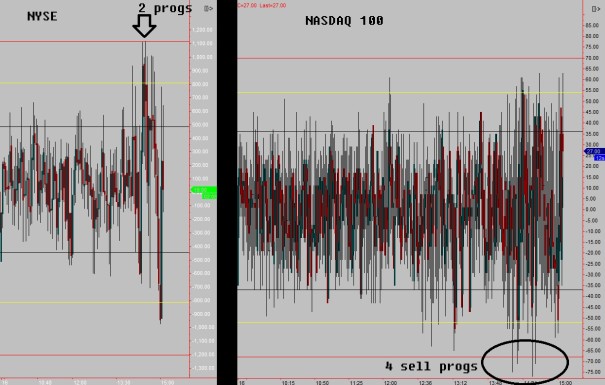

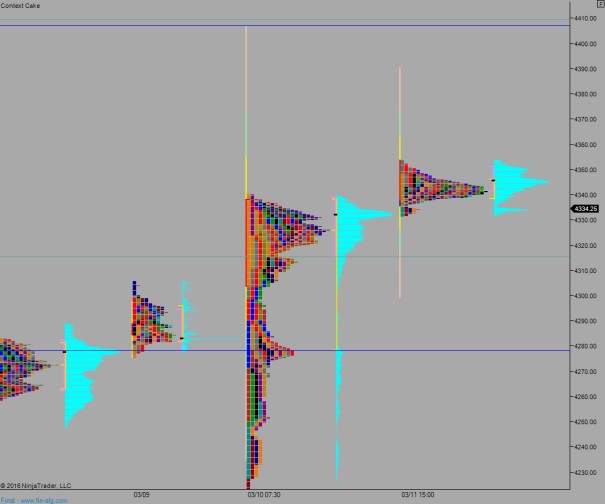

NASDAQ futures are set for a slight gap down opening after an overnight session featuring normal range and volume. Price traversed most of the Friday range, holding the low before zooming higher to briefly make a new swing high before retracing most of the move.

On the economic calendar today we have Existing Home Sales at 10am and a 3- and 6-month T-Bill auction at 11:30am.

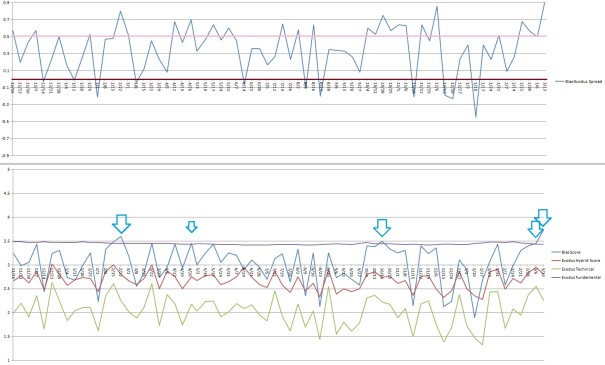

Last week price worked higher. NASDAQ waited to hear the FOMC rate decision then proceeded to rally through the end of the week. Friday we printed a normal variation up on a session that was balanced overall.

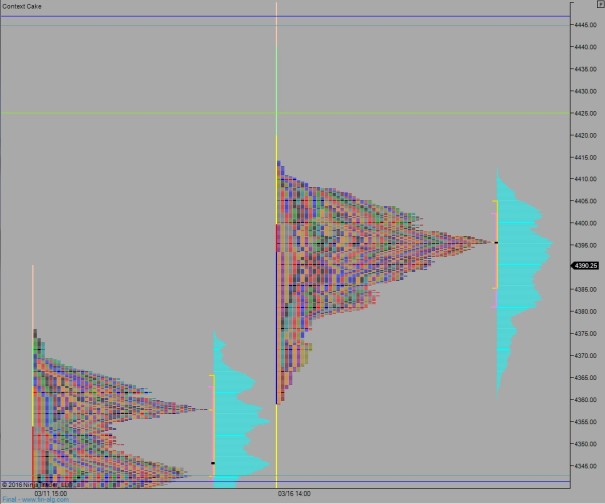

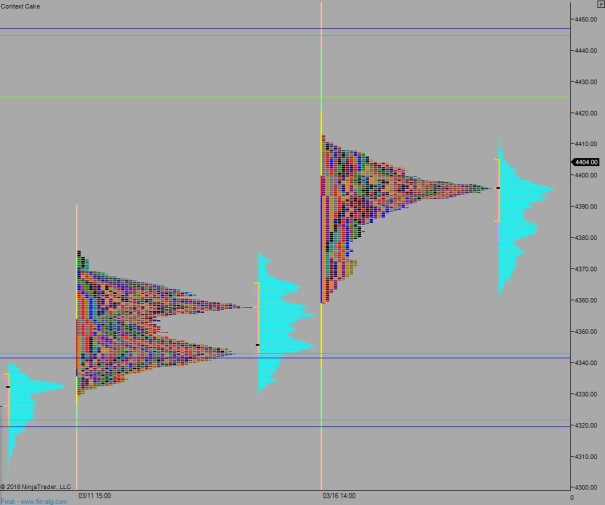

Heading into today my primary expectation is for buyers to push into the overnight inventory and close the gap up to 4394.75. From here look for a move to take out overnight high 4414 before two way trade ensues.

Hypo 2 strong buyers push up through overnight high 4414 and work higher to target 4425 before two way trade ensues.

Hypo 3 sellers push down through overnight low 4376.75. Look for responsive buyers down near 4360 and two way trade ensues.

Levels:

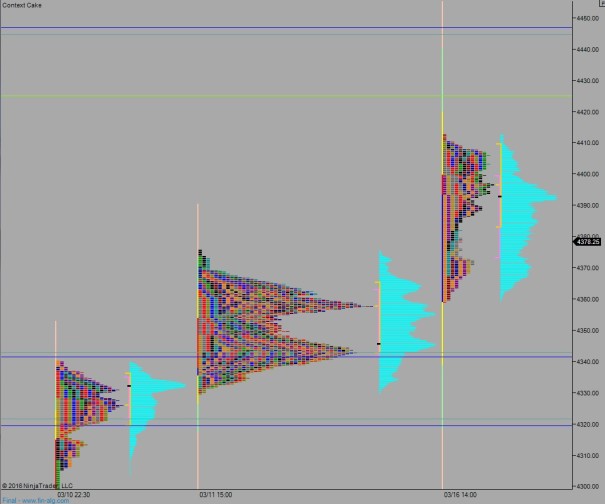

Volume profiles, gaps, and measured moves:

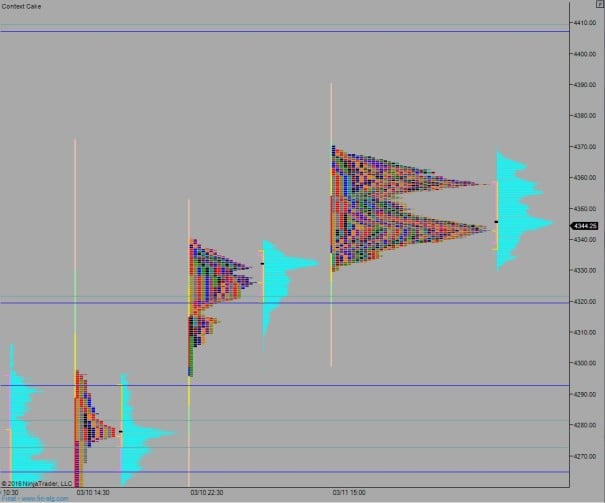

Volume profiles, gaps, and measured moves:

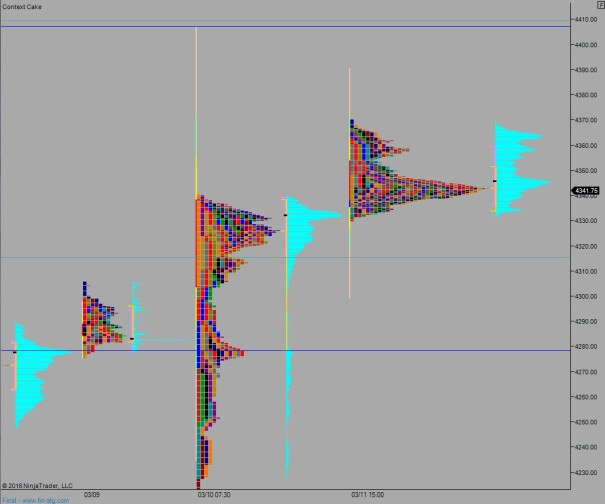

Volume profiles, gaps, and measured moves: