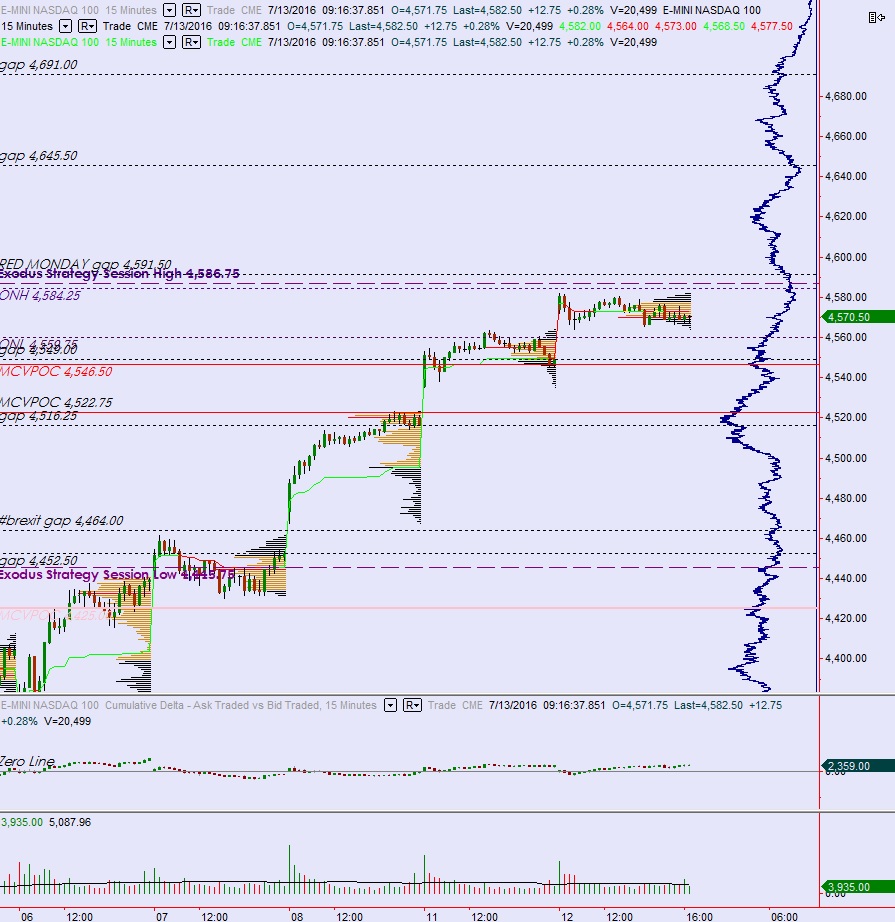

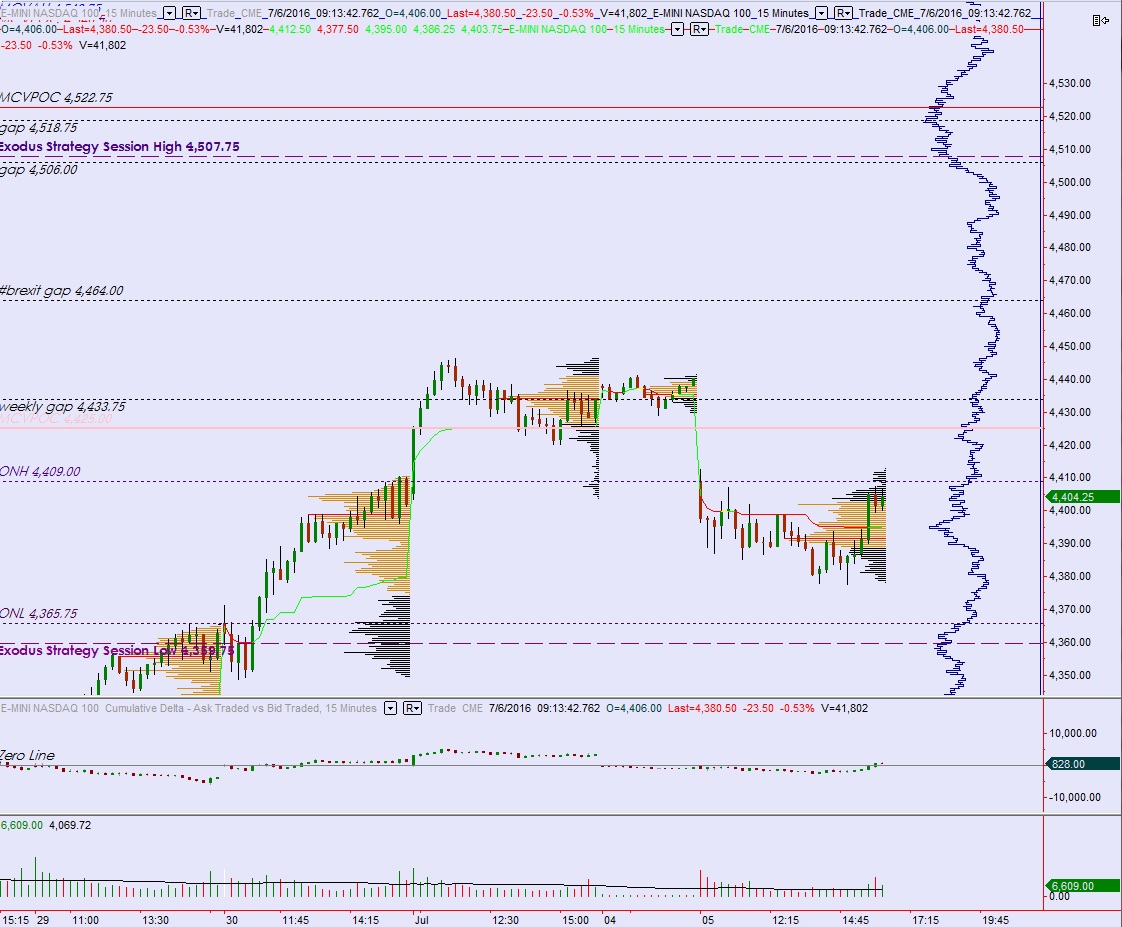

NASDAQ futures are coming into Wednesday gap up, the fifth consecutive gap up, after a balanced overnight session featuring normal range and volume. Price worked both down through and up above yesterday’s cash range, and as we approach the open markets are lingering at the Globex high. At 7am MBA Mortgage Applications dialed back a bit from last week and at 8:30am the Imported Price Index reading came in worse than expected.

Also on the economic docket today we have Crude Oil inventories at 10:30am, a 30-year bond auction at 1pm, and the Fed’s Beige Book at 2pm.

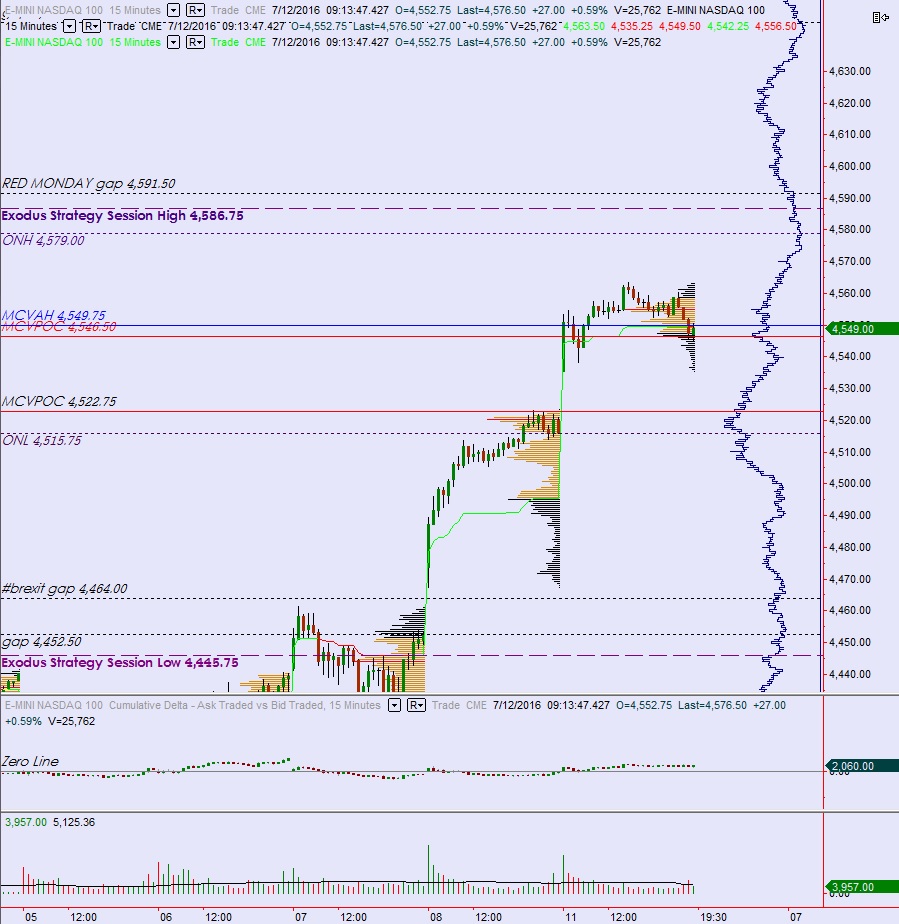

Yesterday we printed a normal day, which is anything but normal. That means we never exceeded the first hour’s price range for the rest of the day and suggests and active higher time frame in the morning then nothing but local-to-local algo trade for the rest of the session. These tend to occur in low volatility markets and also sometimes near inflection points.

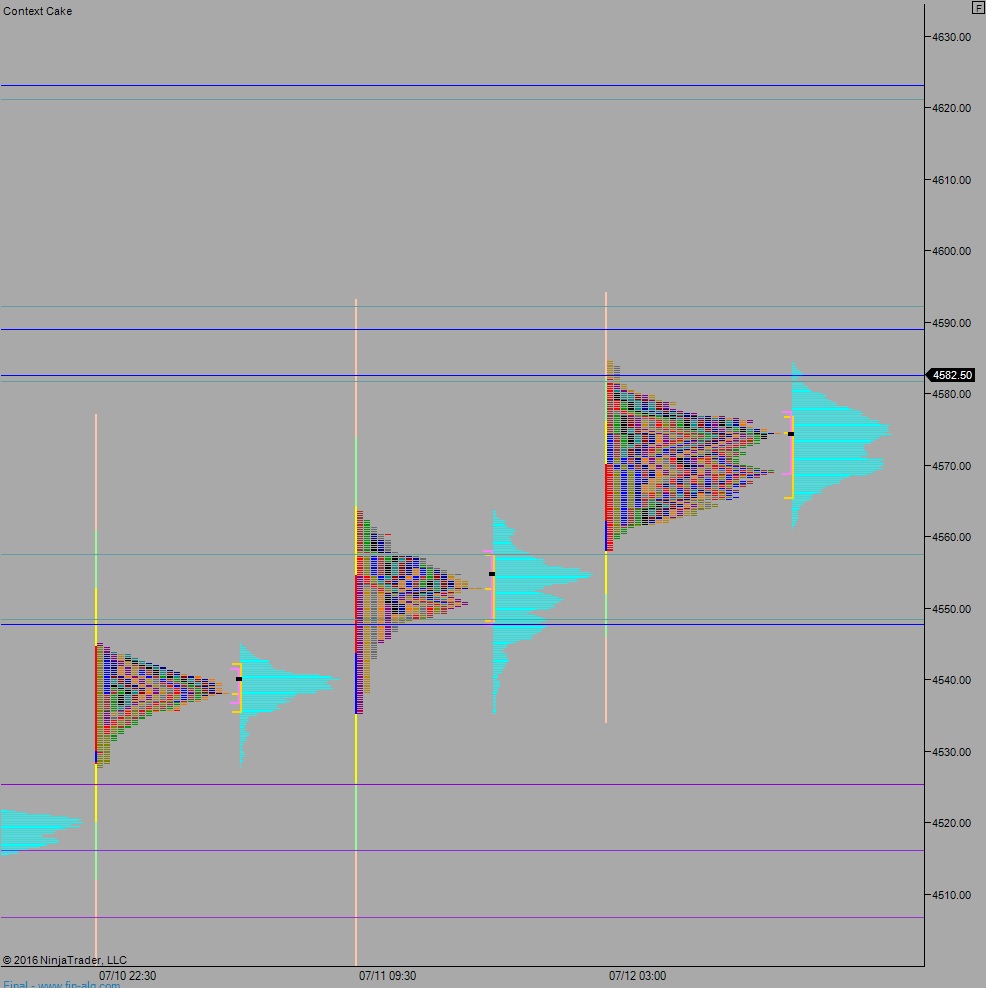

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 4570.50. Look for responsive buyers down at 4565.25 and then a push to takeout overnight high 4584.50. From here buyers target the ‘Red Monday’ gap up at 4591.50 before two way trade ensues.

Hypo 2 buyers gap-and-go. We are sitting above yesterday’s close and a squeeze could ensue, up through the ‘Red Monday’ 4591.50 gap and sustain trade above 4592.25 setting up a rally with little resistance until 4561.25.

Hypo 3 sellers close overnight gap down to 4570.50 then take out overnight low 4559.75. Look for responsive buyers down at 4557.50 and two way trade.

Hypo 4 strong sellers close gap 4570.50, take out overnight low 4559.75, sustain trade below 4557.50 and close the gap down at 4549, responsive buyers down at 4548.25 and two way trade ensues.

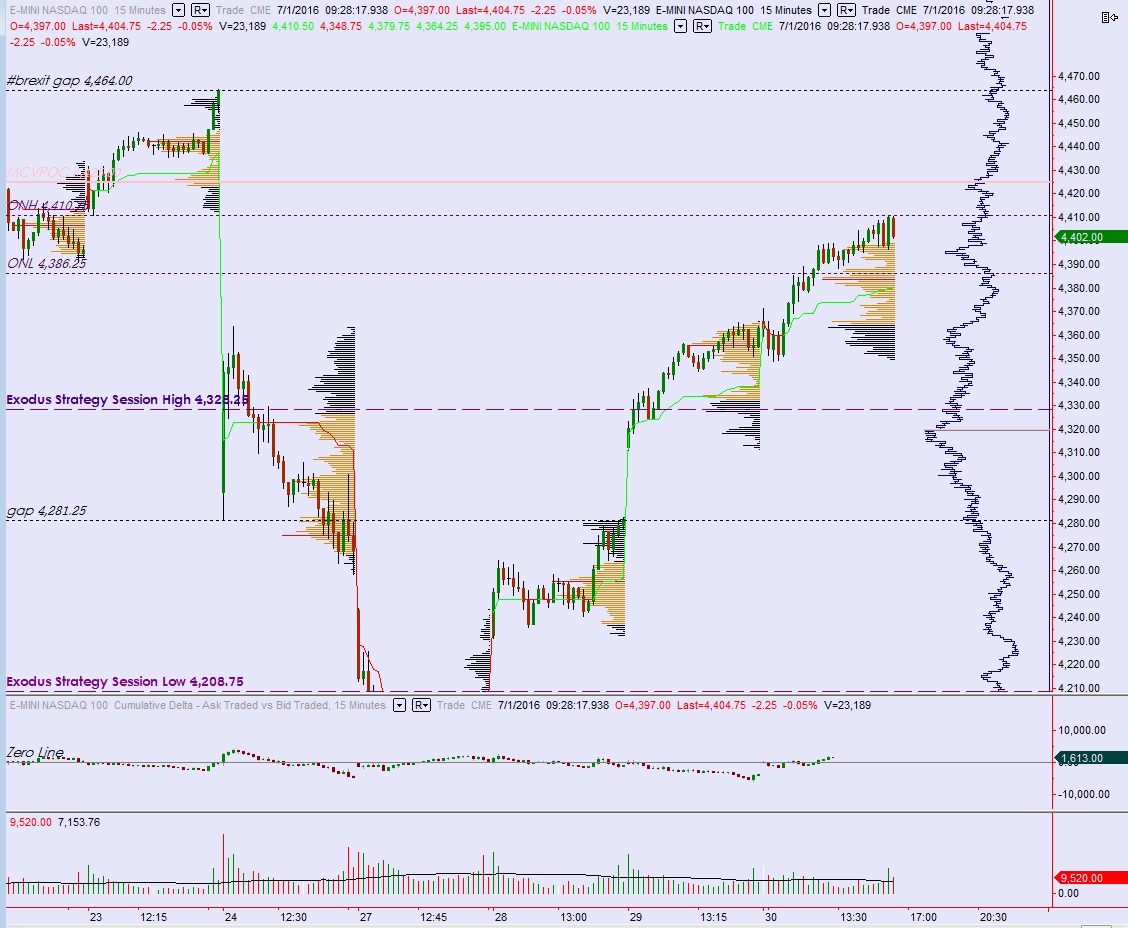

Levels:

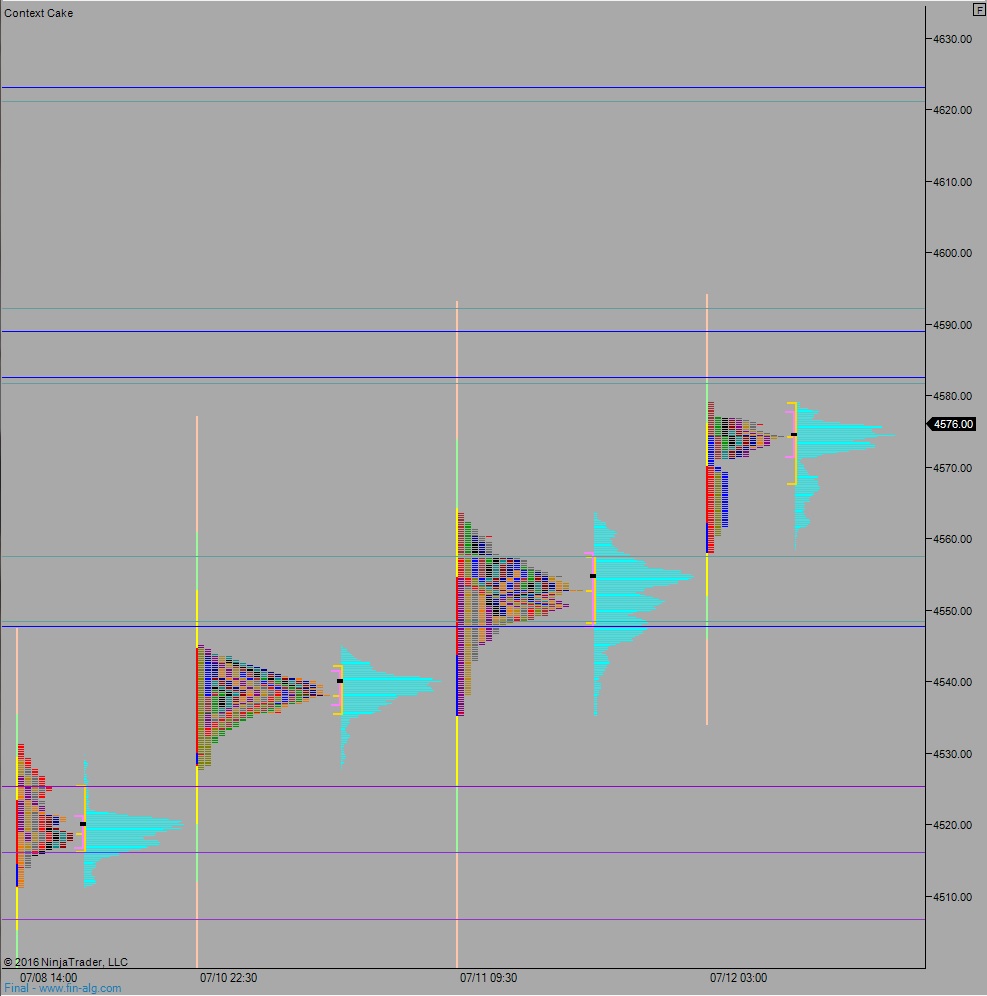

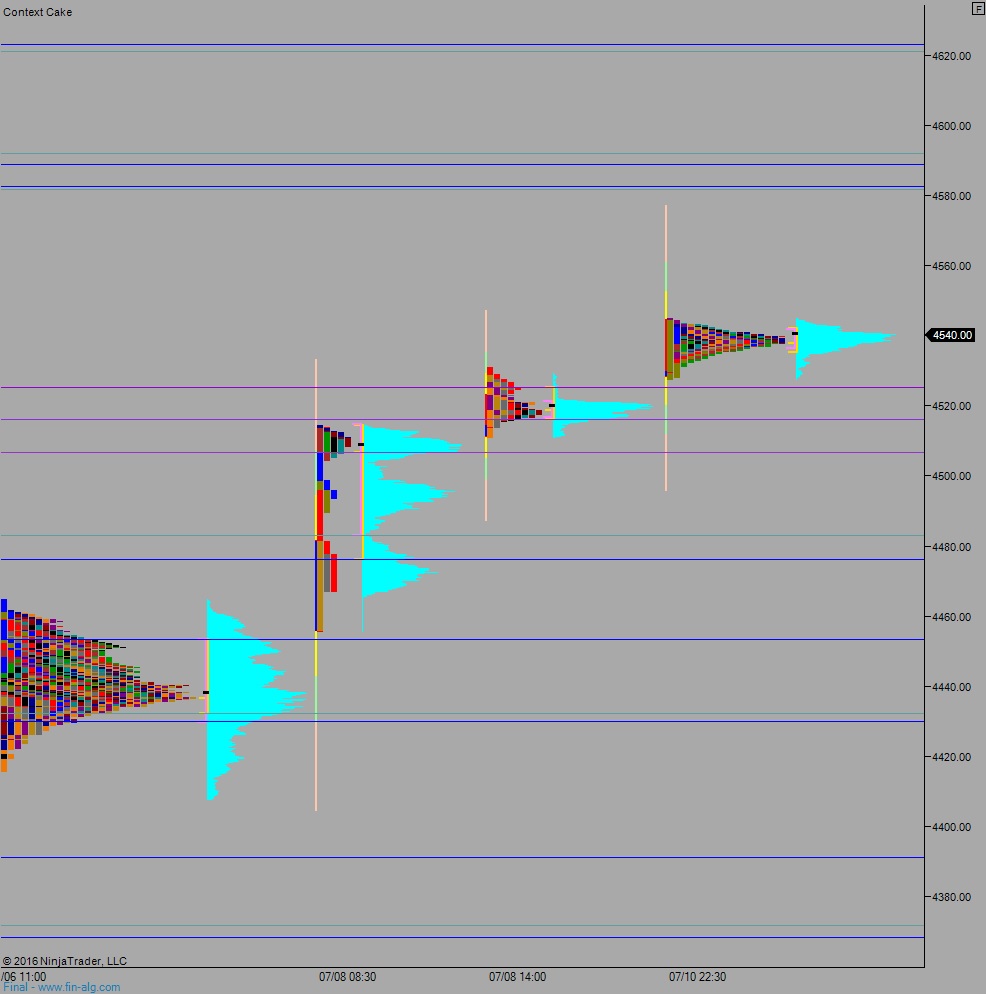

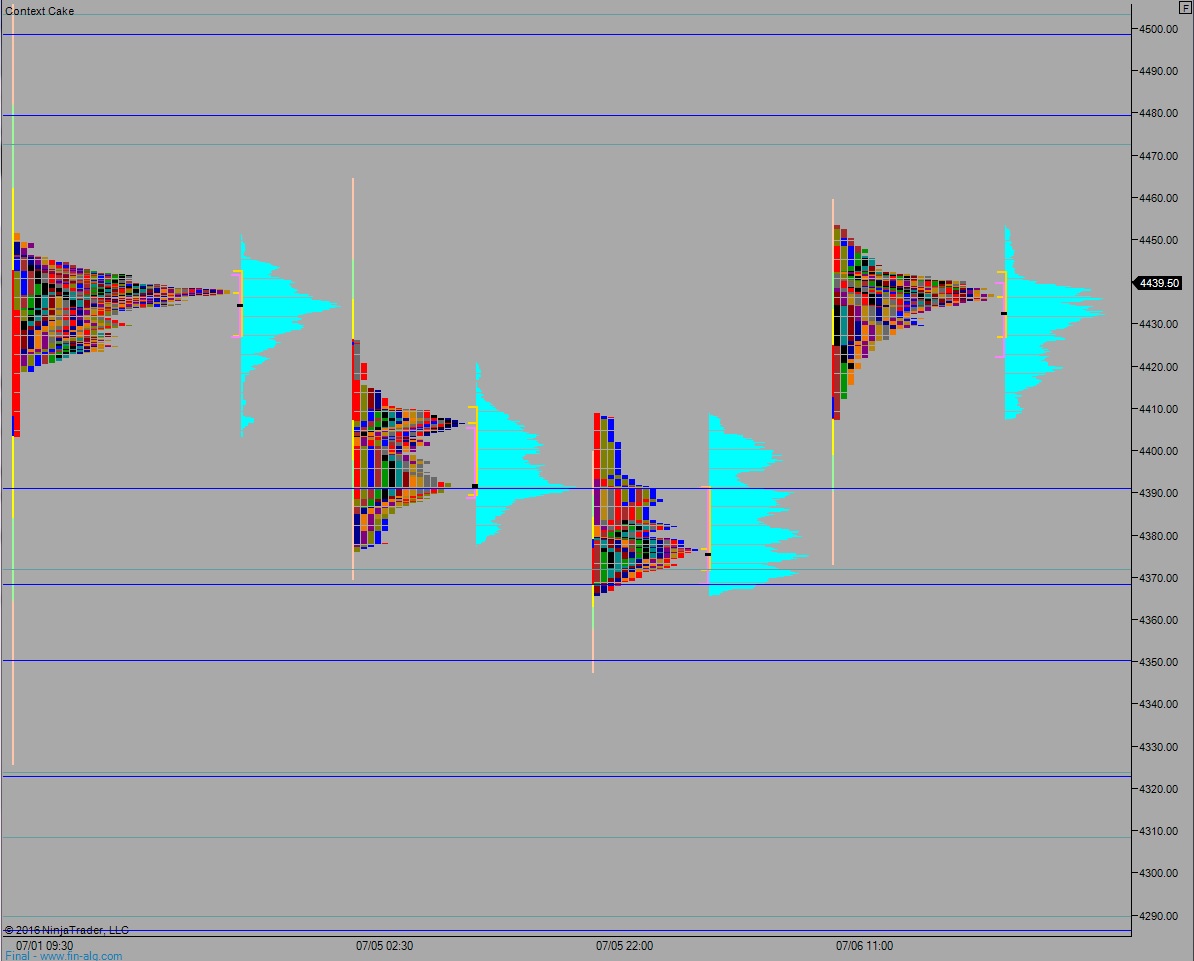

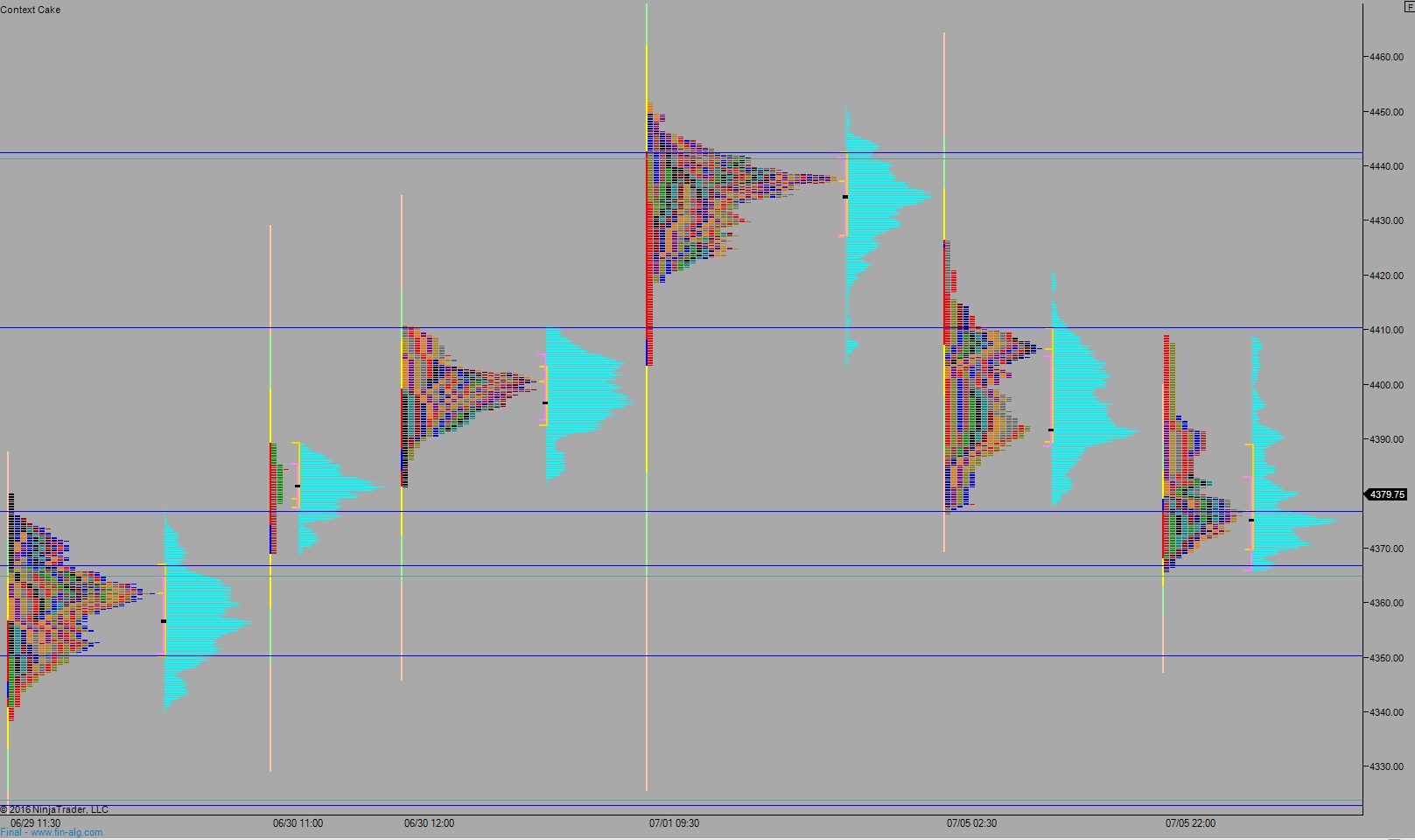

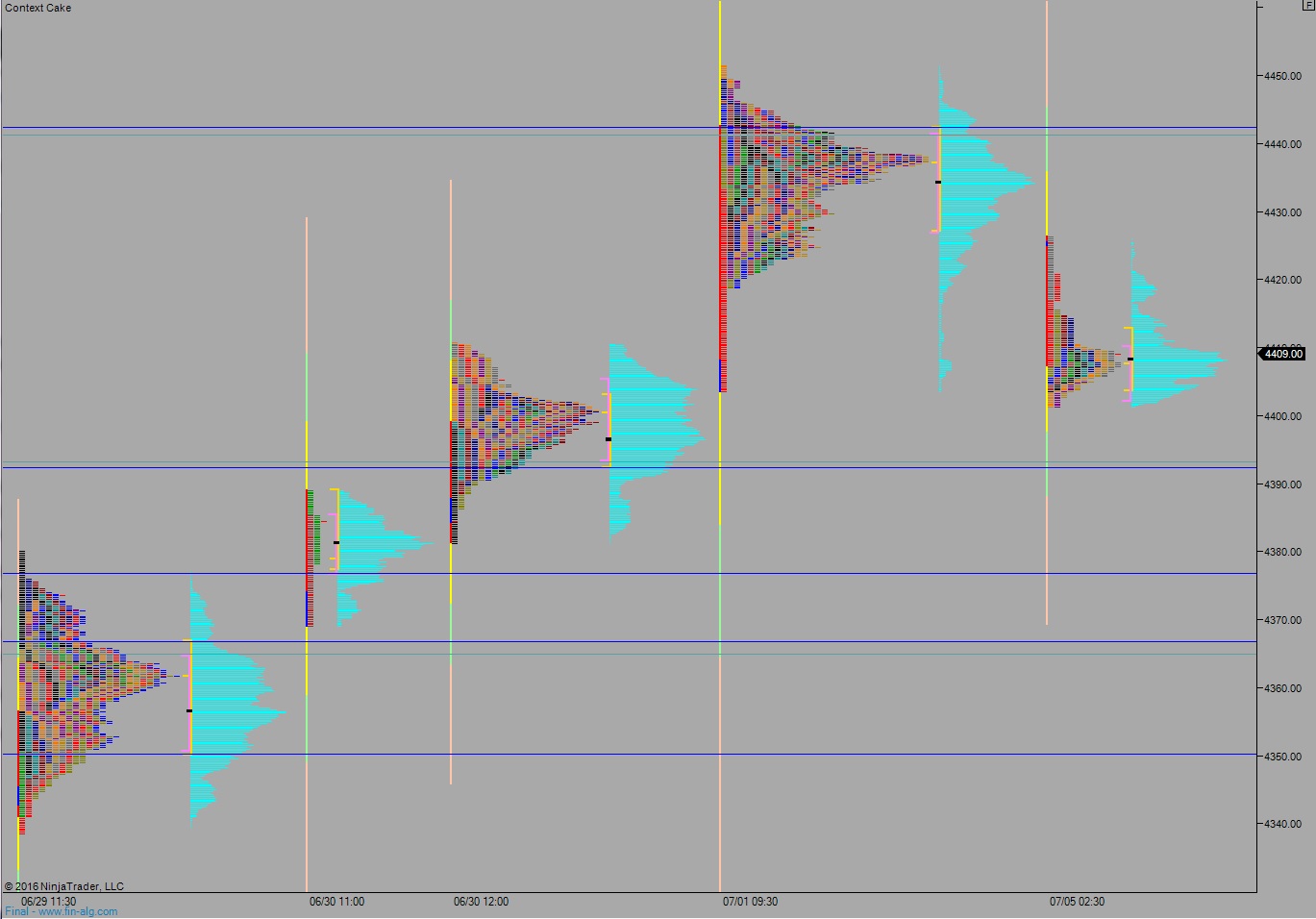

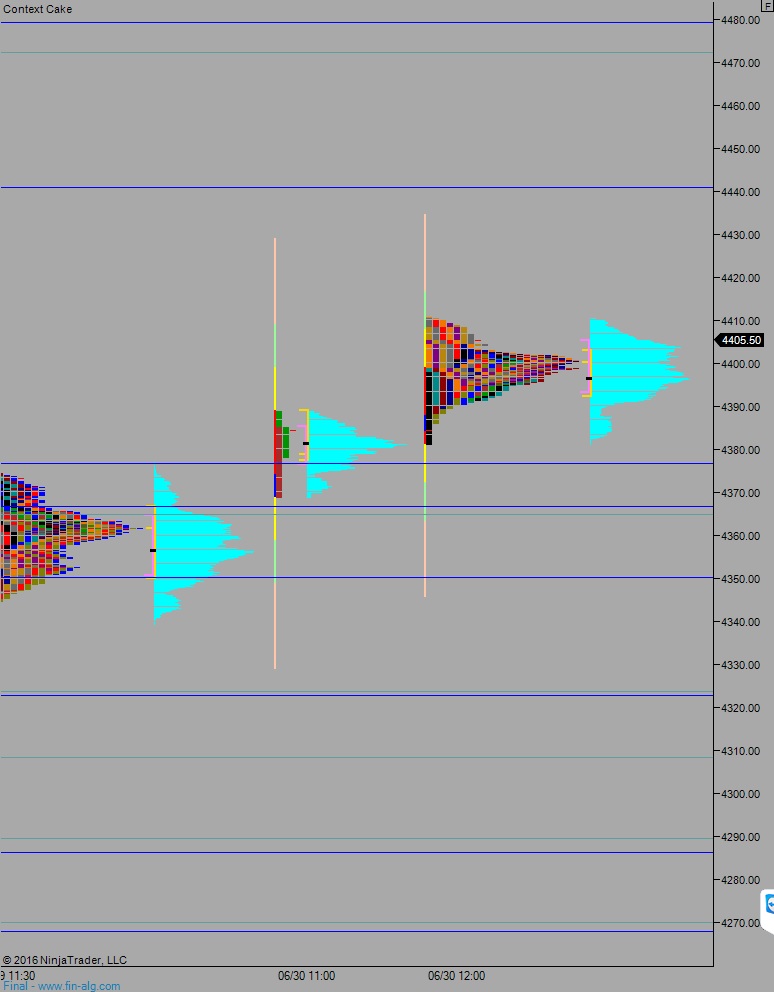

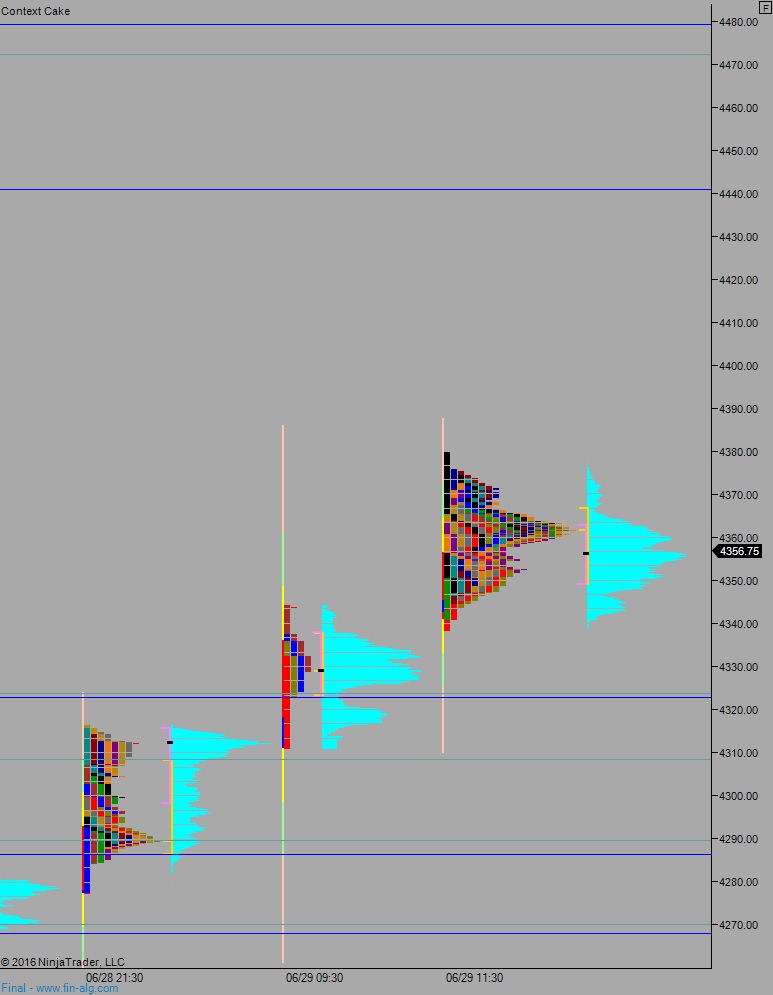

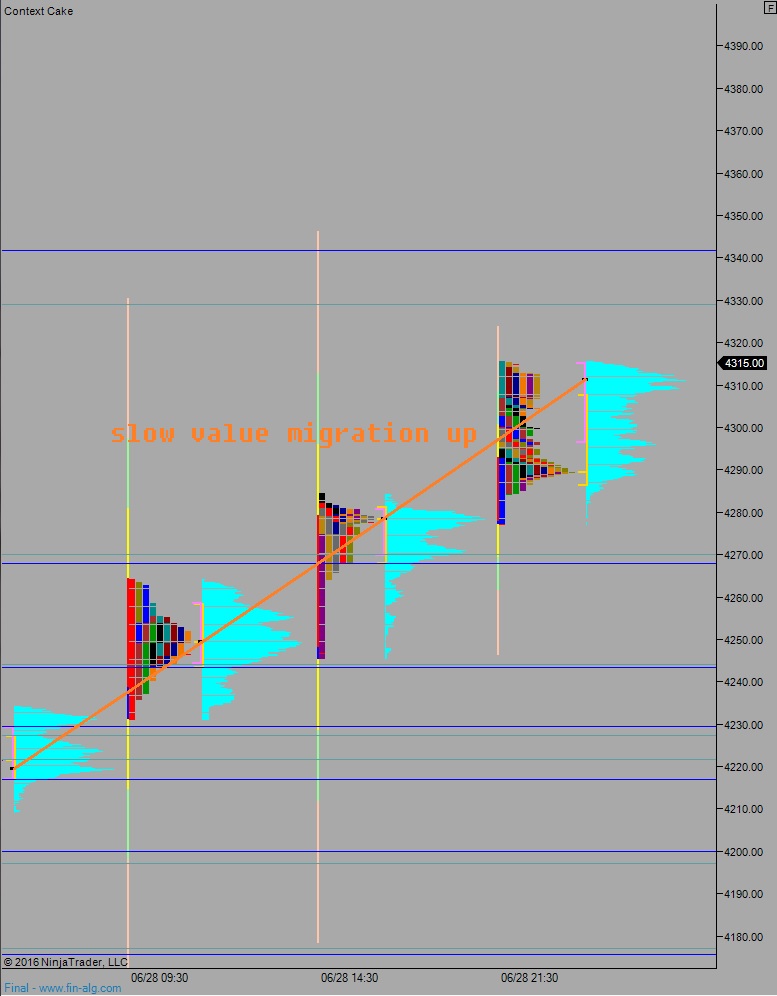

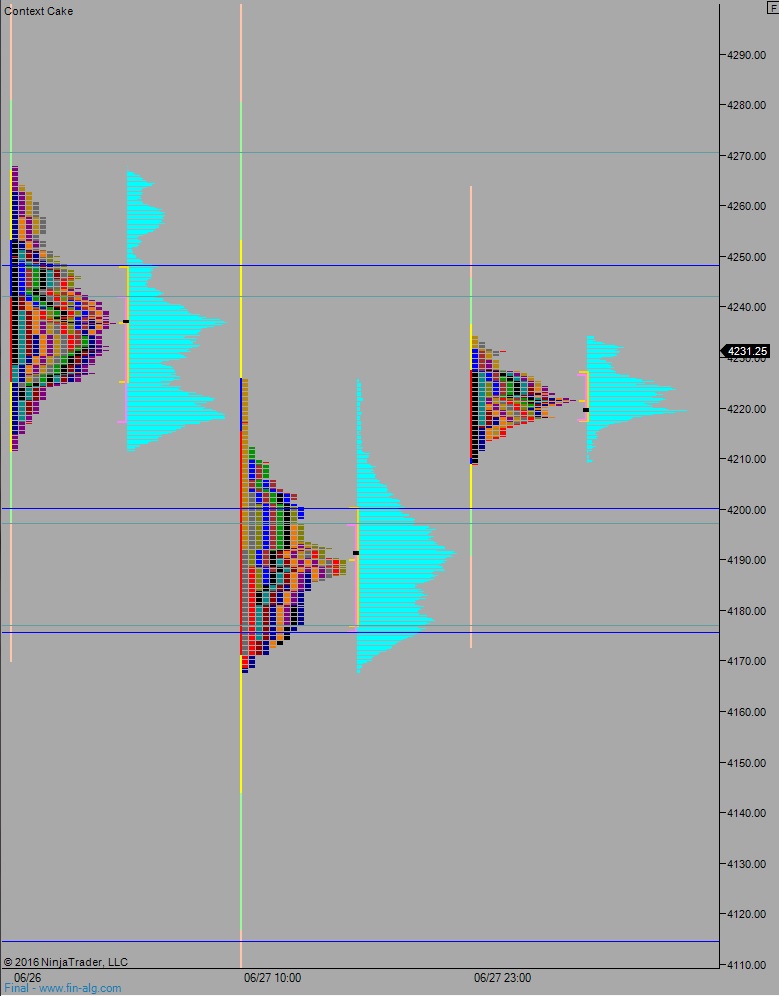

Volume profiles, gaps, and measured moves: