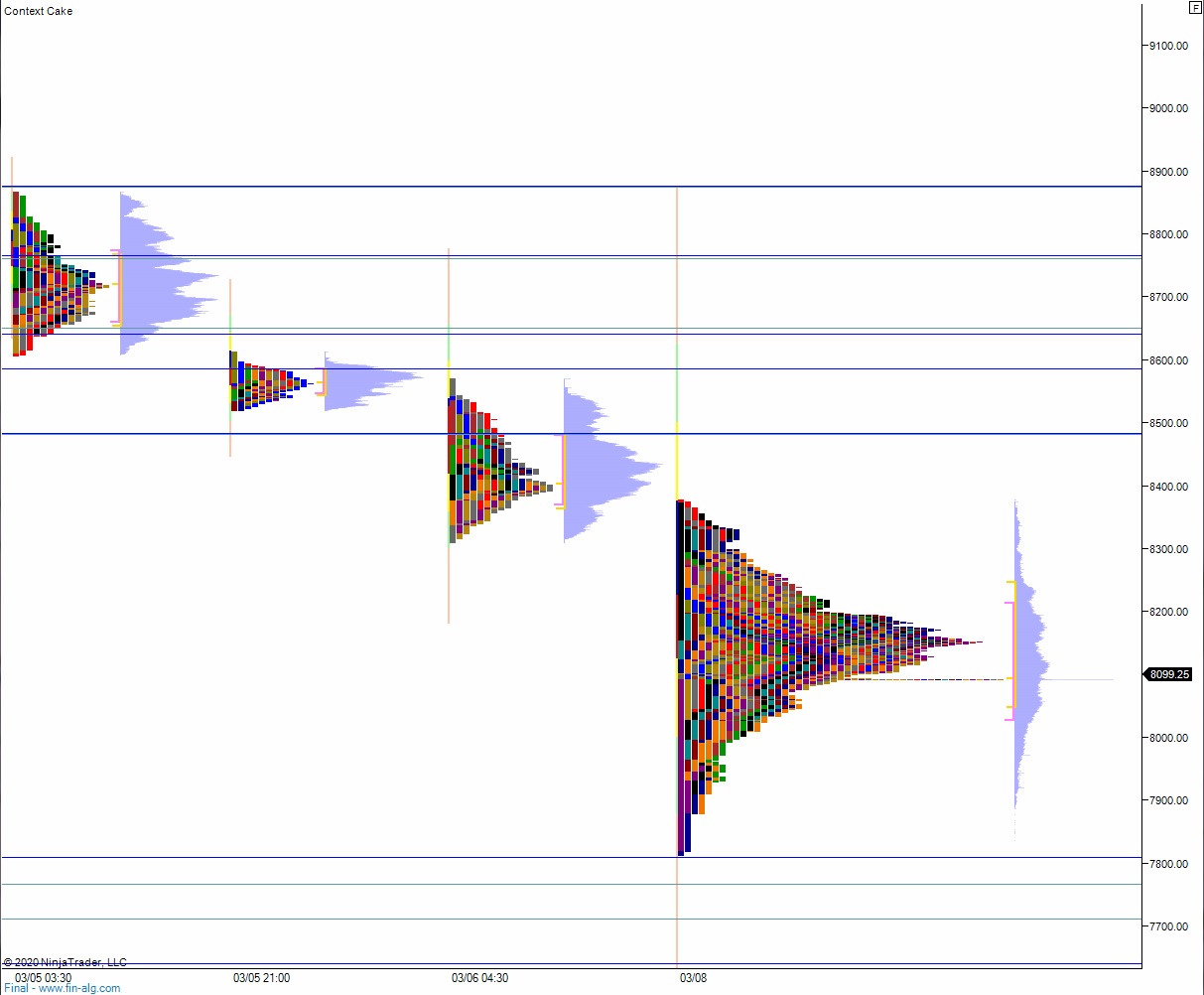

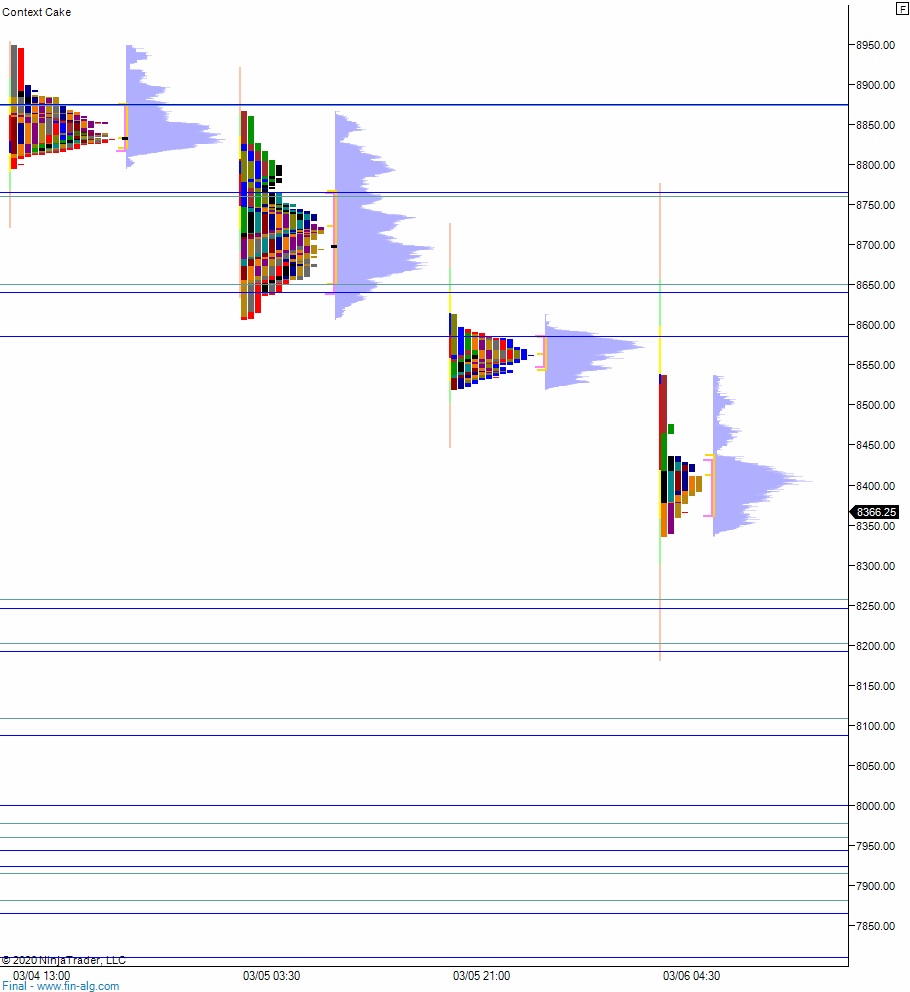

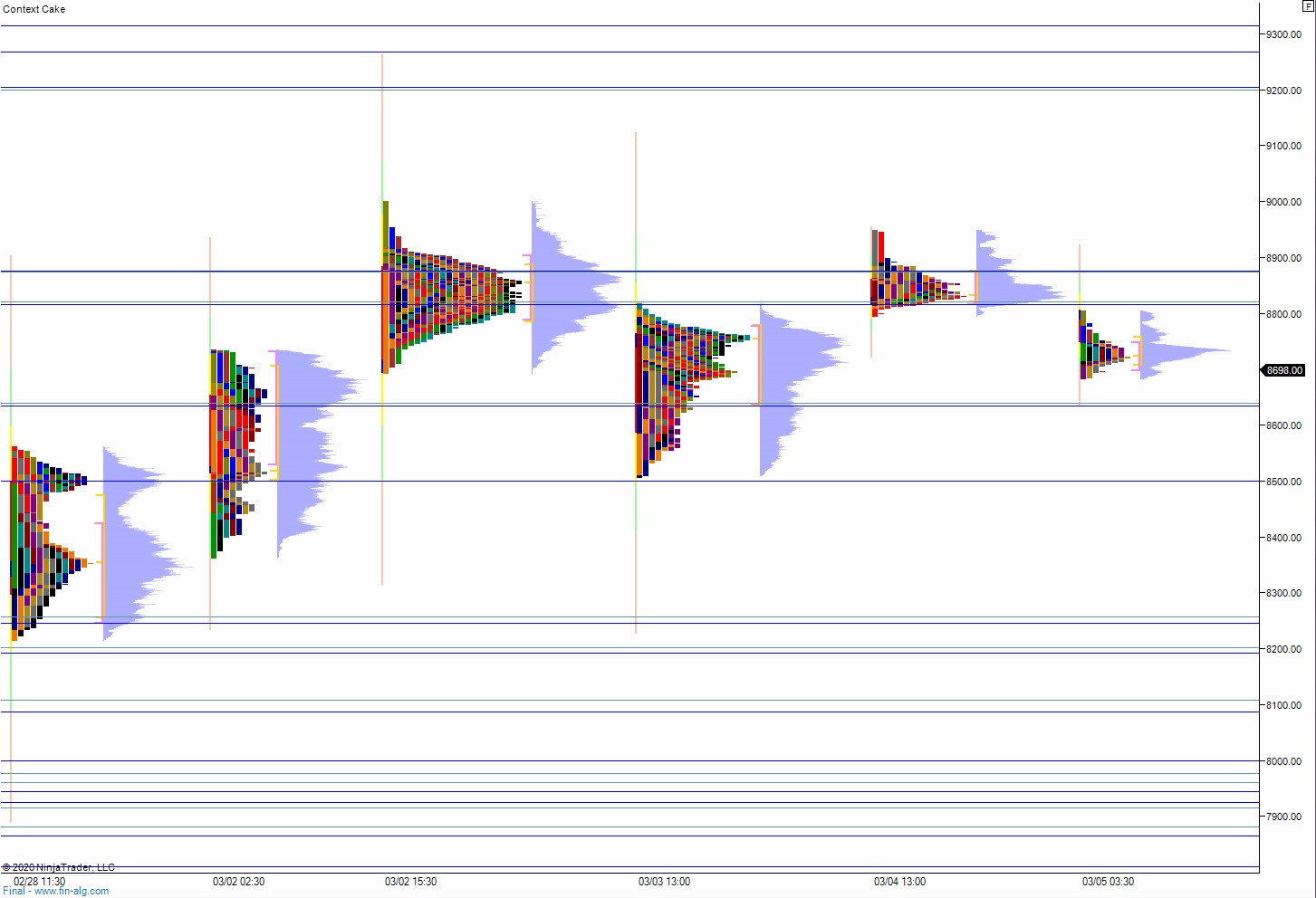

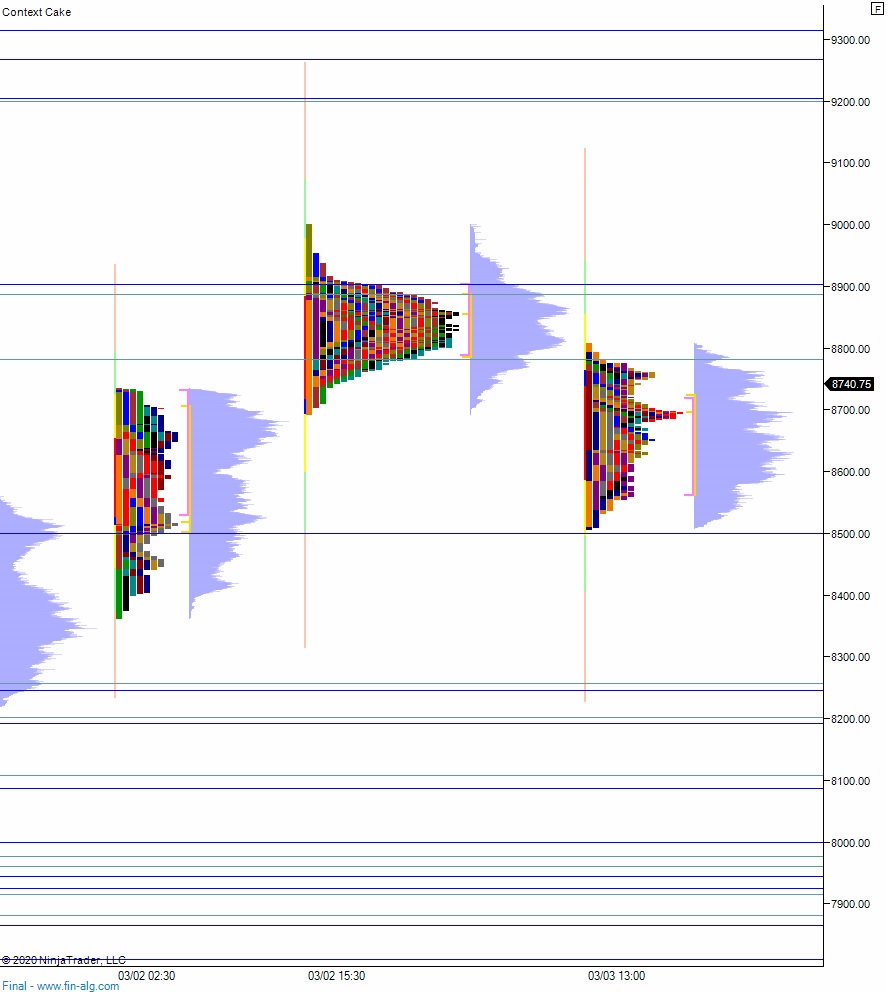

I stepped aside last week because my signals were crossed. IndexModel, which is built on auction theory, was flagging bearish while Exodus was bullish. The signals generated by these two systems are the rocks I stand on when trading NASDAQ futures, which involves so much leverage it is the financial equivalent of cliff diving in shallow waters. If my footing is off, then I refuse to jump. No one can make me. I can think and fast and wait.

Those are times when I like to stand on my head and stare a the world from that uncommon perspective. Anyhow, the signals cleared up over the weekend. I’ve regained my systematic footing and spent all morning fortifying my logical constitution with three hours of sunrise research. Here are my findings.

Thank you for your time.

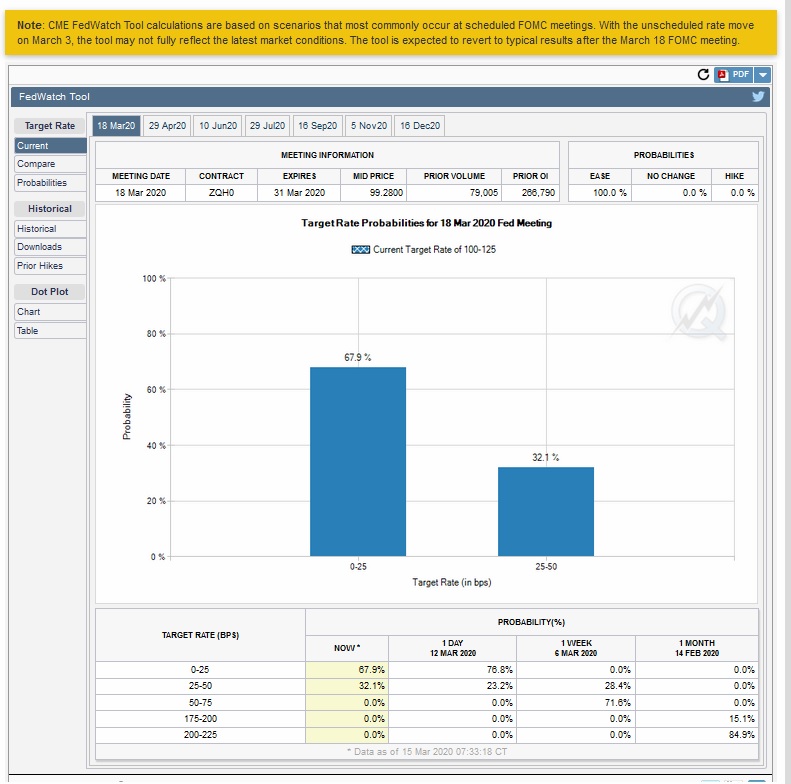

There is uncertainty down at the gambling halls in Chicago.

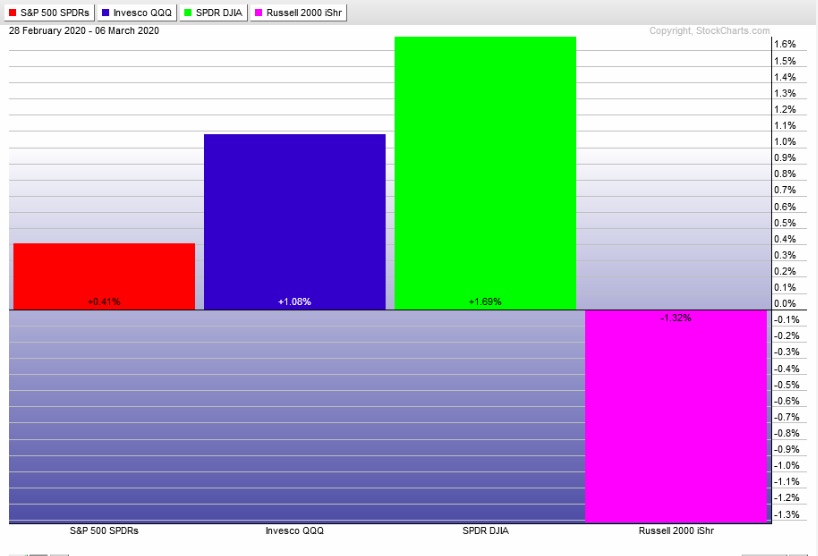

It may seem like I joke around too much, Elder Raul often scoffs that I am, “Always joking around,” when the going gets tough. But the Chicago Mercantile Exchange is a giant gambling hall and you cannot convince me otherwise. Just like Las Vegas makes a book around sporting events, so too are odds placed on FOMC meeting outcomes, via the CME’s Fed Funds futures (say that five times fast). Trading can be gambling, if you go about it like some barstooled jackal. Trading can also be a business, like buying a rail car full of mangoes on Sunday and selling them all by Friday. Anyhow, I watch Fed funds futures closely, have for years, and this week the bookies at the CME are having a hard time making a book on the FOMC rate decision. The CME even felt the need to add a little yellow warning to the data, here is a screenshot:

Say what you will about Janet Yellen (QUEEN), when she was sitting at the helm of the Fed, telling long wandering grandma stories and handing out Werther’s Candies, investors had zero uncertainty with the Fed. The bankers were transparent and calm and non-reactive. Now they are led by Jay Powell, who is like a puppet on arm strings held by the President and his CEO friends and foot strings manned by all the private equity goons he is in cahoots with. With Pinocchio in charge, the Wednesday afternoon rate decision is as hot of a scheduled economic event as we’ve likely ever had. I will be watching the third reaction closely, and “going with it” into the second half of the week.

NEXT

Gold is not a safe haven.

Some would say I am a fox, sure, but I am not here to trick you into burying your gold in the field of miracles. I don’t want your gold and you shouldn’t either. It has no purpose and its value is relegated mainly to fashion. If I want to invest in fashion I buy Gucci.

Keep an open mind.

I have never liked the oil and gas sector. Their actions have destroyed much of the planet, and I’d like to see them all put out of business by Our Dear Leader Elon. And they likely will be, but it will take time, more time than I have been allotted as a mortal. My job, as a speculator, is to extract as many fiat american dollars as possible from the global financial complex and convert said fiat into real assets—land as far north and at as high an altitude as my constitution allows. Said land will be earmarked for development, using steel and concrete and brawn, to create a compound of sorts, for hoarding actual important things like heirloom seeds, quality hooch and firewood.

I think we are seeing a generational buying opportunity in energy and I may take to the equity markets this week and secure a position. I spent some time researching the area this morning and came up with two names, one domestic and one in the emerging markets. The greatest emerging market, of course, is China. PetroChina reports earnings Thursday. I am waiting to hear back from my China correspondent ROBERTO BREGANTE before taking action, but the plan I am setting up is to buy half my position before earnings, and half after.

Domestically I like WES, but for fucked sake, they’re operating in my beloved Rocky Mountains. I’d like to see them become a going concern and then a nonexistent concern. But I may buy some of their stock in the meantime.

Recent comments

Guys (ladies?) you showed up in the comments of my last two posts on dealing with huge losses and wins. I am humbled by your feedback and grateful for the opportunity I have here, standing on my humble little soapbox and talking greasy about making money. Becoming a proficient speculator is an ongoing process. I intend to be the finest speculator this world has ever seen. That said, those posts were an exercise in consistency. In eastern philosophy they have a saying about chopping wood and carrying water. You still have to do the things you did to be successful (enlightened) even after success (failure?) happens.

phoenix your comment resonated with me the most. Excellent observations about the physiological changes that take place after a huge win. I experience many of the same, and they tell me something very important. That if I were to draw a line with “overcautious” on one end and “overconfidence” on the other, with calm and nonreactive in the middle, I am dangerously skewed towards the overconfidence end. Historically, this is when I’ve made the most expensive mistakes in my career. So what do I do after a huge win? Chop wood and carry water. Stay off the phone, take no business meetings and definitely stay away from anything that can execute a trade.

That’s all for now. I am bullish into quad witching OPEX, but will move slowly while the ape men bash each other about with bones and stones.

Raul Santos, March 15th, 2020

Exodus members, the 277th edition of Strategy Session is live. Check out the NASDAQ transportation index. It will tell a story this week.

Comments »