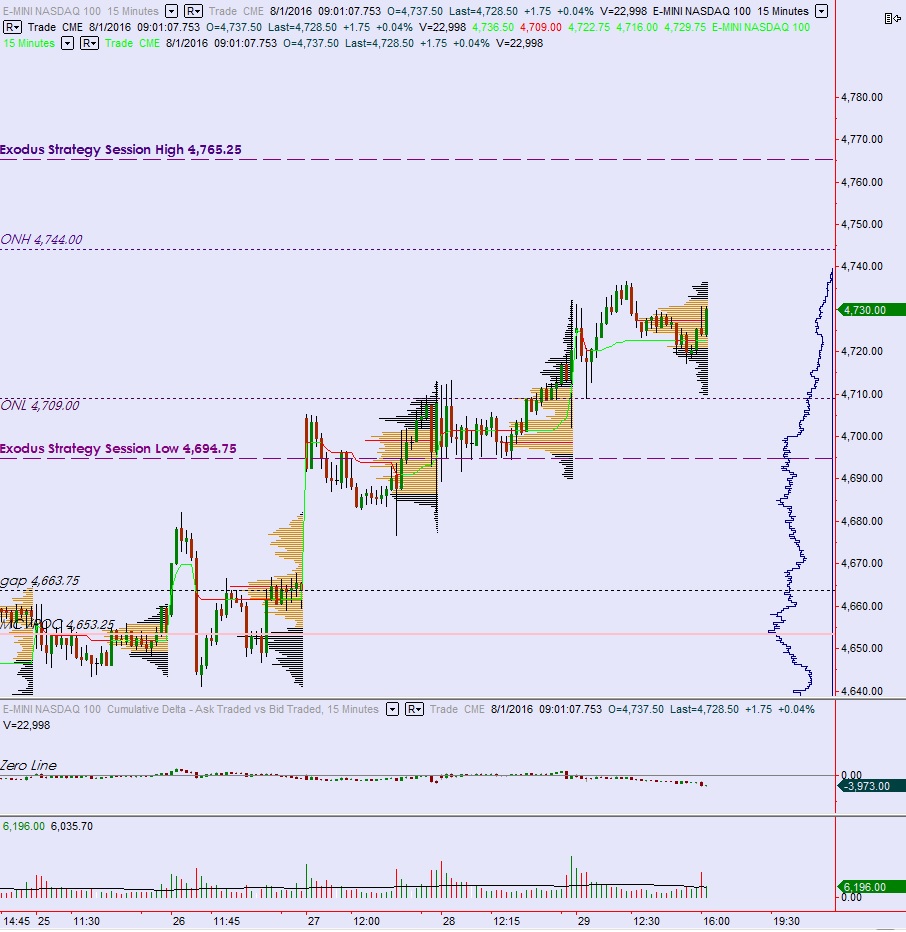

NASDAQ futures are coming into Monday gap up after an overnight session featuring normal range and volume. Price worked up though all prior highs overnight before coming into two-way trade at the new levels.

On the economic docket we have NAHB Housing Market Index at 10am, 3- and 6-month T-bill auctions at 11:30am, and Long-term TIC flows at 4pm.

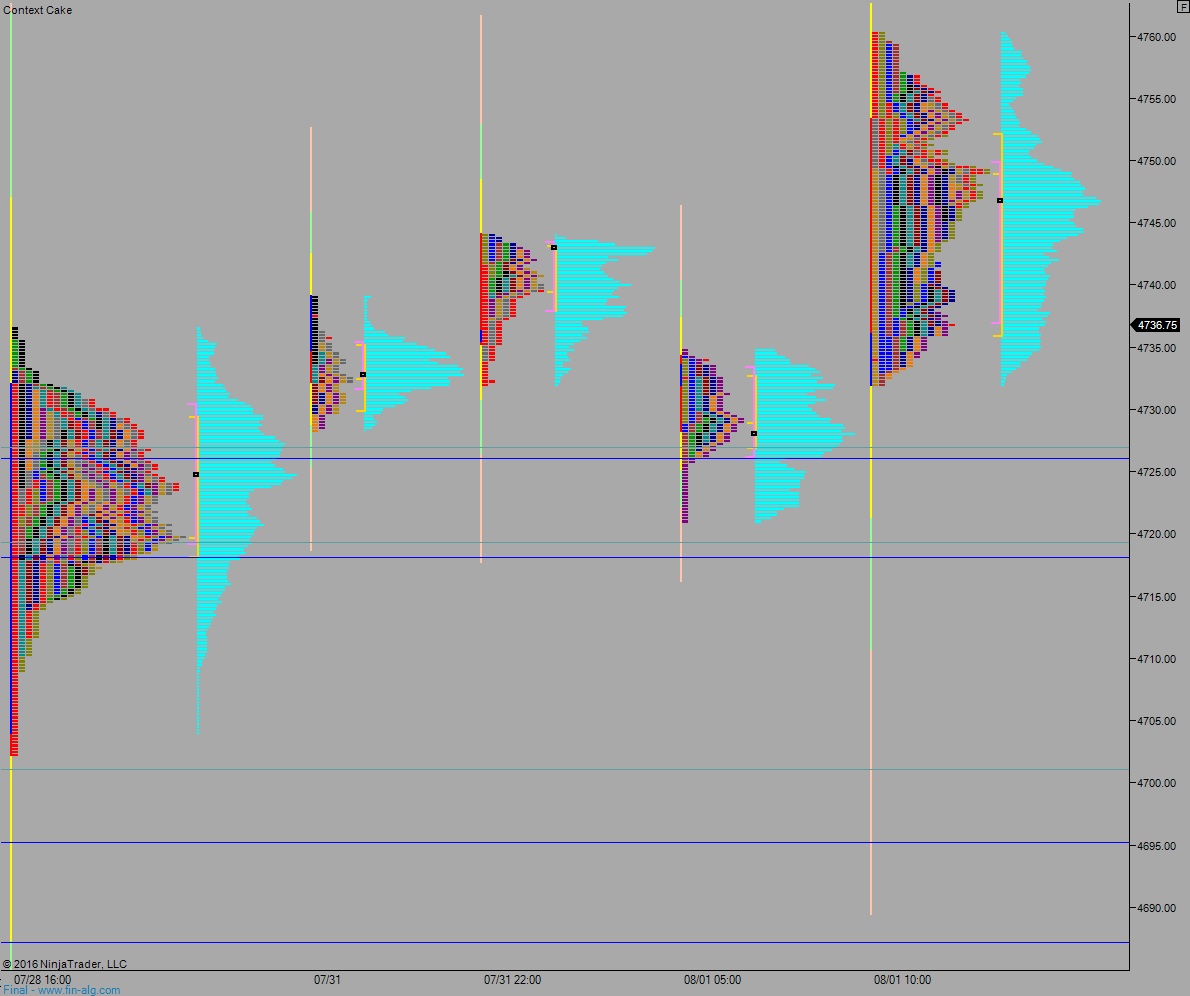

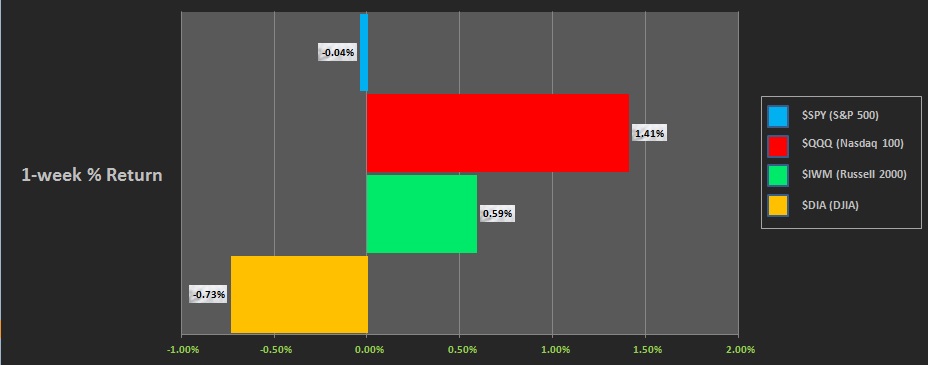

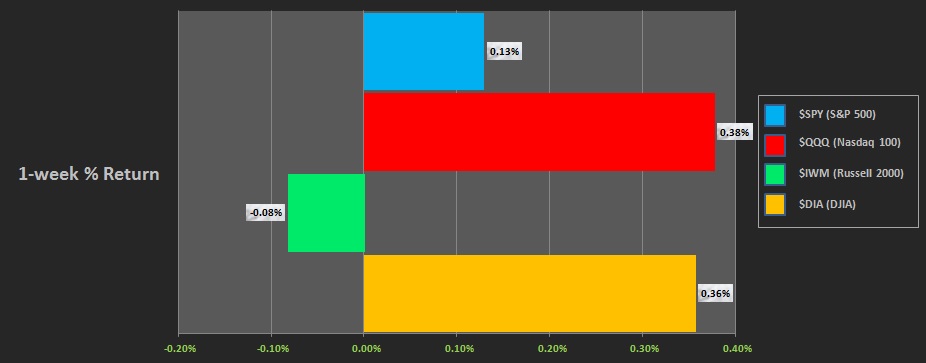

Last week the NASDAQ marked time, trading sideways with an upward drift, all week long. Price worked slightly higher. Here are the returns of each major index last week:

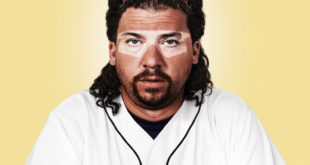

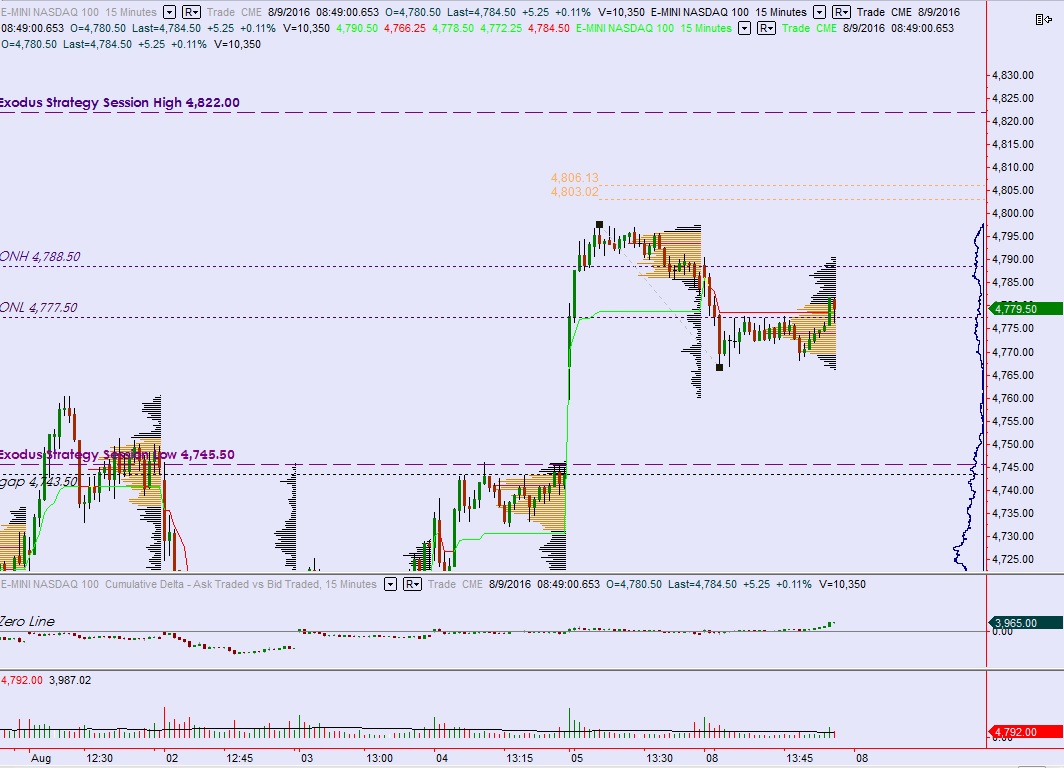

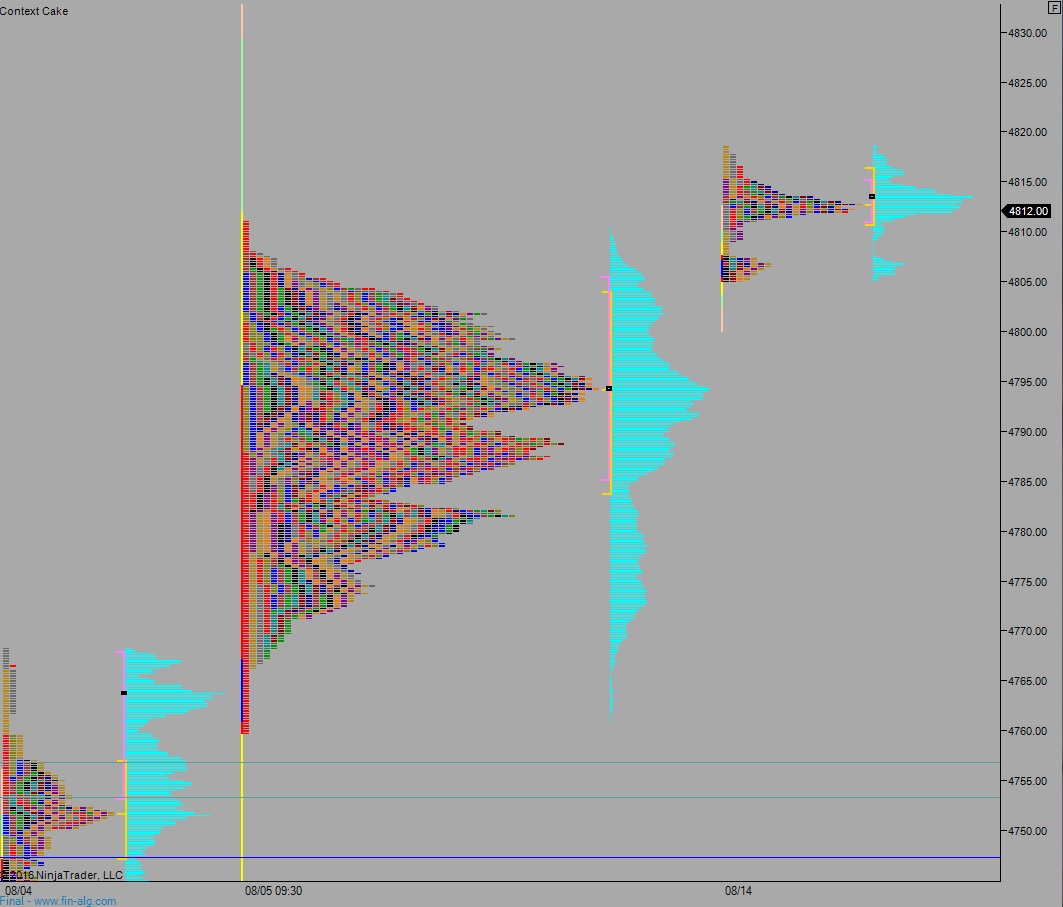

On Friday we printed a normal variation up. Price went right down to Thursday’s low but failed to test below it, instead printing a weak-looking 2-day low along the 4787 mark.

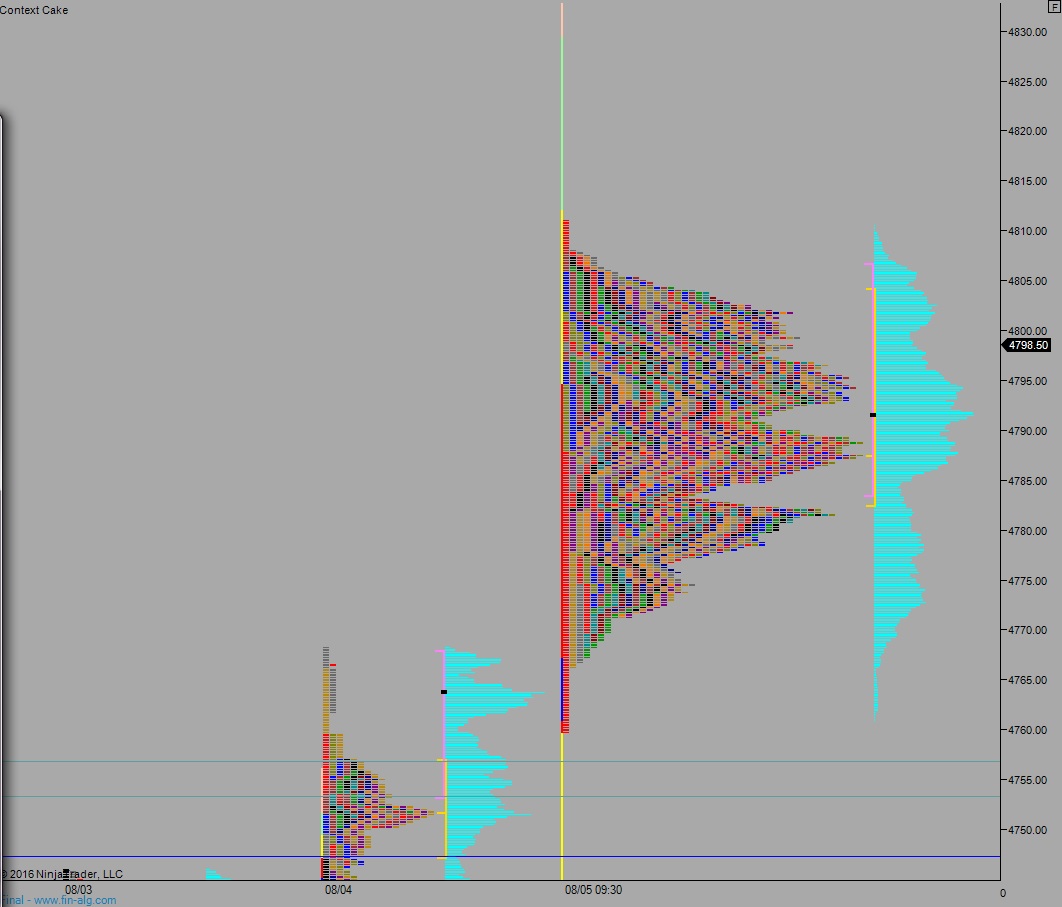

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 4804.25. From here sellers continue lower to take out overnight low 4805 then test Friday’s low and close the gap down to 4781.25 before two way trade ensues.

Hypo 2 sellers cannot close overnight gap. Instead buyers show up around 4808 and continue working the market higher, up through overnight high 4818.50 and continue exploring higher prices.

Hypo 3 strong selling pushes down through the open gap at 4781.25 and continues lower. Look for responsive buyers down at 4767.25.

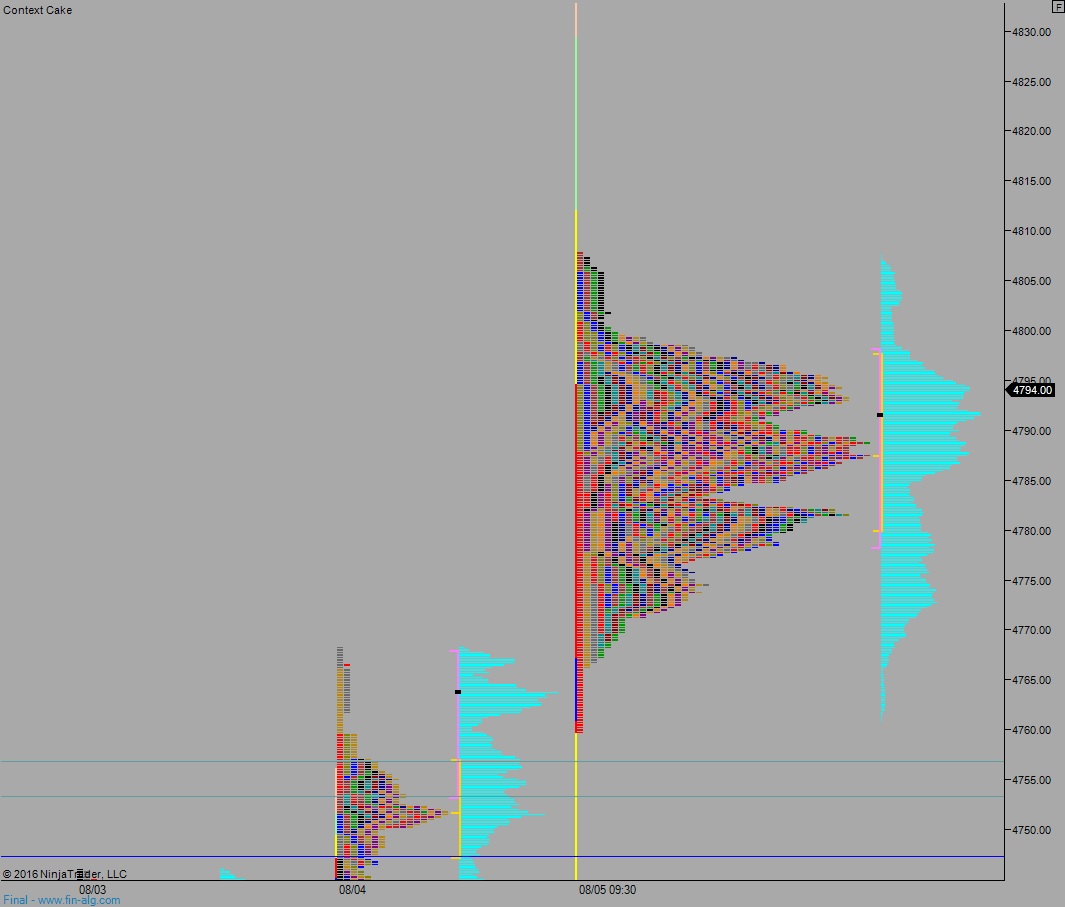

Levels:

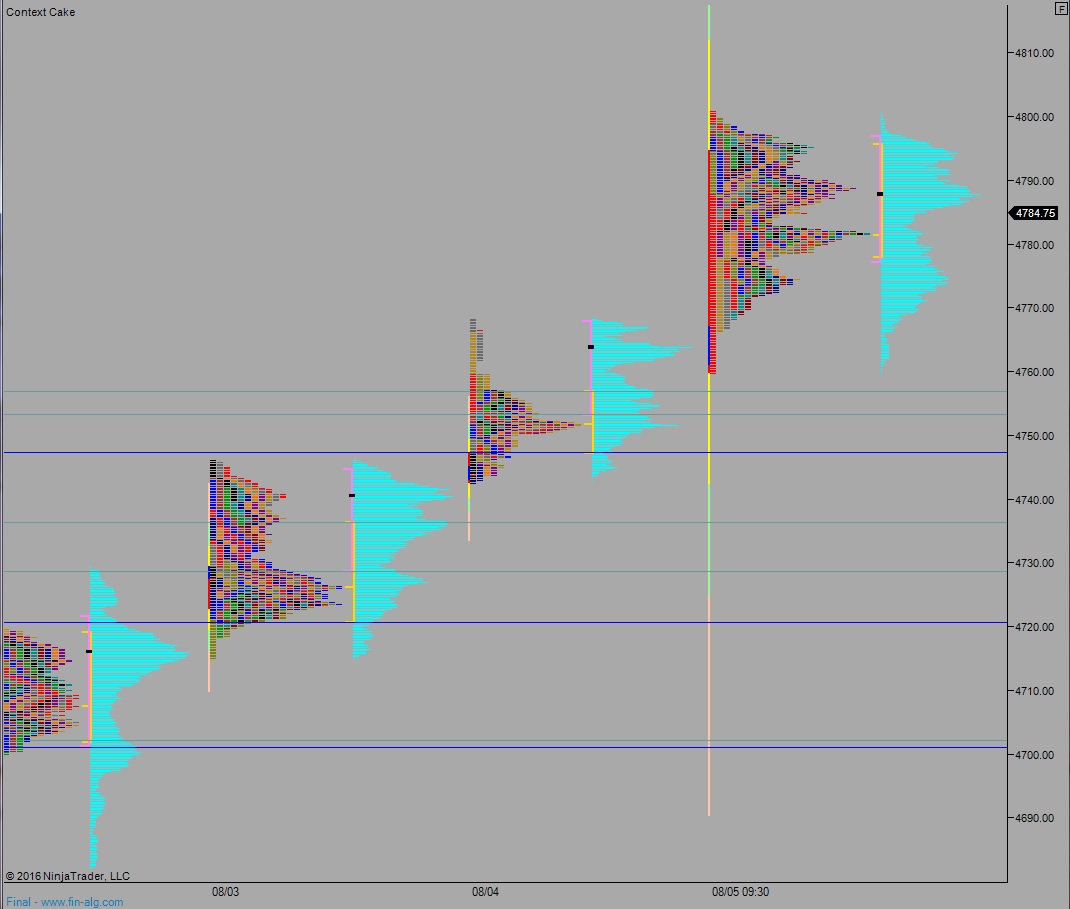

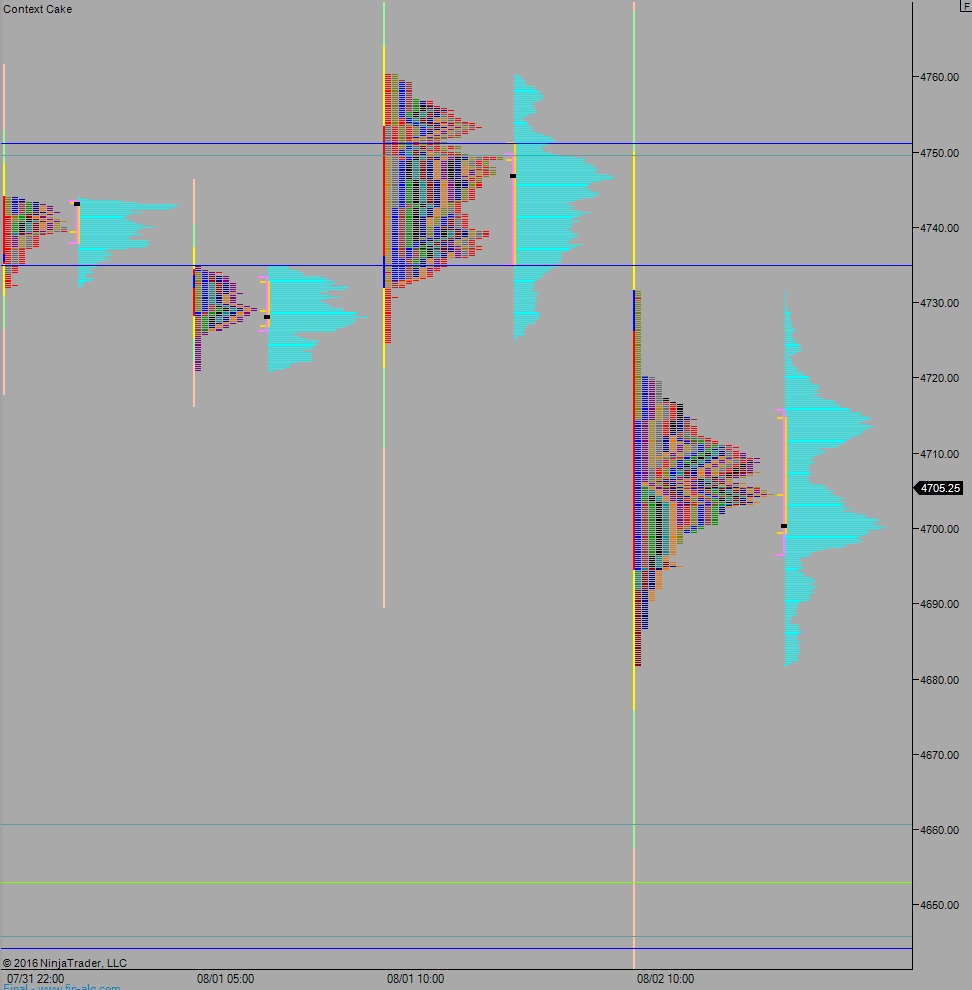

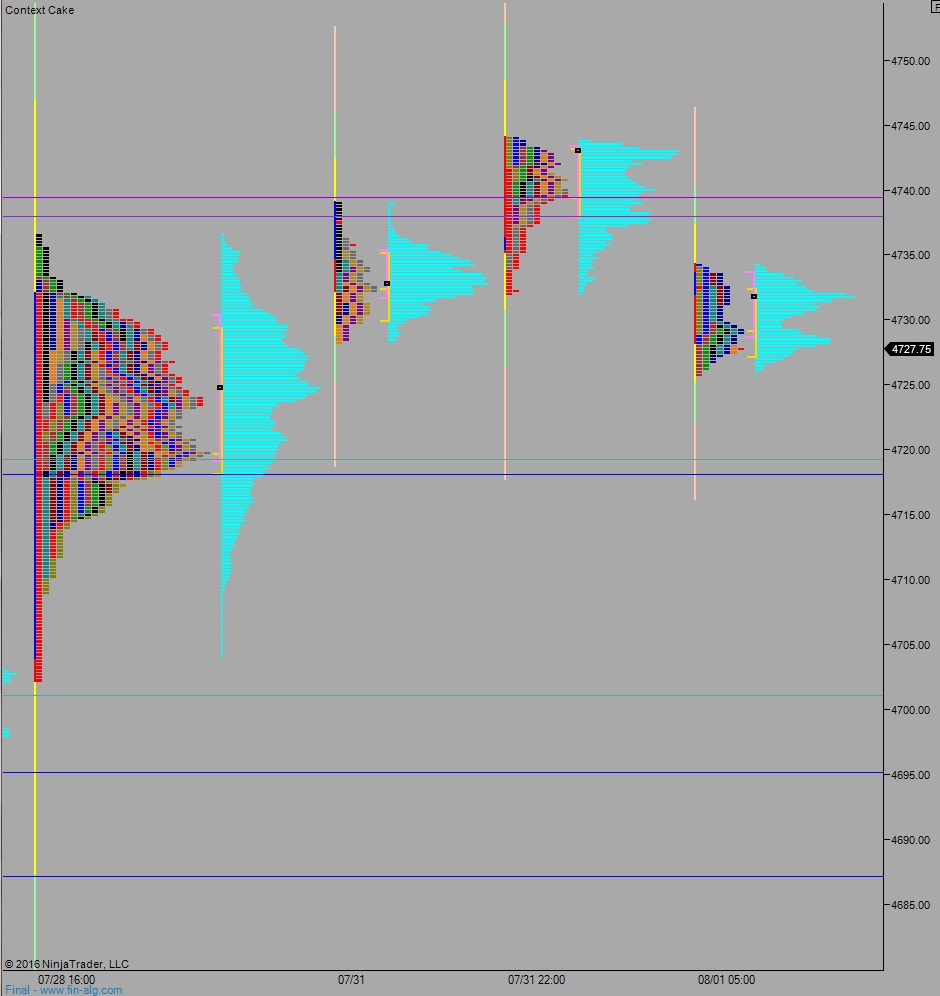

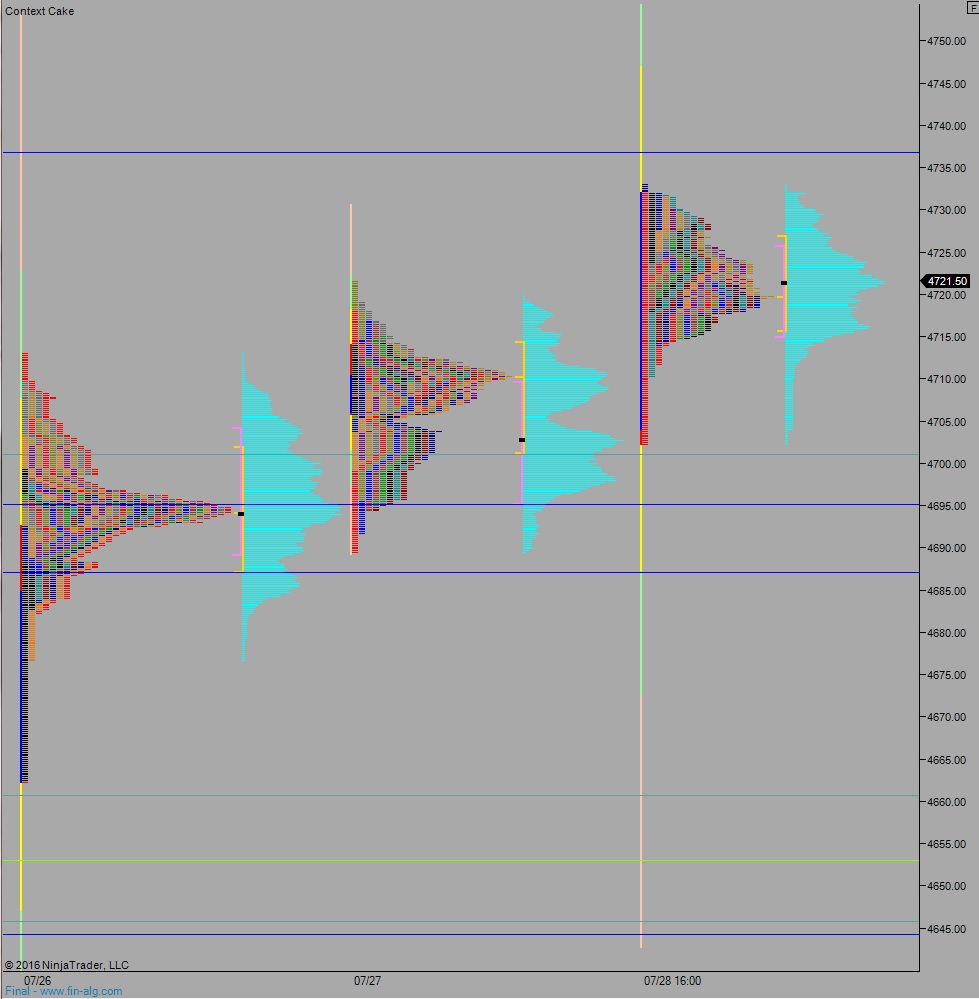

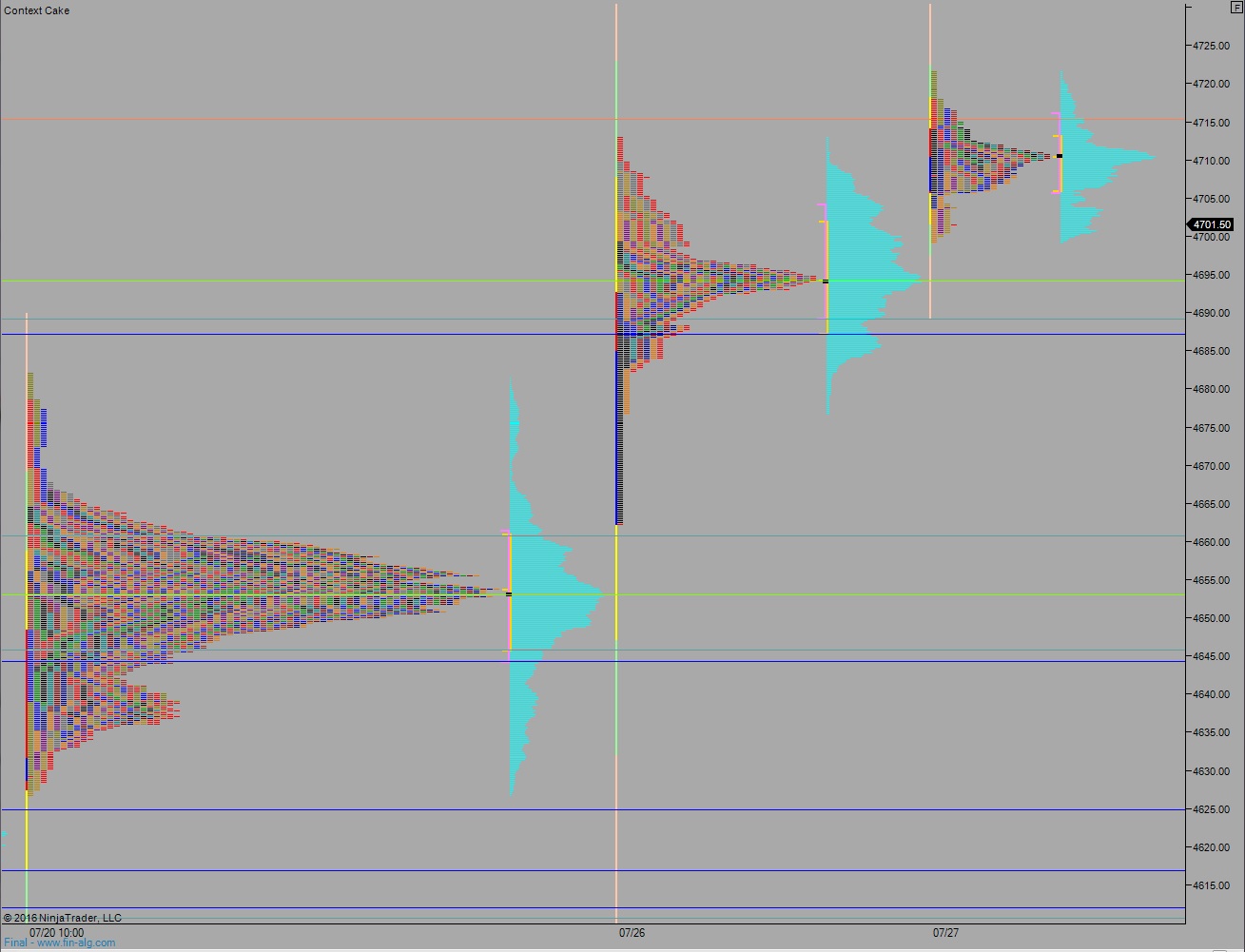

Volume profiles, gaps, and measured moves: