NASDAQ futures are set to enter Thursday gap down after an overnight session featuring normal range and volume. Price managed to recapture most of the FOMC buying reaction from last week on action that is seller controlled. At 8:30am Initial/Continuing jobless claims data looked slightly better than expectations, as did Durable Goods Orders. Ex-transports, the 8:30am Durable Goods data looked weak.

Also on the economic docket today we have Markit Manufacturing PMI at 9:45am and the Baker Hughes rig count at 1pm.

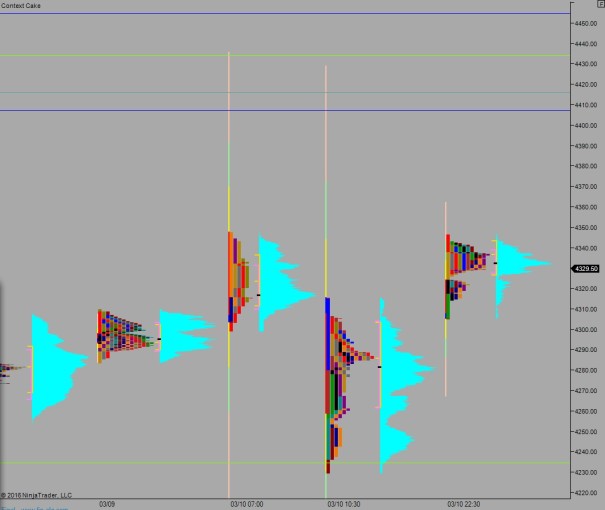

Yesterday we printed a normal variation down. Price opened gap down and sellers pressed lower off the open. Responsive buyers stepped in ahead of Tuesday’s low but were ultimately overrun late in the day before two way trade ensued.

Heading into today my primary expectation is for buyers to work into the overnight inventory and trade up to 4381.25. Look for sellers to defend here and work to take out overnight low 4365 setting up a move to target 4343 before two way trade ensues.

Hypo 2 buyers press up through 4381.25 and sustain trade above it setting up a gap fill to 4396.75. From here overnight high is an easy take up at 4397.25. Look for responsive sellers at 4412 then two way trade ensues.

Hypo 3 sellers press off the open and trade down to 4342.75 early. Responsive buyers defend here but are ultimately overrun. Downside target is the measured move down to 4337.

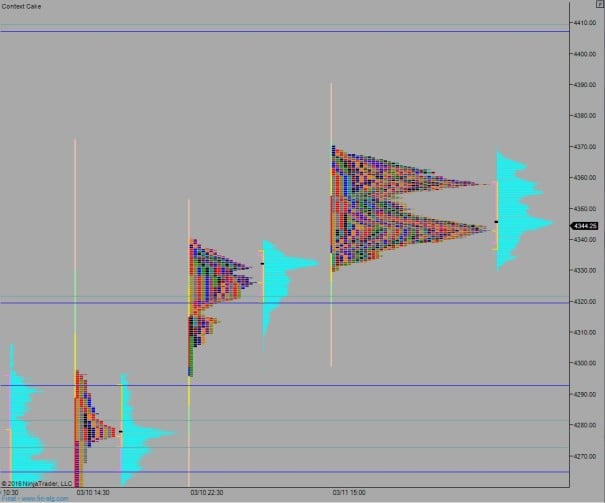

Levels:

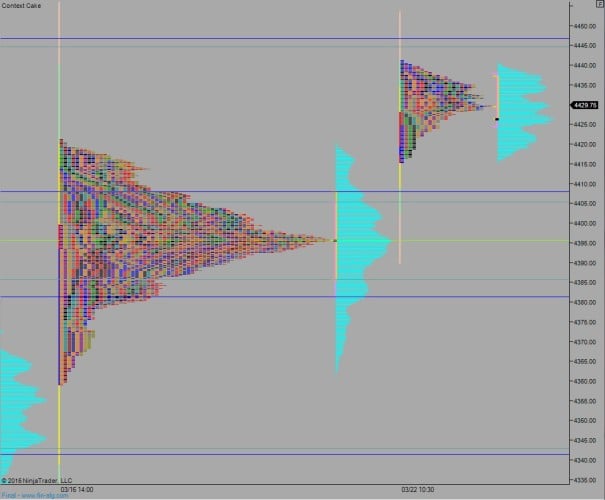

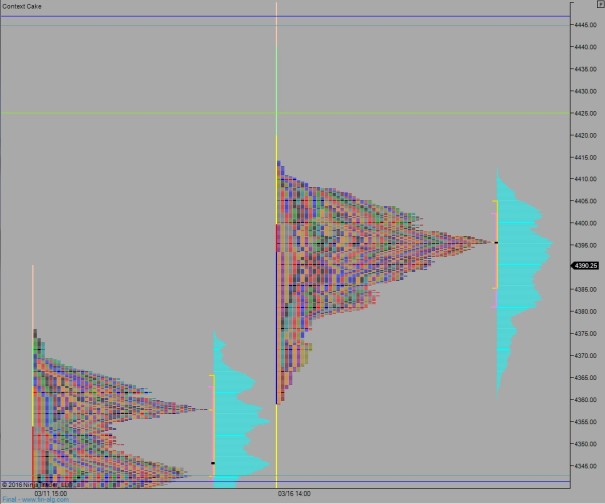

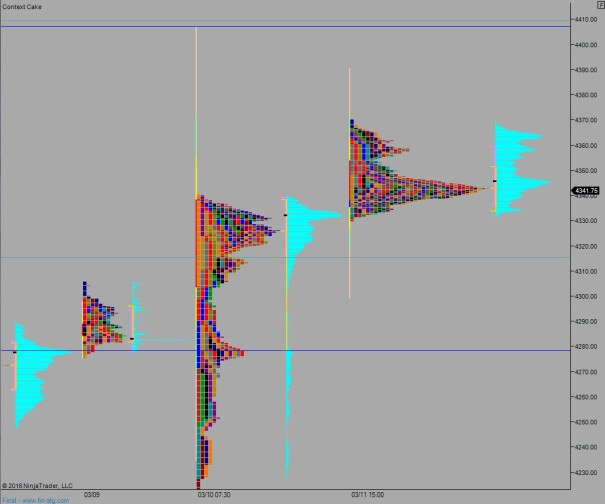

Volume profiles, gaps, and measured moves:

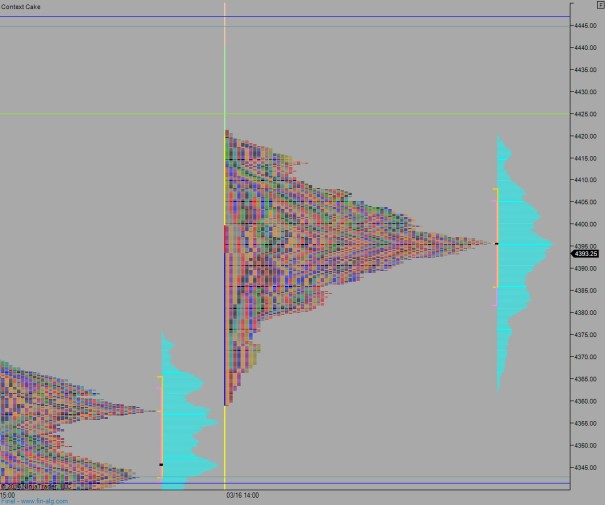

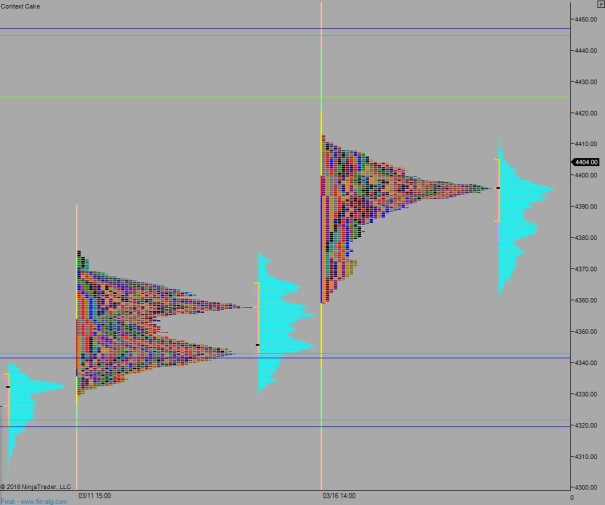

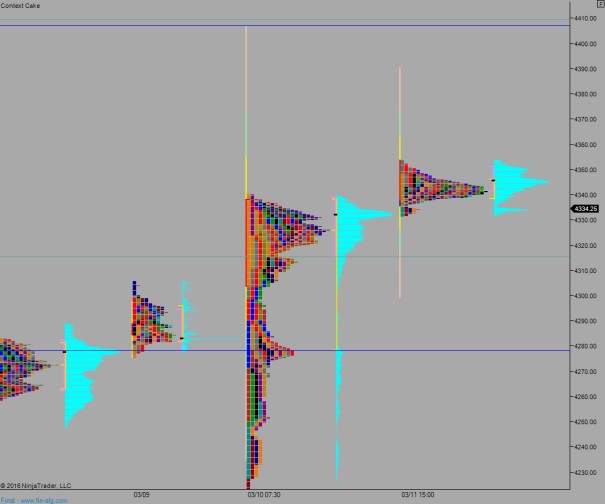

Volume profiles, gaps, and measured moves:

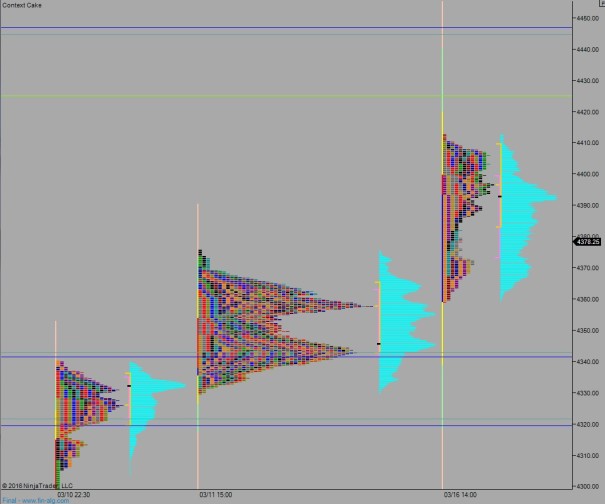

Volume profiles, gaps, and measured moves: