Yesterday I wrote about Dick’s Sporting Goods earnings report as a “tell” for the retail sector.

I don’t have a position in DKS but I have about 50% of my portfolio tied up in retail stocks despite the economy showing signs of going utterly pear-shaped.

Investing isn’t about being smarter than everyone else. It’s about being smarter and/or faster than the masses. The idea is to find a particular set of specific measurable performance metrics or trends shortly before they become conventional wisdom then get long as you can stand and wait for the world to catch up to you.

Two important points on this strategy:

- Timing is critical. Early is the same as Wrong. I want to be about a month ahead of the pack. Any longer than that and it’s time to rethink.

- You have to understand the other side of your theme perfectly. When chess prodigy Bobby Fischer ran out of opponents he practiced against himself. You’d be amazed how hard that it is to compete against yourself in anything without cheating. Don’t invest until you can make a perfect case for how and why you could be wrong. Seek dissenting opinions.

My Thesis

I think this is the year Wall St rewards companies for spending on their core business rather than doing more buybacks. Specifically, I am investing in retailers that are a) growing their online business faster than the low teens rate of overall US ecommerce b) investing with the goal of seemlessly integrating on and offline… Customers don’t make the distinction between on an offline. It’s all just selling stuff. c) are willing to take an earnings hit in order to spend.

That last point is counter-intuitive. I want to be long stocks that are warnings-proof. Short interest at DKS is up >3x since last May. Most of them were betting earnings would miss. My bet (on retail in general) is earnings misses will be foregiven. If that happens the shorts are hosed. They have to cover because their catalyst (earnings miss) didn’t work.

We’ve seen Best Buy, Macy’s and JWN go up after bad reports (though in the case of JWN it took a while). So when DKS missed and fell 8% pre-market my question wasn’t why shares fell (they missed, duh) but if the stock could bounce, ala BBY:

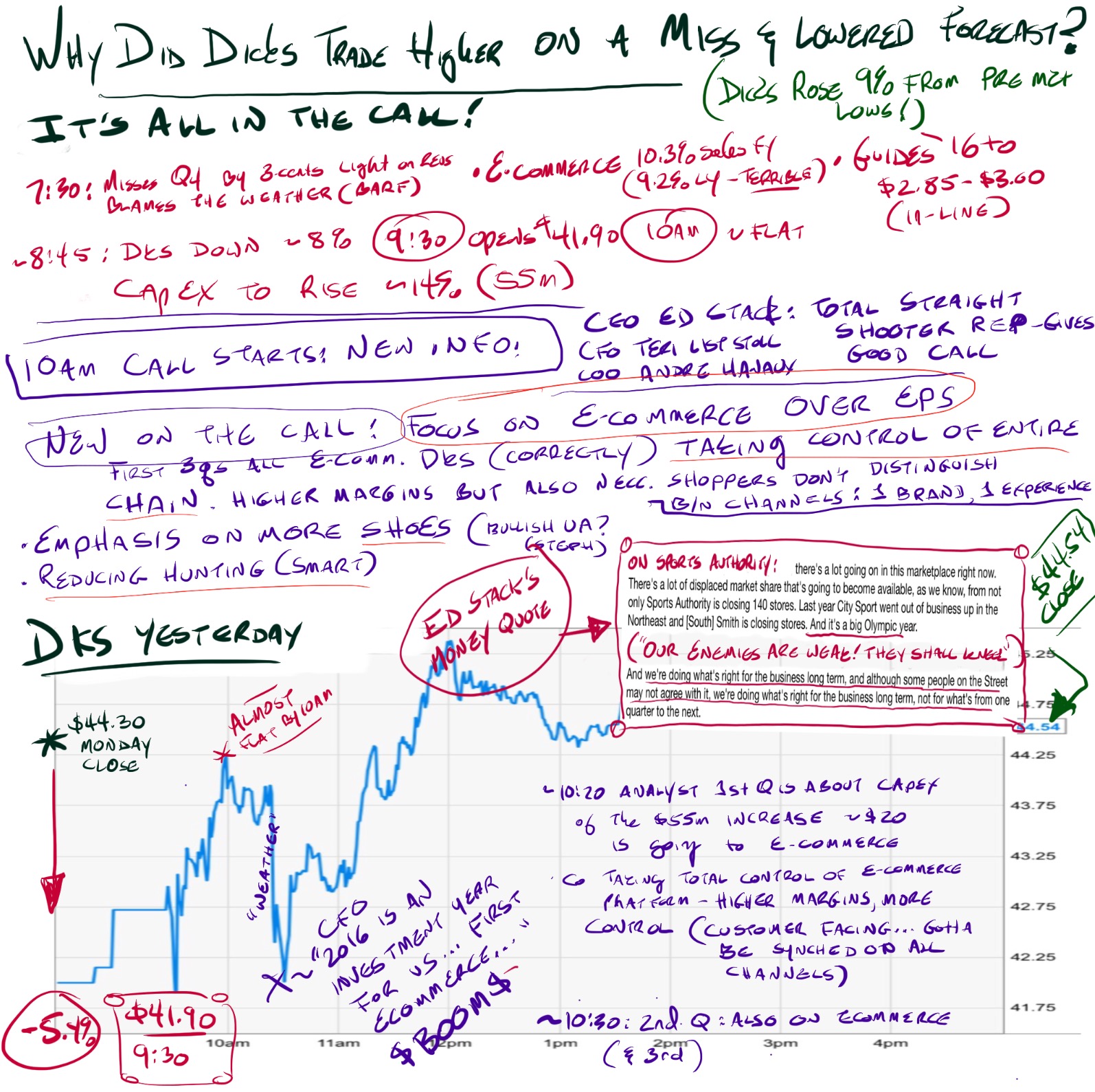

It did. Here, in nearly indecipherable but surprisingly useful form are my notes on the the surprises during the conference call that triggered a 9% rally from when DKS reported to the close of trading. If the rest of the retail sector continues to trade this way you can expect to see a lot more people getting on the retail train.

Those are the folks I want to sell to at higher prices.

Thx Jeff love the writing… you are the new version of Don Coxe.. articulate and erudite

High praise of which I am unworthy. But will accept because I’m somewhat easy as well.

Thank you.

Hi Jeff, thank you for responding to my question in your last post. No apologies necessary in not answering sooner; quite frankly, you’re not under any obligation to answer a question so I always appreciate it when you do.

What struck a cord with me on your retail thesis is the comparison to the market’s reaction Restoration Hardware. They missed on earnings, but as you noted in a post, gave an absolutely horrible conference call.

If we see a similar set up in a retailer (down 5%-8% after earnings announcement, but starts to recover during conference call and hear positives regarding focused capex and tangible strategies), do you have to be long in advance of the announcement, or can you play the reaction if you recognize it fast enough? Thanks again for the insight.

You gotta dig. I read the transcripts (rather than listen). Go through as many as possible. The wheat and the chafe become clear.

Appreciate the response; I’ll start making a habit of it.

Done in great style. Big fan of your posts.

Thanks!

Dick’s is quite an operation, I was surprised but then again we don’t have anything comparable up here. CMG back in the news, possibly an unfortunate coincidence?

where is up here?

Jeff, you wreck the curve for content quality. I’d recommend you to write songs for rock stars if there was any money in it! Book quality day to day, thank you.

What is the counter case for being 1st mover in proprietary chronic uber diagnostics, as SMLR is? 90 minute medical uber exam, once per year, no cost to patient, to diagnose just about every chronic, asymptomatic medical condition under the sun. 1/3 of the top 25 insurers are their paying customers already, albeit extremely small sample sizes, not that 88% sequential revenue growth just reported is too shabby. They’ve got a pretty good powerpoint of their business model on their investor relations page. Patient wins, insurance company gets paid more annually from medicare, medicare pays less for preventative care than terminal care, seems like a winner here. Market says ‘too early’…hmmm

I accept being two years ahead of the crowd on stocks. I know. I know.

However, what I just read, by the great Jeff Macke, brought to my mind $DSW because of my recent purchases; some made in store, one item shipped and one made on-line. They will ship your on-line to the store for pick-up and no hard feelings if you leave it there. One item ordered online and picked-up at the store can easily go back to the store for the return, I don’t like the item.

I think I’ll start on their transcript.