Third reaction Fed analysis, a sophisticated method of identifying the three major rotations after the rate decision, yielded the buy and I went to work vanquishing short sellers. Participation is limited to the day time frame however, because this market is setting up just like I have envisioned over the last two weeks.

See also: The Dow Is Forming The Wedge

There was a clean improvement from the internals that gave confidence to the long trade this afternoon. After FOMC, Net Tick improves substantially, blasting up to session high and holding the gains:

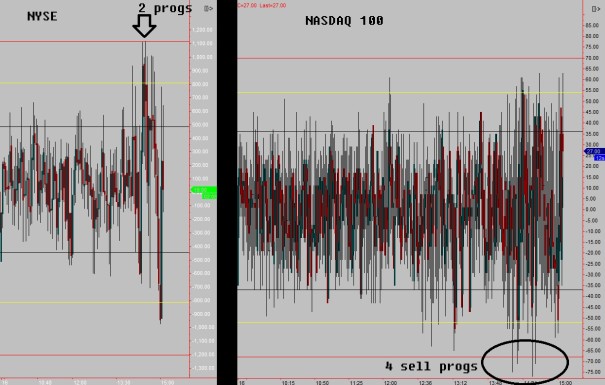

Then, despite 4 big sell programs running on the NASDAQ 100, the robots were trumped by two huge buy programs running over at the NYSE. These you can go with intraday, but tell a story going forward [more on that in a moment, first observe the algo wars]

When NYSE ticks hard, and this is only an observation, it tends to mark the crescendo of a move.

See also: All The Fixings for a Rally

With my last long closed, I have initiated a short position on the NASDAQ, via the QID, a position I will add to should we close out the week strong.

If you enjoy the content at iBankCoin, please follow us on Twitter

Hi Raul, I was wondering if you could clear something up for me. Were those 2 larger buying programs on the NYSE the third reaction you were looking for? Because it was a buy, that lead you to go long intra-day? Thanks for confirming this.

You are not wrong, but may be a few days early. Have to see how the rest of the week goes. 38.2 retrace on deck. Stop popping point at approx. 4458.

I like your timing, however, I have a feeling there are macro economic factors at play that could keep oil and the market as a whole buoyed. The dreaded inflation is starting to rear its ugly head in earnest, and with a lower valued dollar, stocks will rise.

I’m long oil and gold here. Trading in and out of them for outsized returns.