First time touching my desk in like two weeks lads. There have been too many folks making claims on my time these last several days, when alls I really need to be doing is gardening.

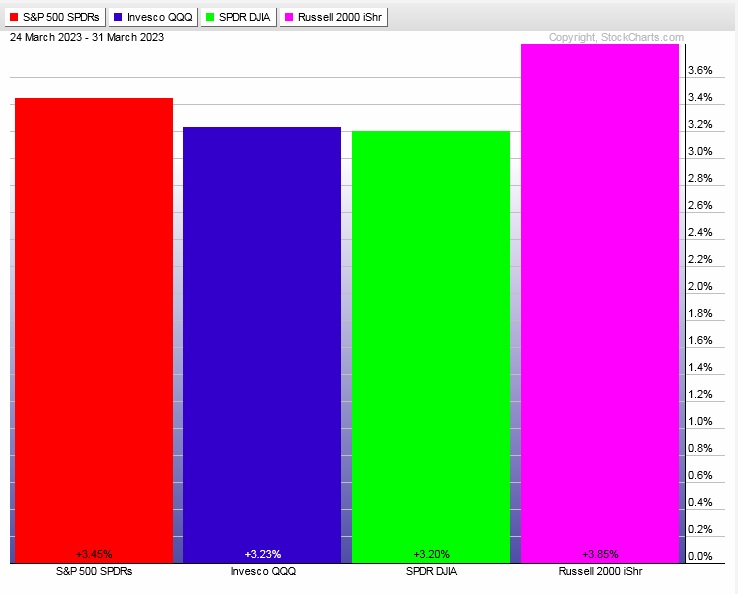

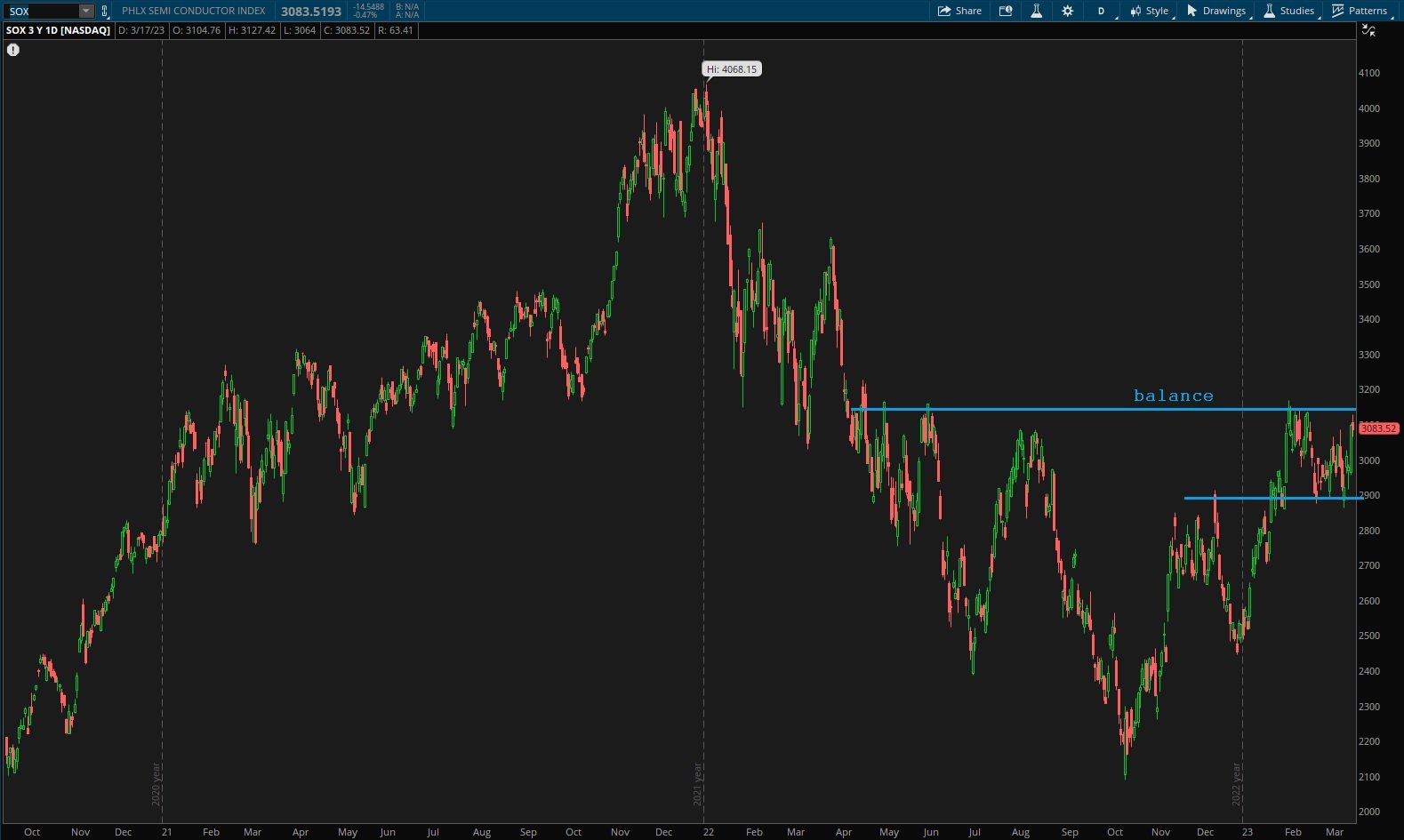

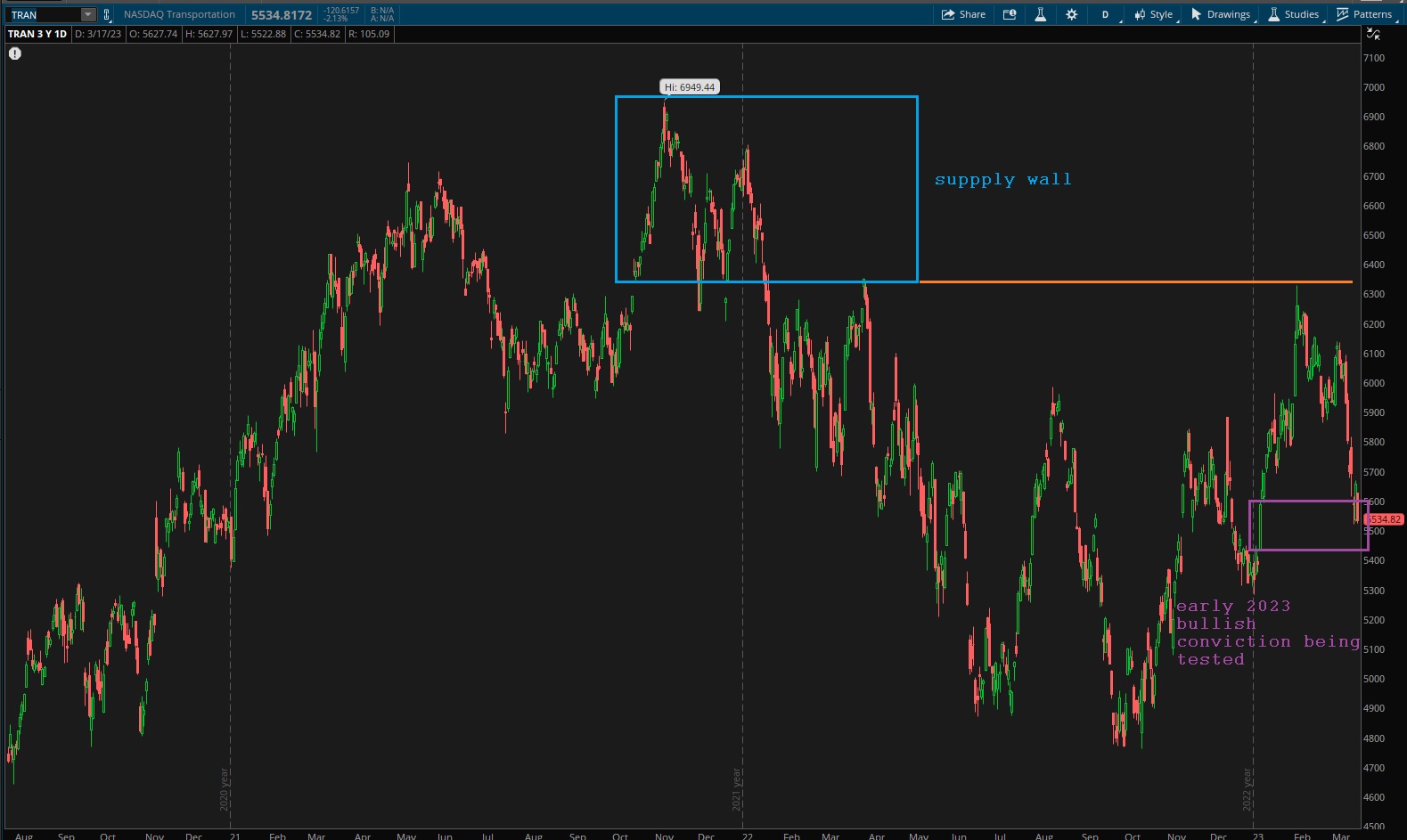

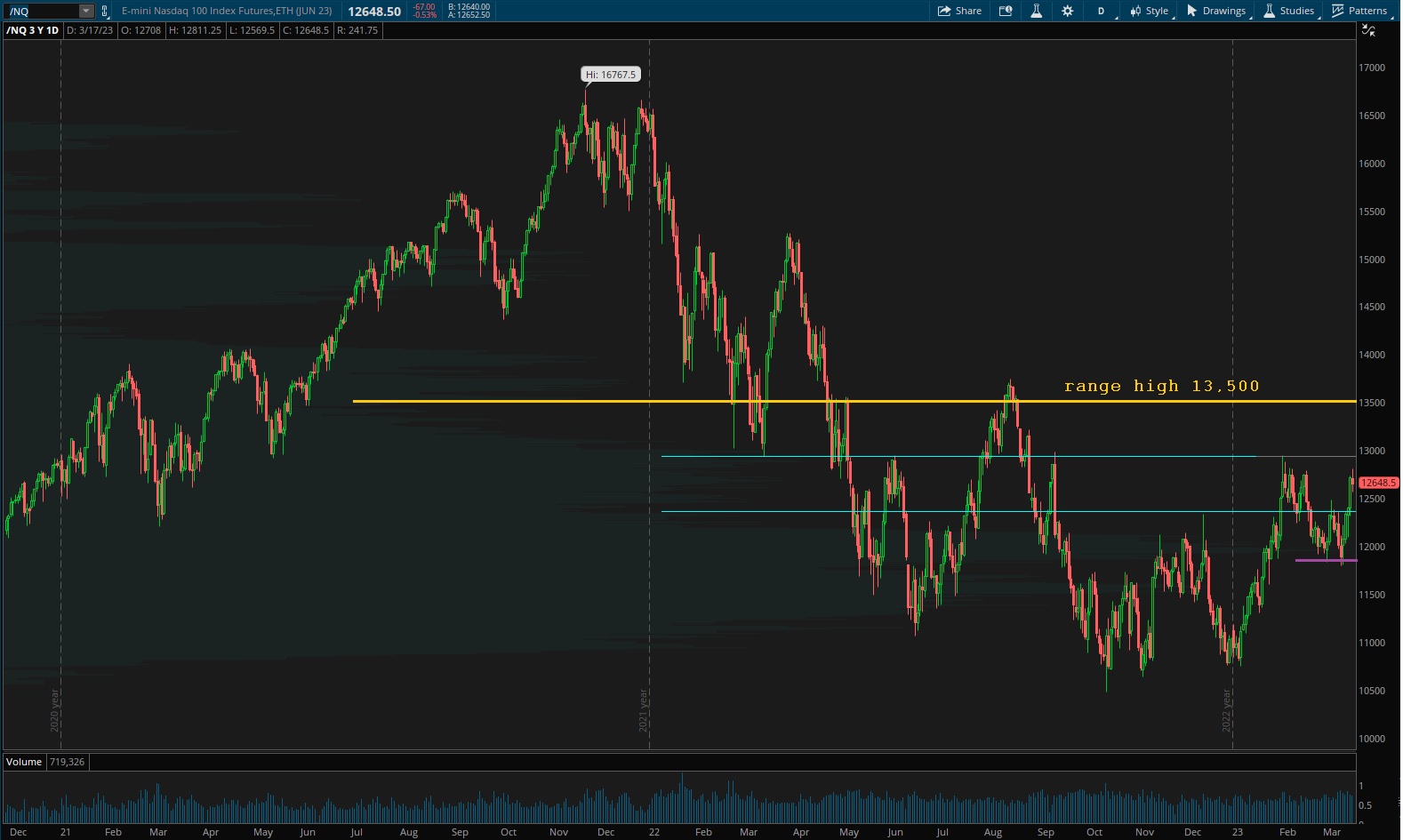

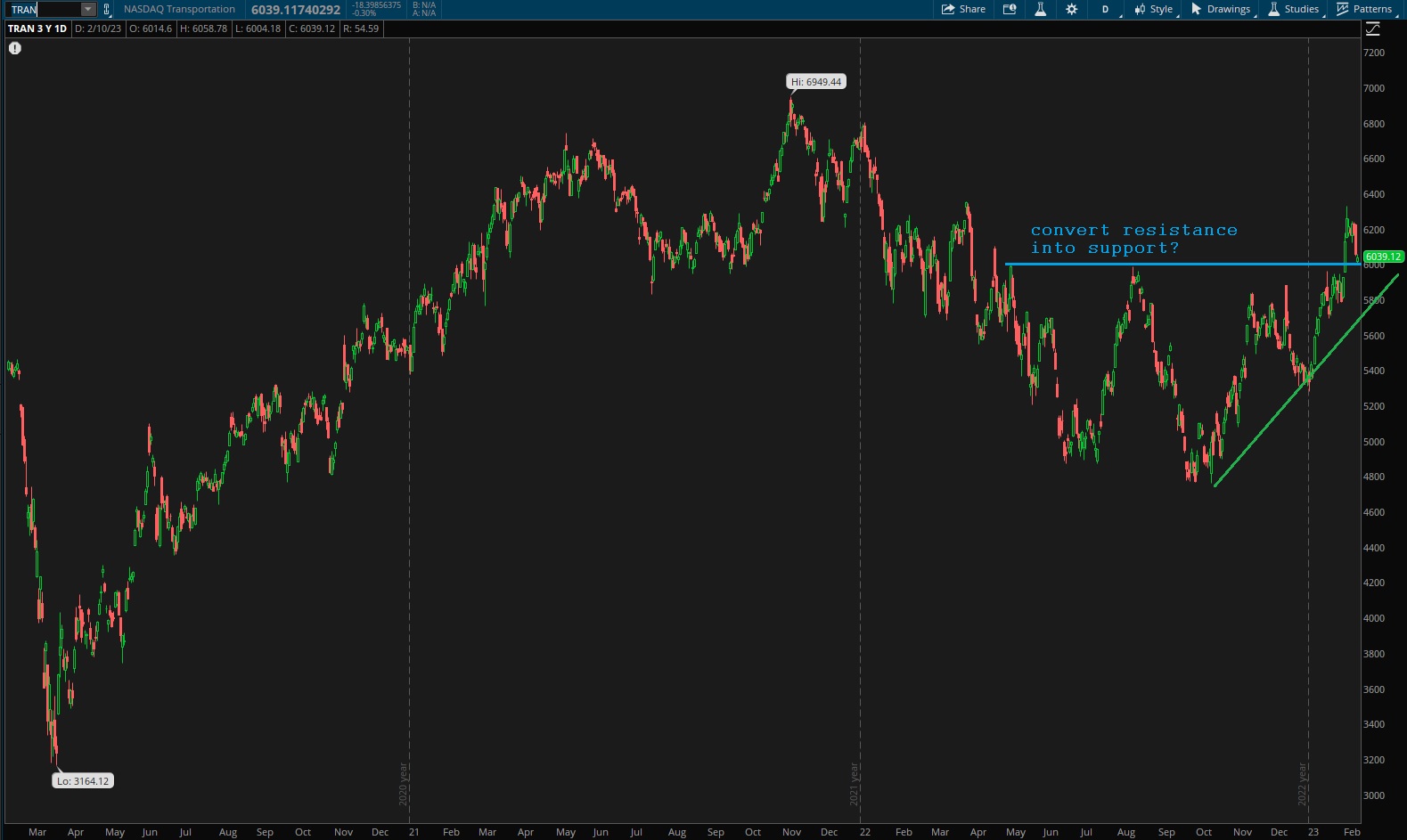

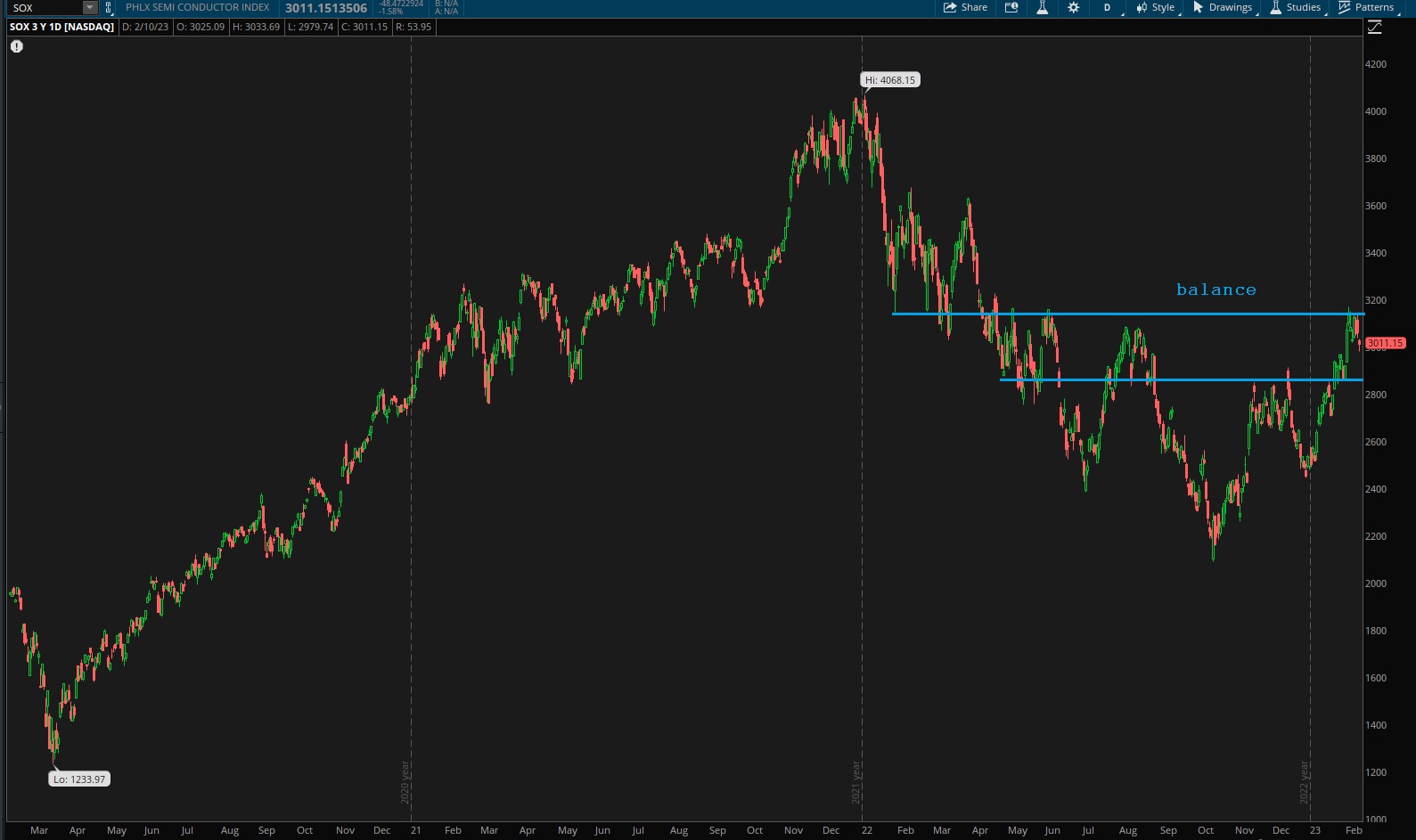

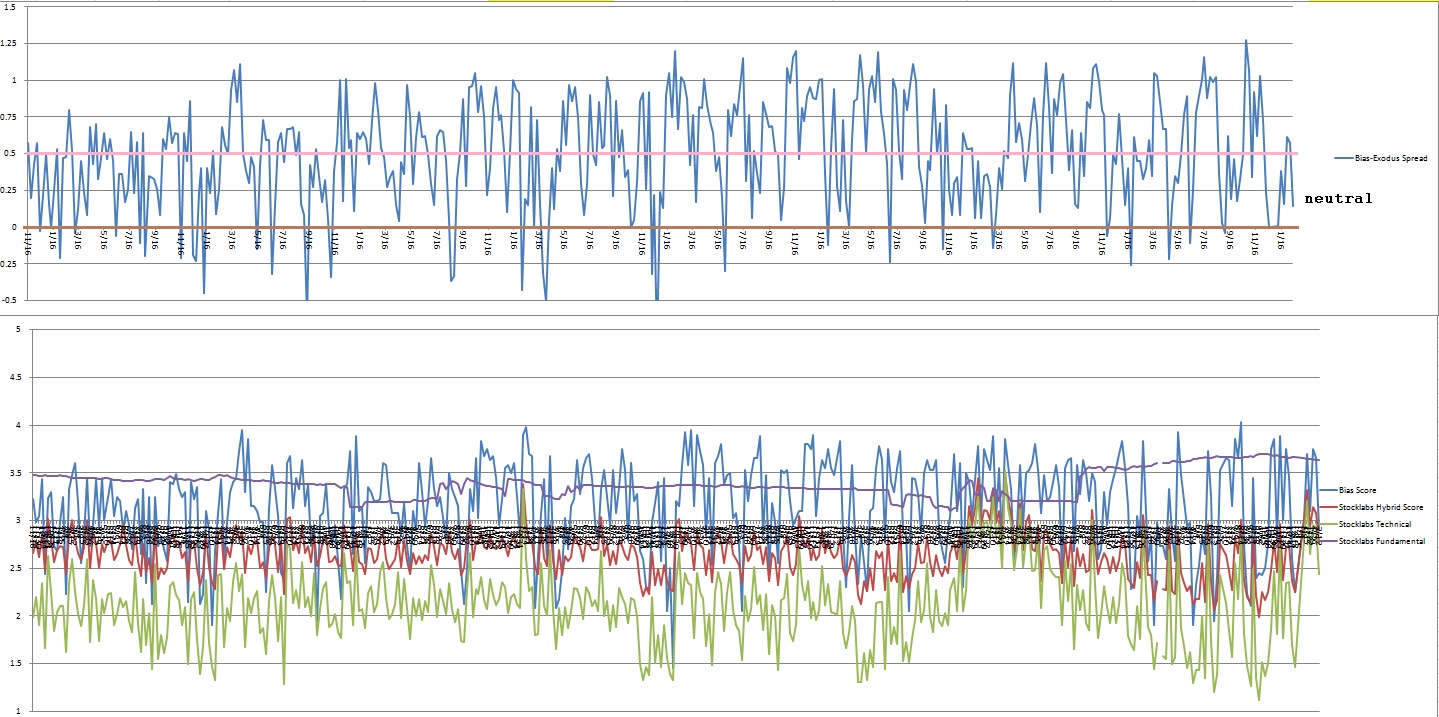

The NASDAQ busted loose. We were positioned aggressively for this to happen, and yes I did scale off a bit of risk a bit sooner then was correct.

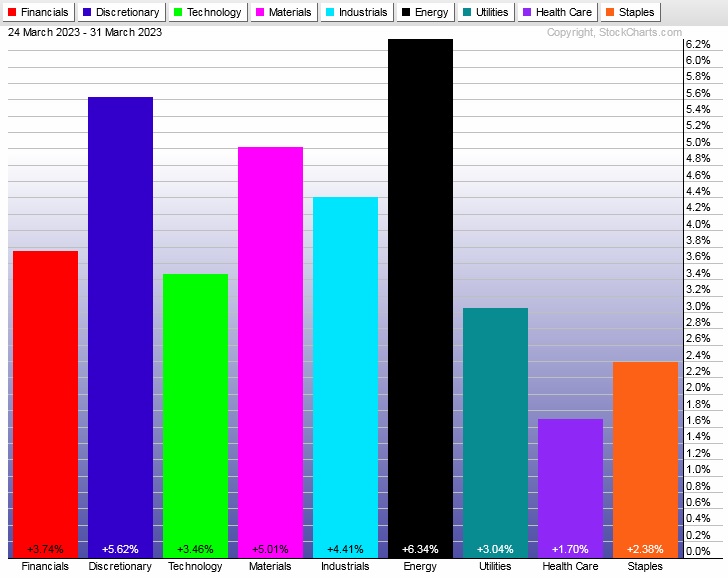

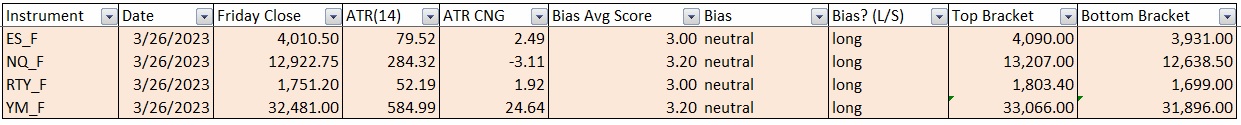

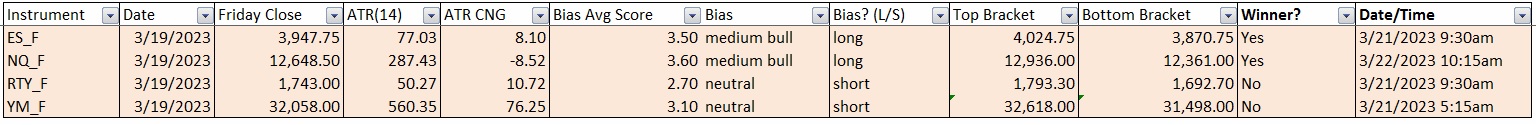

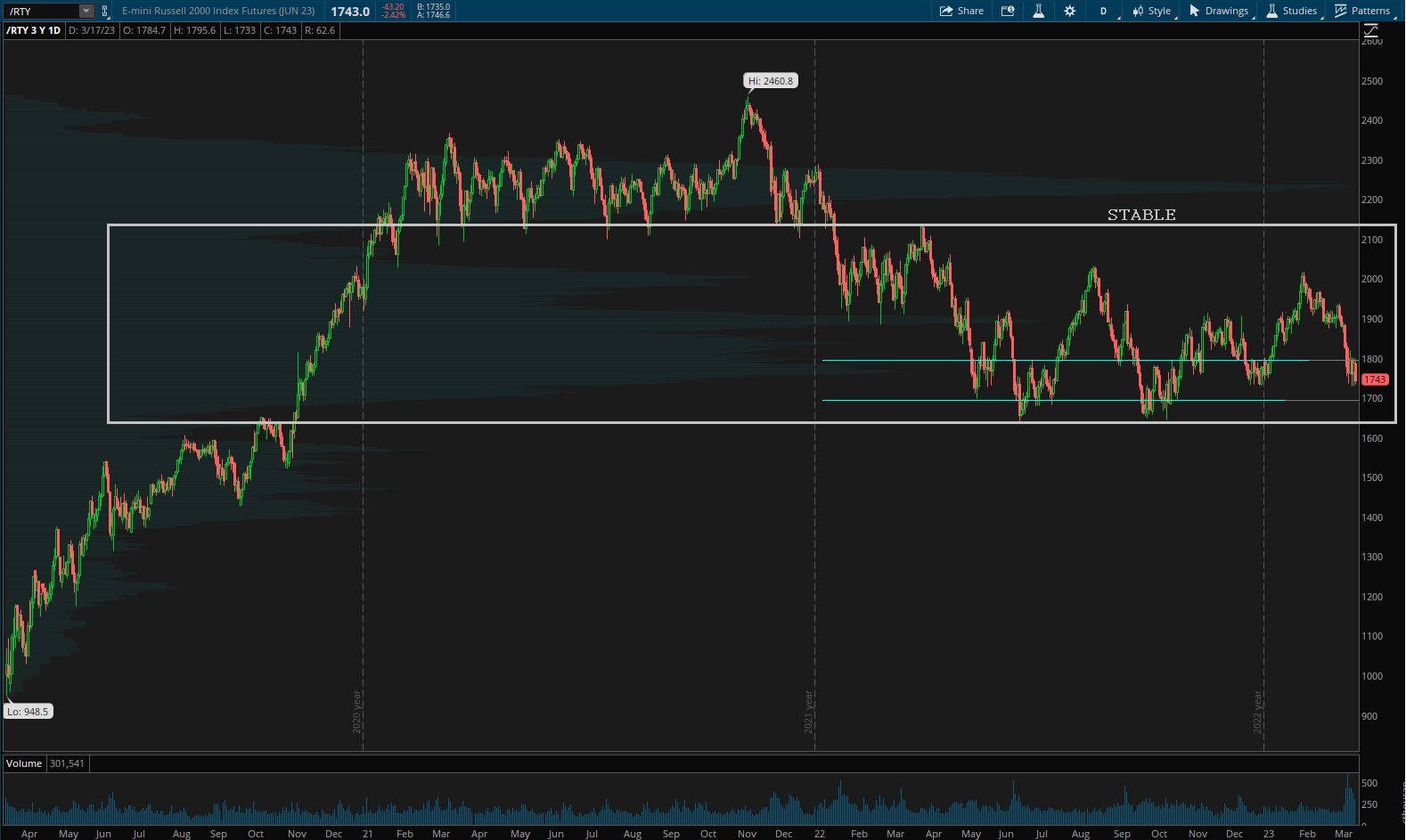

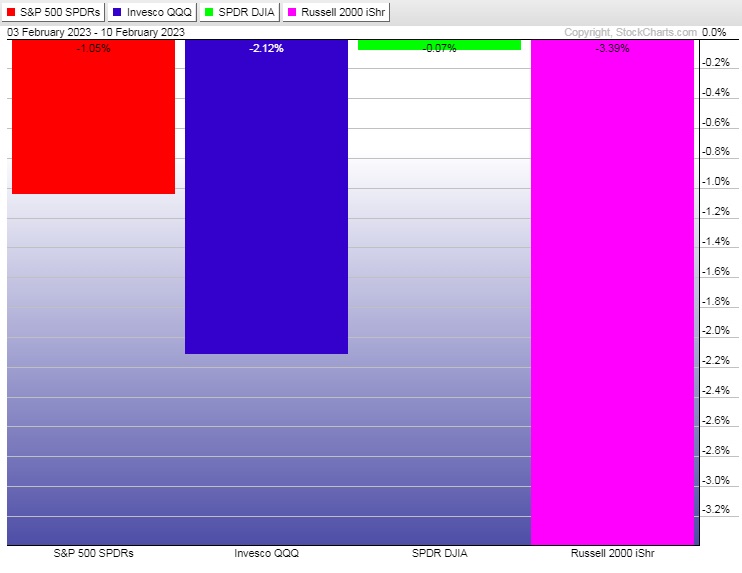

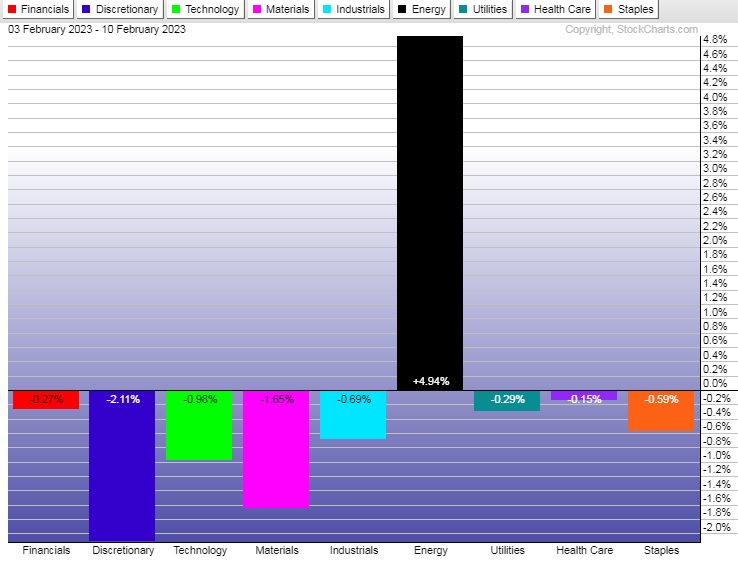

The charts look okay. I see no reason to be eyeing the exits, but maybe that in and of itself is reason to be doing so.

I have hundreds, approaching a thousand, plants I need to install. Many of them needed to be installed yesterday, and I will begin the work today just as soon as I complete this note.

Young lads, that there are folks committed to living on their computers, putting on seminars on how to extract moneys from the global financial complex, folks like Le Fly, count that as a blessing. I see nothing wrong in stepping away from the markets from time-to-time. My biggest wins often come when I am out working the hole. But to have a seasoned speculator out here, hand holding, day-in-and-out, that is a special thing.

I long for the desk lately. I spent nearly $4k recently building a new virtual reality trading rig. I haven’t even taken delivery of the tower yet. The chap who built it is perplexed. I ran into him at a rave last weekend, and he was like, “I built your computer lol, will you ever come retrieve it?” He has been paid in full. It is not money that I lack, it is time.

Time is truly a scarce asset, and even with the use of stimulants like COFFEE, REEFER and HOOTCH powering me to work 16+ hours per day, I am still coming up short on my tasks.

I’ve had to put new sets of tires on three of my vehicles in the last thirty days. The tire dudes they love me.

My desk is papered over with receipts that need to be logged, dating back to mid-March.

“Embrace the madness,” that’s a sign I hung on my office wall a few years ago, I suppose to remind me to stay cool in times like these.

Another sign reads, “If you are greedy, a monster will come for you.” That monster comes from within the self.

Those are the only two signs on my wall. I’ve been meaning to hang a nice portrait of Madam Secretary Yellen, maybe two portraits of that sweet queen, one from her tenure as leadership of the Fed before she was usurped, and another from her current role leading the Treasury.

I also want to go up north and simply wander through the woods, writing stories and foraging for ramps and mushrooms.

Maybe next year.

In summary, I am spread thin lads, and doing my best to maintain a rosy disposition despite the monster grumbling in the background.

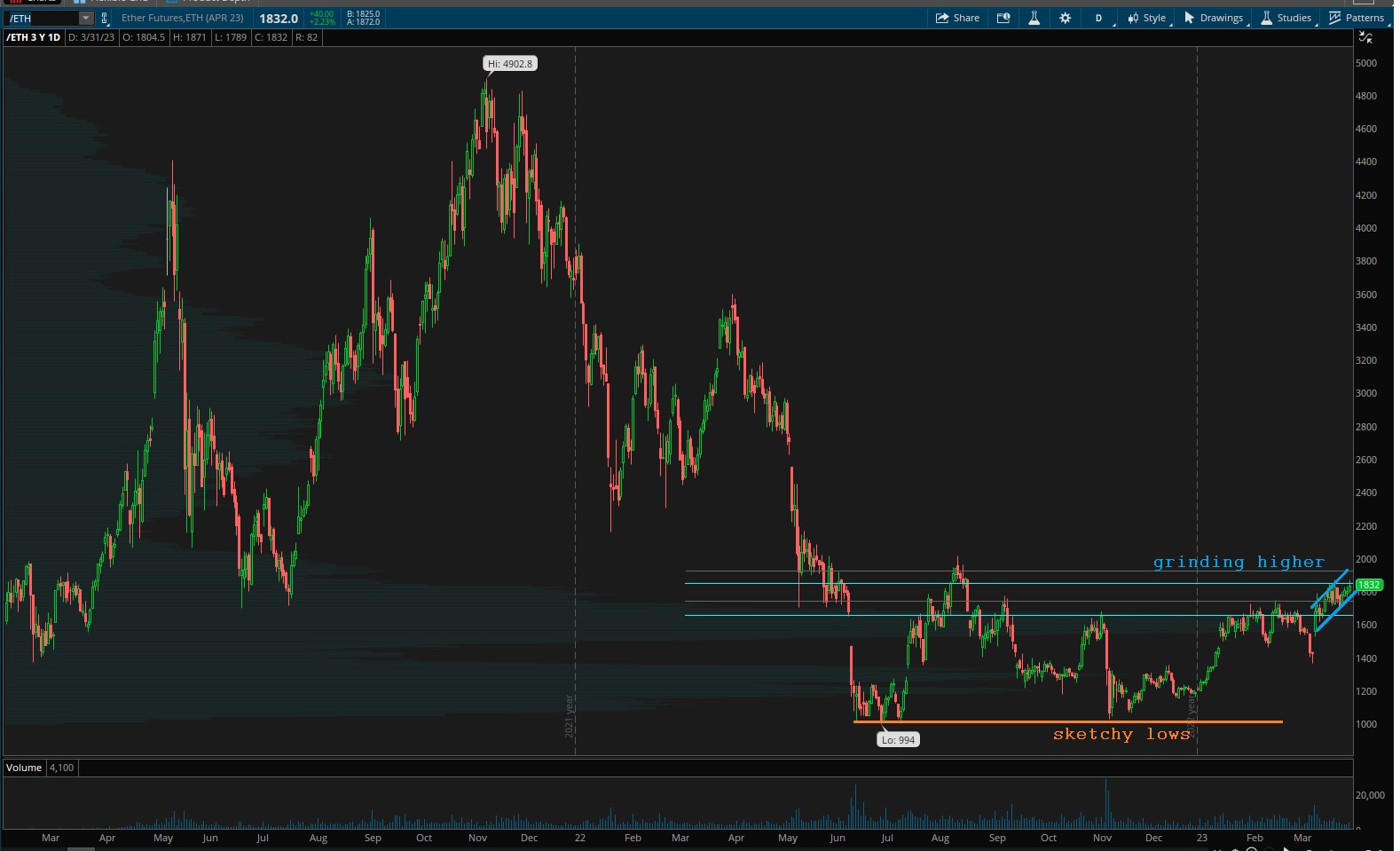

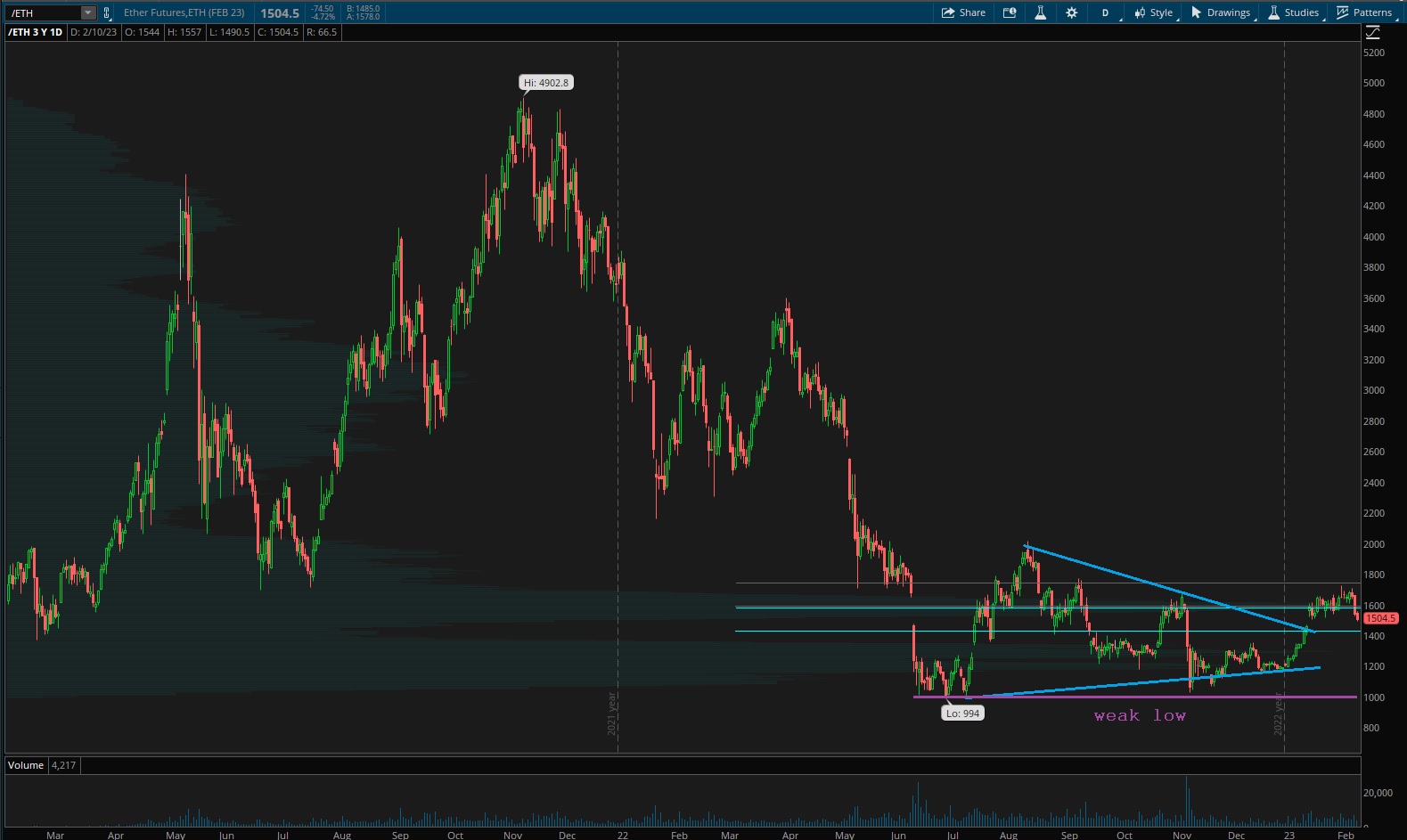

I think the memecoin summer rallies of crypto aren’t over. The GWEI on ETH finally mellowed out a bit, and the key now is making sound judgement calls on which is the most silly. I think that HarryPotterObamaSonic10Inu is just dang good humor. TICKER SYMBOL: BITCOIN. How ridiculous is that?

What else, what else…ah yes, I’ve assembled a crew to begin the daunting task of saving a hovel that is adjacent to my urban farmstead. I do believe a more sane person would simply demolish the wreck and start over. But then again, anyone who has spent the last three-or-so years navigating the Detroit Building Department (BSEED) understands that keeping four walls in place removes a ton of painful bureaucracy. So we’re bringing in the cherry picker, some dumpsters, and ten military-aged men to begin the process of saving this moldy oldt shack. For GLORY. For electricity, and for municipal water.

For the last two years I’ve had to truck in water to the farm, a process I’ve used for the last decade to irrigate guerilla gardens all throughout this wonderful Big Gretch city-state. But I’m tired lads and dread doing it a gain. So I am holding off on installing my pepper crop until municipal water is active.

This may have been a blessing, as they are slated to implode the incinerator stack from the nearby trash burning facility later this month. I definitely didn’t want that dust landing on my shishitos. The soil has been covered with thick blankets. Once that end-of-times dust settles, I will throw on a hazmat suit and begin prepping those plots.

The games we play lads, for glory.

Okay for now,

Raul Santos, June 4th, 2023

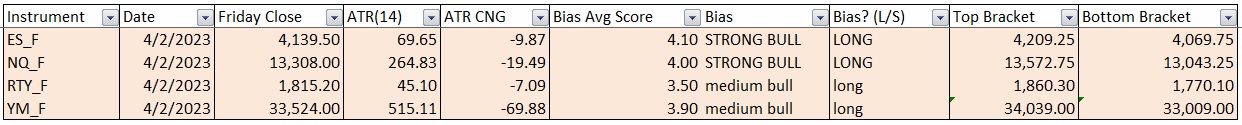

No strategy session. Terrible. I know. Please seek guidance from the other experts working here. I will be back as soon as I possibly can.

Comments »