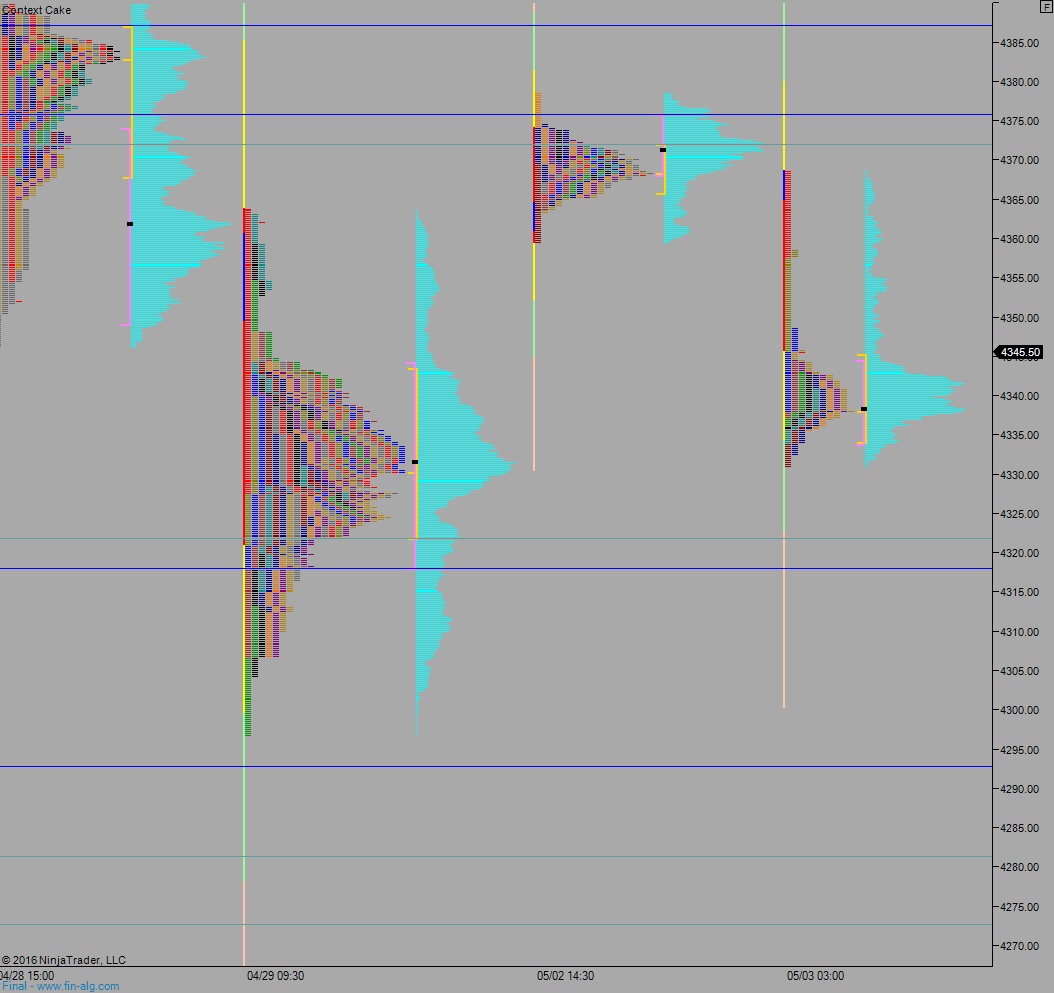

NASDAQ futures are coming into Tuesday gap down after an overnight session featuring an elevated range on normal volume. Price held upper value for a portion of the evening before sellers pushed into the market and retraced the entire low-volume rally from yesterday’s cash session before coming into balance near Monday’s opening print. The resulting profile resembled a lowercase b–the type of profile we typically see during a long liquidation.

Long liquidations are often temporary phenomena driven by triggering stop orders.

On the economic docket today we have a 4-week T-bill auction at 11:30am.

Yesterday we printed a normal variation up. Price opened gap up and the market found buyers just after the gap was filled. The rest of the morning featured a tight range. Just after lunchtime buyers became initiative and pushed the market higher, stalling just ahead of the 04/28 gap at 4382.75.

Heading into today my primary expectatino is for buyers to push into the overnight inventory and work price up to 4350. Look for sellers to defend here and set their sights on overnight low 4331. Look for responsive buyers down at 4321.75 and two way trade to ensue.

Hypo 2 strong buyers push up through 4350 and sustain trade above it, triggering a pole climb to close overnight gap up to 4369.50. Buyers then take out overnight high 4374.50. Look for responsive sellers up at 4371.75 before two way trade ensues.

Hypo 3 sellers work a gap-and-go lower, take out overnight low 4331 early on. Look for responsive buyers down at 4318.25 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves:

very underrated movie. i loved they live.