H.W. is the first President I remember from my childhood. “Read my lips: no new taxes,” stuck with me. I didn’t understand taxes, but I saw that taxes angered adults, and this feller was going on the TV and promising no new taxes. So he seemed like a pretty solid dude. I knew about as much about politics then as I do now, which is next to nothing. But I remember liking conservatives back then, back before it became a political arm of the evangelical christian institution, which I find to be the most vile entity on the planet. Hail Satan.

It’s not the christian people I have an issue with. It’s the institution, and how they are invading our political system and jeopardizing the foundations of America. The America H.W. made stronger during Desert Storm—a sweeping victory that sent a message across the world that America is the best, #1.

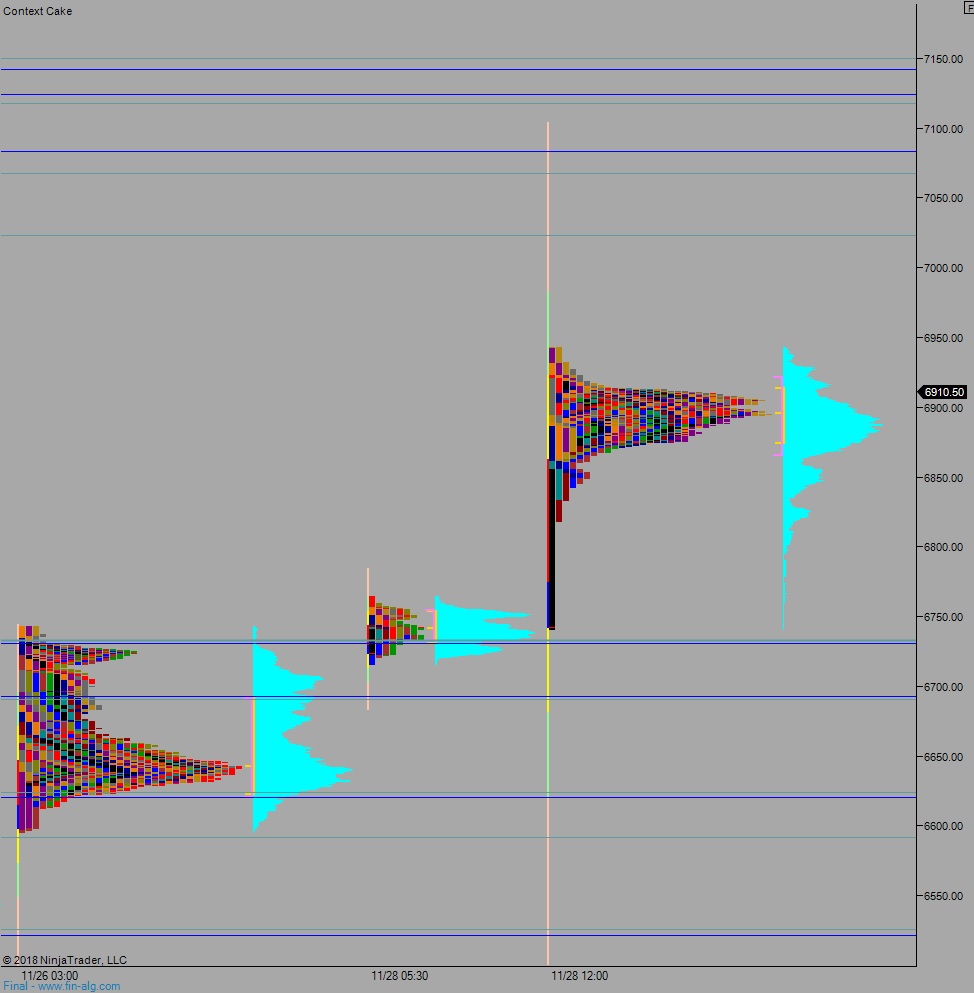

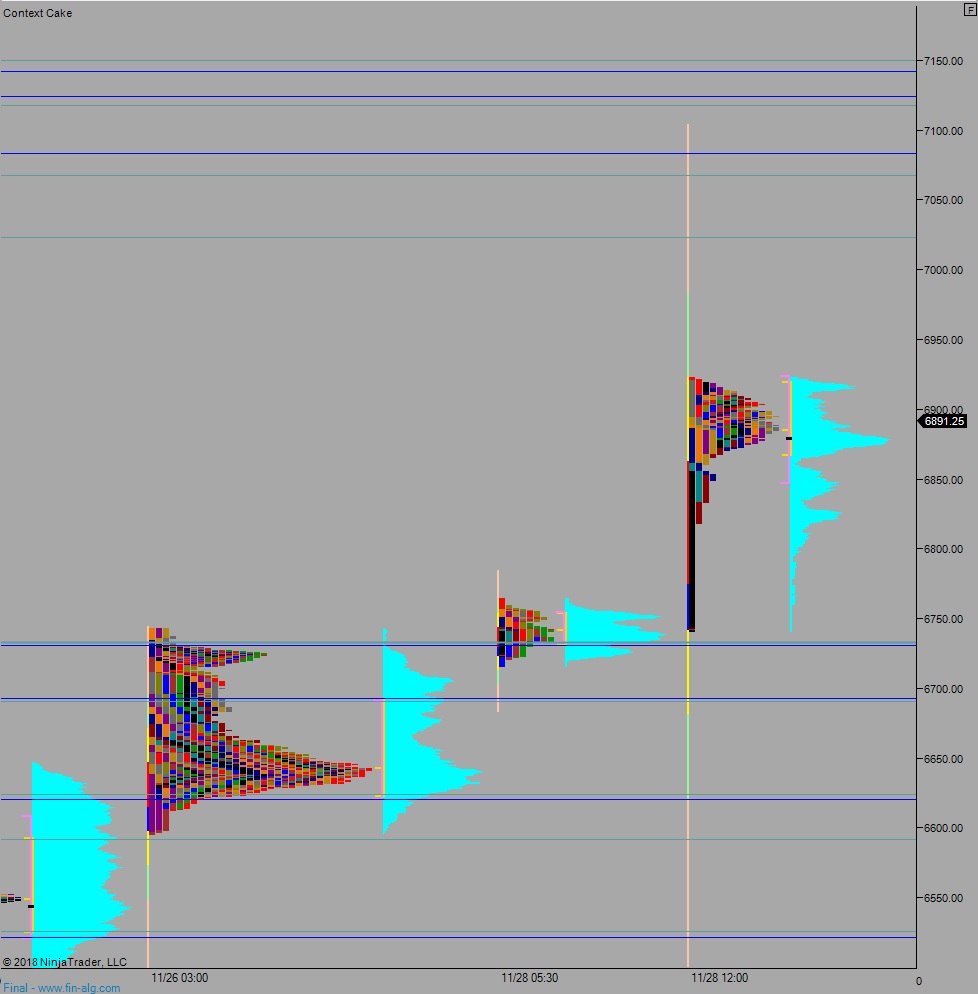

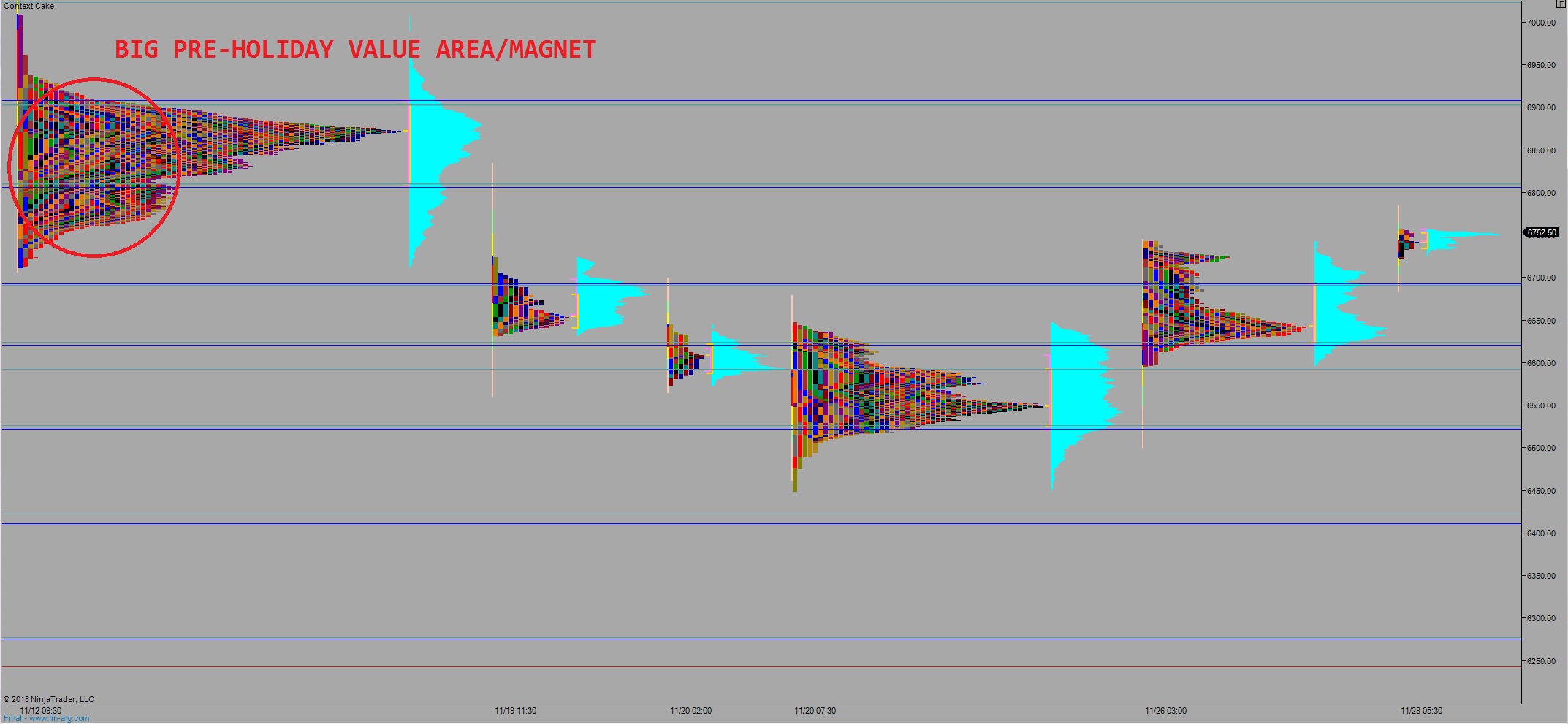

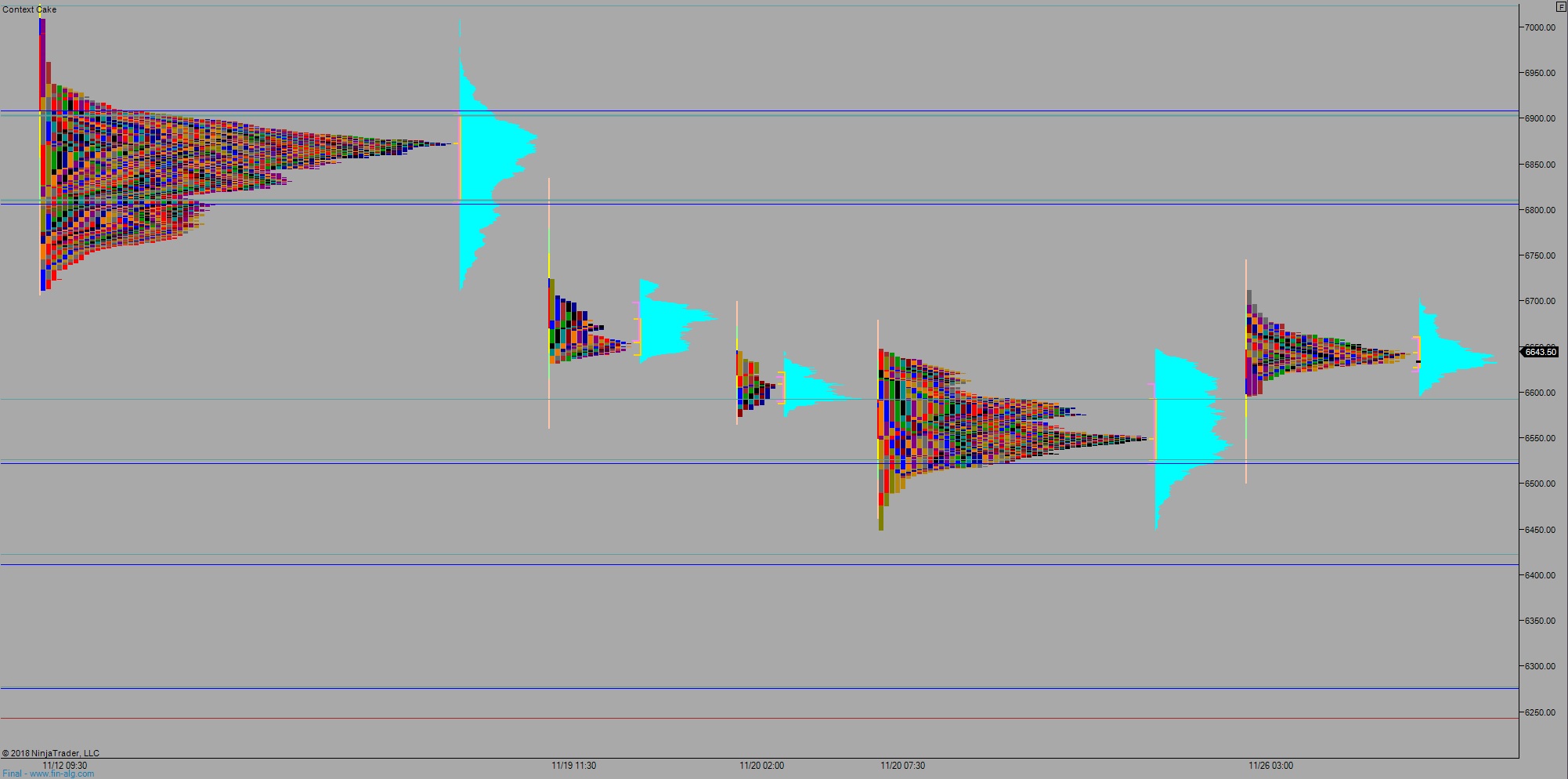

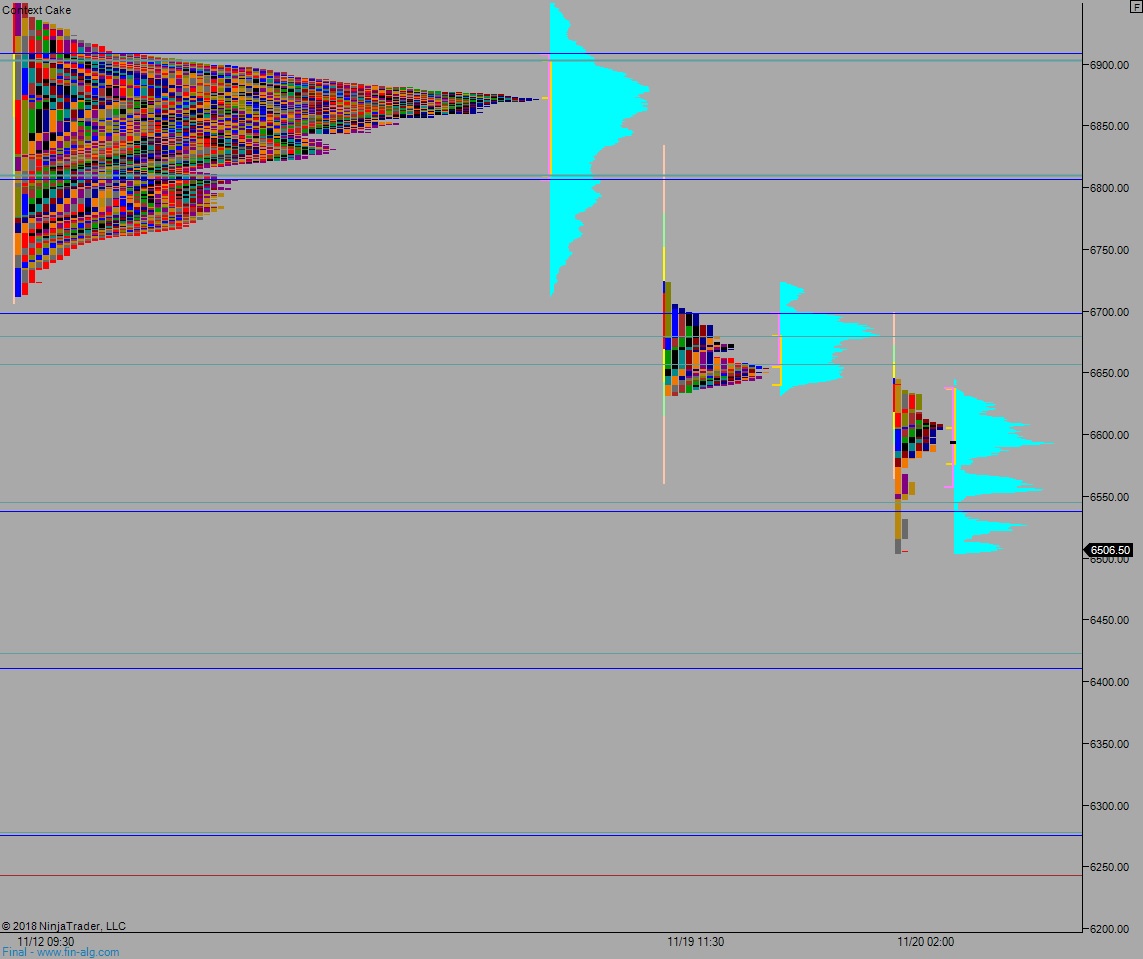

This year has had a transitional vibe to it. The passing of our 41st President here at year-end only solidifies that feeling. Enough about feelings and christians. The algorithms are all bullish heading into the first week of December.

And by golly, all I am here to do is carry out the commands of my robot overlords. The rest of the information generated by humans interacting with the world is noise when it comes to short term trading, and I need to trade well short term.

I slayed last week. Slayed. Best week in months. I hope you did too, and I hope you all have a prosperous go at the markets this December.

Human interaction is actionable long-term. This requires long-term patience, short-term urgency. Like climate change. We need to urgently address this issue which is why it is so important that we defend the efforts of Elon Musk and his crack team of engineers and scientists. They are showing us what happens when capitalism attacks an issue—progress. They seem to even have NASA stoked again and doing good work. Would NASA be planning to send folks to Mars had it not been for the curious developments at SpaceX? We don’t know. That is a different simulation entirely.

What we do know is that TSLA is the absolute best long term investment available on the public stock markets. Also we know that science shattered the absurd grip christians had on the modern world once before (indulgence, anyone?), and science will topple these flat-earth, conspiracy-loving psychopaths again.

It is best to side with the scientists, believe me.

And the robots. And the robots are bullish heading into the first week of December.

Behave accordingly.

001010111011

Exodus members, the 211th edition of Strategy Session is live, go check it out!

Comments »