Forget about trend lines and all the other chart charlatanry and listen. A full-grown human male saw an entire year’s worth of his work destroyed by a single tweet.

A tweet is a message posted to Twitter that must be contained to 140 characters but can also include a picture. Here is the tweet that caused Jared Yates Sexton to have an emotional meltdown in public:

Donald Trump Jr. is the first born son of the President of The United States. On our planet, the President is considered pretty important, and first born sons are considered important too.

Jared Yates Sexton is an investigative journalist. Investigative journalists are less important than American Presidents. They also make less money. Most humans spend the majority of their life figuring out how to make and keep money. Some people are really good at making lots of money. Below is a picture of a human male holding a stack of money up to his ear:

One way humans earn money is by working. Jared Yates Sexton worked for a whole year investigating whether the President and his first born son secretly worked with Russia when he was trying to win the the Presidential Election.

* * *

The Presidential Election is a contest where two people with lots of money are put on a piece of paper called a ballot. Sometimes there are a few other people competing to be president, but they do not have lots of money. These few other people never win even through their names are on the ballot. Everyone living in the United States is allowed to pick a name on the ballot.

These ballots are counted and the person who was picked the most might win, even if they have less money. It all gets confusing at this point because after everyone picks who they want as American President, a small group of people with lots of money pick the President. This small group of people is called the Electoral College.

* * *

Russia is another place on earth that has its own President. It also has an election but investigative journalists often say the Russian election is rigged. Something is rigged when it seems up to chance but a scheme fixes the outcome. Lots of people in America think the Russians are good at rigging elections.

Listen, Jared Yates Sexton had an emotional meltdown on Twitter. An emotional meltdown is when is human can not hide their unpleasant feelings from others. Humans are encouraged to keep their emotions hidden, unless they are envious emotions like happiness. When a human is happy, they often add a smiling face to their end of their messages that looks like this:

Jared Yates Sexton was not happy. A tweet destroyed a year of his work. And so he went on Twitter an had an emotional meltdown. Here is his emotional meltdown:

Twitter is a business. The idea behind their business is to create a place where humans hangout, and to then show the humans advertisements. Advertisements are a combination of pictures and words designed to make humans buy things with money. Twitter makes other businesses pay money to put their advertisements at the human hangout. The humans hangout on Twitter, which is on the internet.

* * *

Nobody knows who invented the internet but lots of people started using it in the 1990s. Humans began hooking computers to telephone wires and talking to each other. Humans agreed it was a powerful invention but not everyone knew why. And so businesses started trying to make money on the internet. Humans were so excited that businesses were trying to make money on the internet that they invested in any business trying to make money on the internet.

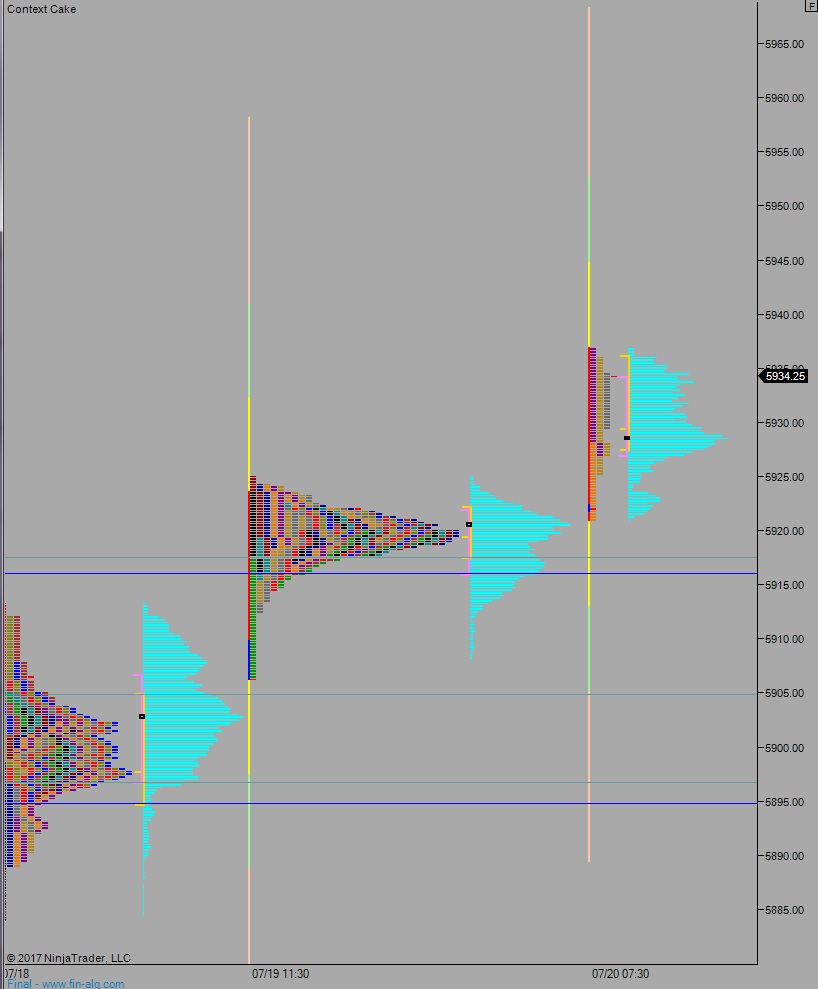

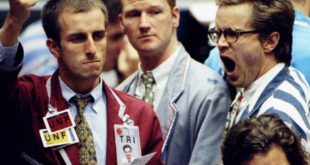

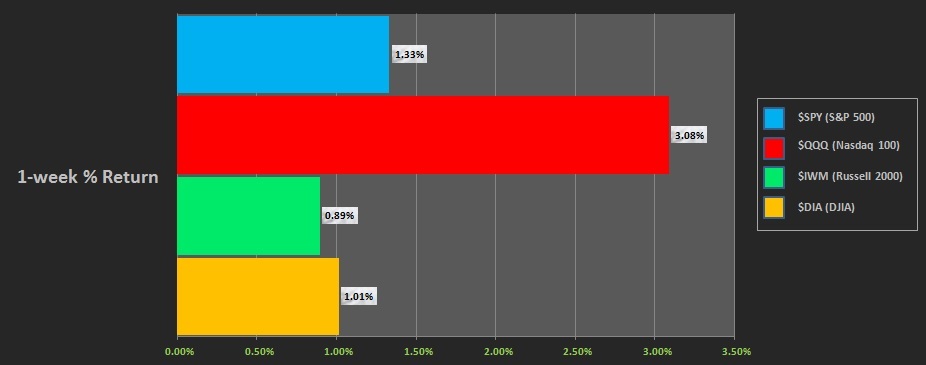

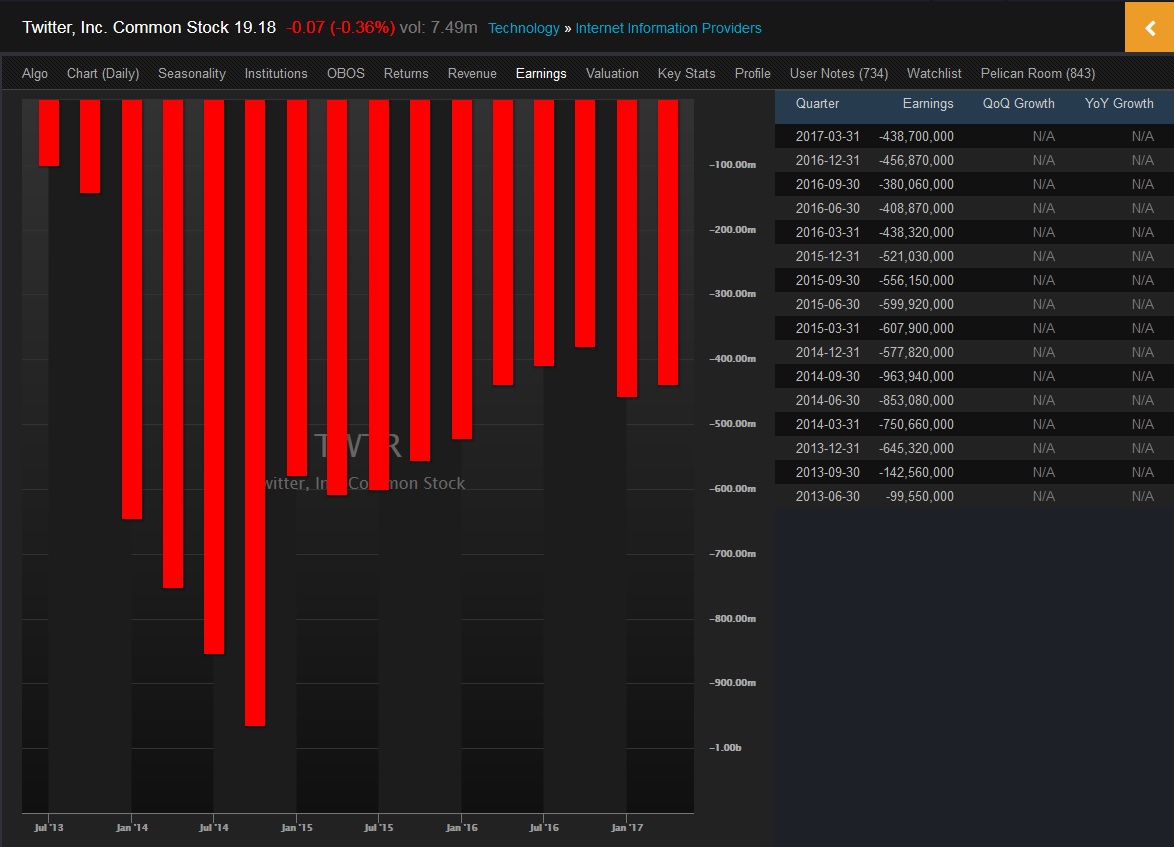

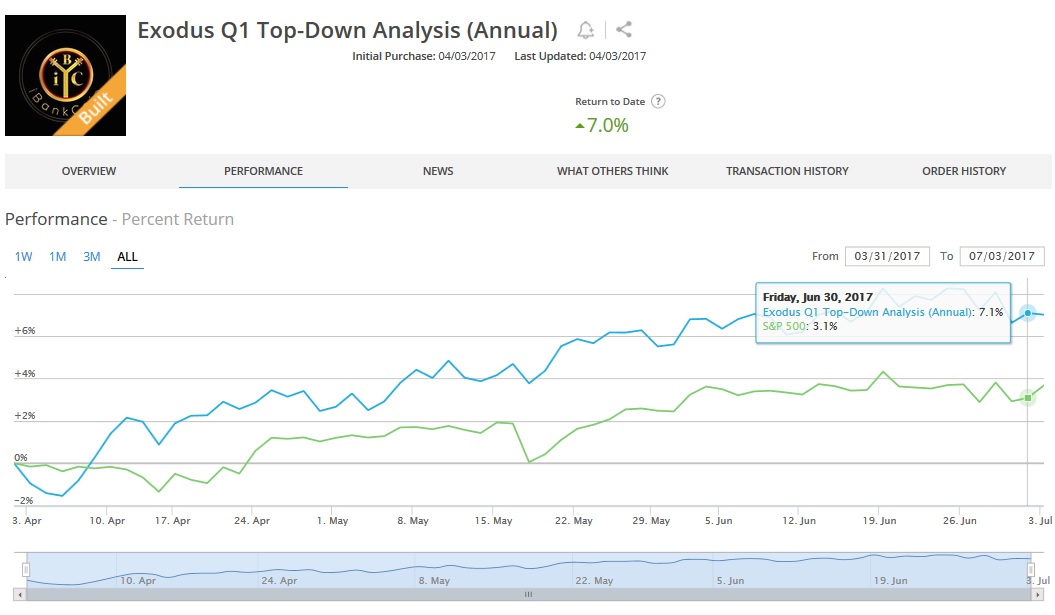

The problem is, lots of internet businesses do not make money. Twitter does not make money, look:

* * *

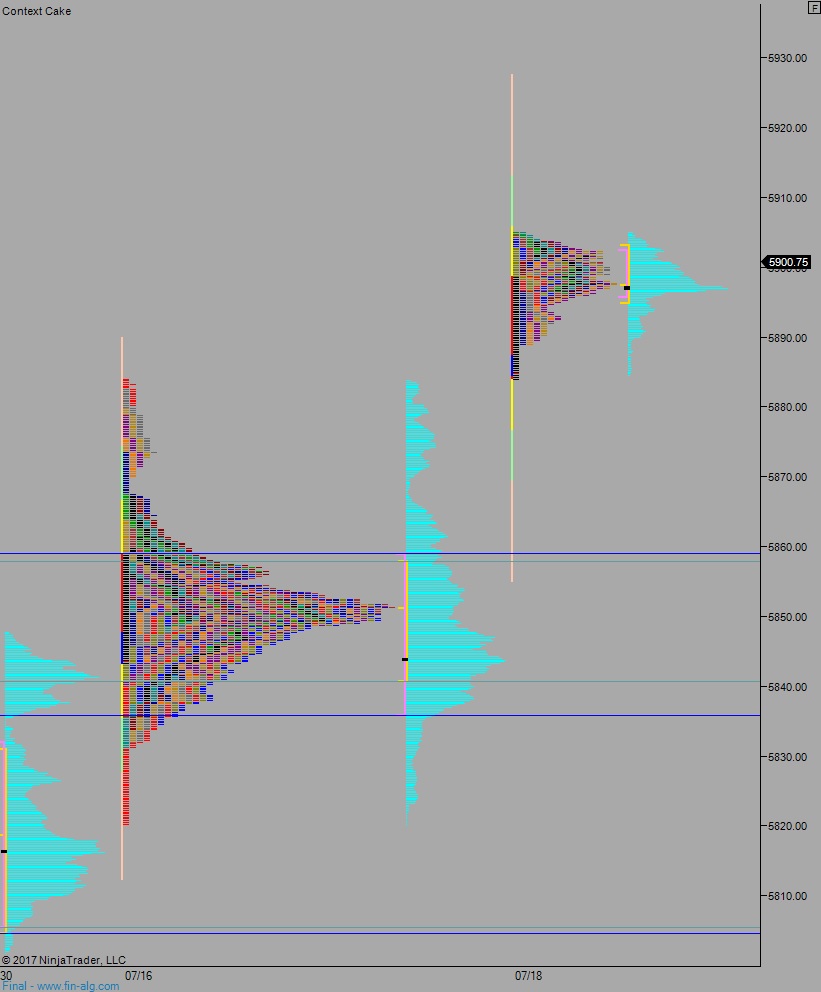

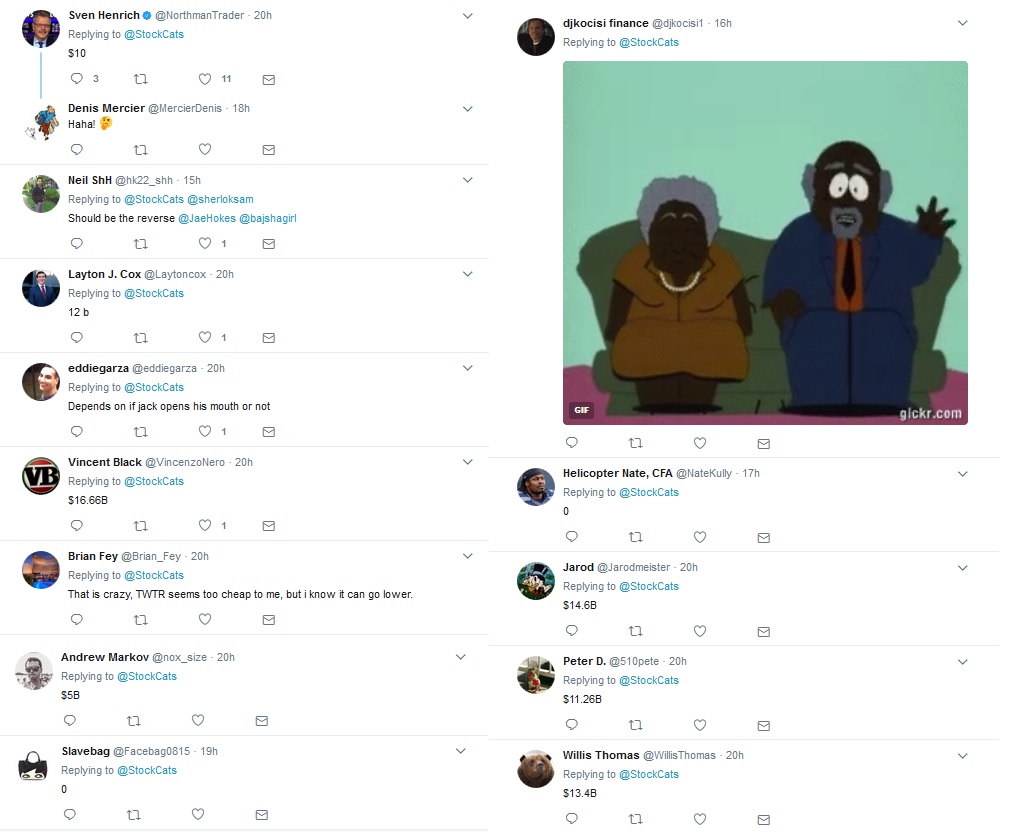

And so Twitters advertisement scheme is not working even though lots of humans hang out on Twitter including the President and investigative journalists. And most investors think they can not make money by giving their money to Twitter. A popular investor on Twitter goes by the name of StockCats. Since he is popular, lots of other investors reply to his tweets while they hangout on Twitter.

I look at replies to his tweets like a litmus test of whether investors are leaning too extreme in favor or against a business. A litmus test is a way to test if water is all full of acid that will burn you, alkaline that will burn you, or somewhere in between.

Look at the StockCats tweet and tell me these investors haven’t turned into toxic acid:

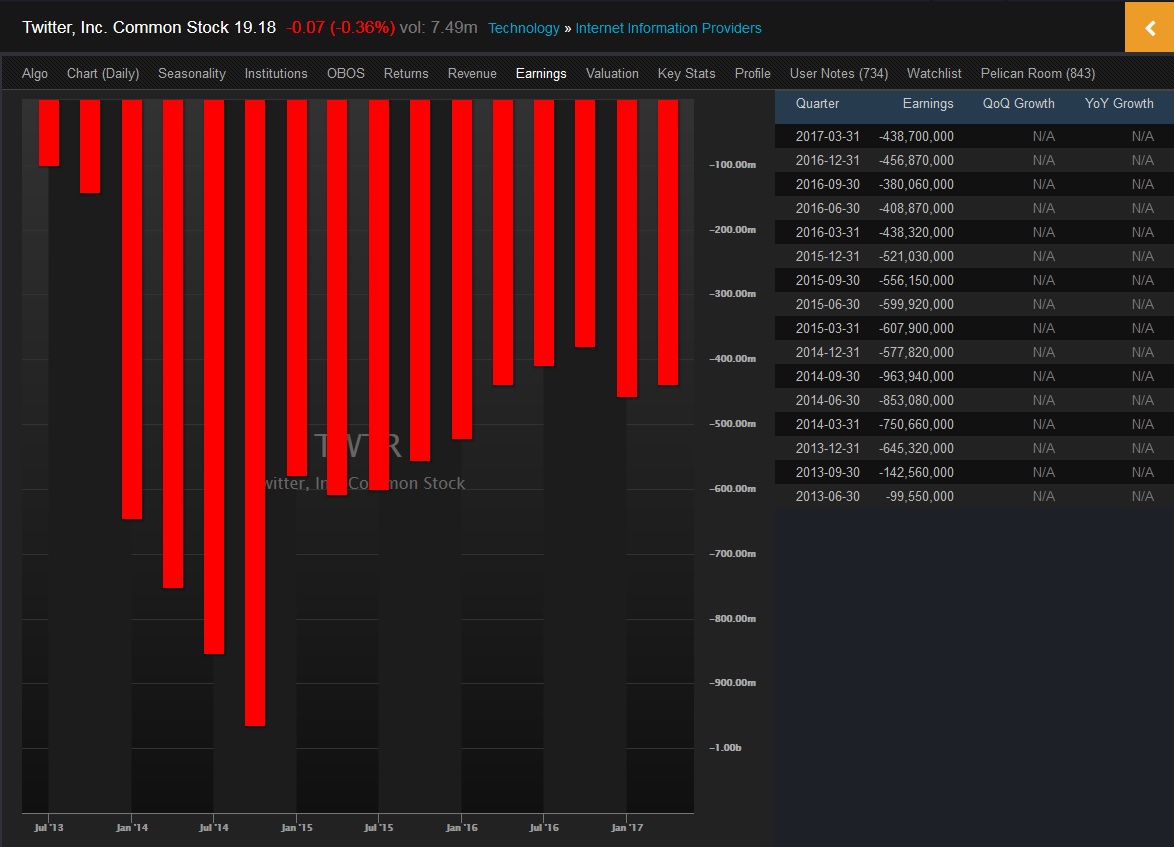

90% of humans fail to successfully make money investing. As an investor in Twitter, I am part of the 90% losers. I have been invested in, and buying more Twitter for a long time. When I do the algebra, it tells me Twitter stock needs to be above $27 dollars for me to not be a failing human investor.

Algebra is a way of organizing numbers developed by Arabian people. It is very useful. Arabian people are often brown and are known on earth to be excellent merchants. They also grow some of the longest beards on earth. Organizing numbers is very important for a merchant.

Listen, Jared Yates Sexton is a very serious, full-grown human male. Full-grown human males are the last people on earth allowed to have emotional meltdowns. They are supposed to be champions. They are supposed to have strong penises. Beyond how much money a full-grown human male has, they are often also valued by the size of their penis.

We do not know how large Jared Yates Sexton’s penis is, but we do know he is a full-grown adult male because he has a beard. Also, he identifies as a male which is important in the year 2017. Therefore we know he should not be have an emotional meltdown. But he did.

When things that are not supposed to happen happen, the astute opportunist perks up. I am an astute opportunist. I look for opportunities to make money. My fully erect penis swells to just over 7 inches in length. Money and penis size are how most humans measure my worth. Being an opportunist allows me to make money by doing as little work as possible.

I do not like wasting time and effort.

Humans are slowly recognizing that time is more important than money and penis size. Jared Yates Sexton spent an entire year of time investigating Don Jr. Then after one tweet, Jared Yates Sexton realized he had wasted an entire year of time.

One tweet.

Emotional meltdown.

Writer’s Note: This is in no way meant to be a personal attack against Jared Yates Sexton, nor is it intended to glorify Donald Trump, Junior. The purpose of this piece is to simplify the reasoning behind why I have become EXTREMELY BULLISH on $TWTR, despite the company not being able to make money.

Comments »