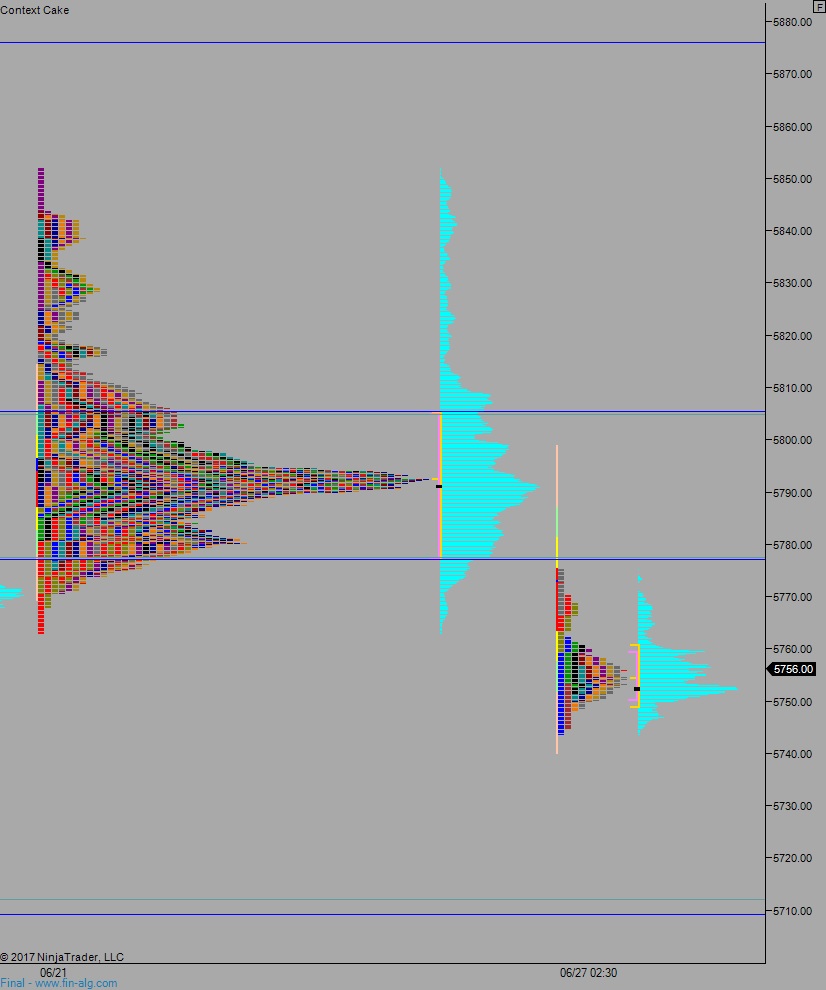

NASDAQ futures are coming into Tuesday gap down after an overnight session featuring normal range and volume. Price worked lower overnight, pressing down into last Wednesday’s range before settling into balance. At 9am the Case-Shiller Composite-2o data came out below expectations.

Also on the economic agenda today we have Consumer Confidence at 10am, a 4-week T-bill auction at 11:30am, a 5-year Note auction at 1pm. Janet Yellen is also speaking in London, England at 1pm.

Yesterday we printed a double distribution trend down. After opening the week with a strong gap up and early drive higher, responsive sellers stepped in and sold the entire gap. Then they continued selling, ultimately stalling out ahead of last Friday’s low before balanced trade kicked in.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 5779. From here we continue higher, up through overnight high 5784 to tag the naked VPOC at 5790 before two way trade ensues.

Hypo 2 sellers press down through overnight low 5743.75 and continue lower, closing the gap down at 5733.50 before two way trade ensues.

Hypo 3 stronger sellers trigger a liquidation down to 5712 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: