NASDAQ futures are coming into Monday gap up after an overnight session featuring normal range and volume. Price worked higher during the Sunday evening-to-Monday morning extended trade after spending 10 minutes trading lower. The other twelve hours and fifty minutes were spent trading higher. At 8:30am Durable Goods data was well below expectations.

No reaction.

Also on the economic docket today we have 3- and 6-month T-bill auctions at 11:30am and a 2-year Note auction at 1pm.

The economic calendar is light all week. It is summertime, after all.

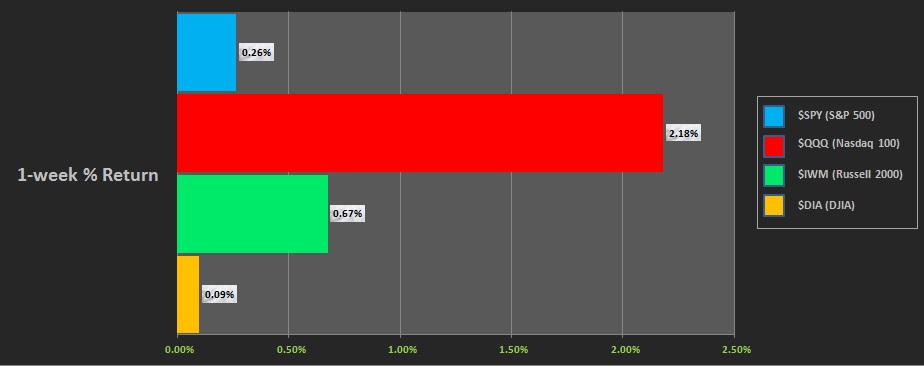

Last week began with an impressive gap up—a much higher magnitude gap up than today’s—and then a drive higher at the open. This set the tone for the entire week. The tone was, “This is summer. Go live a little. We’ve got this.” The last week performance of each major index is shown below:

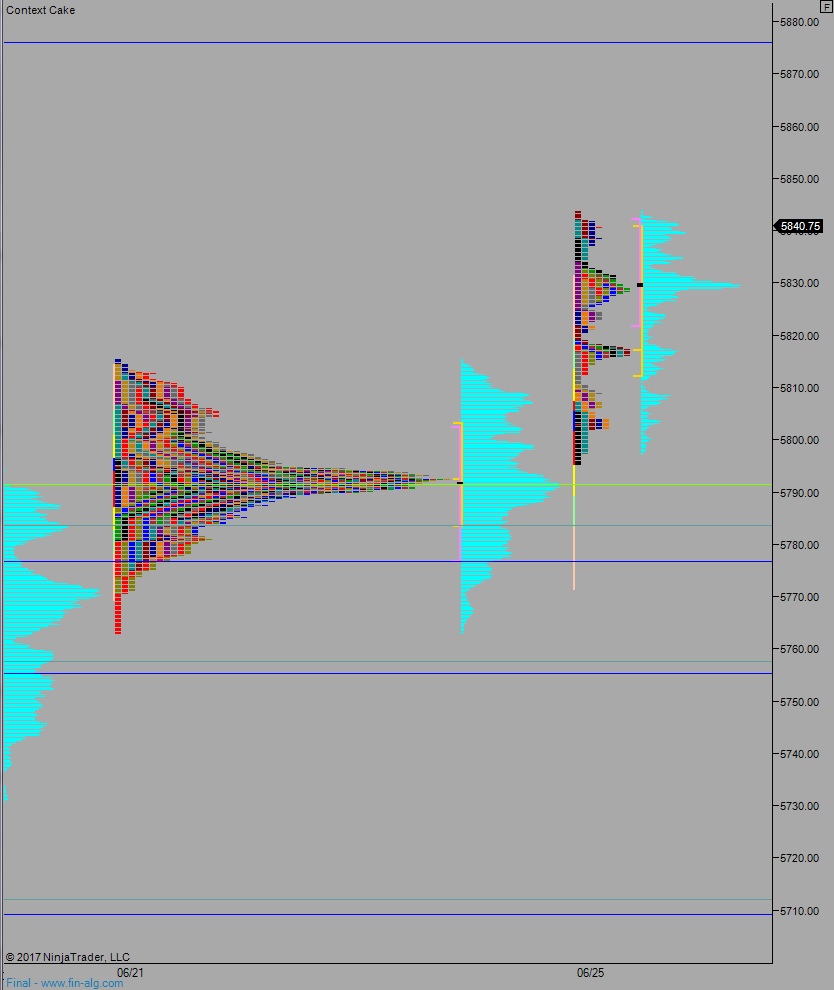

On Friday the NASDAQ printed a double distribution trend up. The day began with a gap lower. Sellers made an early probe below Thursday’s low which found a responsive bid. We spent the rest of the day trading higher, ultimately closing at the weekly high.

Heading into today my primary expectation is for buyers to gap-and-go higher, up to 5876 before two way trade ensues.

Hypo 2 buyers work even higher, up to 5888.25 before two way trade ensues.

Hypo 3 sellers work into the overnight inventory and close the gap down to 5812.75. Then they continue lower, down to 5791.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: