NASDAQ futures are coming into Friday gap down after an overnight session featuring extreme range and volume. Price worked lower overnight, trading down near the per-Amazon earnings spike before coming into balance. At 8:30am PCE core data came out in-line with expectations. As we approach cash open, price is hovering below 9200, about -50 points off the overnight high.

On the economic calendar today we have Chicago purchasing manager at 9:45am followed by the final January reading of sentiment from the University of Michigan.

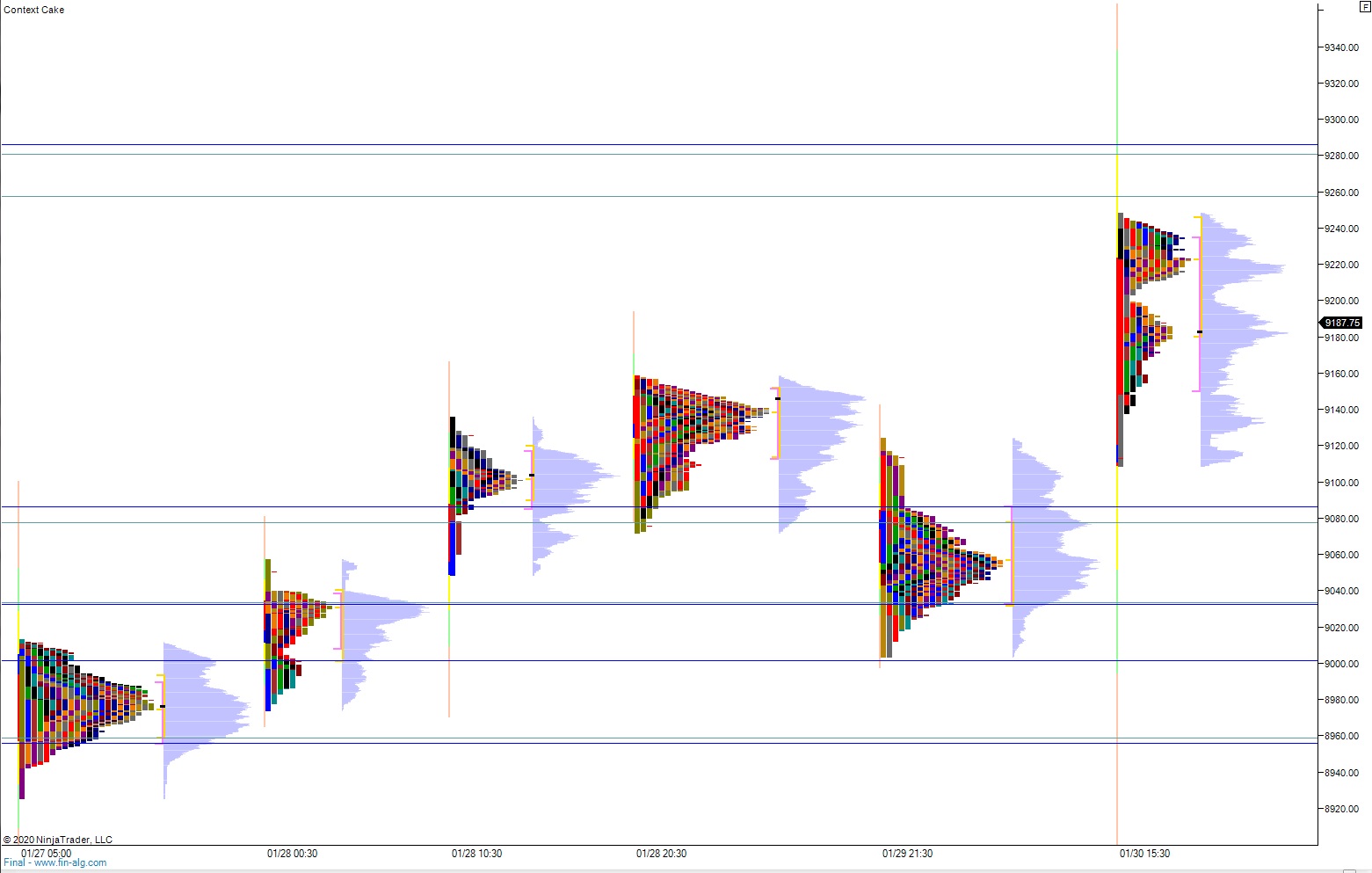

Yesterday we printed a neutral extreme up. The day began with a gap down that buyers quickly resolved with an open drive up. After closing the gap and trading a few points beyond 9100,responsive sellers stepped in and reversed the morning gains and more, going range extension down and pressing deep into Tuesday’s conviction buy range. Then as the late afternoon progressed, bidders stepped back in, reclaiming the midpoint then defending it around 3pm before rallying price to a new high of day, pushing us neutral. Amazon earnings then propelled a sharp move higher, trading up beyond last Friday’s midpoint during before the settlement period ended. We closed near the high.

Neutral extreme up.

Heading into today my primary expectation is for sellers to be actively defending 9200, taking out overnight low 9138 to set up a move down to 9100. Look for buyers down at 9086 and two way trade to ensue.

Hypo 2 buyers work into the overnight inventory and trade up through overnight high 9248.75. Look for sellers up at 9257.25 and two way trade to ensue.

Hypo 3 stronger buyers trade up to 9280.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: