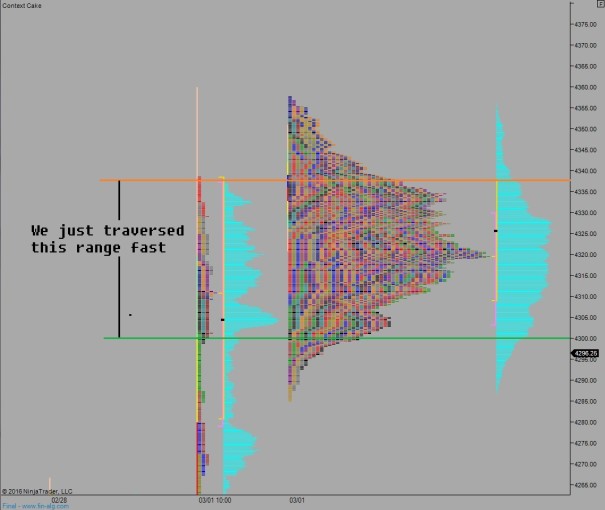

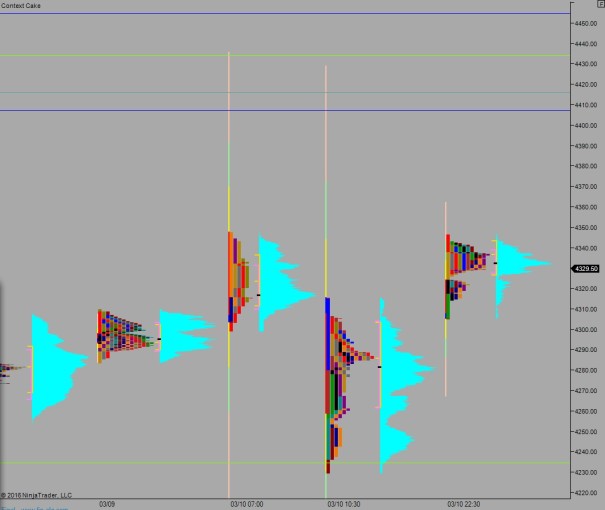

NASDAQ futures are coming into Friday gap up after an overnight session featuring extreme range on indecipherable volume. Volume is split between the March and June contracts because of rollforward. I will stick with the March contract into the weekend. Price worked higher during the entire session, stalling out just before the weekly high set Monday.

The only economic event today is the Baker Hughs Rig count at 1pm.

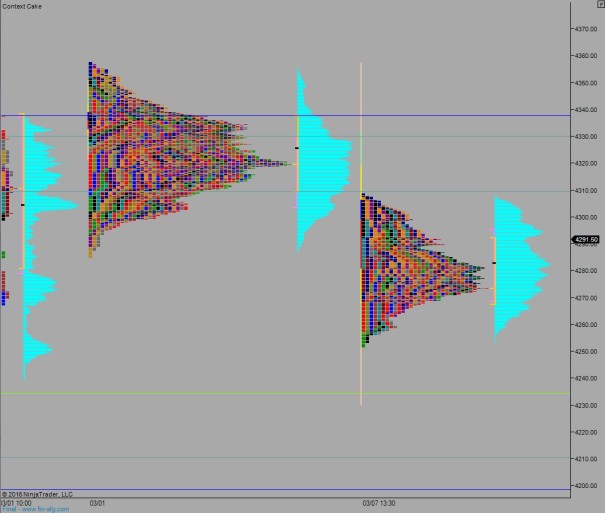

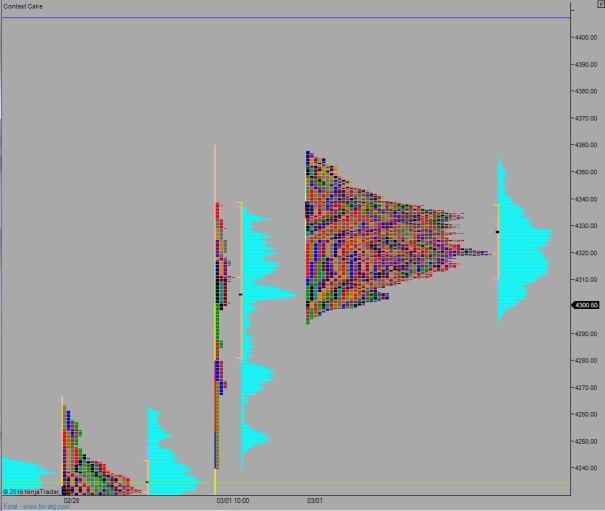

Yesterday we printed a big normal variation down. Late into the session it looked like a double distribution trend down, but the strong end of day bounce radically shifted its form.

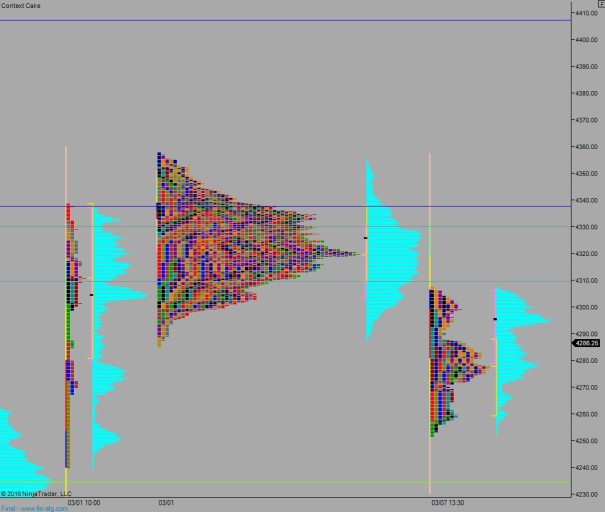

Heading into today my primary expectation is for sellers to push down into the overnight inventory and test down to the 4300 century mark before buyers step in and work up though overnight high 4346.50. From here look for a test above the Monday high 4355 before two way trade ensues.

Hypo 2 buyers gap and go, take out overnight high 4346.50 early on then sustain trade above the Monday high 4355 setting up a big rally to target the 4400 century mark. Stretch targets are 4407.50, 4415.50, then 4433.25.

Hypo 3 strong selling closes overnight gap down to 4285.25 then takes out overnight low 4282.50. From here sellers continue lower to target 4267.75 before two way trade ensues.

Levels:

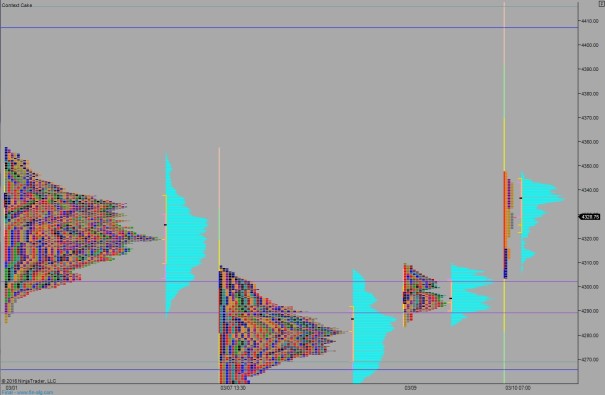

Volume profiles, gaps, and measured moves: