NASDAQ futures are coming into Friday with a slight gap down after an overnight session featuring extreme range and volume. Price was balanced overnight, chopping along the Thursday midpoint for most of the Globex session. As we approach cash open price is hovering just above the mid. At 8:30am both GDP and durable goods orders data came out below expectations.

Also on the economic agenda today we have PCE core at 10am.

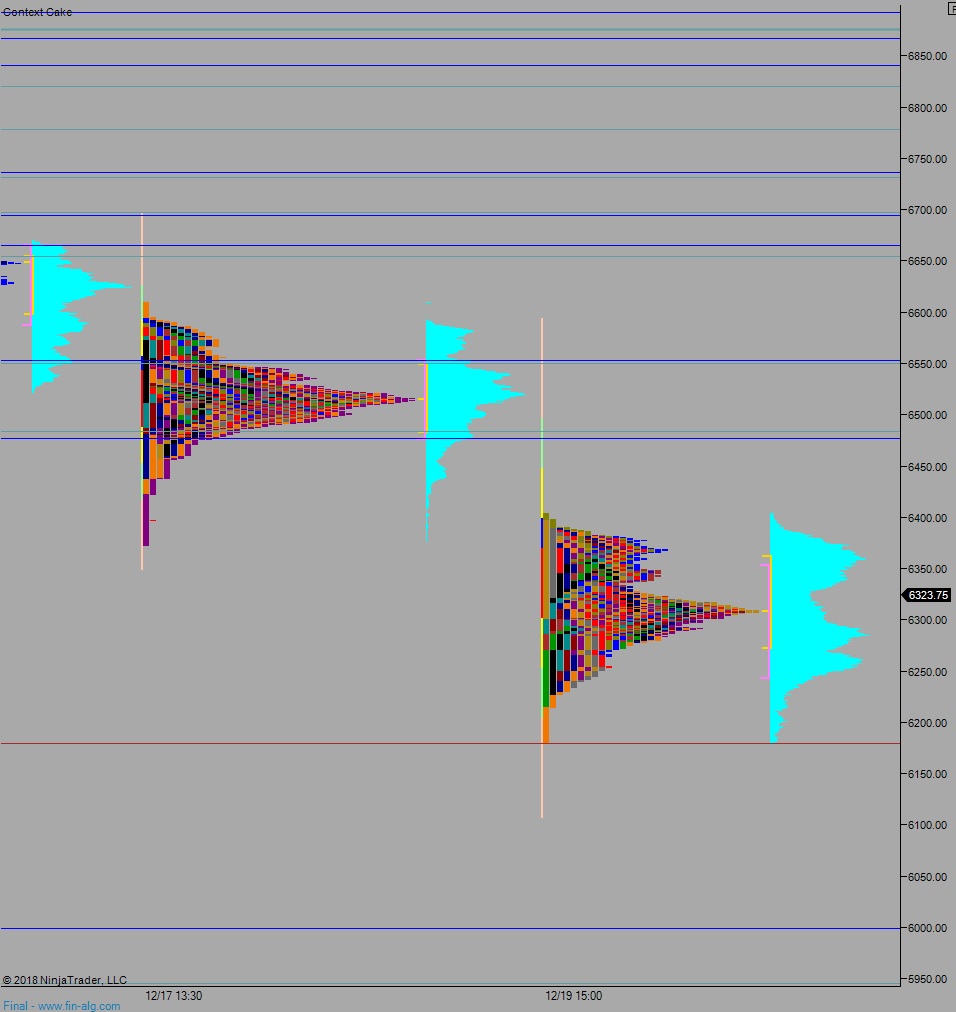

Yesterday we printed a normal variation down. The day began with a slight gap down which buyers quickly resolved. Said buyers were hesitant to initiate risk up into the Wednesday liquidation however. As a result, responsive sellers stepped in before we completed the initial balance and began working price lower. We made a new swing low by late morning and continued to probe lower into the afternoon. We traded to levels unseen since February 9th before a responsive bid stepped in. Buyers managed to ramp price higher into closing bell, positioning price above the daily midpoint into the close.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 6326.50. From here we continue higher, up through overnight high 6333.50 setting up a move to target 6400 before two way trade ensues.

Hypo 2 stronger buyers trade us up to 6476.75 before two way trade ensues.

Hypo 3 sellers trade down through overnight low 6265.05 setting up a move back down to swing low 6180 and a test down below it. Look for buyers down at 6100 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: