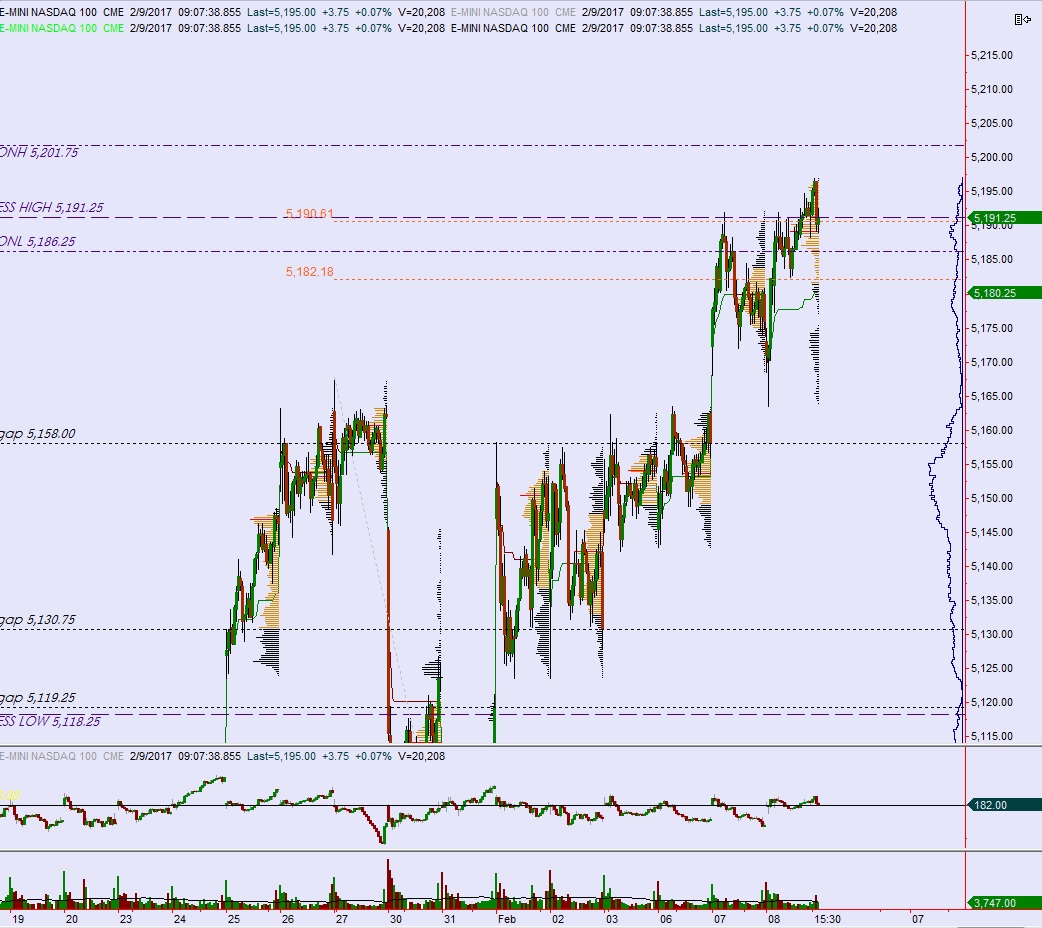

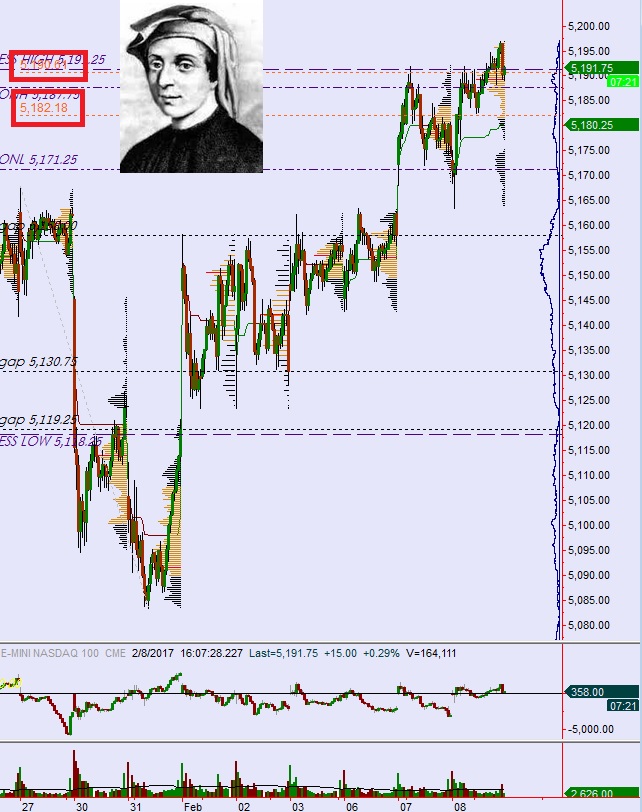

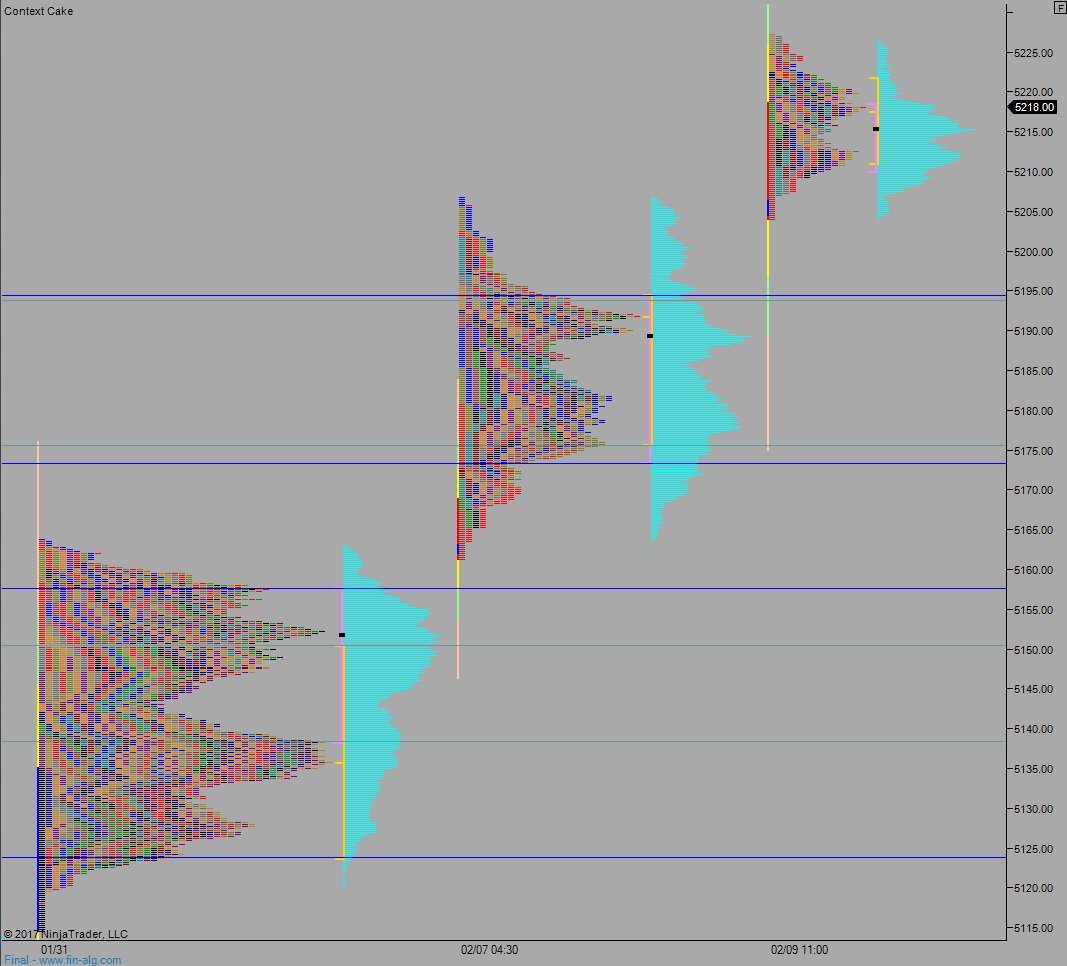

NASDAQ futures are coming into Friday gap up after an overnight session featuring normal range and volume. Price worked higher overnight, achieving new highs before settling into two-way trade.

The economic calendar is light as we wrap up the week. At 10am we have U of Michigan Confidence, at 1pm the Baker Hughes rig count, and at 2pm a Monthly Budget Statement.

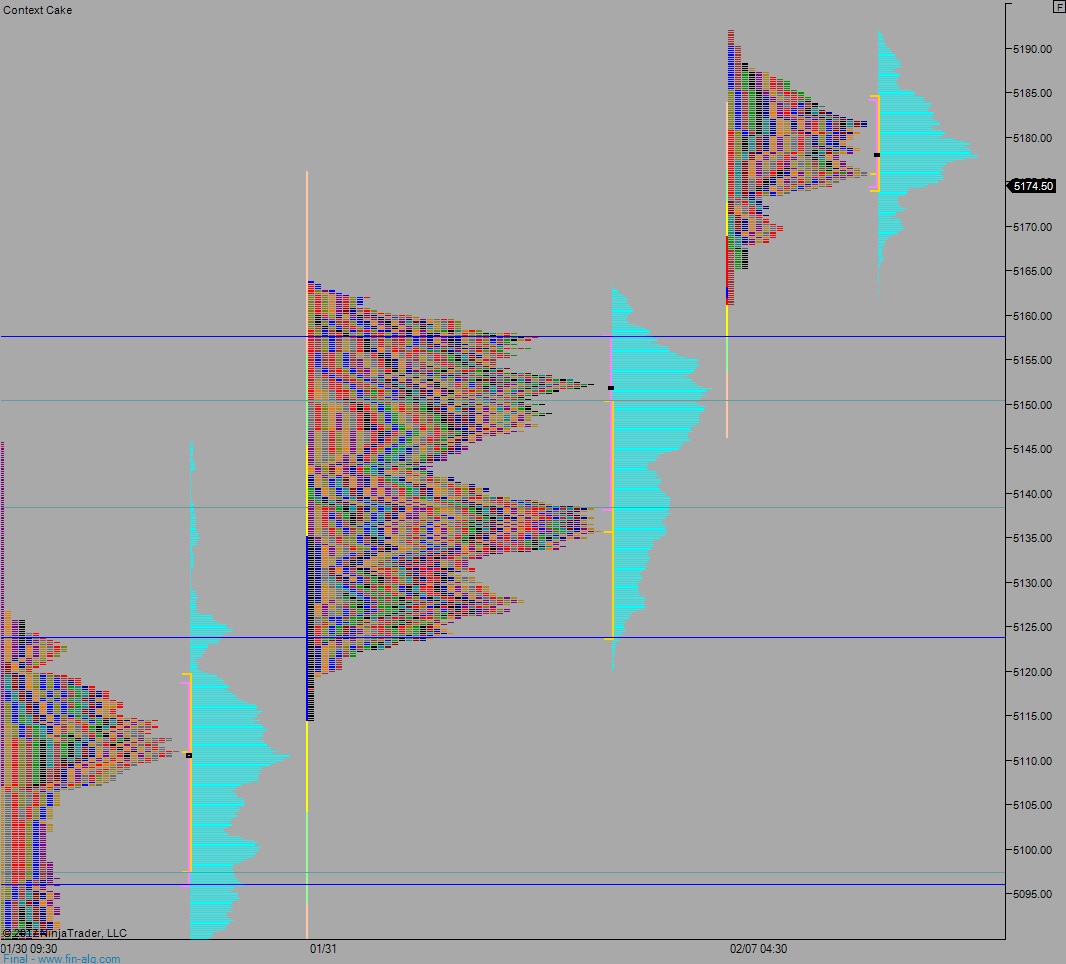

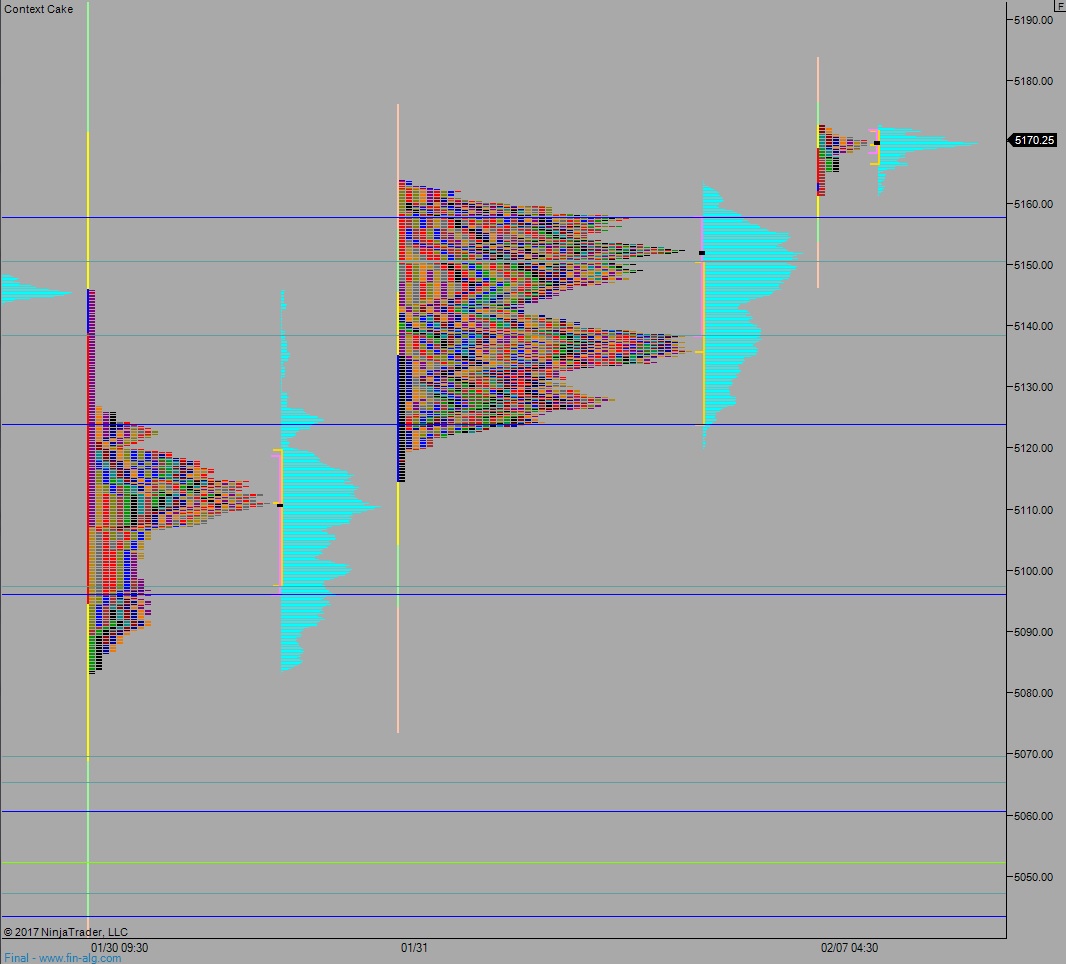

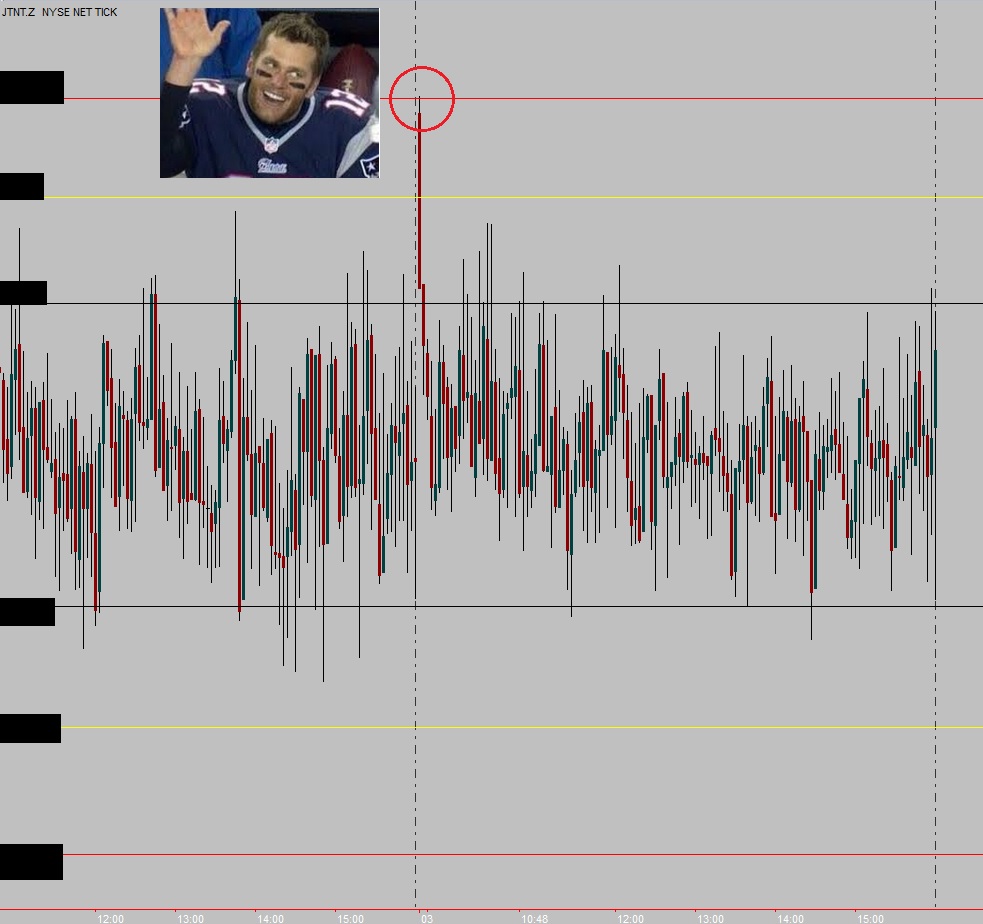

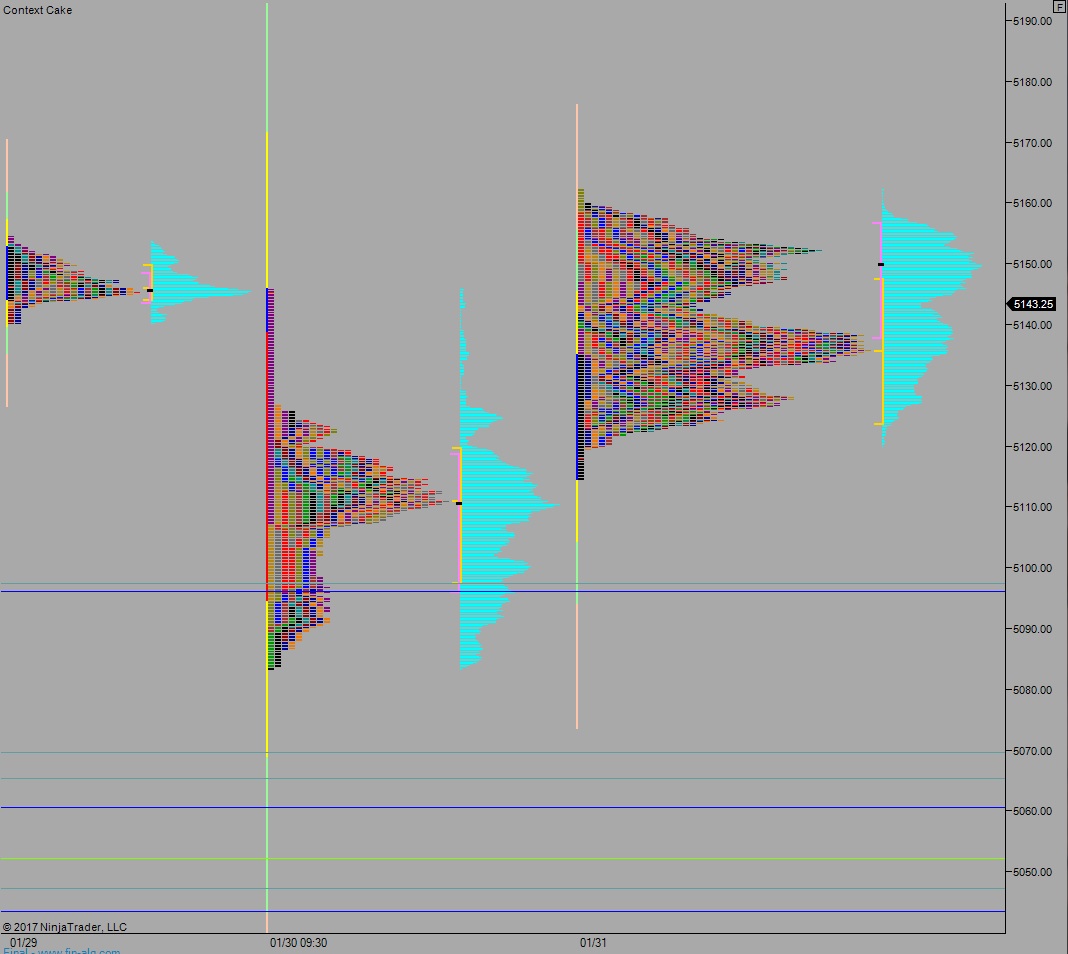

Yesterday we printed another double distribution trend up. After opening flat a strong buyer drove the market higher in the morning and buyers continued bidding the market, turning initiative in the afternoon and pressing value higher before two way trade ensued.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 5212. From here we take out overnight low 5209.25. Look for buyers down at 5194 and two way trade to ensue.

Hypo 2 buyers press up through overnight high 5227.25 and continue exploring higher prices.

Hypo 3 strong sellers press down through 5194 and sustain trade below it setting up a move to target the open gap at 5191.25 then 5189.25. Stretch target is 5175.75.

Levels:

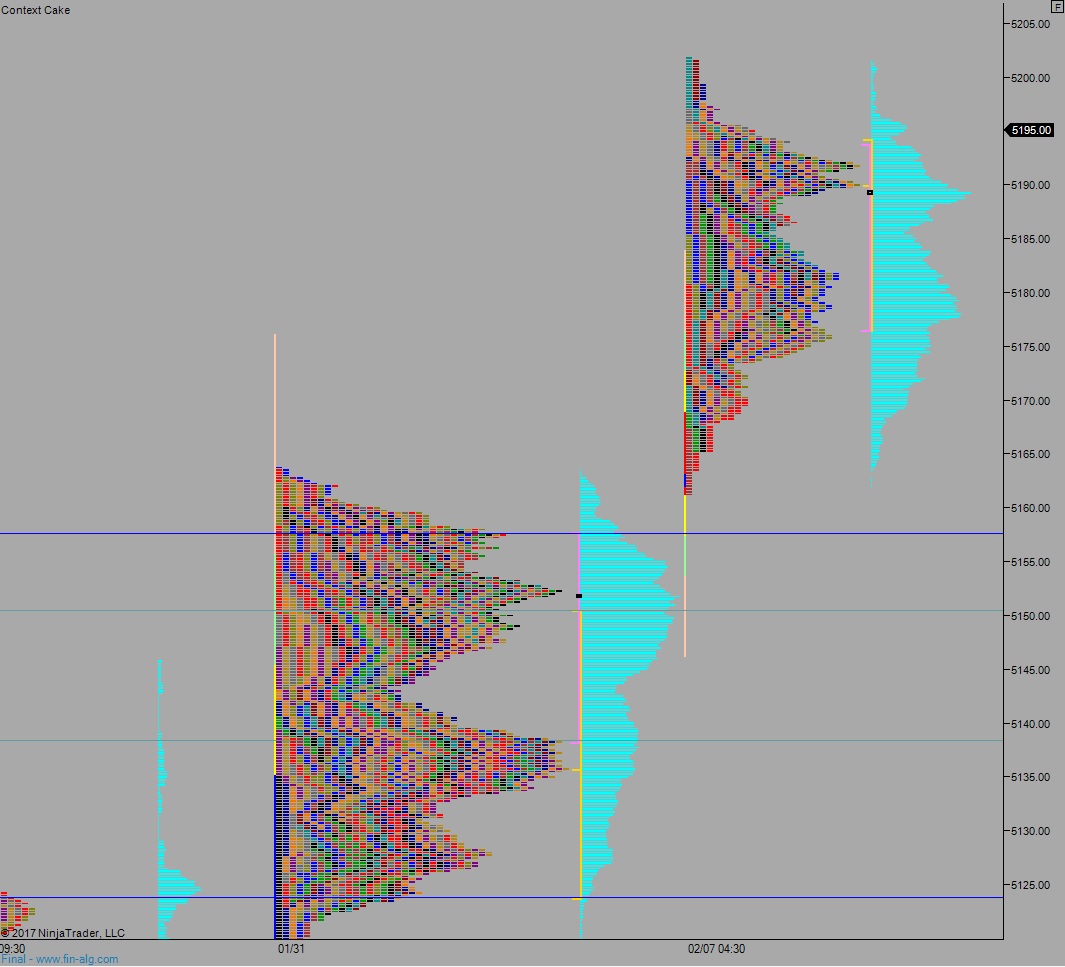

Volume profiles, gaps, and measured moves: