NASDAQ futures are coming into Wednesday gap up after an overnight session featuring extreme range and volume. Price continued lower overnight trading down to prices unseen since May 18th before discovering responsive buyers. At 8:30am advance goods trade balance and wholesale inventories data were both better than expected.

Also on the economic agenda today we have pending home sales at 10am, crude oil inventories at 10:30am, a 2-year floating rate note auction at 11:30am, and a 7-year note auction at 1pm.

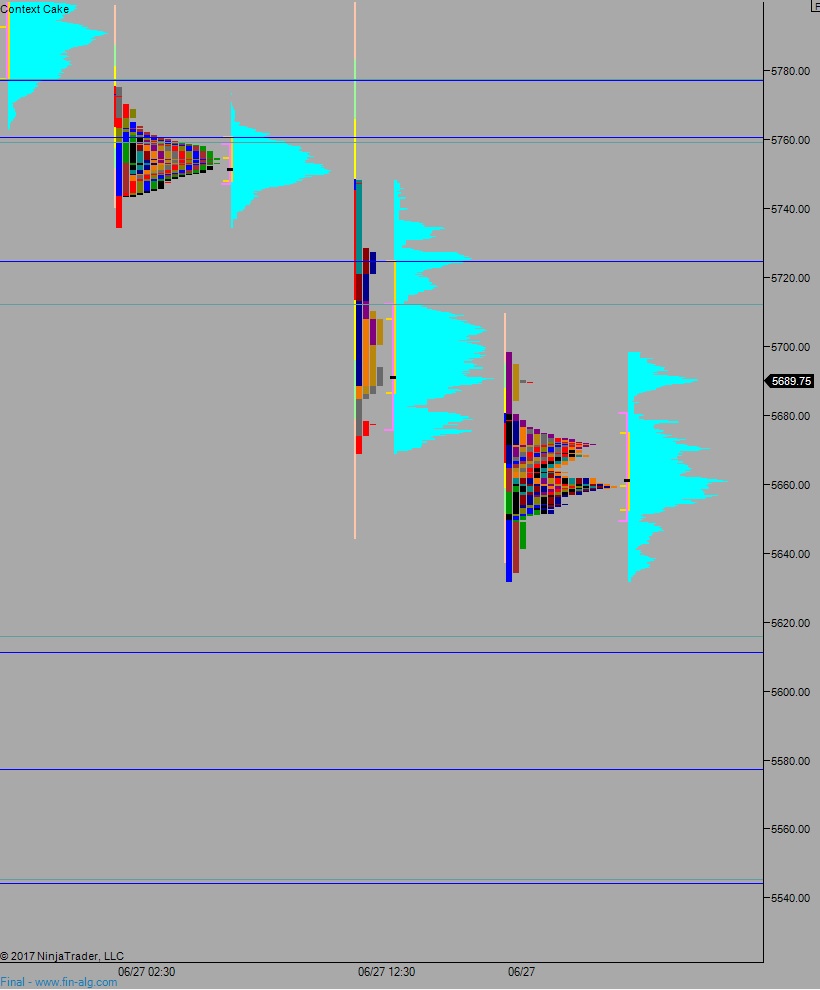

Yesterday we printed a trend down. The day began with a gap down below the Monday range. Sellers sold into the gap down, and after a morning of two-way trade sellers continued pressing the market lower in a trend-like manner.

Heading into today my primary expectation is for buyers to press up through overnight high 5698.50 and trade up to 5712.50 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory and close the gap down to 5677.5 then continue lower, but stall out around 5650 and two way trade ensues.

Hypo 3 strong sellers work down through overnight low 5632 and trade down to 5615.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: