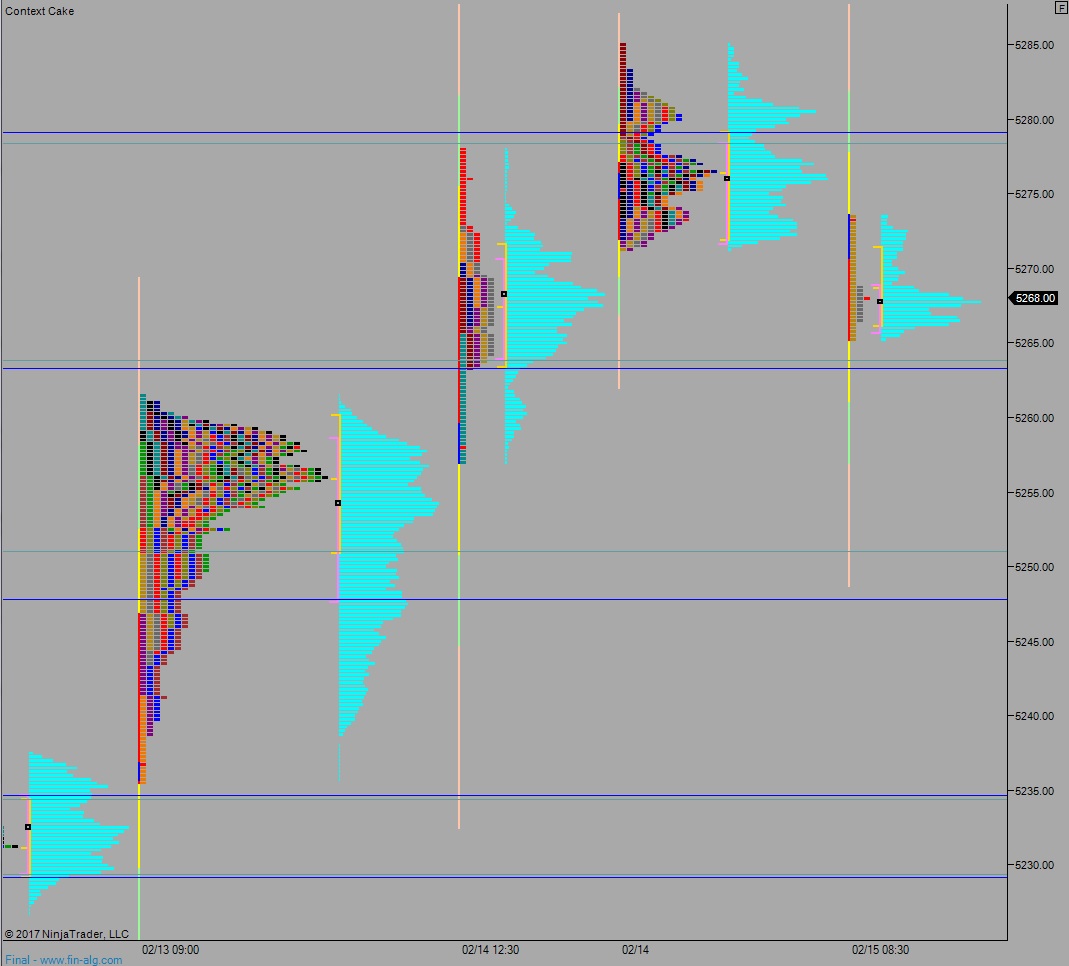

NASDAQ futures are coming into Thursday flat after an overnight session featuring normal range and volume. Price made new all-time highs before settling into two-way trade along the unchanged line. At 8:30am Housing Starts data were below expectations, Building Permits above expectations, Initial/Continuing jobless claims data worse than expected, and Philadelphia Fed data was much better than expected.

The only other economic event on the docket today is a 30-year TIPS auction at 1pm.

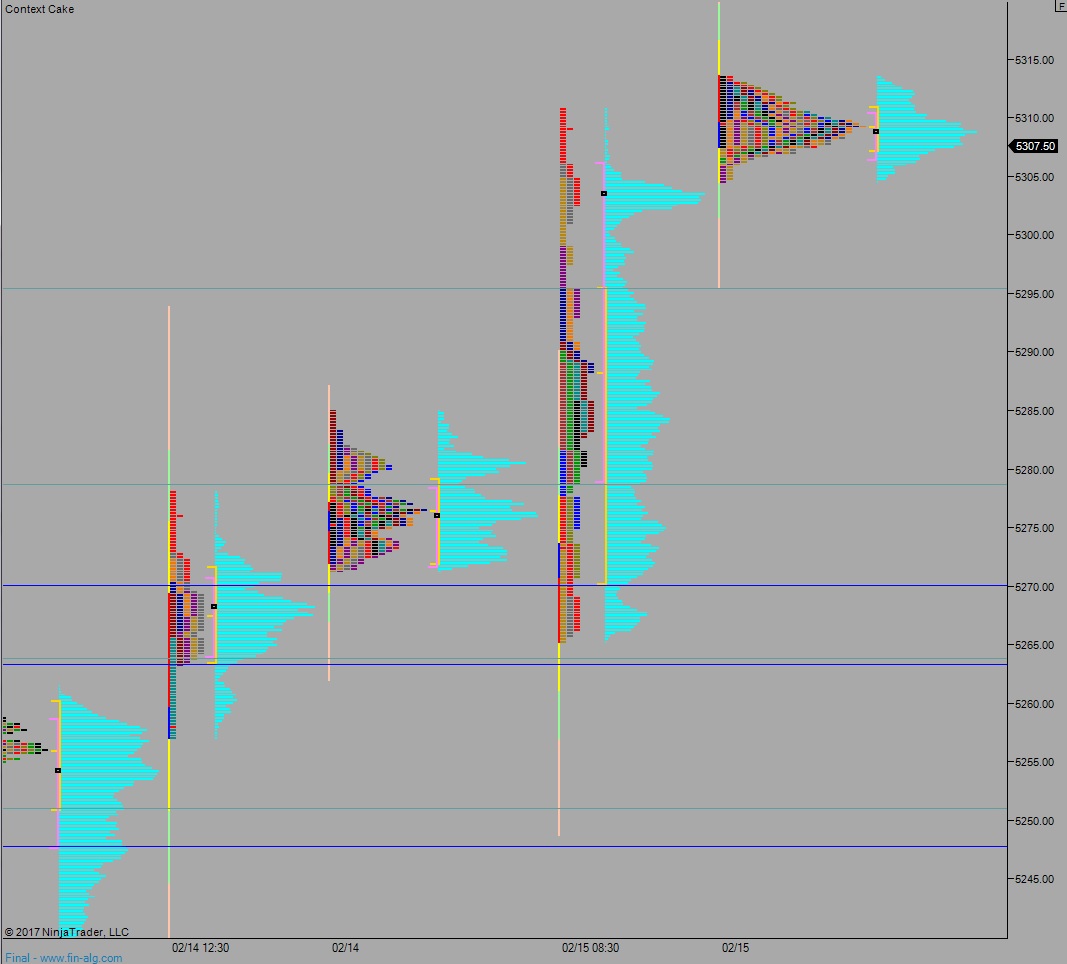

Yesterday we printed a trend up. Steady buying all day from open-to-close.

Heading into today my primary expectation is for buyers to take out overnight high 5313.50 and continue exploring higher prices—open air.

Hypo 2 sellers press down through overnight low 5304.50. Look for buyers down at 5295.50 and two way trade to ensue.

Hypo 3 stronger sellers press a move down to 5279 before two way trade ensues.

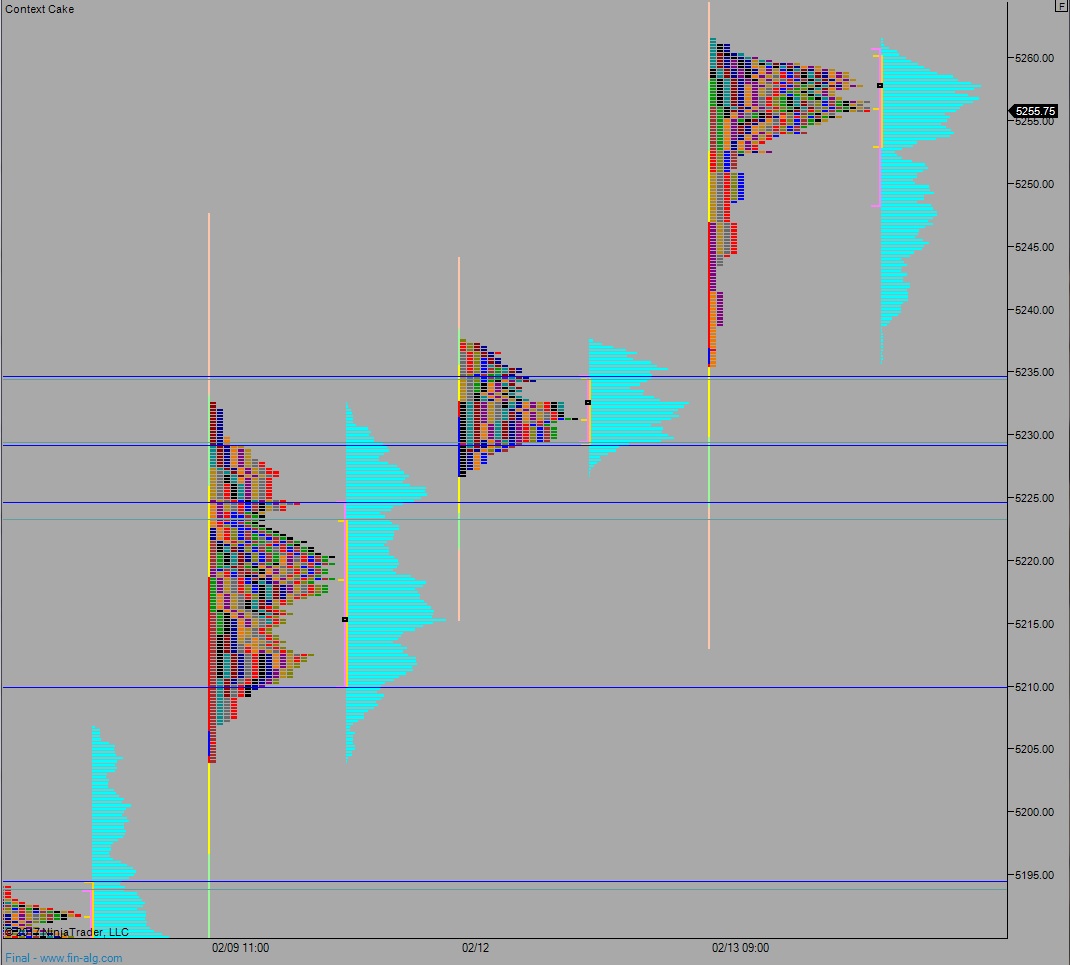

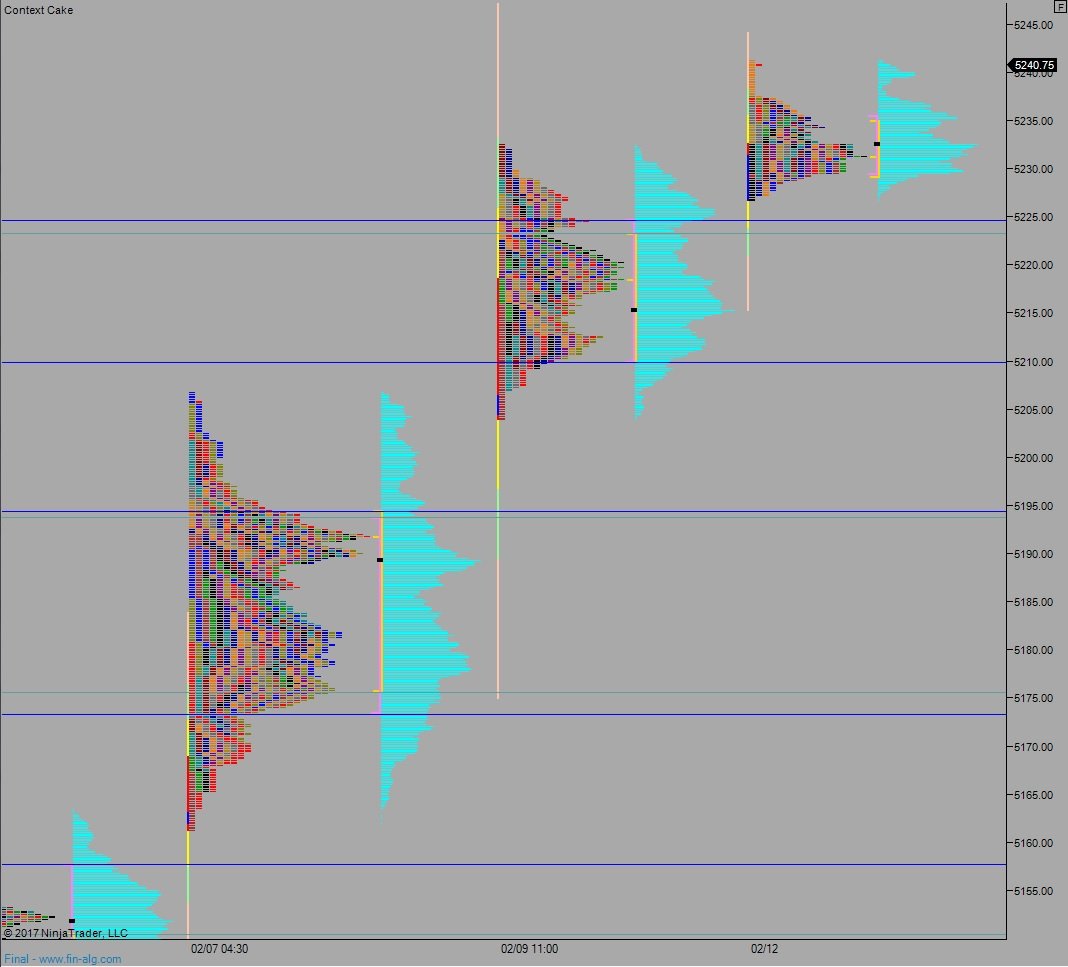

Levels:

Volume profiles, gaps, and measured moves: