Greetings from the land of victory, the land of brawn and industry and freedom, greetings from the United States!

Hopefully you are enjoying buckets of Miller Low Life with friends and family, so much so that these words appear a bit fuzzy. Remember, the good scientists in Palo Alto built Uber for you, so no need to go barrelling down the interstate in your Buick. There are plenty of strangers who will happily transport you to-and-fro.

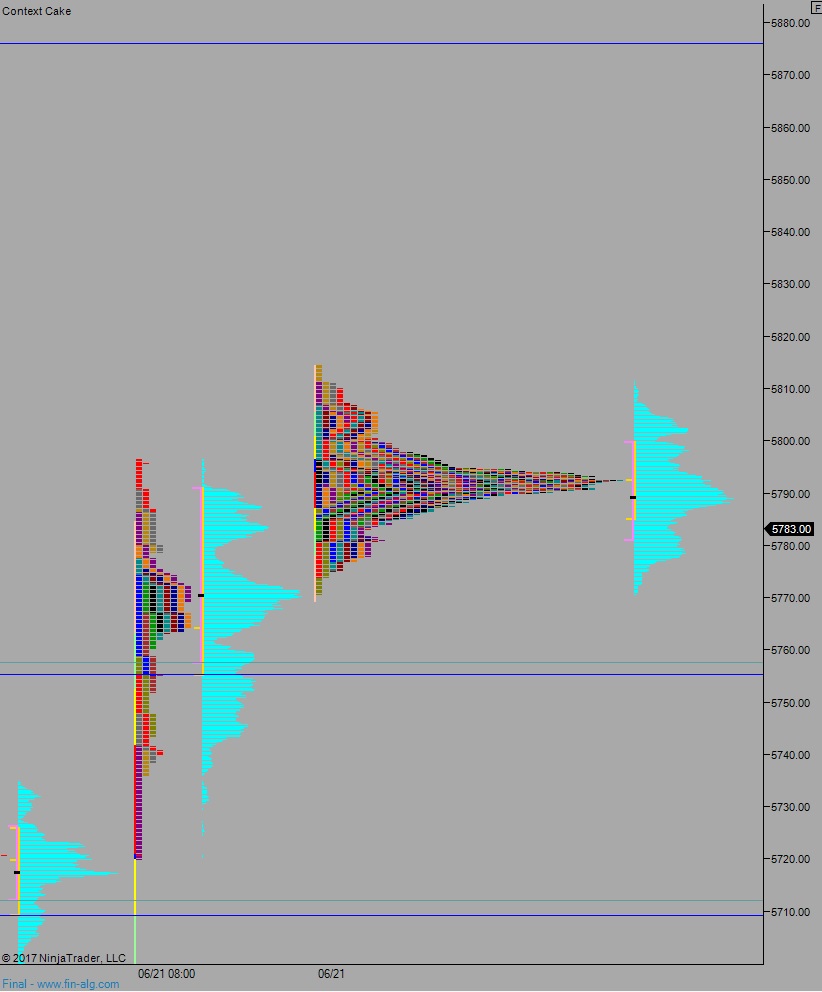

The markets are open for a few hours Monday, which is fantastic because there are stocks to purchase. Which ones? We are not entirely sure yet.

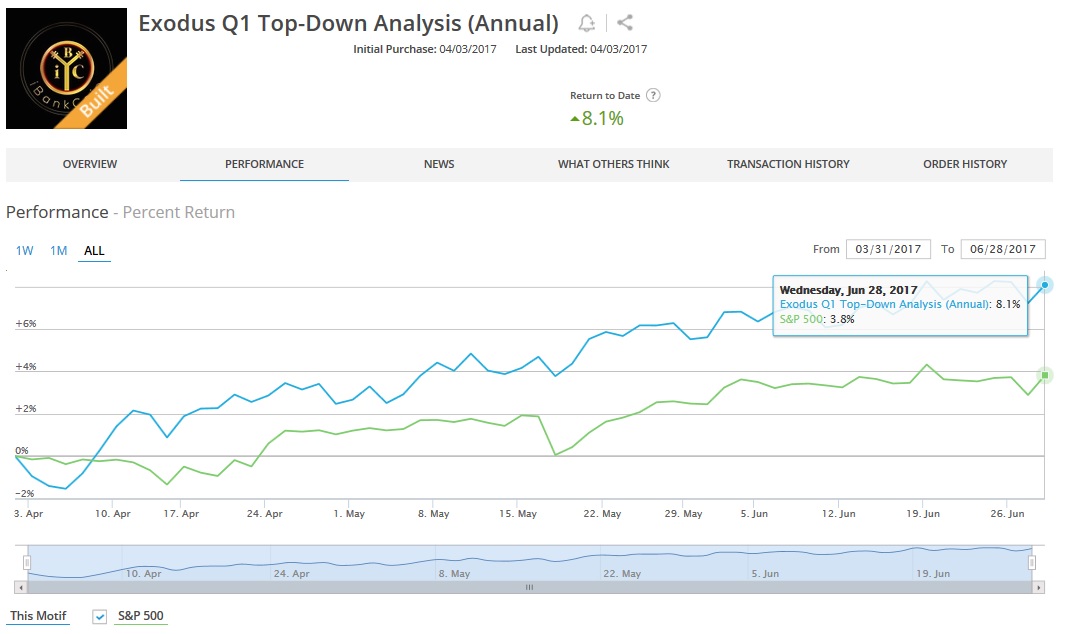

But stay tuned, we are about to go live on iBankCoin YouTube to build Phase II of the systematic equity portfolio that is taking the financial world by storm.

A quick note on IndexModel. It is neutral for a second week. All machines are calibrated, and all info parsed to ensure accurate readings. It is our duty to keep a watchful eye on the financial markets, no matter who is celebrating holiday. It is this discipline that affords the kind scientists at iBankCoin the freedom promised to us by our Founding Fathers and Elon Musk (all Praise and Glory to The Leader).

If even one sound bite, video clip, blog entry, tweet, insta, email, between us gets you one step closer to real freedom, then we have done our job. You have no fucking idea how much I appreciate you guys for finding my content worth your time. Thank you.

Comments »