Happy Martin Luther King Junior day everyone. MLK had the crazy notion that people should be kind to each other instead of being mean and miserable, so they killed him. His bravery and kindness helped us start down a path to equal rights. The civil rights he stood for are still being challenged today. His calm and reasonable voice continues to resonate in the hearts and minds of our young nation’s people.

I listened to the Joe Rogan/Mike Tyson podcast this morning and suggest you do the same. It’s a trip to hear Tyson reflect on his old self. He is brutally honest about who he was but not able to step back into his competitive mindset at all. He cannot so much as start jogging because he worries it will reawaken the ego that drove him to some incredibly dark places. For some people, complete abstinence from an activity or place or drug is the only option for self-preservation.

I’m reading The Hitchhiker’s Guide To The Galaxy right now. It is a wonderful book that leads the reader to contemplate the purpose of living, and while doing so keeps the tone light and playful.

I went to an old, restored movie theater last night in Detroit and watched Easy Rider. The way Peter Fonda’s character is treated in some areas of the rural south is a disturbing reminder of the mentality still present in many parts of the country—that anyone different looking is bad. Jack Nicholson’s character explains that Americans will talk about freedom all the time and expound how the policies of the United States allow for it, but the second they see someone who is actually free it scares the shit out of them. Especially if the ones who are free choose to live differently.

The future is decidedly feminine. Look at the Pantone color of the year. Or last years. Or how the mid-term elections played out. Our democracy and the perceived freedoms of consumerism have expressed a desire to move away from masculinity. Not because masculinity is bad, it isn’t, but because for some other reason that, if I’m being honest, I don’t truly understand.

I’ve never assigned too much energy to understanding why something is the way it is. All I ever concern myself with is being in a position to benefit from the way things are. I find tools that seem helpful and, I go to work. I write, poorly, but it helps me gather my thoughts. I teach the fundamentals of investing and trading to anyone in Detroit who will come to my meetups. It forces me to distill fifty blog entries into 10-15 minutes of talking. This helps me solidify the most important principles of my approach so they don’t crack under pressure.

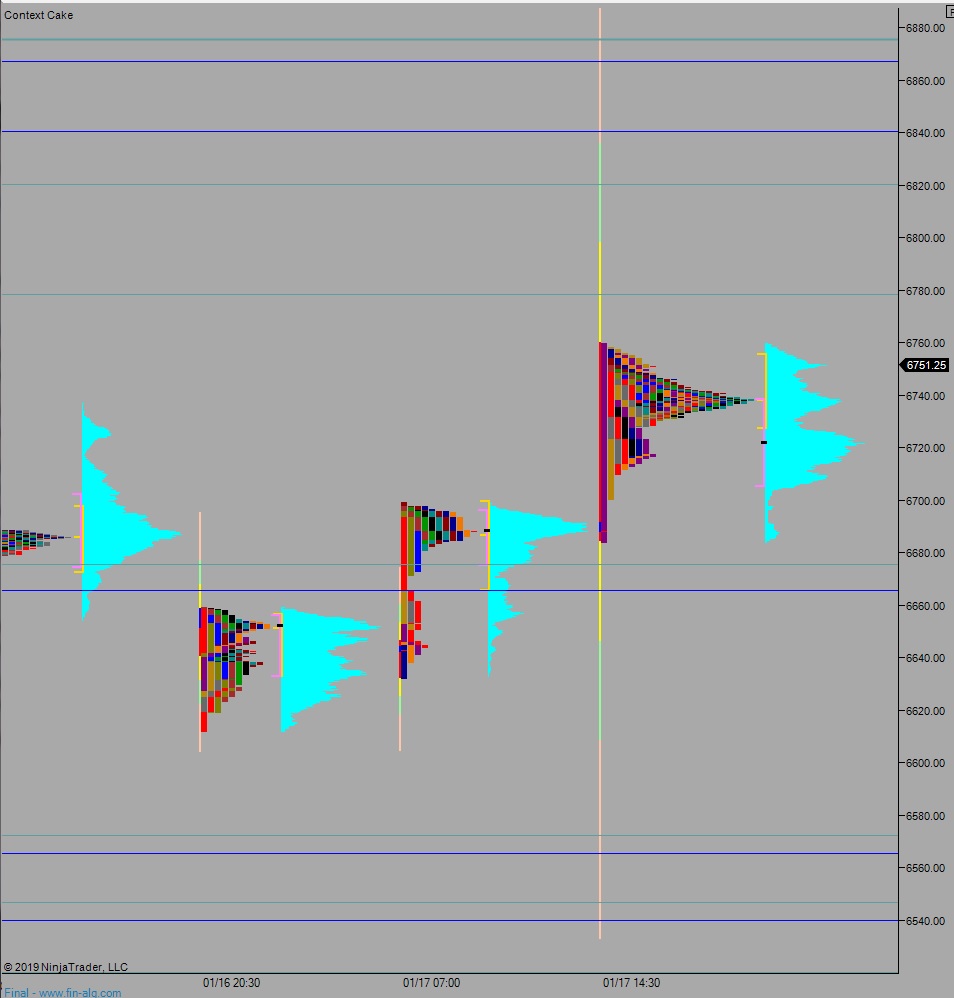

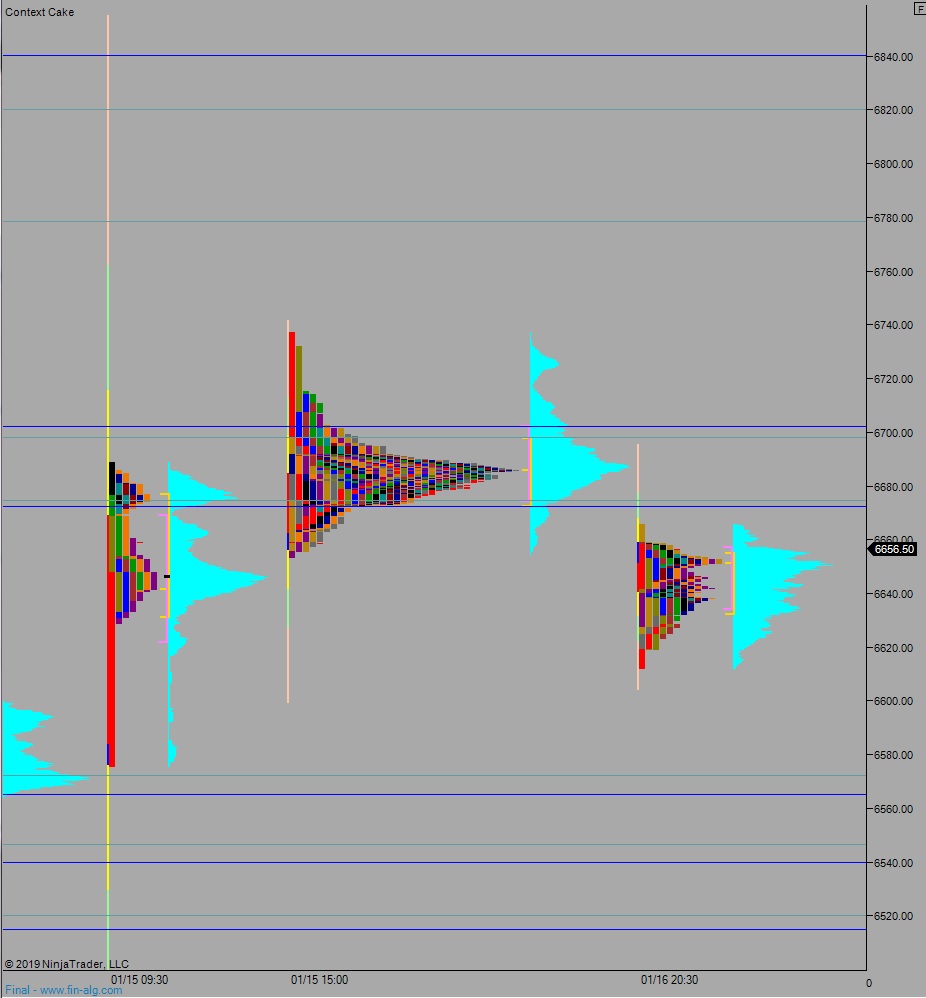

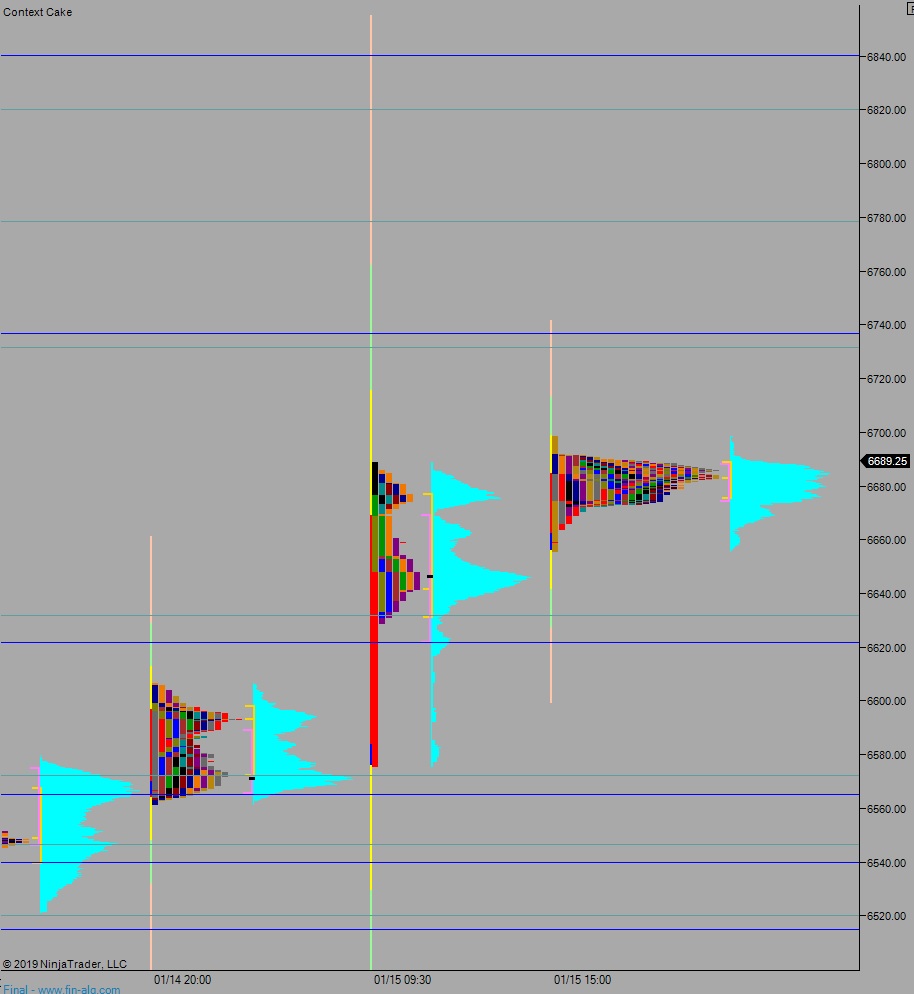

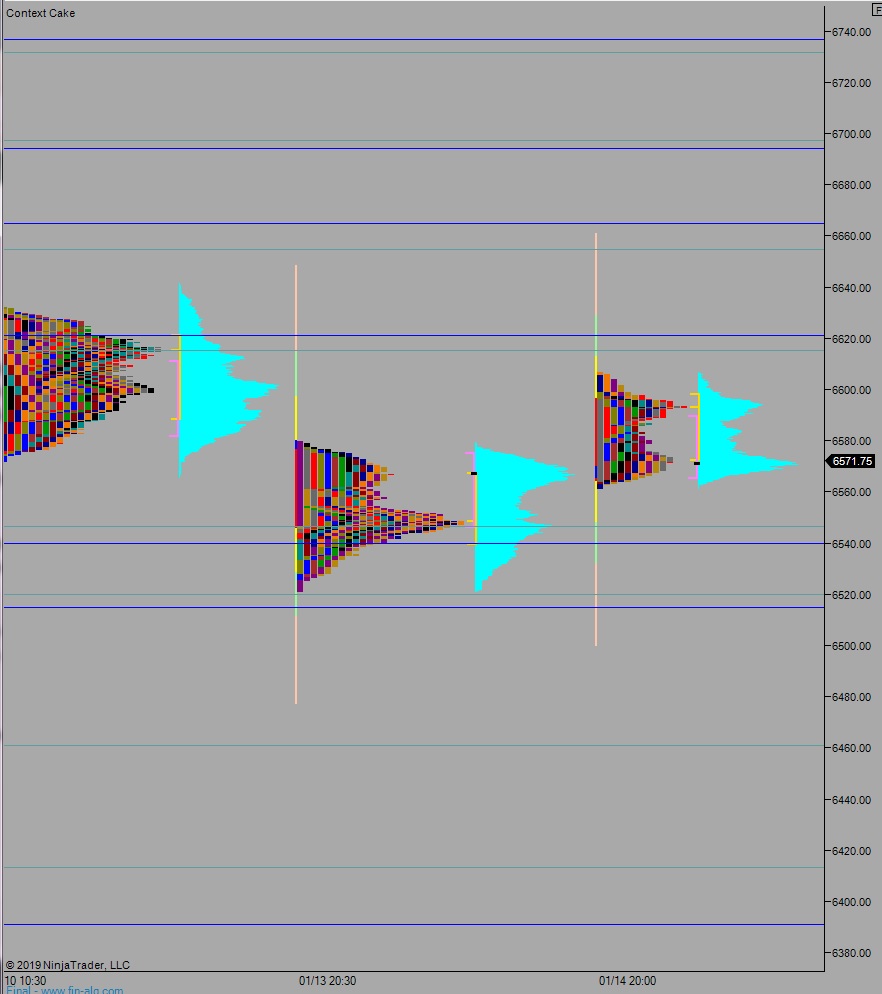

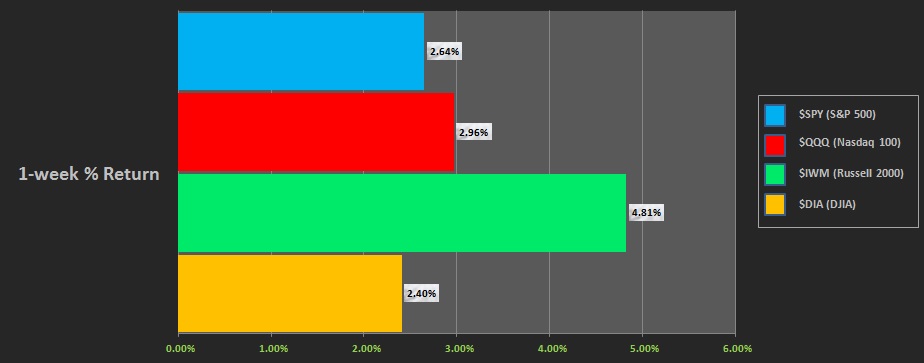

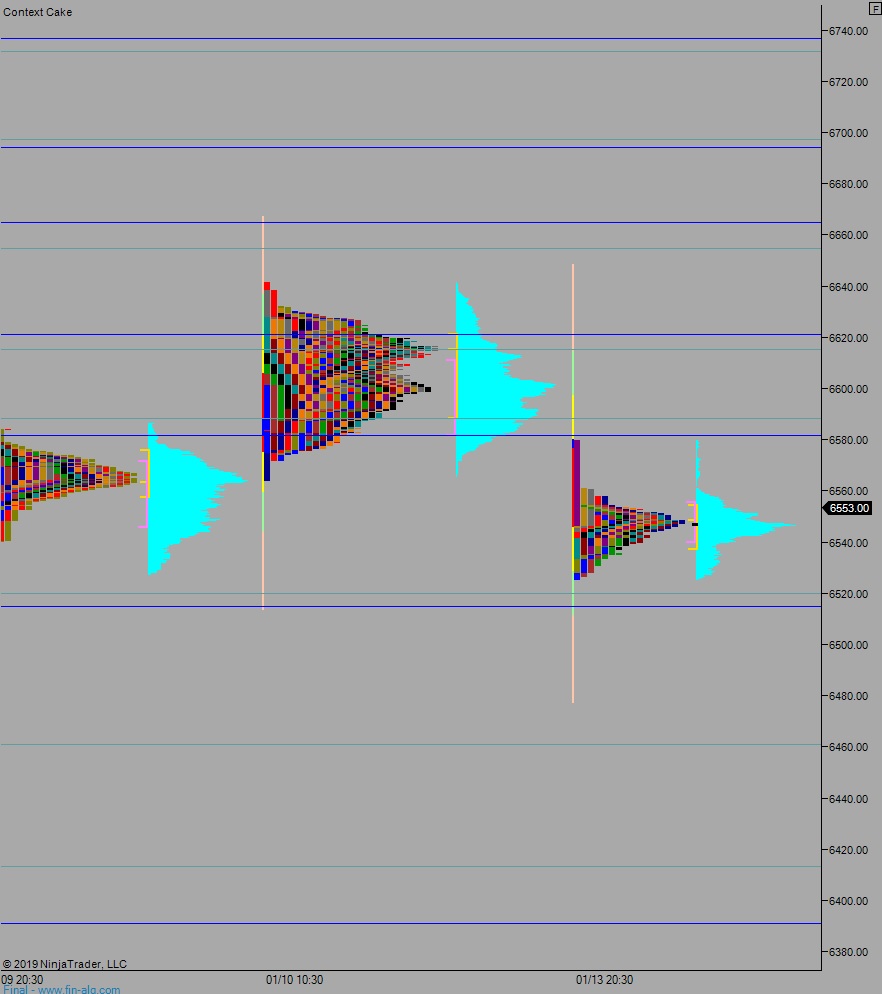

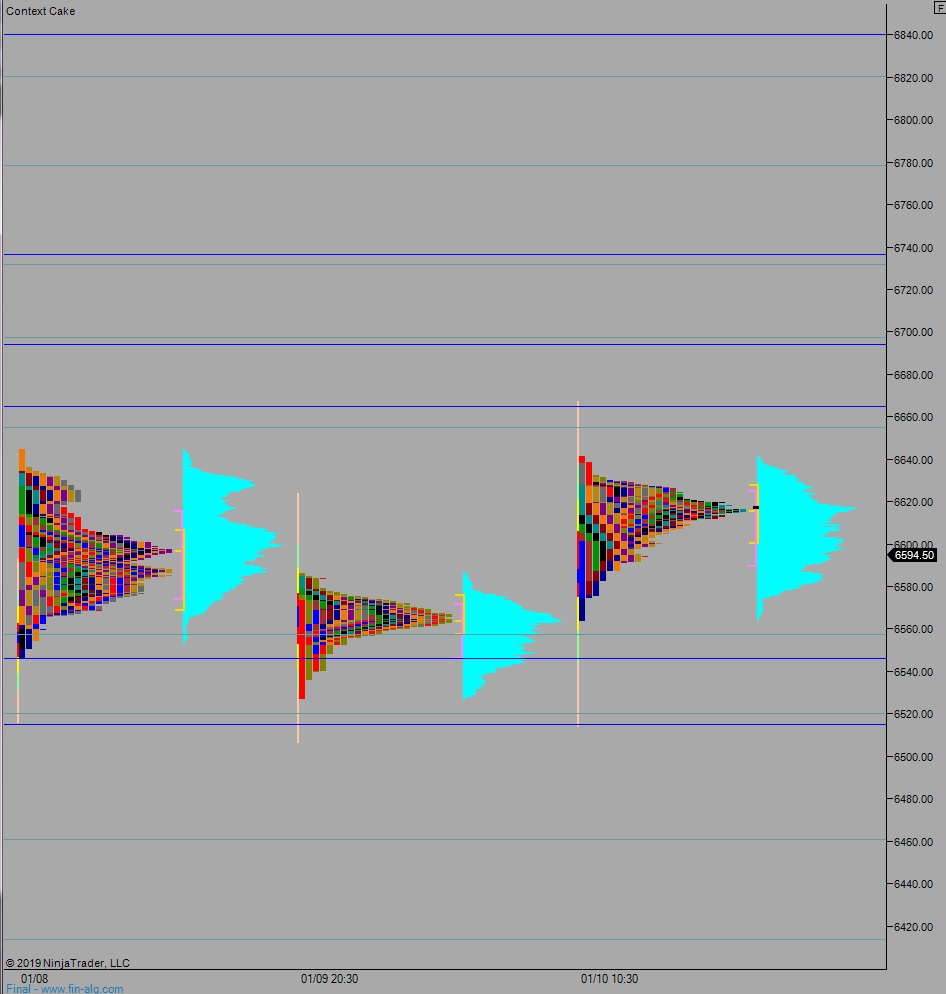

Next week is a bye week for the stock market. OPEX is behind us. No major tech companies are reporting earnings. The IndexModel is signalling calm conditions for a second consecutive week. The government is shut down. No major economic meetings or releases are taking place.

I’ll be trading, long only. If we have a gap down inside the prior day’s range, I’ll be working that gap fill. Other trades I will take include targeting the overnight high or range extension up. My primary expectation is for a calm drift clean through Friday.

It seems like all the manufactured hostility is sort of frozen. Perhaps it is because a large part of the country was just blanketed with a fresh coat of snow. I dunno. Maybe it’s all the time I’m spending in 110 degree yoga studios. Again, I dunno. All I know is all my context points to next week being a bye week for the stock market.

Position accordingly.

Exodus members, the 218th edition of Strategy Session is live, go check it out!

Comments »