NASDAQ futures are set to open gap down after an overnight session featuring normal range and volume. Price briefly exceeding yesterday’s high on balanced trade. At 8:30am the Consumer Price Index came out slightly better than expected [1.0% vs 0.9% expected] and introduced sellers who worked price below the midpoint of yesterday’s session.

There are several economic data points out today, with the FOMC Rate Decision at 2pm being the most significant. The consensus forecast is for rates to stay unchanged at 0.50%. The announcement will be followed by a press conference with Fed chair Yellen at 2:30pm. Also on the docket we have Industrial/Manufacturing Production at 9:15am and crude oil inventory at 10:30am.

Yesterday we printed a normal variation up. it was a quiet session that briefly pressed to a new weekly low before printing a failed auction near last Friday’s VPOC and began trading higher. Price slowly worked the overnight gap fill before settling into two way trade.

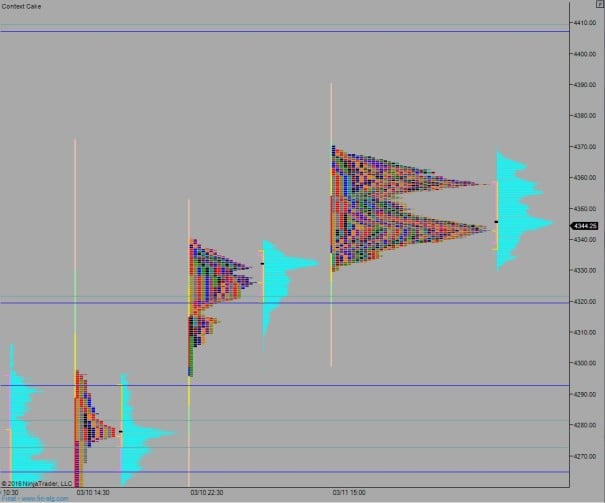

Heading into today my primary expectation is for buyer to work into the overnight inventory and close the gap up to 4356. From here look for a move up to 4360 before we settle into two-way trade ahead of the FOMC.

Hypo 2 sellers use this news-driven sell momentum to continue pushing lower and test yesterday’s low 4329. Look for sellers to continue down to 4322.25 before two way trade ensues ahead of FOMC.

Hypo 3 strong buyers close gap up to 4356 then take out overnight high 4369 before settling into balance ahead of the Fed. Stretch targets are 4400 then 4407.

Levels:

Volume profiles, gaps, and measured moves: