Whispers are going around that Louisiana Republican Senator David Vitter has said the Wells Fargo’s account scandal is not limited to consumer banking.

The San Fransisco bank has become the government’s punching bag after the Justice Department determined they had fraudulently created over 2 million fake bank accounts and credit cards designed to slowly suck late-fees out of their customer’s accounts.

Since paying the $185 million fine, the firm was also fired by the Sate of California, who announced they would no longer issue municipal bonds through Wells Fargo nor would they conduct any investment banking with Wells Fargo securities.

Last Friday the Justice Department also determined the repo division of Wells Fargo had illegally taking possession of over 400 service members’ vehicles.

Now rumors are flying that Louisiana’s Senator Vitter is fixing to take a hard look at their business banking practices. Many suspect their other actions are a likely indication that shenanigans were afoot in business banking also.

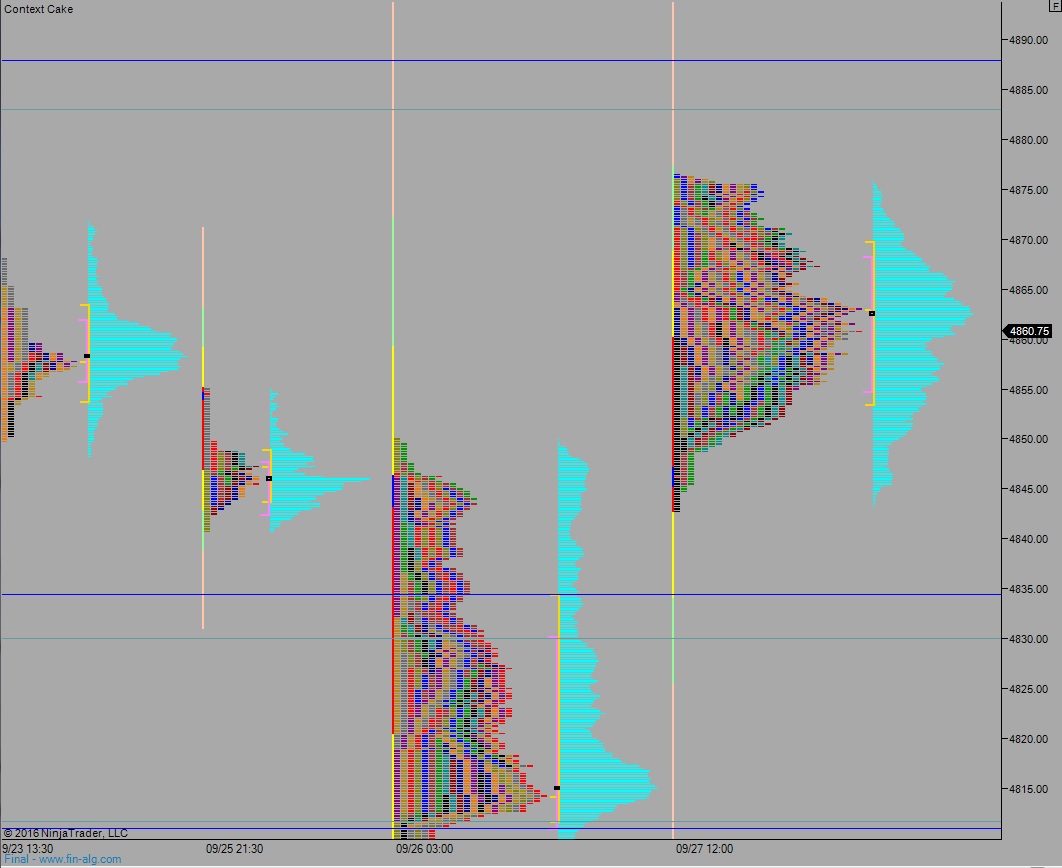

WFC shares are breaking down below their multi-month range low of about $44/share. If the selling persists, it is likely to trigger a fast, liquidation type move, with little in the way of support until around $35/share.

This is a developing story without credible sources. The good folks at iBankCoin will update the story as more information becomes available.

Comments »