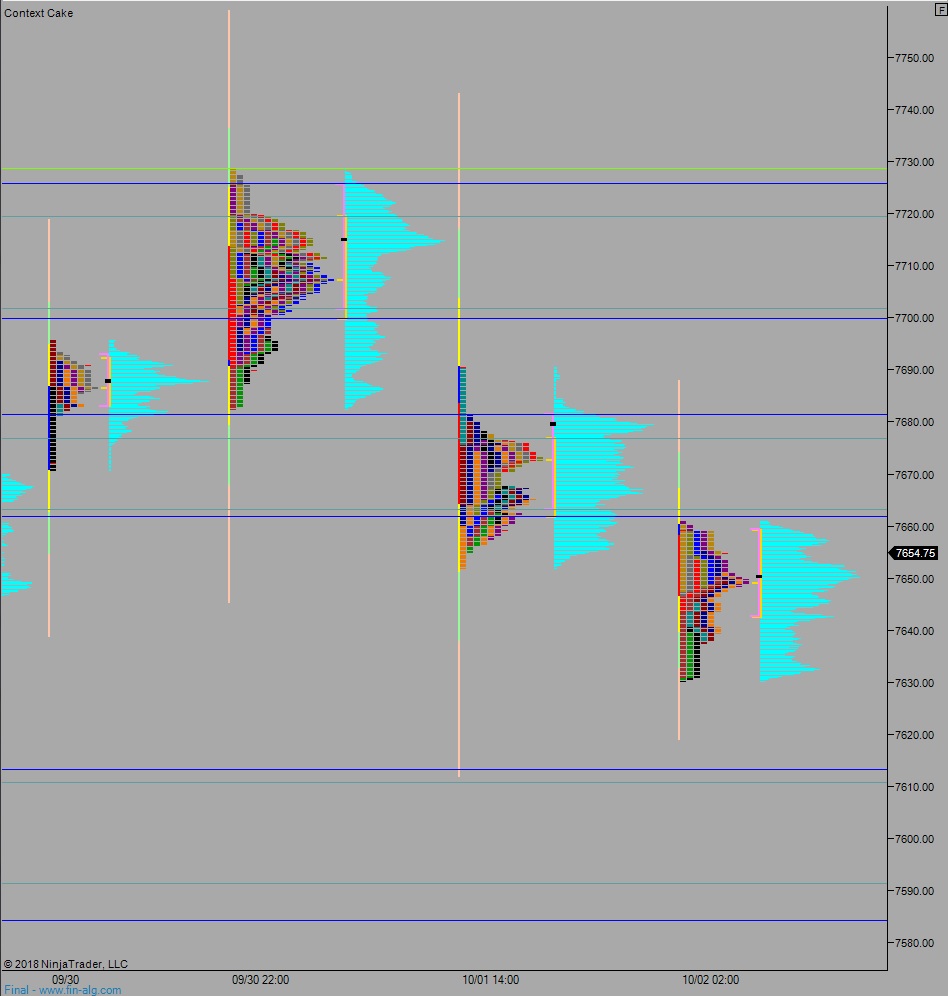

NASDAQ futures are coming into Tuesday gap down after an overnight session featuring extreme range on elevated volume. Price worked lower overnight, trading near last Friday’s low before catching a bid and coming into balance. As we approach cash open price is hovering just barely inside of Monday’s low.

On the economic calendar today we have a 4-week T-bill auction at 11:30am. Then at 12pm Jerome Powell is talking in Boston at the NABE conference.

Yesterday we printed a normal variation down. The day began with a gap up-and-out of the prior week’s range. Price drove higher off the open, briefly making a new record high before the auction stalled out. Buyers were unable to press the market range extension up despite an hour-or-so spent hovering just below the high. Instead responsive sellers stepped in and pushed. They continued pushing until we went RE down, then closed the overnight gap, then continued lower, finally discovering responsive buyers just ahead of Friday’s naked volume point of control and experiencing a small ramp into the bell.

Heading into today my primary expectation is for sellers to reject us out of the Monday range, driving lower off the open to take out overnight low 7630.25. This sets up a move down to 7613.50 before two way trade ensues.

Hypo 2 stronger sellers trade us down to the open gap at 7590.50 before two way trade ensues.

Hypo 3 buyers work into the overnight inventory and close the gap up to 7674 then continue higher, up through overnight high 7678.25. Look for sellers up at 7676.75 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: