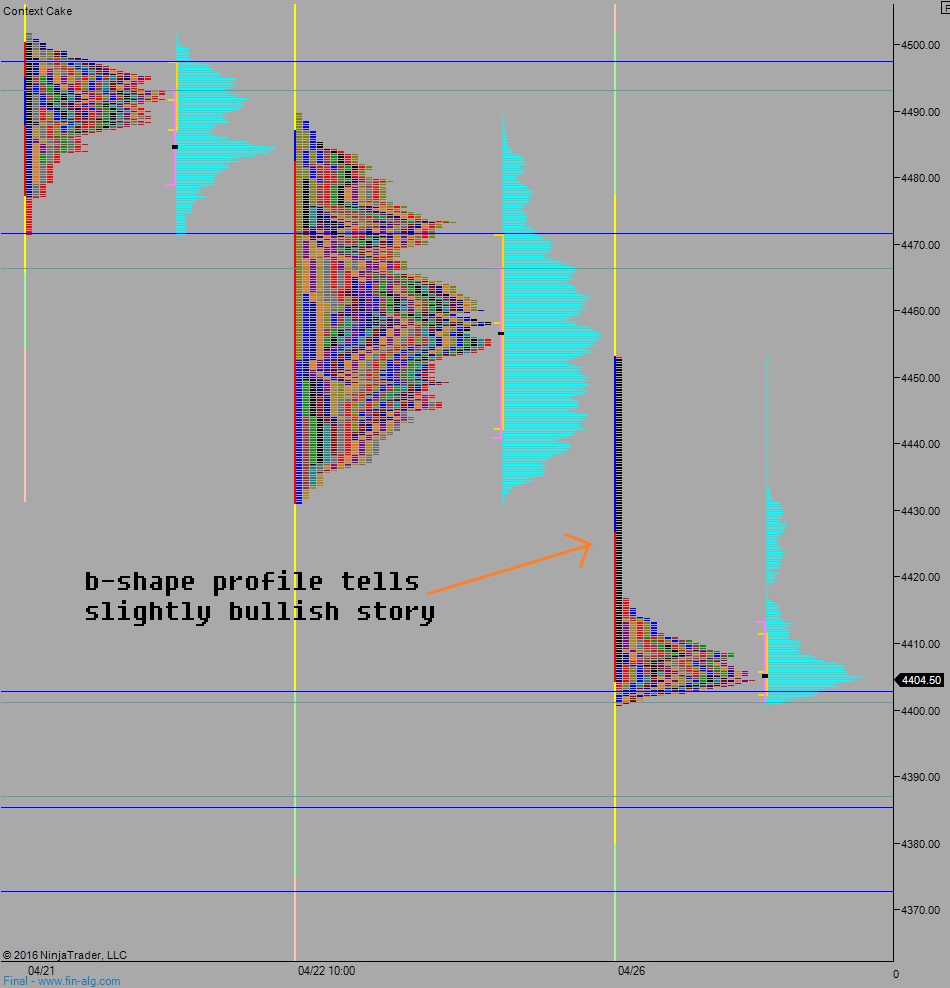

NASDAQ futures are coming into Wednesday gap down after an overnight session featuring an elevated range on normal volume. Price made a fast move lower after the Apple earnings then came into balance. The resulting market profile has a b-shape, which suggests longs were liquidated but sellers never became initiative. Thus it could be only a temporary phenomenon. At 7am MBA Mortgage Apps came in at -4.1% well below last month’s 1.3% read. At 8:30am Advance Trade Goods balance put a slight bid in the market when the data came out better than the consensus forecast. US trade deficit for market was-$56.9 billion vs -$62.8B expected.

Also on the economic calendar today we have Pending Home Sales at 10am, crude oil inventory at 10:30am, the FOMC rate decision at 2pm, and Facebook earnings after market close.

Yesterday we printed a normal variation down. While the other major indices are resilient–flat and/or higher–the NASDAQ spent most of the session working lower. After opening gap up, sellers pushed the overnight gap fill lower before buyers made an early attempt to move price higher. This was met with a strong responsive offer that sent the market down below Monday’s low. A brief responsive bid stepped in around lunchtime but was overrun in the afternoon when sellers became initiative. The end of the session featured a strong ramp higher, before the Apple earnings eventually sent the market careening lower.

See Also: The Chinese Billionaire Was Right: Apple…OBSOLETE!

Heading into today my primary expectation is for buyers to work the market higher and test back up to yesterday’s session low 4431.75. Look for responsive sellers up at 4440.75 then two way trade ensues as we wait for the FOMC rate decision.

Hypo 2 sellers take out overnight low 4400.75 setting up a move to test 4387.25 before two way trade ensues ahead of the FOMC minutes.

Hypo 3 sellers take out overnight low 4400.75 then stall out. We settle into two way trade from 4420 – 4400 awaiting the FOMC minutes.

Hypo 4 strong buyers press higher to close overnight gap up to 4453.25 then take out overnight high 4454.50. Look for responsive sellers up at 4466.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

Raul, could you shed a little light on what you look for in terms of market reaction from Fed for guide in direction? From what I’ve come to understand, you look for a 2-3 major moves and the trend (up or down) after the last move dictates the direction, correct? Thanks for your insight into this!

3rd reaction analysis, I look for the first 3 significant rotations after the news. today was small sell small buy then buy #bullish