NASDAQ futures are coming into the first Monday of February gap down after an overnight session featuring normal range and volume. Price chopped around inside last Friday’s range in balanced trade, however as we approach cash open there is some selling pressure hitting the tape.

The economic docket is light all week, and today we only have two T-bill auctions to monitor, both at 11:30 am, the 3- and 6-month duration, $34B and $28B respectively.

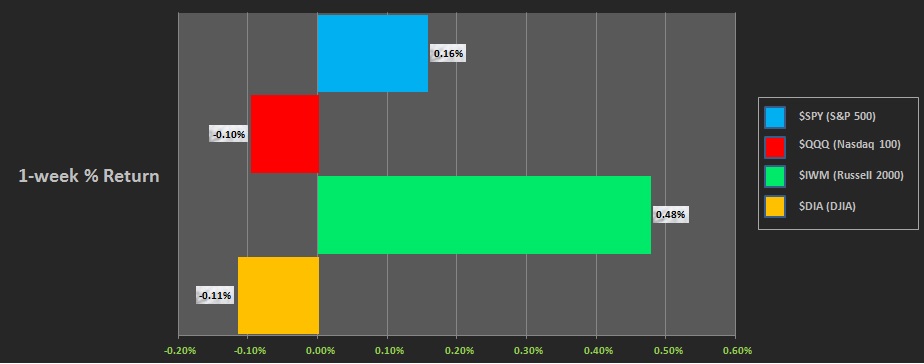

Last week began with a hard sell that was bought. Then a gap down Tuesday that traded the same way, lower in the morning than higher in the afternoon. Wednesday was gap up and range bound, and the rest of the week marked time. The performance of each major US index can be seen below:

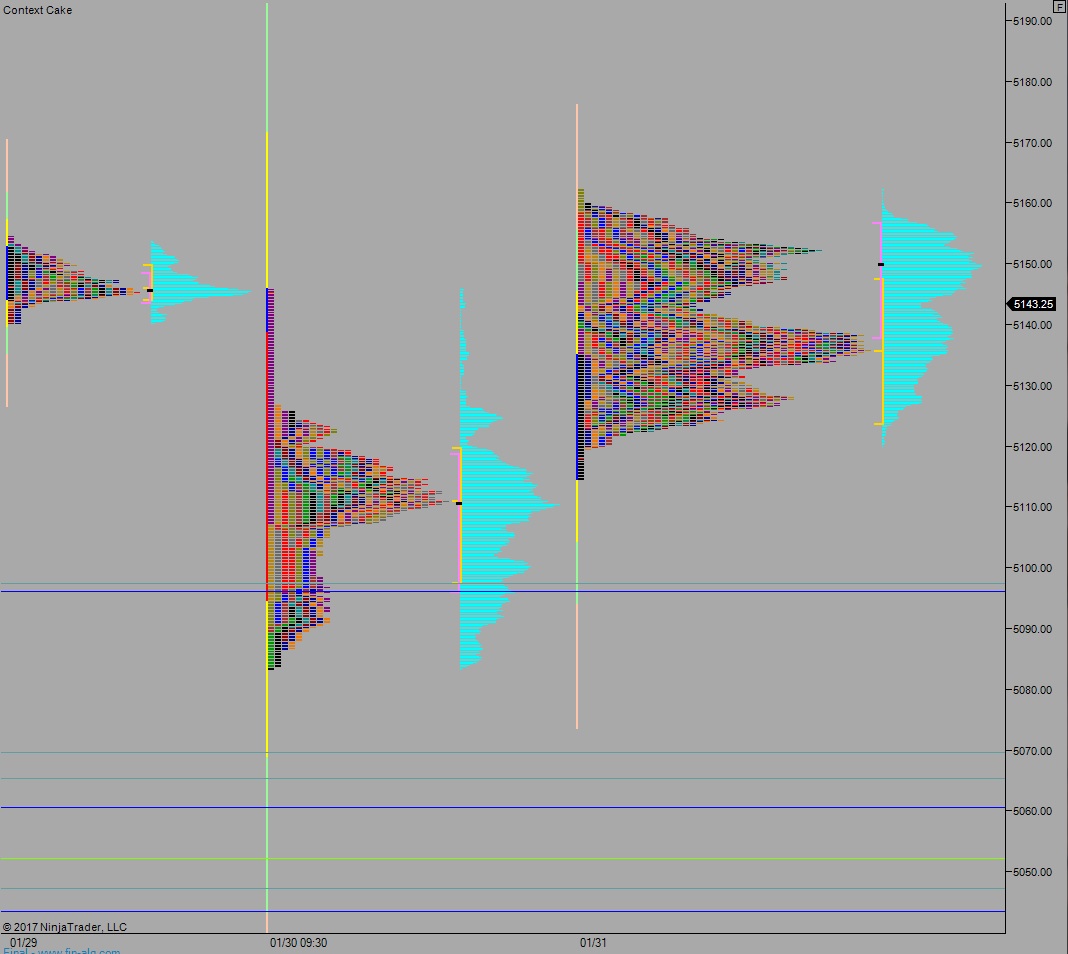

On Friday we printed a normal variation down on the NASDAQ. After opening gap up closing the gap left behind when we came into last week, price stalled, and excess high formed and we poked below initial balance low for a second. Then we slowly traded higher through the rest of the session.

Heading into today my primary expectation is for sellers to push off the open and trade down to the open gap down at 5130.75. Sellers continue lower, closing the gap down at 5119.25 as well. Look for responsive buyers down at 5118.25 and two way trade to ensue.

Hypo 2 buyers work into the overnight inventory and close the gap up to 5154.75. Buyers continue higher, up through overnight high 5160 and test above all time high. Look for sellers up at 5182 and two way trade to ensue.

Hypo 3 range trade, from 5156.50 to 5123.50.

Levels:

Volume profiles, gaps, and measured moves: