NASDAQ futures are coming into Monday gap down after an overnight session featuring elevated range on elevated volume. Price worked lower overnight, making one slow, uni-directional downward move throughout the Globex session. As we approach cash open, price is hovering below last Friday’s midpoint.

There are no economic events scheduled for today, possibly because it is Armistice Day.

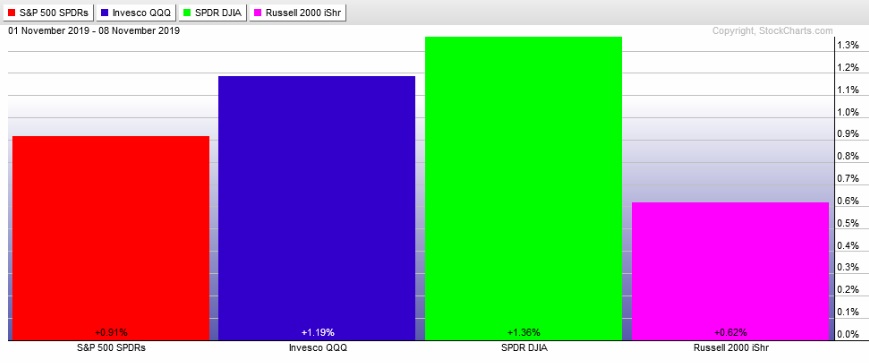

Last week began with a gap up and sideways drift through late Tuesday. Then sellers pressed late Tuesday and into Wednesday before discovering a responsive bid. Buyers then auctioned price higher through Thursday afternoon before we balanced out into the weekend. The Russell lagged throughout the week. Here is the last week performance of each major index:

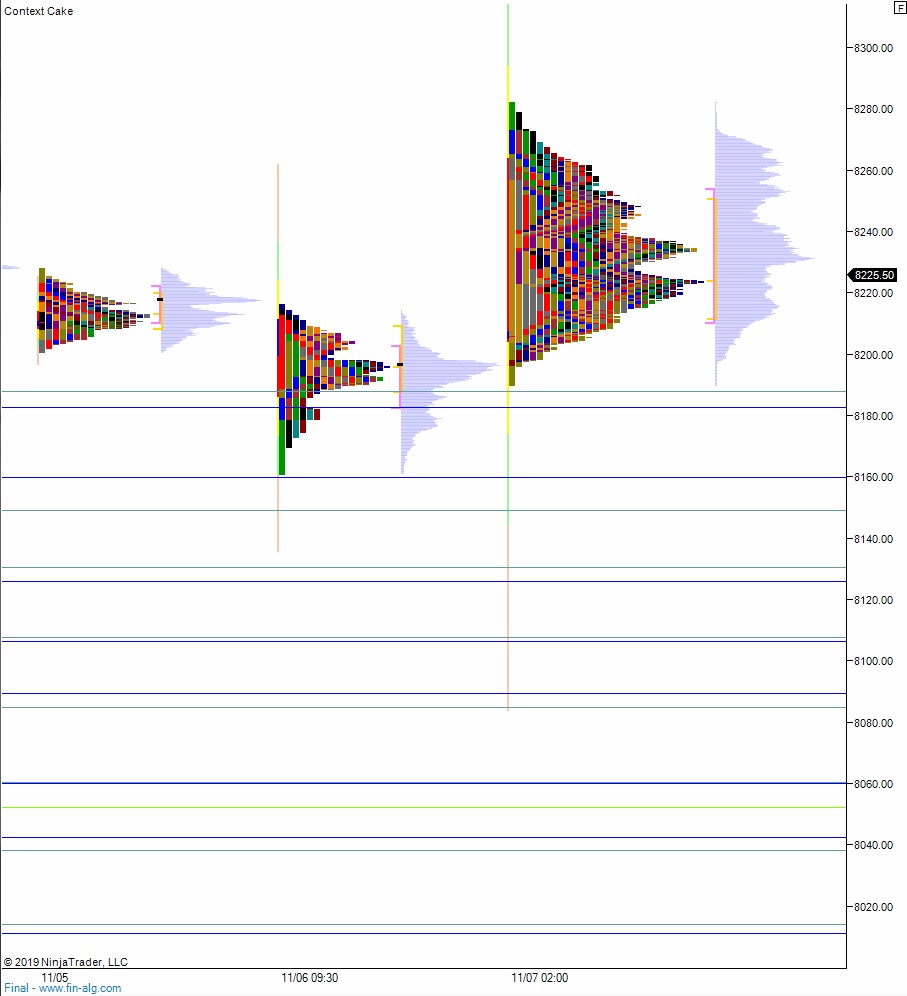

On Friday the NASDAQ printed a normal variation up. The da began with a gap down that buyers quickly resolved with an open drive up. Sellers then pushed down through the Thursday low before forming a sharp excess low. The rest of the day was spent auctioning higher, including a strong ramp near end of day.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 8256.25. From here we continue higher, taking out overnight high 8264.25. Look for a tag of the naked Thursday VPOC at 8267.50 before two way trade ensues.

Hypo 2 sellers press down through overnight low 8213.75 setting up a move to target 8200 before two way trade ensues.

Hypo 3 stronger sellers tag 8187.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: