While reviewing last week’s action to prepare the Sunday Strategy session, I kept catching myself feeling negative emotions towards the stock market. Then venomous thoughts and more anger. I had to step back and read some Marcus Aurelius for a minute and ended up using a line from the OG emperor as quote of the week:

“You have power over your mind—not outside events. Realize this, and you will find strength.”

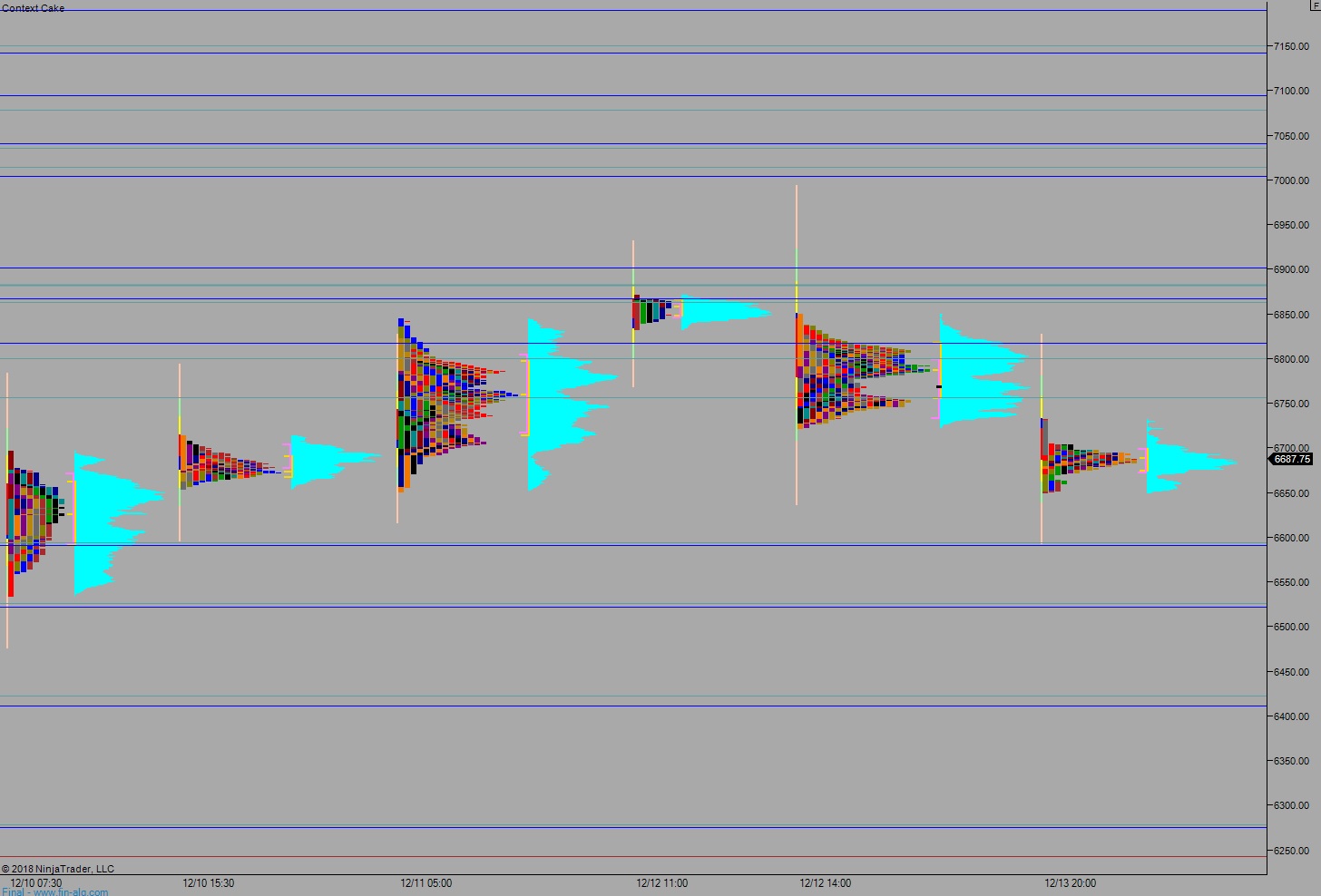

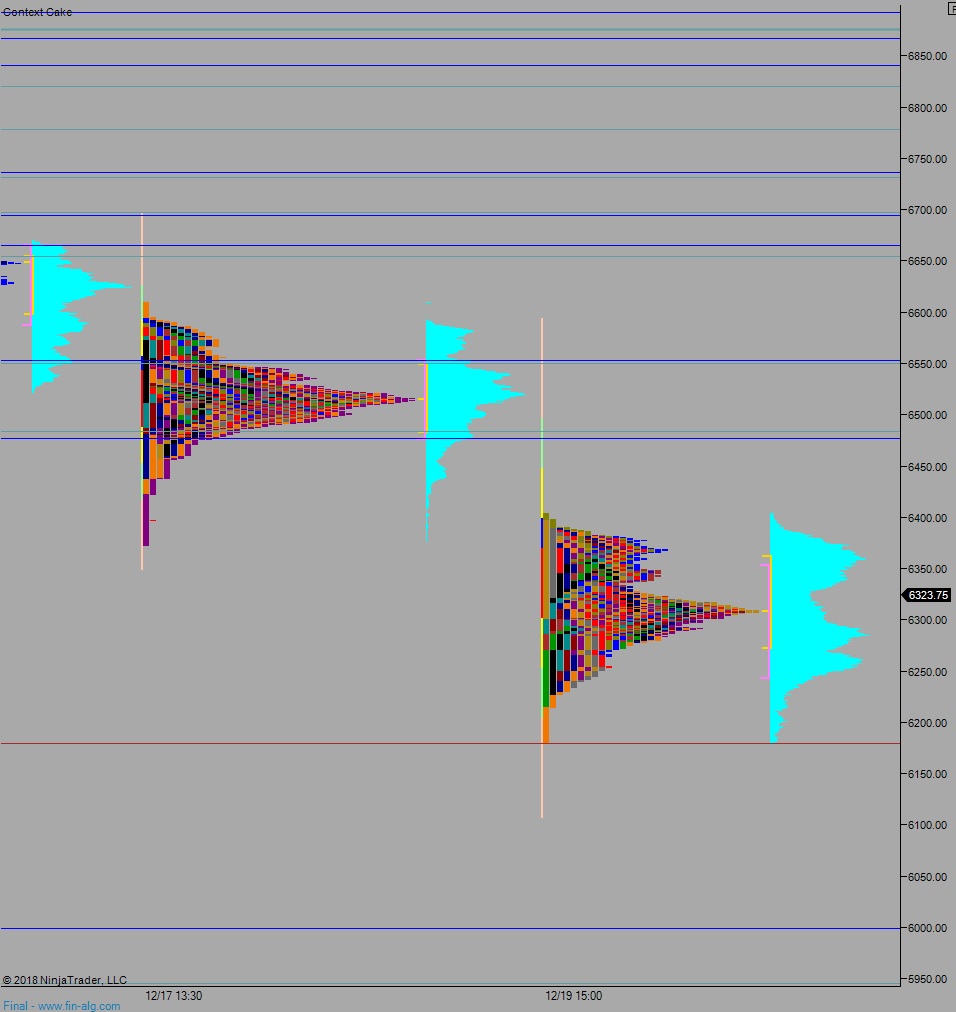

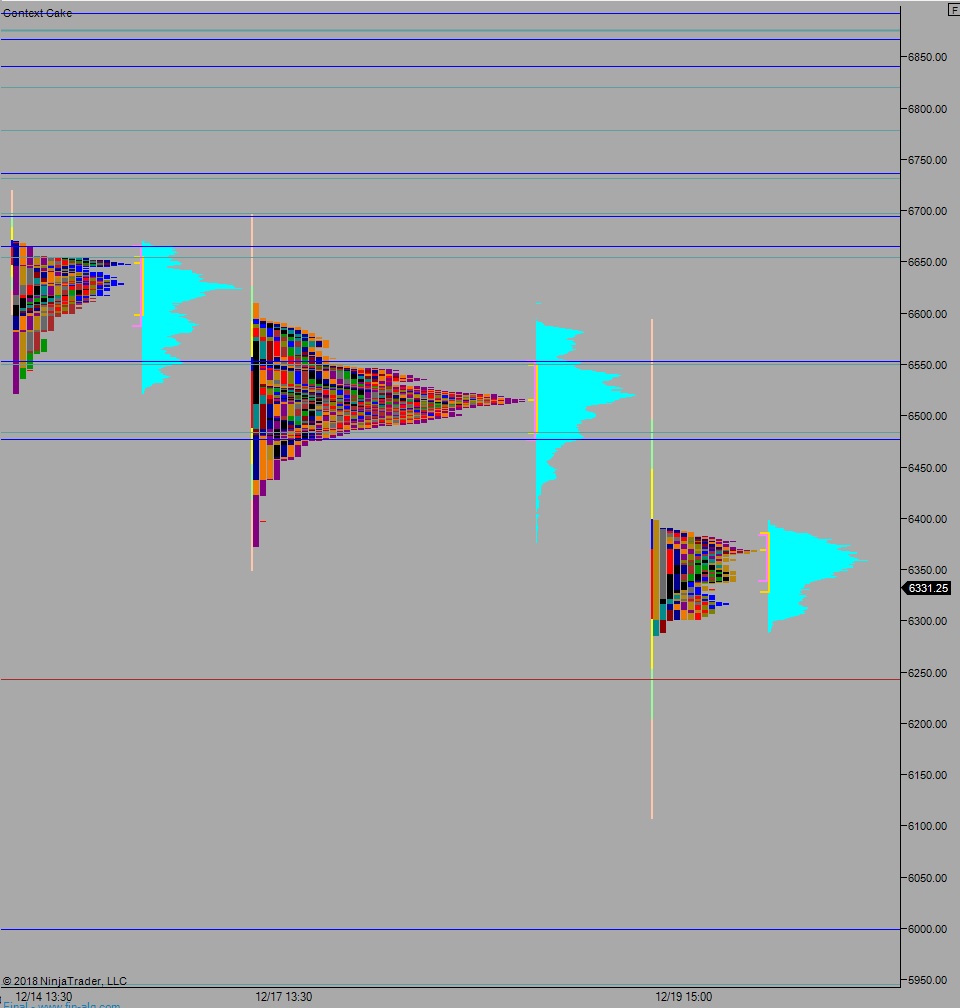

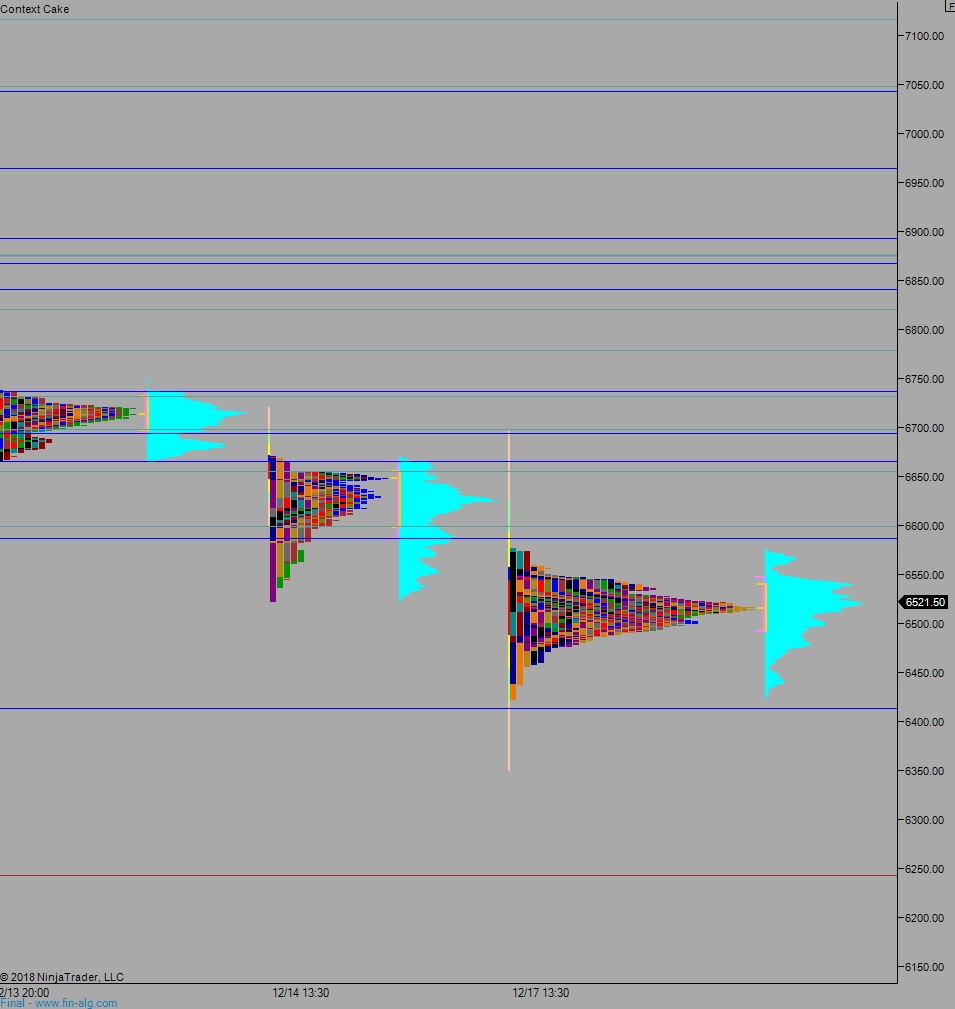

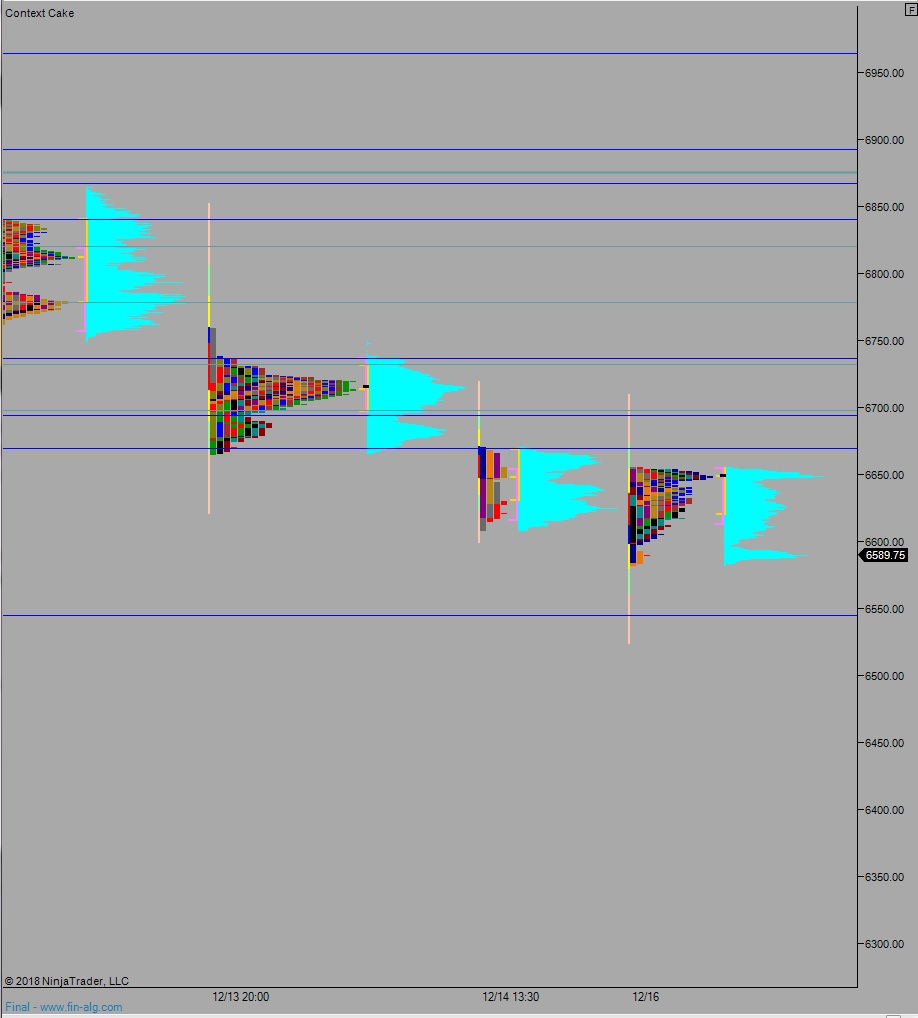

I built my trading career on closing the overnight gap. I trade it extremely well. I am the one out of ten trader of fintwit lore, who quietly did one trade well. Over the years I began adding new trades to my arsenal, notably to Exodus Strategy Session readers I added Rose Colored Sunglasses, Extreme Rose Colored Sunglasses, and Bunker Buster. These ‘biases’ were used as part of a trade I’ve been taking for the last two years or so where I target either a break of the overnight range or the initial balance range. If bias is Rose Color Sunglasses, I target overnight low/initial balance low, e(RCS) overnight high/IB high, and Bunker Buster begins the week targeting lows, then forces me to pivot at some point, mid-week, and start targeting the highs.

Straight up—Bunker Buster is too fucking confusing to trade in the heat of battle. I will keep tracking it, but using it to trade futures is off the table. Power over the mind :::breathes in, breathes out:: power over the mind.

For next week, I am sitting the action out. Come January I will start rebuilding my emotional confidence by only trading overnight gaps in range, with a little 2-lot, and assess my fortitude on a week-to-week basis. I will likely be in the mountains for the entirety of February, chasing powdery mountains, then in March I will consider adding back the RCS and e(RCS) trades.

This isn’t my first significant drawdown. I have been made a poor man many times by the oscillations of stock market price. I have also managed to extract great sums and put said funds into other investments, like farmland. Financial markets taught me years ago that they are nothing more than an intangible representation of millions of humans interacting, and that the ‘wealth’ they represent [on paper only] is merely a social construct—much like nations or ‘borders’. These things are not real to me. A farm is real. Farm equipment is real. Livestock is real. You cannot take away my work ethic and ability to sustain my people with the fruits of our mother earth.

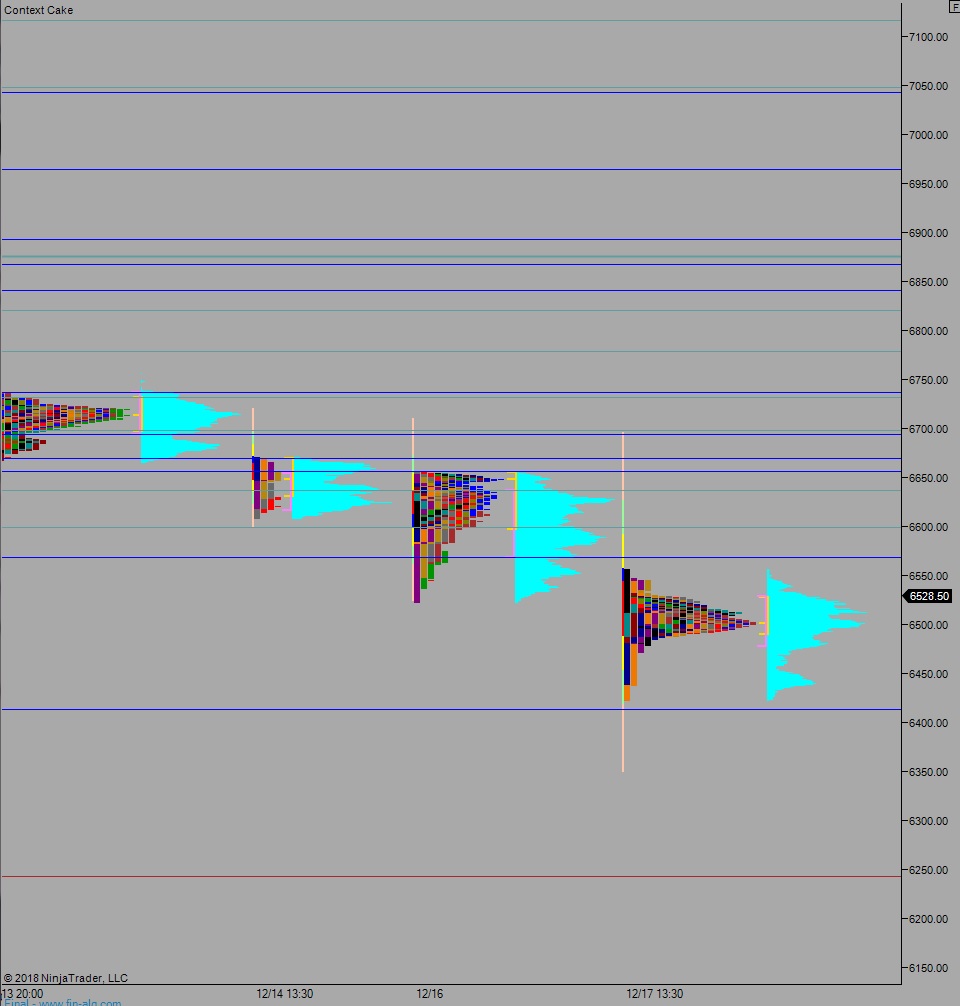

I love pulling money out of the financial complex and earmarking it for my farm complex. I will continue to do so for as long as my mental abilities allow it. While I am a very poor man in stock market and bitcoin terms, I am very wealthy in time, health, workable land, and working capital. So while all of my timing algorithms have failed me, one after another, big time! –since the failed auction at the beginning of October–I will only be making minor tweaks to them. I still consider them to be of better guidance than any banker or activist fund (lumps of coal for Andrew Left) or media sound biter.

I also still consider TSLA to be the greatest investment of all time. It is incredible that Elon and his crack team of scientists and engineers are actually solving modern societies greatest problem (commuting). TSLA will eventually be the largest company in the world, and when it is we can start to worry about the dumb dumbs in congress jamming the company up.

Investors with long term horizons can seem arrogant during bear markets. I hope I do not come off that way. Only time will tell if buy-and-hold and dollar-cost-average will be proven right again. My money says it will. Good thing I never plan on retiring.

Merry Christmas everyone. Here’s to another year down in the trading trenches with you. Saluti

Exodus members, the 214th edition of Strategy Session is live, we gone make through this bear market, and be better for it!

Comments »

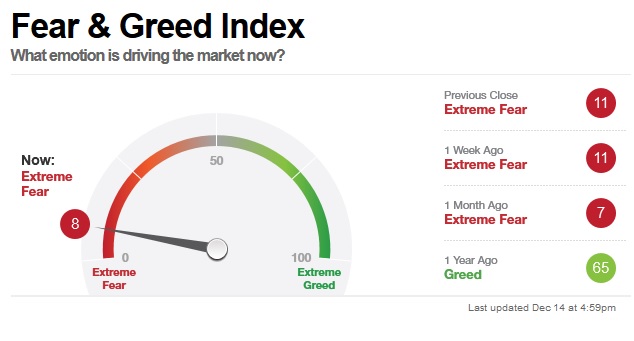

But I do not base my decisions of the capricious sentiment of the herd, or the newspapers, or even the politicians. Or the raucous behavior of Frenchmen, or the patriarchal shake-ups in Arabia. I base my decisions on the will of my robots. They are my guide. I am their steward.

But I do not base my decisions of the capricious sentiment of the herd, or the newspapers, or even the politicians. Or the raucous behavior of Frenchmen, or the patriarchal shake-ups in Arabia. I base my decisions on the will of my robots. They are my guide. I am their steward.