NASDAQ futures are coming into Thursday flat after an overnight session featuring extreme range and volume. Price briefly took out the Wednesday low overnight before rotating higher. As we approach cash open price is hovering in the lower quad of Wednesday’s range. At 8:30am initial/continuing jobless claims data came out mixed.

Also on the economic calendar today we have 4- and 8-week T-bills up for auction at 11:30am followed by a 5-year TIPS auction at 1pm.

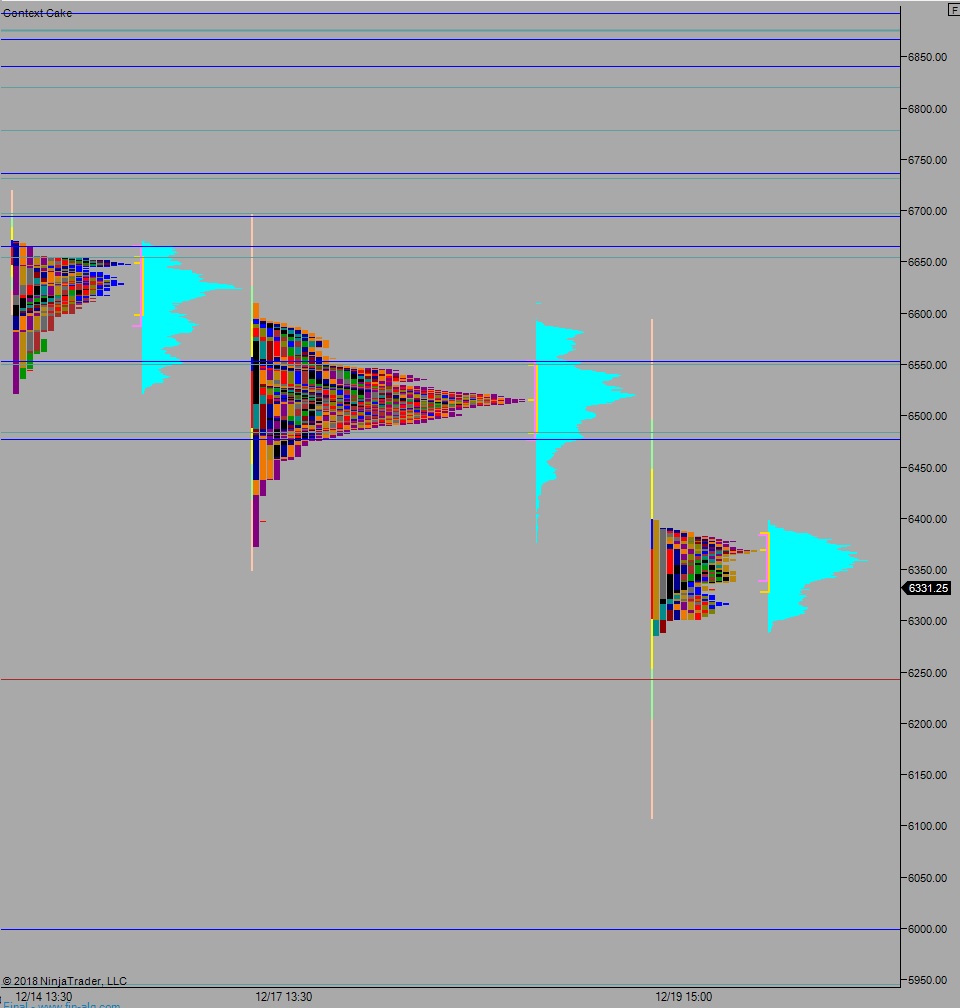

Yesterday we printed a neutral extreme down. The day began with a gap up and drive higher. Price was chopping along the Tuesday high, briefly probing above it twice. Then after the FOMC rate hike sellers stepped in, there was a battle at the weekly lows which ultimately resulted in sellers overpowering the buying response and sending us down through the lows. A responsive bid stepped in late in the session that managed to stabilize the selling right near the year-to-date unchanged mark.

Heading into today my primary expectation is for sellers to press down through overnight low 6287 setting up a move to target 6241.50 before two way trade ensues.

Hypo 2 buyers sustain trade above 6326.50 setting up a move up through overnight high 6391. Look for selelrs up at 6477.25 and two way trade to ensue.

Hypo 3 stronger sellers sustain trade below 6250 setting up another leg of liquidation.

Levels:

Volume profiles, gaps, and measured moves: