NASDAQ futures are coming into Thursday flat after a balanced overnight session featuring normal range and volume. Price managed to hold yesterday’s range through Globex. At 8:30am Initial/Continuing jobless claims data came out better than expected while the Philadelphia Fed manufacturing index came in well below expectations. Verizon is trading lower in pre after reporting inline sales continued EPS growth.

The bigger earning announcements, however, come after the bell when both Microsoft and Alphabet (aka Google) are set to report. Also on the economic docket today we have House Price index at 9am and Leading Indicators at 10am.

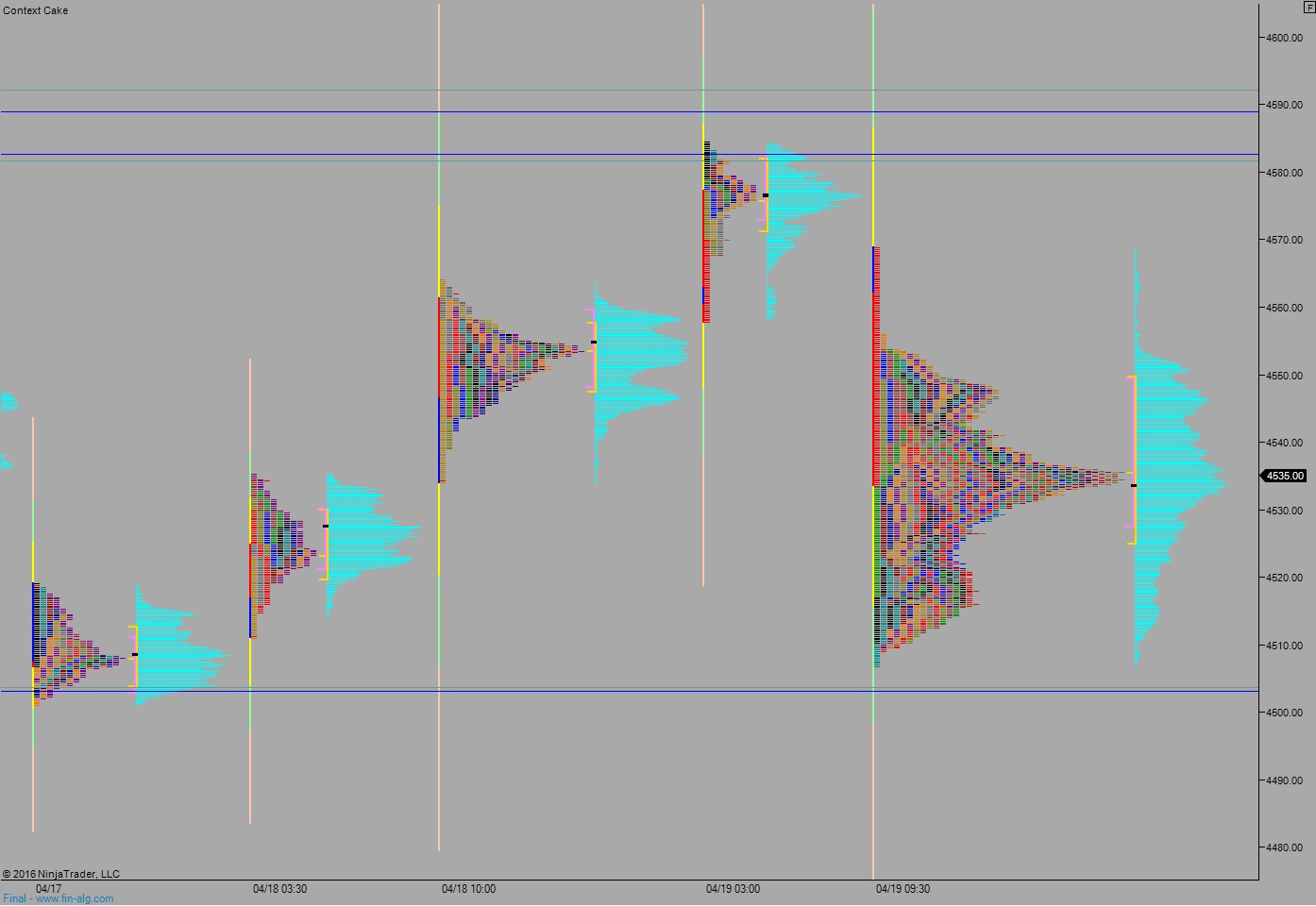

Yesterday we printed a normal variation up. Price opened gap up and sellers pressed into it early on. By 9:45am a responsive bid stepped in and the market worked higher but was unable to push up into the Tuesday morning liquidation drive. Late in the session sellers came and knocked price back down to session mid.

Heading into today my primary expectation is for a choppy session. Look for buyers to work higher and take out overnight high 4549.50. Look for responsive sellers up near 4550 and two way trade to ensue.

Hypo 2 sellers work down through overnight low 4526. Look for responsive buyers just below the overnight low and two way trade ensues.

Hypo 3 sellers become initiative below overnight low 4526 and continue working lower to test below Wednesday low 4515 and potentially below Tuesday low 4506.75. Stretch target is open gap down at 4489.75.

Hypo 4 strong buying sustains trade above 4550 setting up a rally. Stretch target is 4581.25.

Levels:

Volume profiles, gaps, and measured moves:

enjoy your work. Where can I find a primer on Market Profile method?

Mind Over Markets by Dalton is a good start. there’s a 5 part series inside After Hours with Options Addict. Also, be sure to subscribe to the iBankCoin YouTube channel because I’ll be doing some more market profile work on their as well, cheers