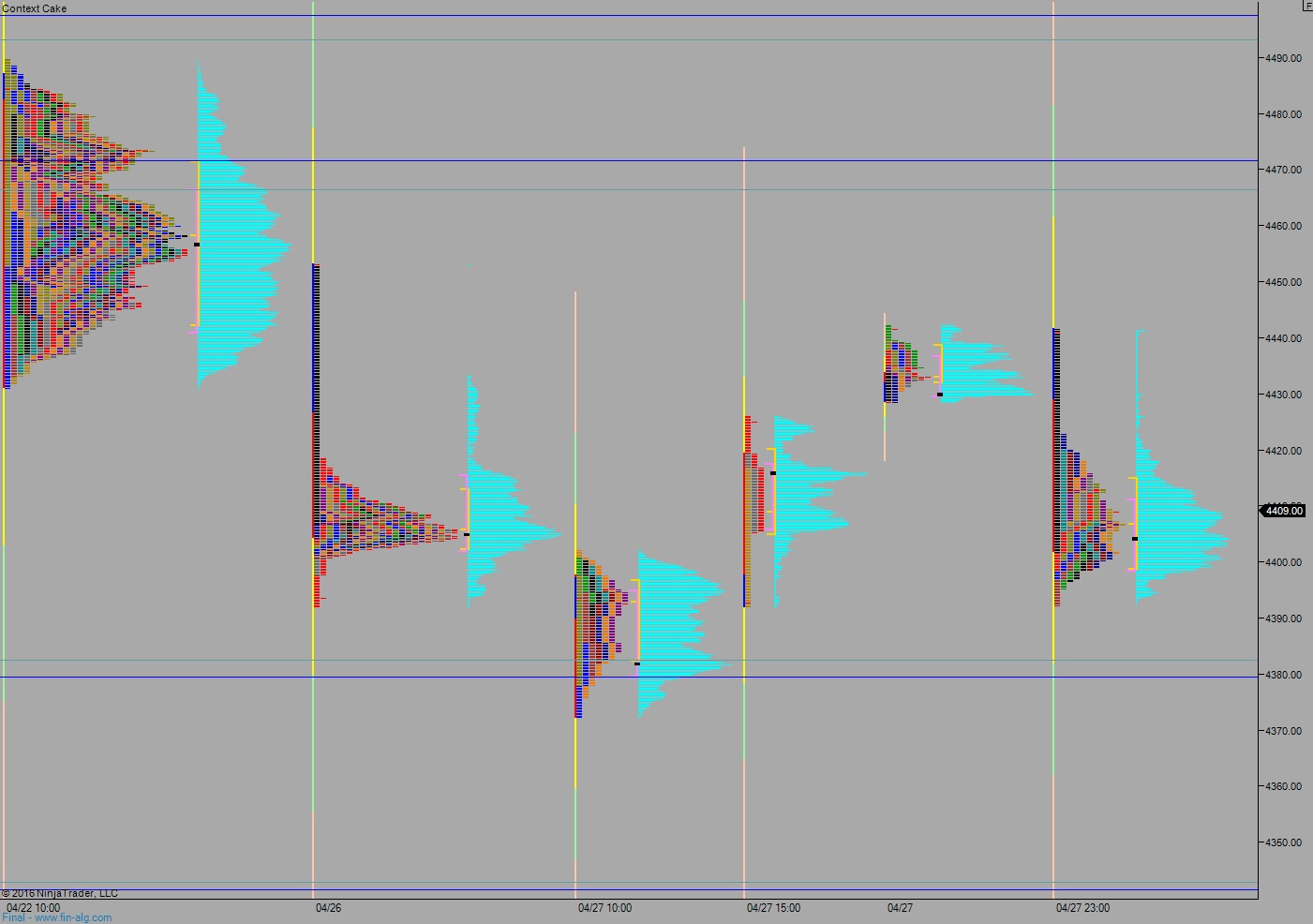

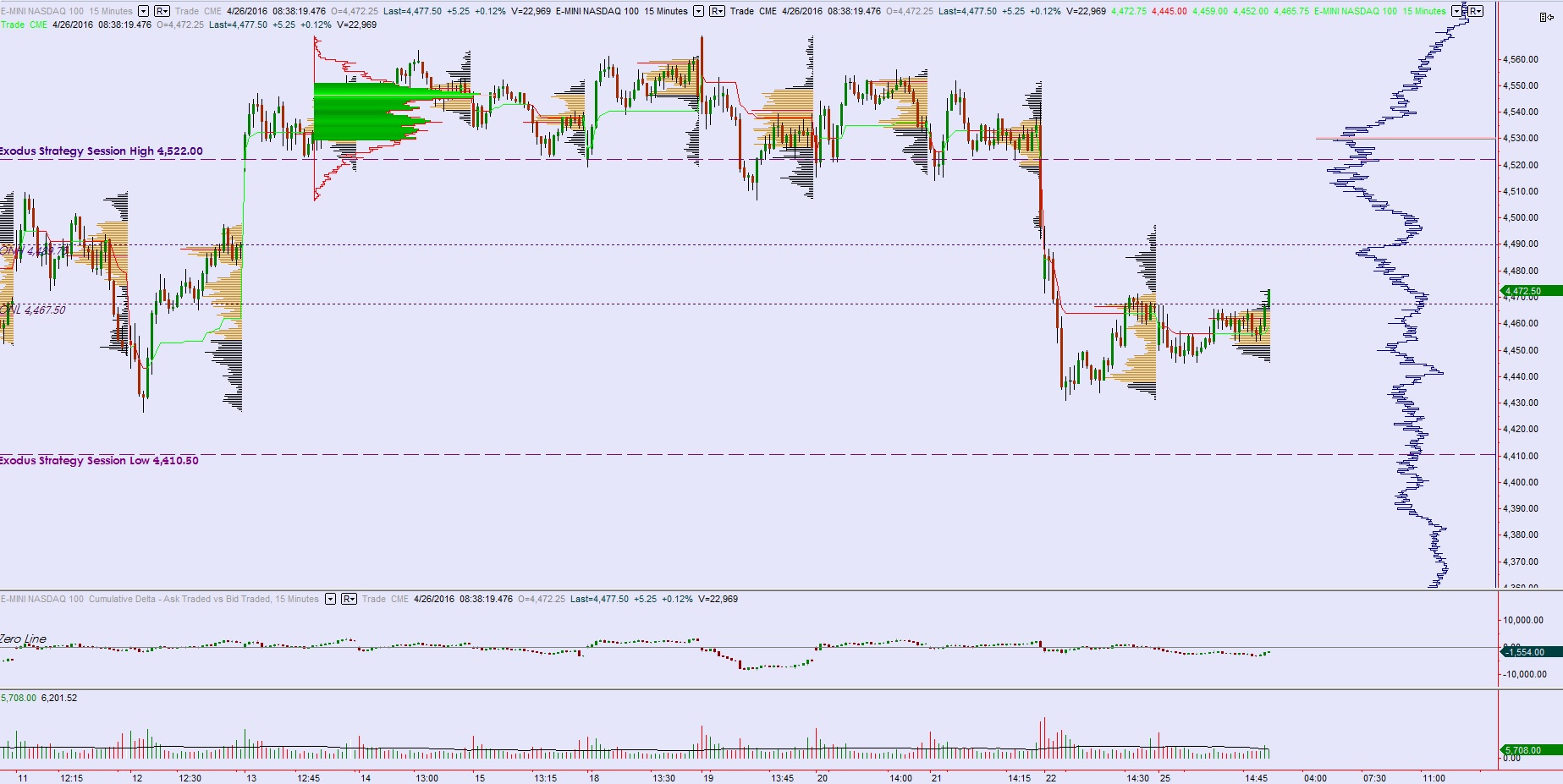

NASDAQ futures are coming into Wednesday gap down after an overnight session featuring an elevated range on normal volume. A balanced session fave way to selling around 4am sending price down near last month’s lows. At 8:15am ADP Employment came in below expectations. Also at 8:30am Trade Balance data was slightly better than expected.

Also on the economic docket today we have Factory/Durable Goods Orders and Non-Manufacturing/Services Composite at 10am. At 10:30am we will hear the crude oil build up numbers.

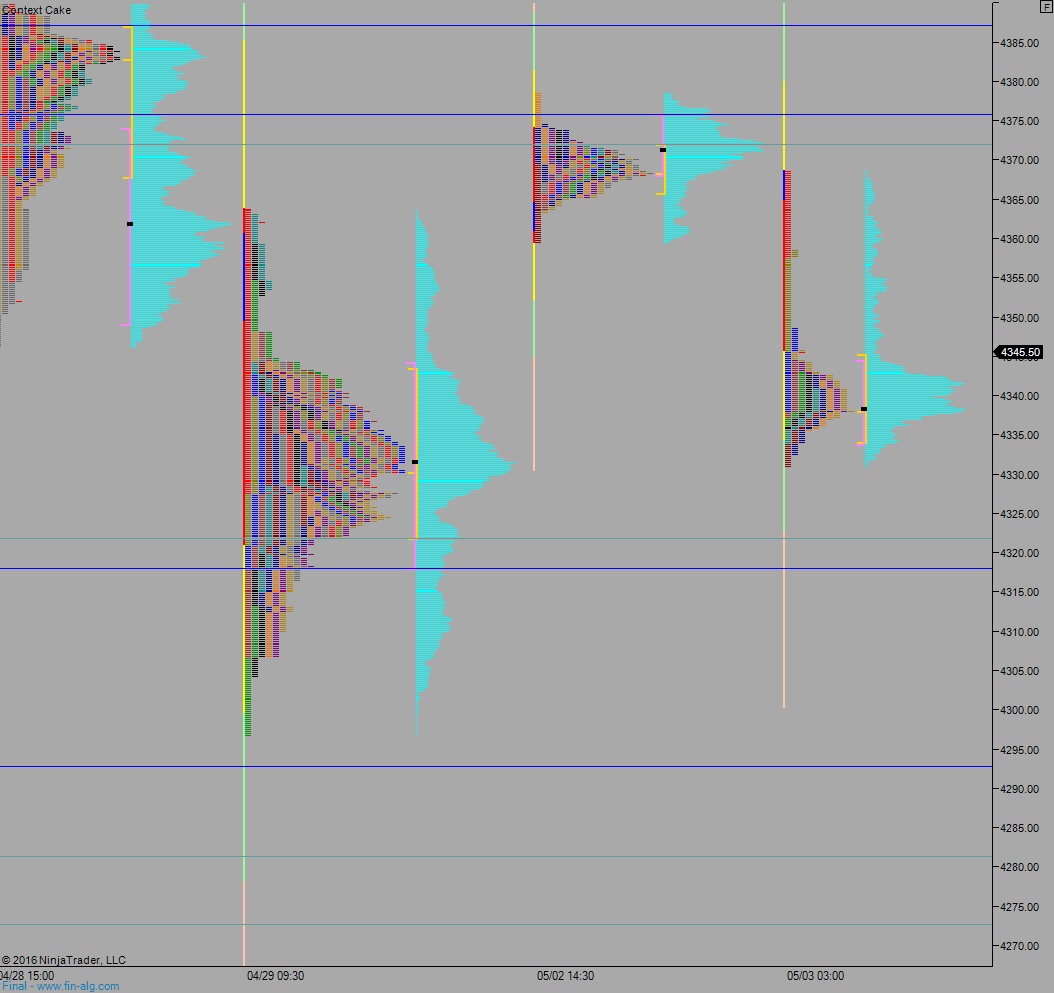

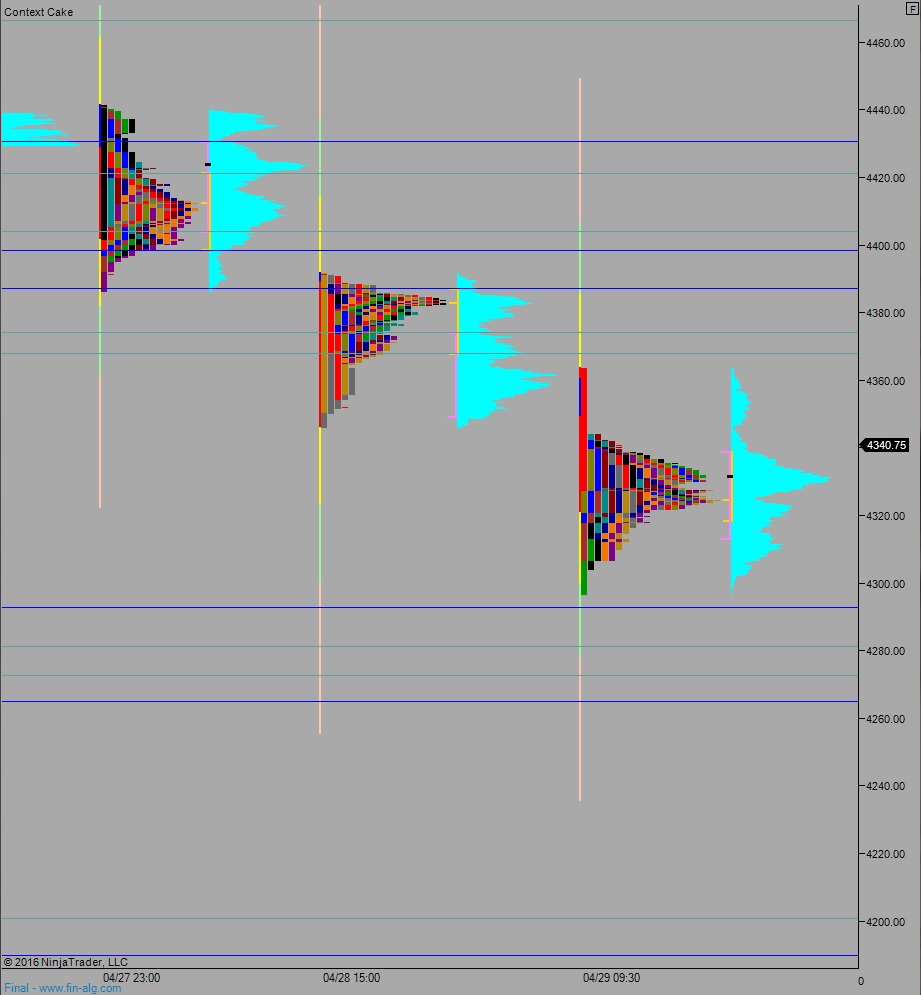

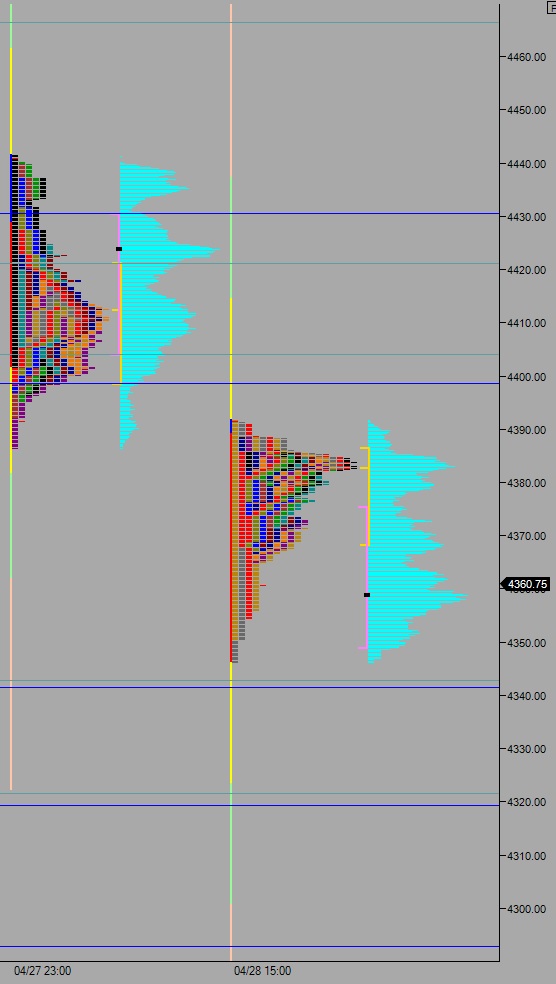

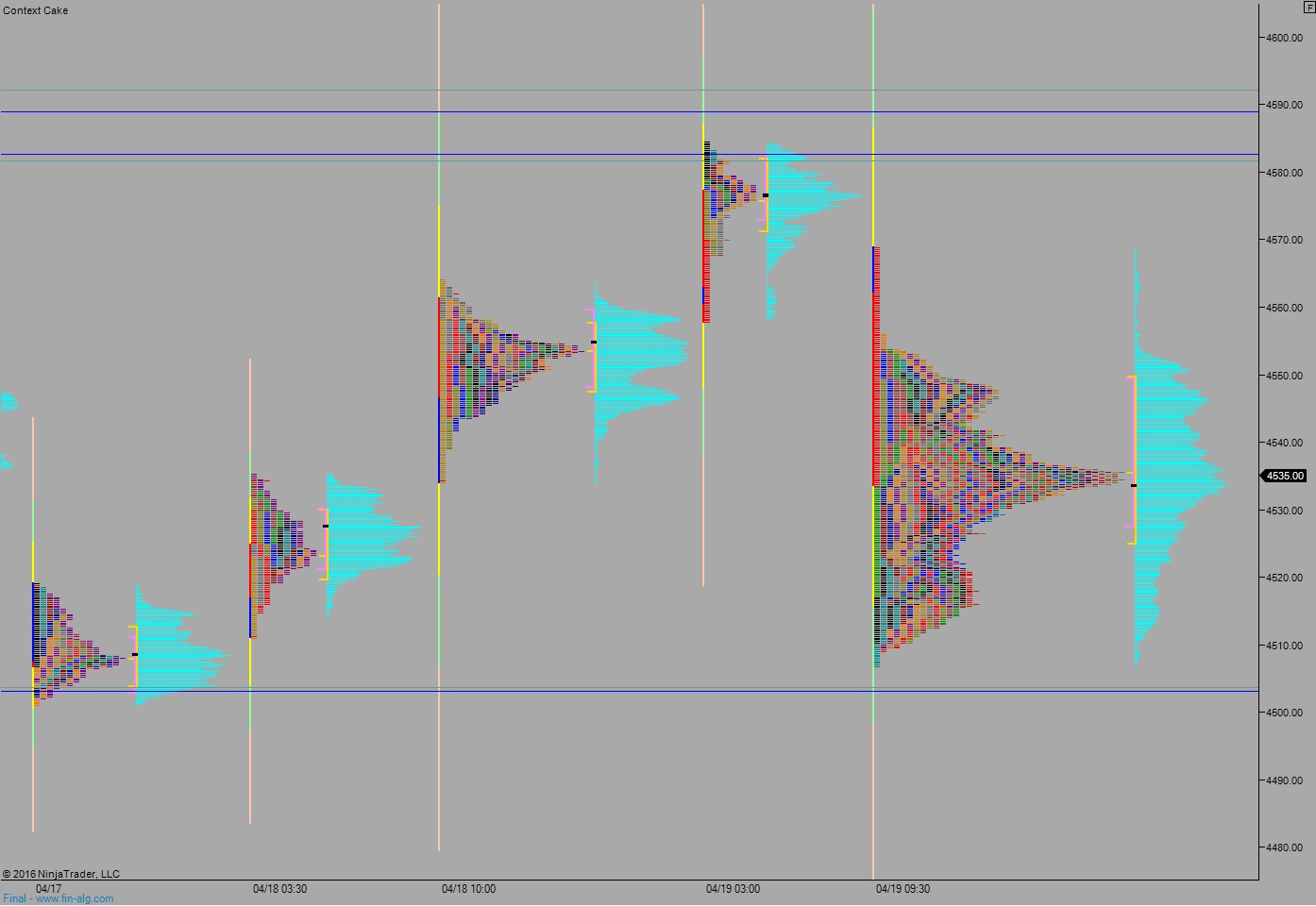

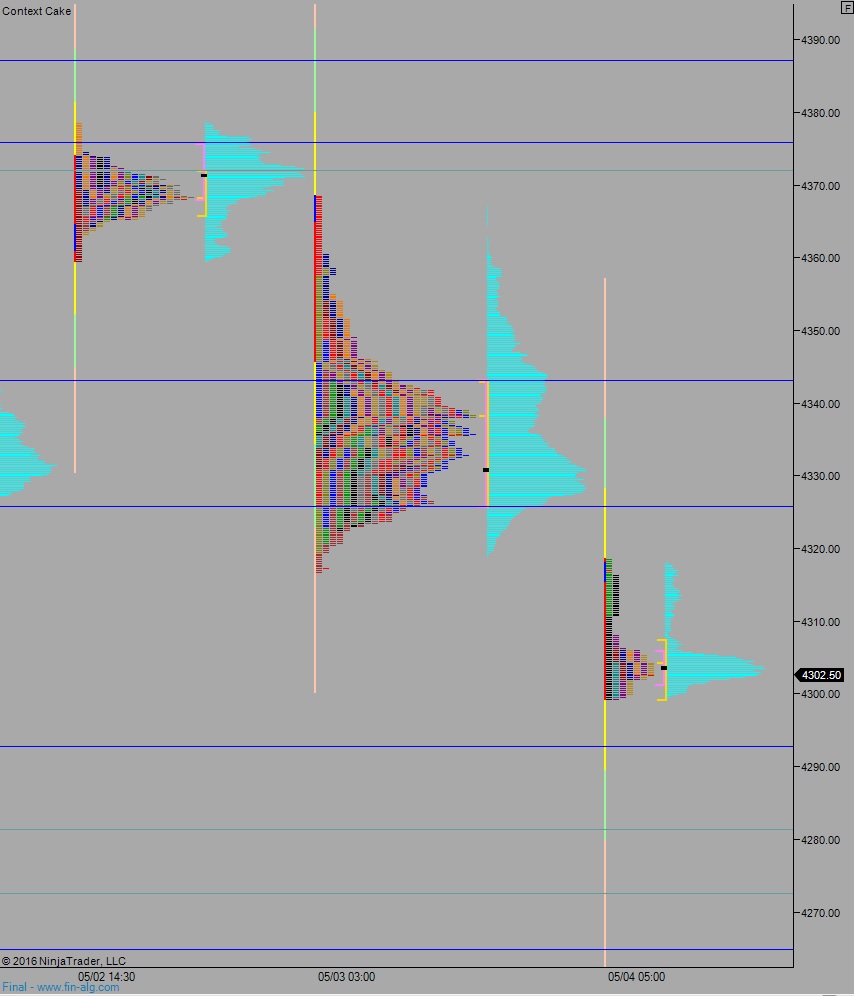

Yesterday we printed a normal variation up. Price opened gap down and an early attempt to fill it was swiftly rejected around 4350 by sellers. Sellers struggled to become initiative, however, and buyers pushed a low-volume range extension up. This was faded back down into balance in the afternoon.

Heading into today my primary expectation is for sellers to probe the lows. Look for overnight low 4299.25 to be taken out early on and a test down to 4292.75 where buyers step in and two way trade ensues below 4310.

Hypo 2 gap-and-go trend day down. Sellers take out 4292.75 early on and sustain trade below it setting up a move down to 4281.75. Sellers continue working lower to target the open gap down at 4275.75 before two way trade ensues.

Hypo 3 responsive buyers step in and work into the overnight inventory. They work higher but stall before the overnight gap, finding sellers up at 4325.50 before two way trade ensues.

Hypo 4 full gap fill up to 4335.25 then a continued move up to 4343 before two way trade ensues.

Levels:

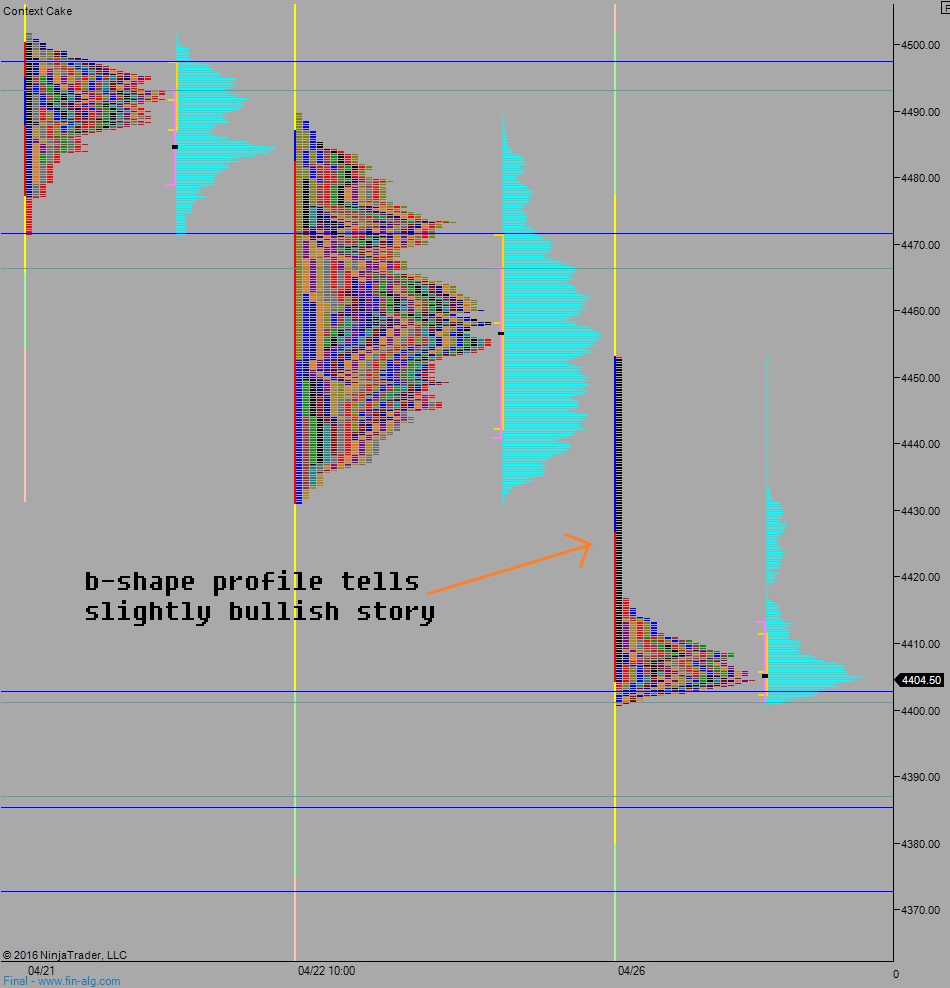

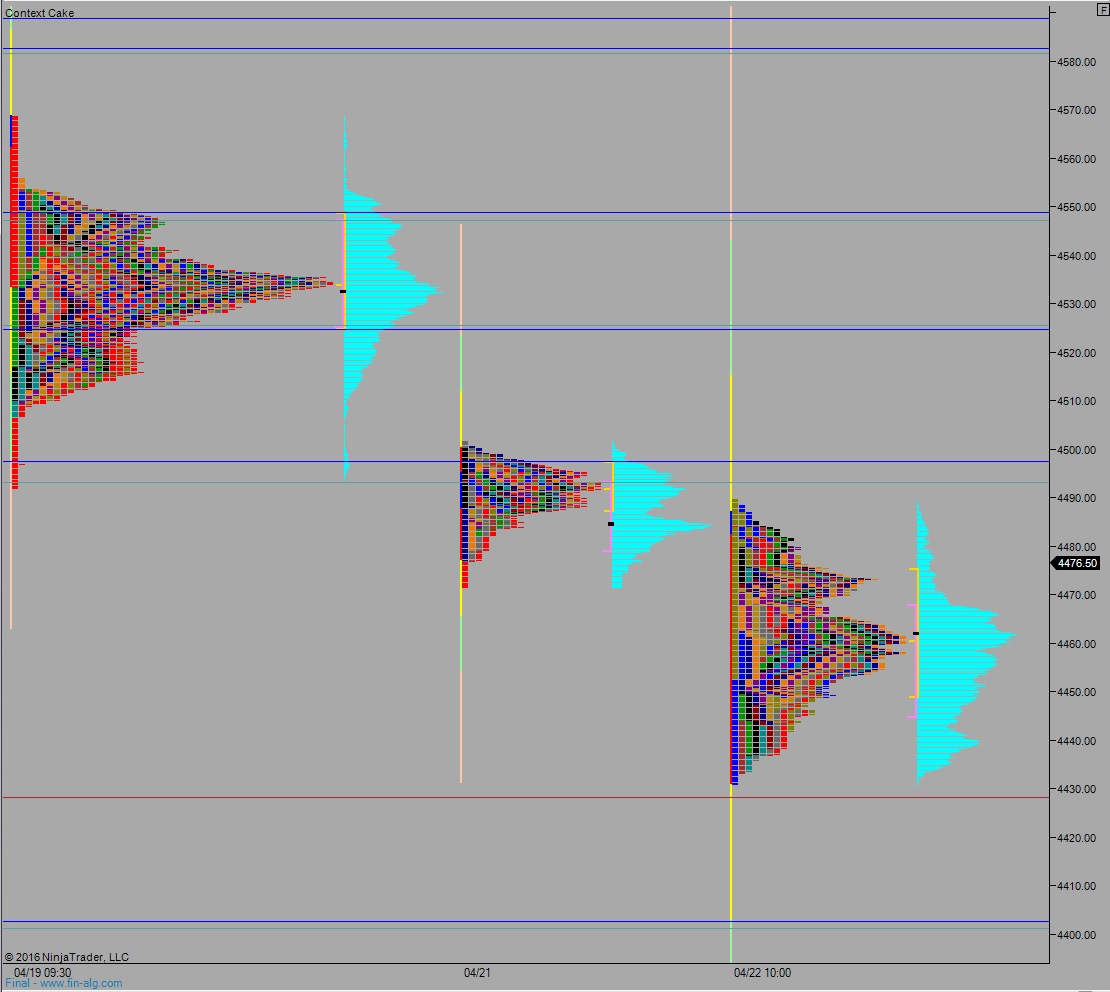

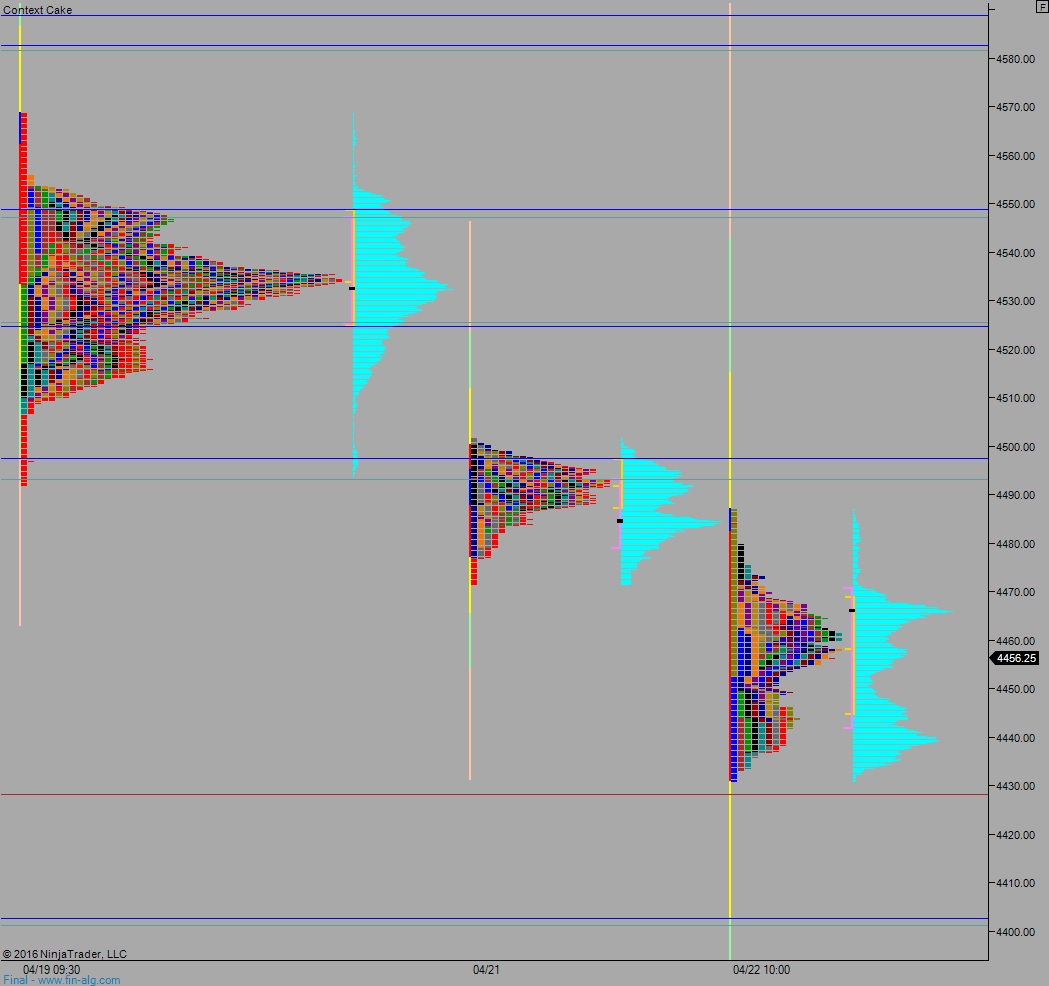

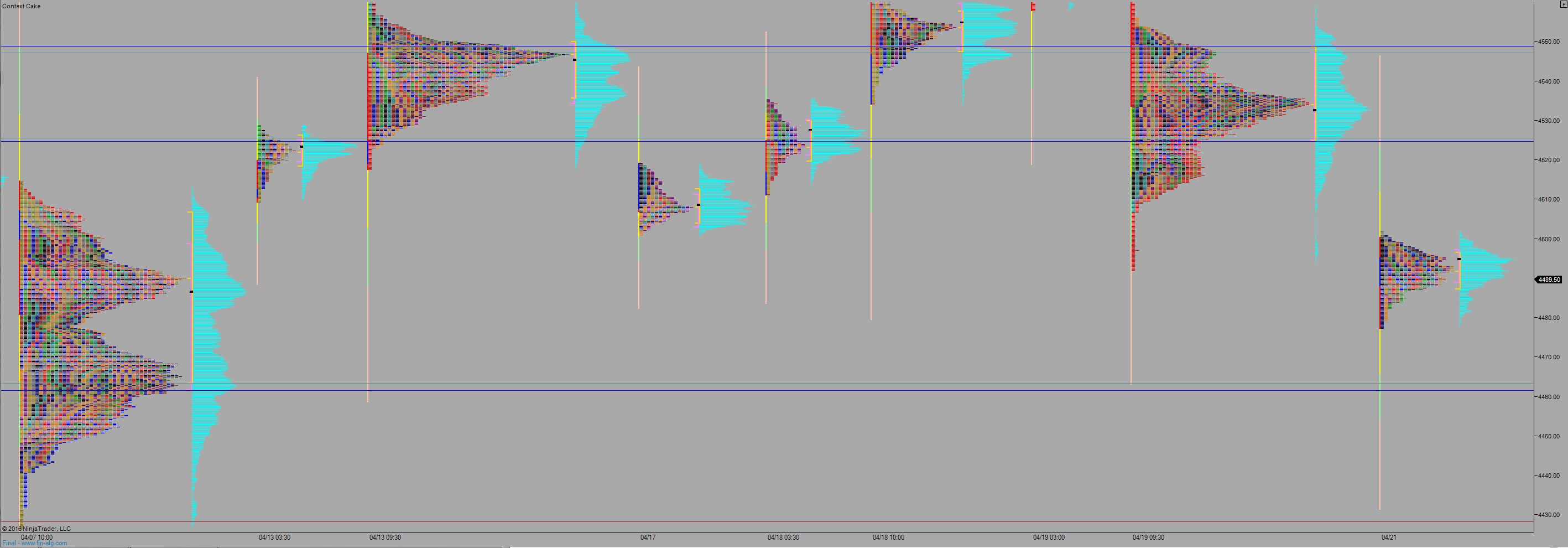

Volume profiles, gaps, and measured moves:

Comments »