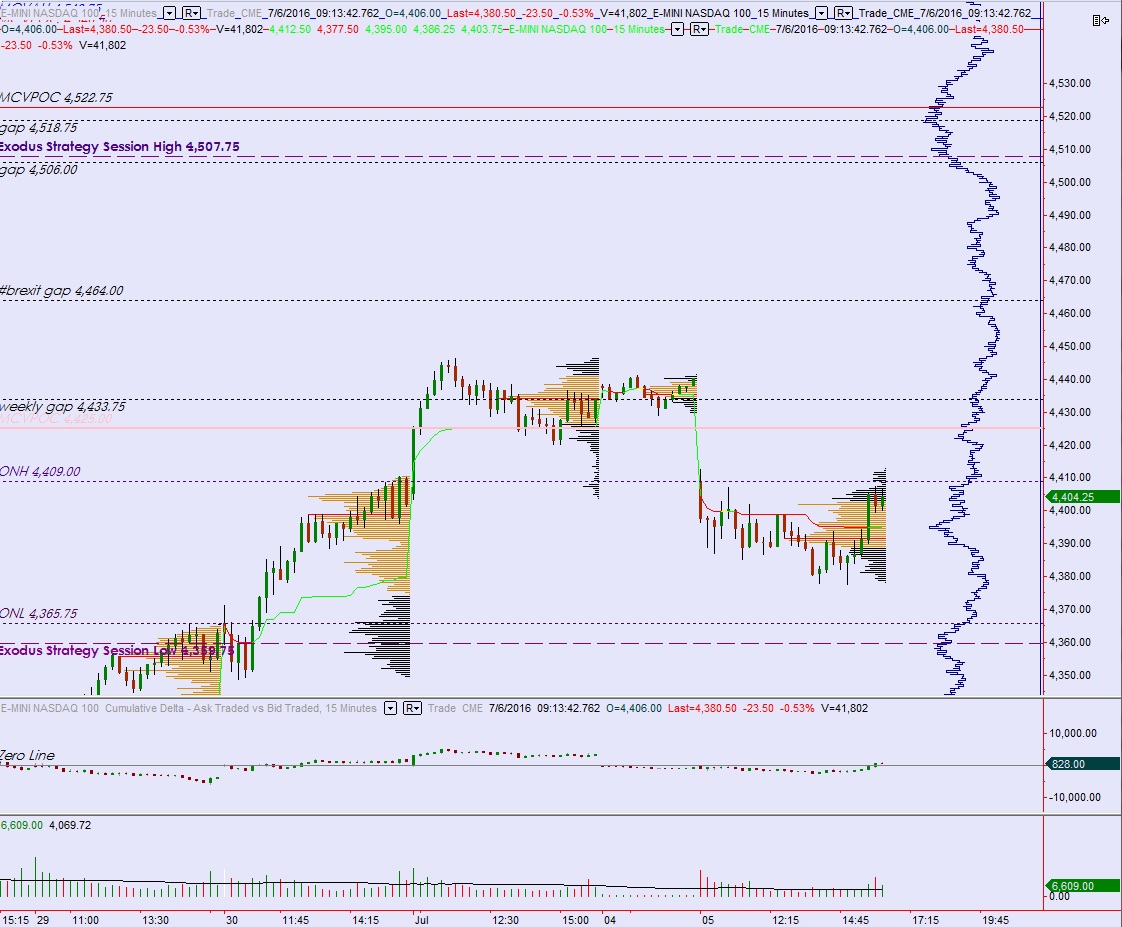

NASDAQ futures are coming into Wednesday gap down after an overnight session featuring elevated range and volume. The session kicked off with a hard sale, down through Tuesday’s low, before a sharp responsive bid came into the market and erased the losses. Said reflect rally was unwound as the evening progressed, pushing the market down to fresh lows before price settled out. At 7am MBA Mortgage Applications jumped back to where it was two weeks back after being negative last week. At 8:30am Trade Balance data was worse than expected.

Also on the economic calendar today we have ISM Non-Manufacturing Composite at 10am, an 4-week T-Bill auction at 11:30am, and FOMC minutes at 2pm.

Yesterday we printed a normal variation down. Price opened gap down on the week and after a brief spurt higher sellers became initiative and worked price lower. The session was overall a slow walk lower before a responsive bid stepped in near the end of the day.

Heading into today my primary expectation is for buyers to push into the overnight inventory and close the gap up to 4404.25. Look for buyers to take out overnight high 4409 then responsive sellers up at 4410 and two way trade to ensue.

Hypo 2 buyers push up to 4390 before sellers step in and continue working price lower. They take the market down through overnight low 4365.75 and target 4359.75 before two way trade ensues.

Hypo 3 strong sellers trigger a liquidation. Price works down through overnight low 4365.75 then sustains trade below 4359.75 setting up a move to 4350. Stretch target is 4323.50.

Levels:

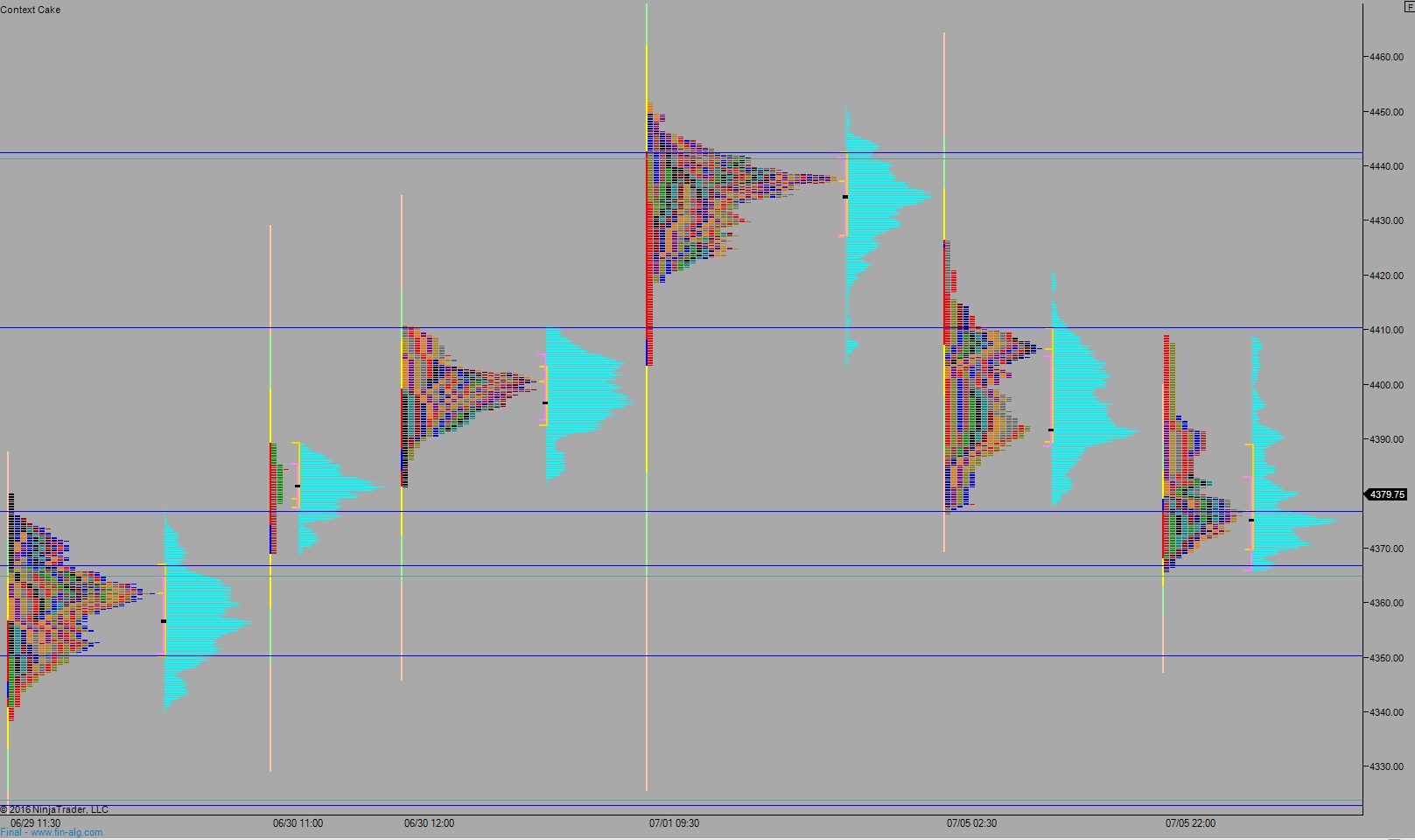

Volume profiles, gaps, and measured moves: