NASDAQ futures are set to open the week gap down after an overnight session featuring normal range and volume*. Price held the upper half of the Friday range on quiet, two-way trade.

*Volume data will be skewed this week, however, due to some participants staying behind and trading the March contact while most move forward to June.

On the economic calendar today we have a 3- and 6-month T-Bill auction at 11:30m.

Last week was a slow grind down through Thursday. Early Thursday we heard from the ECB, who pushed their key borrowing rate down to negative 0.40% while promising additional monetary stimulus. This jostled the NASDAQ a bit, opening it gap up before heavy selling came in. The heavy selling was ultimately reversed, effectively trapping sellers down in ‘the hole’.

Friday price opened gap up and slowly churned higher.

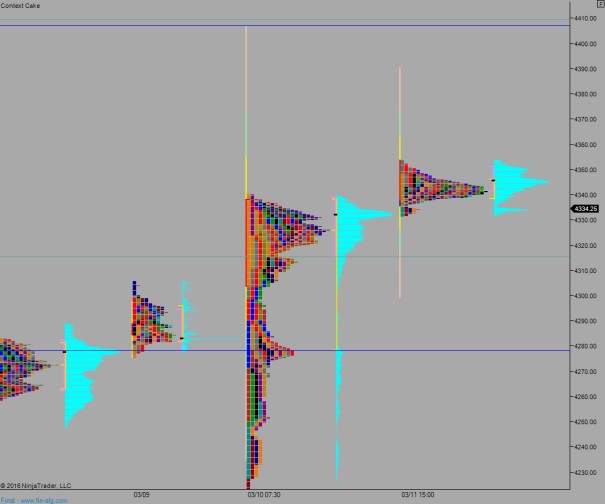

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 4345.75. From here a move to take out overnight high 4350.75 sets up a test above last week’s high 3453.75 before two way trade ensues.

Hypo 2 sellers work down through overnight lo 4331.50 and find responsive buyers down at 4315.75 before two way trade ensues.

Hypo 3 strong selling pushes price down through 4315.75 to test below the Friday low 4309. Look for a move down to the 4300 century mark before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

Volume profiles, gaps, and measured moves: