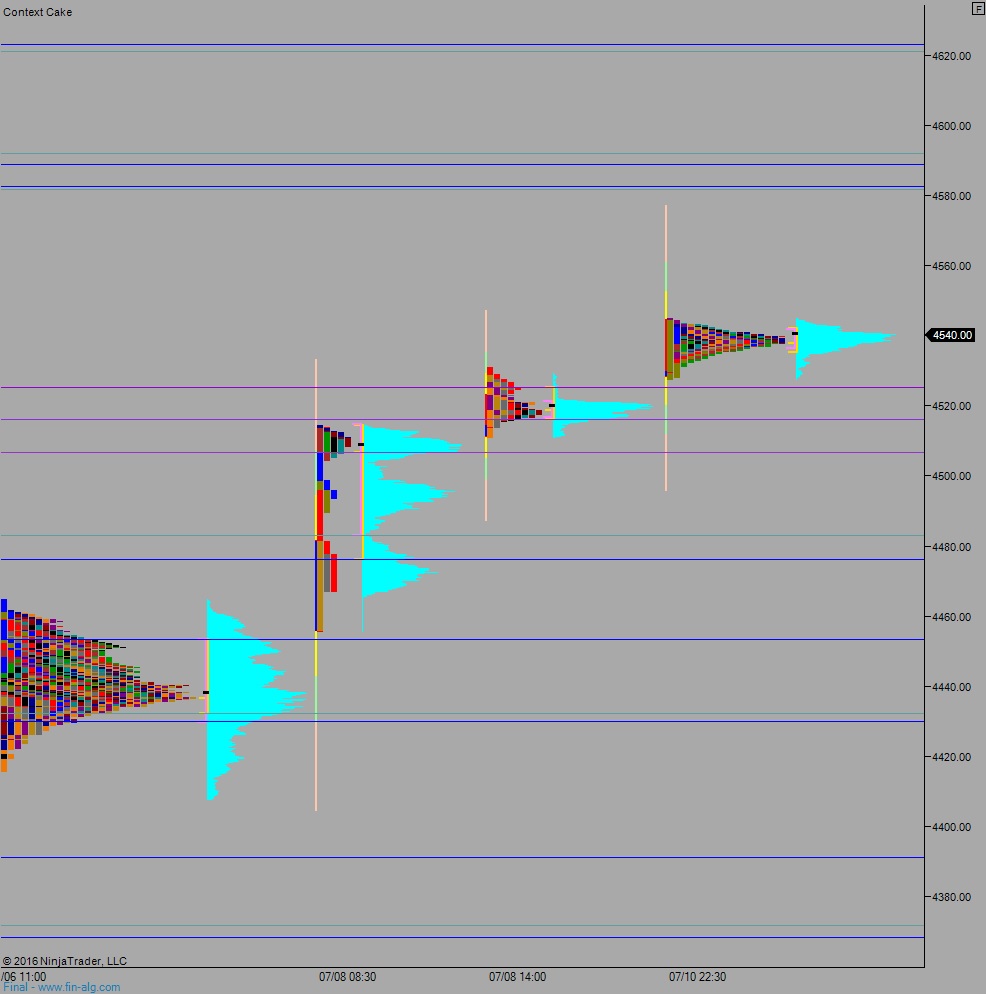

NASDAQ futures are coming into the second full week of July trade [also OPEX] gap up after an overnight session featuring an elevated range on normal volume. Price worked clear above the June 2016 high print before balancing out near the mid-value of a multi-day value established back in April.

On the economic docket today we have Labor Market Conditions Index Change at 10am, 3- and 6-month T-bill auctions at 11:30am, and a 3-year Note auction at 1pm.

Last week started out with a big gap down and drive lower on Tuesday (Monday was a market holiday). The weakness persisted through the end of Tuesday. Wednesday an attempt to continue the selling campaign was rejected and a strong bid kept markets moving higher through the end of the day. The strength was accepted Thursday with price balancing out near Wednesday’s session high.

Friday was a trend day up.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 4516.25. Sellers take out overnight low 4515.75. Look for responsive buyers at 4507 and two way trade to ensue.

Hypo 2 buyers gap-and-go, take out overnight high 4545 and target the MCVAH at 4549.75 before settling into two way trade and balancing.

Hypo 3 strong buyers push up through 4550 and sustain trade above it setting up a move to target 4581.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: