NASDAQ futures are coming into Wednesday gap up after an overnight session featuring extreme range and volume. Price worked higher overnight, slowly working its way back up to the Tuesday midpoint. As we approach cash open, price is hovering just above the Tuesday mid.

On the economic calendar today we have existing home sales at 10am, crude oil inventories at 10:30am, an FOMC rate decision at 2pm, and a Jerome Powell press conference at 2:30pm.

Investors are currently pricing a 71.5% probability of a 25 basis point lift in the Federal Reserve’s benchmark borrowing rate. Investors will also be pouring over the statement’s verbiage and the tone of the press conference afterwards for indication of whether or not the Fed will continue their plan of lifting rates through 2019, or if they intend to slow the pace of rate hikes.

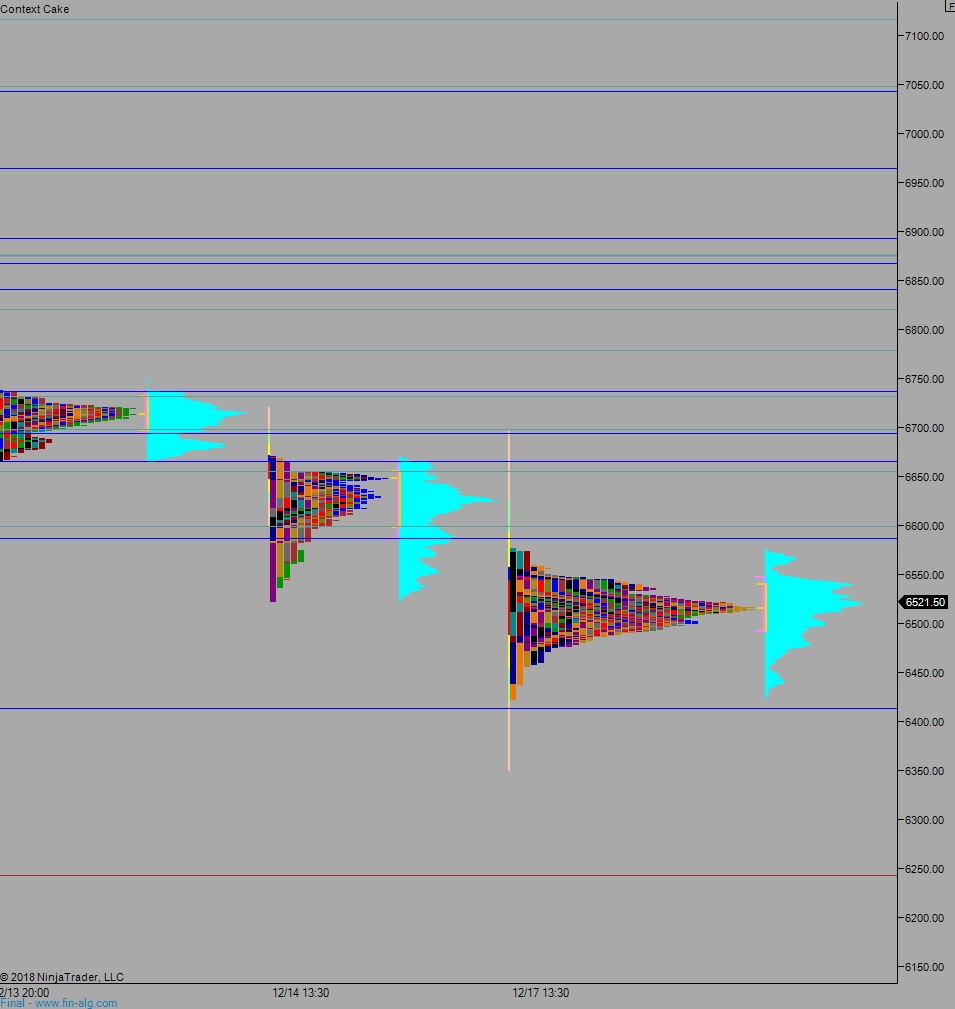

Yesterday we printed a neutral extreme down. The day began with a gap up and tight two-way auction. The market went range extension down before lunch, then price shot higher to go neutral. This neutral rally was sold into, with selling accelerating into the afternoon and close. We closed near session low.

Neutral extreme down.

Heading into today my primary expectation is for a gap-and-go higher. Look for price to take out overnight high 6549, setting up a move to target 6586.50 before two way trade ensues. Then look for the third reaction after the FOMC rate decision/press conference to drive direction into the close.

Hypo 2 sellers work into the overnight inventory and close the gap down to 6479.50 setting up a move down through overnight low 6458.50. Look for buyers down at 6413 and two way trade to ensue. Then look for the third reaction after the FOMC rate decision/press conference to drive direction into the close.

Hypo 3 stronger buyers trade us up to 6654.75 before the FOMC decision, then look for the third reaction after the FOMC rate decision/press conference to drive direction into the close.

Levels:

Volume profiles, gaps, and measures moves: