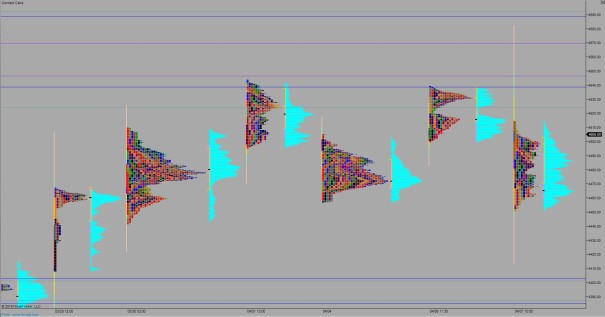

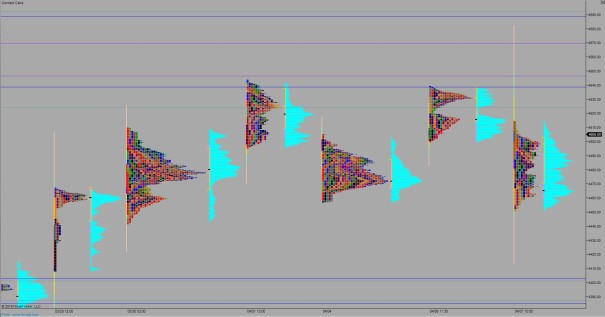

NASDAQ futures are coming into Friday gap up after an overnight session featuring elevated range on normal volume. Price held yesterday’s low before pushing higher, up through the pocket-zone (see green/red volume profile on chart below) and settling in the upper quadrant of Thursday’s range.

The economic calendar is light as we close out the week. At 10am we have Wholesale Inventories and at 1pm the Baker Hughes rig count.

Yesterday we printed a double distribution trend down. Which is interesting because Wednesday was a trend up. Thus yesterday’s action came as an unpleasant surprise to bulls.

Market Profile theory states that any entry in the direction of a trend day is “risk free” heading into the following session because we take out the session’s high (if trend up) by at least a tick more often (I have not run this study independently).

However, when you consider the current range, spanning about 7 days, since the major trend day back on 3/29, it makes more sense viewing these last two days of up and down trend. The intermediate term time frame is battling it out after a multi-month rally higher.

Heading into today my primary expectation is for sellers to push down into the overnight inventory and trade down to 4490.25. Look for buyers here and a move to target overnight high 4504.75. This sets up a fast move to 4524 before two way trade ensues.

Hypo 2 sellers push a full gap fill down to 4470.50. Look for buyers around here and two way trade to ensue, but for price to stay range bound between 4500 and 4460.

Hypo 3 strong sellers fill overnight gap down to 4470.50 then set their sights on overnight low 4458.25 setting up a move to test Thursday’s low 4450.75 before two way trade ensues.

Hypo 4 strong buyers push up through 4524 and sustain trade above it setting up a move to close Wednesday’s open gap up at 4535. Stretch upside targets are 4538, 4545.50, then 4569.

Levels:

Volume profiles, gaps, & measured moves:

Comments »