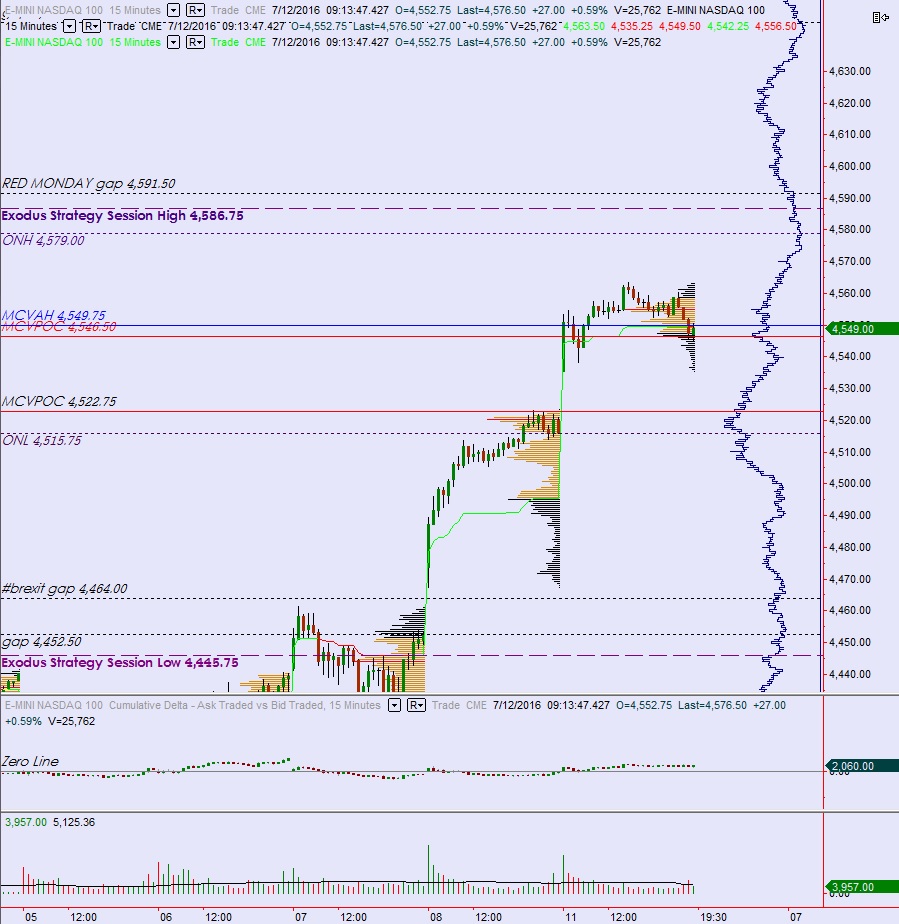

NASDAQ future are coming into Tuesday gap up after an overnight session featuring normal range and volume. Price worked higher, up above all 2016 levels to trade just below the 12/31/2015 low before settling into balance.

On the economic calendar today we have Wholesale Inventories at 10am, 4-week T-Bill auction at 11:30am, and the 10-Year Note auction at 1pm.

Yesterday we printed a normal variation up. Markets opened gap up and buyers drove price higher off the open. The move quickly fizzled out however buyers became initiative ahead of lunch and pushed the market range extension up before finding responsive sellers and settling into two-way trade.

Heading into today my primary expectation is for sellers to work into the overnight inventory but struggle to close the overnight gap, instead finding a responsive bid [responsive relative to the open, initiative relative to yesterday’s close] at 4557.75. From here buyers work higher to take out overnight high 4579 then continue higher to target 4586.75 before settling into two way trade.

Hypo 2 buyers gap-and-go, take out overnight high 4579 and thrust up through 4586.75 to target the yearly gap up at 4591.50 before two way trade ensues.

Hypo 3 sellers work a full gap fill down to 4549 then take out overnight low 4546.75. Look for responsive buyers just below overnight low and two way trade to ensue.

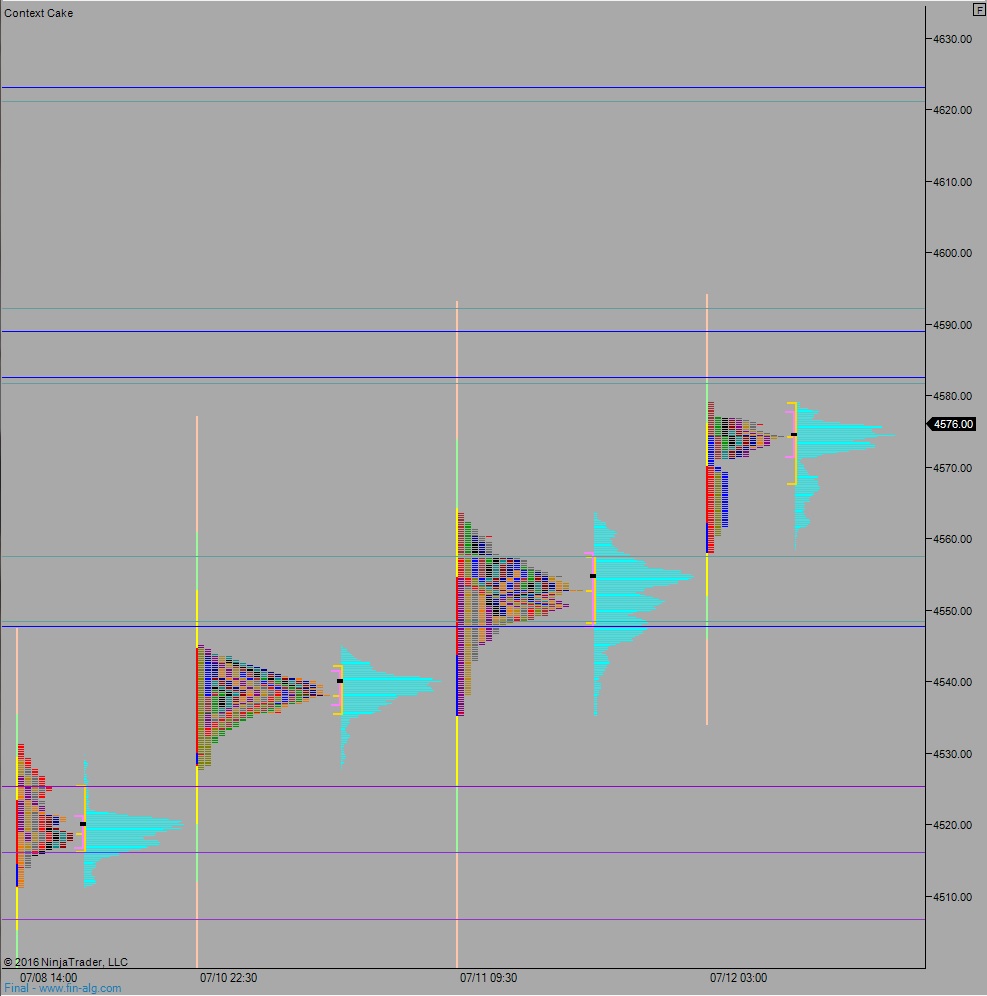

Levels:

Volume profiles, gaps, and measured moves: