NASDAQ futures are coming into Thursday gap down after a balanced overnight session featuring elevated range on normal volume. Price extended upon Wednesday’s rally a bit before settling into two-way trade above yesterday’s midpoint. At 8:30am Initial/Continuing jobless claims data came out mixed [initial claims 268k vs 267exp, continuing claims 2120k vs 2152k exp]. The initial reaction is a small buy.

Yesterday we printed a second-consecutive double distribution trend up. This day type is not as explosive as a trend day, but does see a market that is discovering higher prices. Price managed to test above last Friday’s high and sustain trade above it heading into the close.

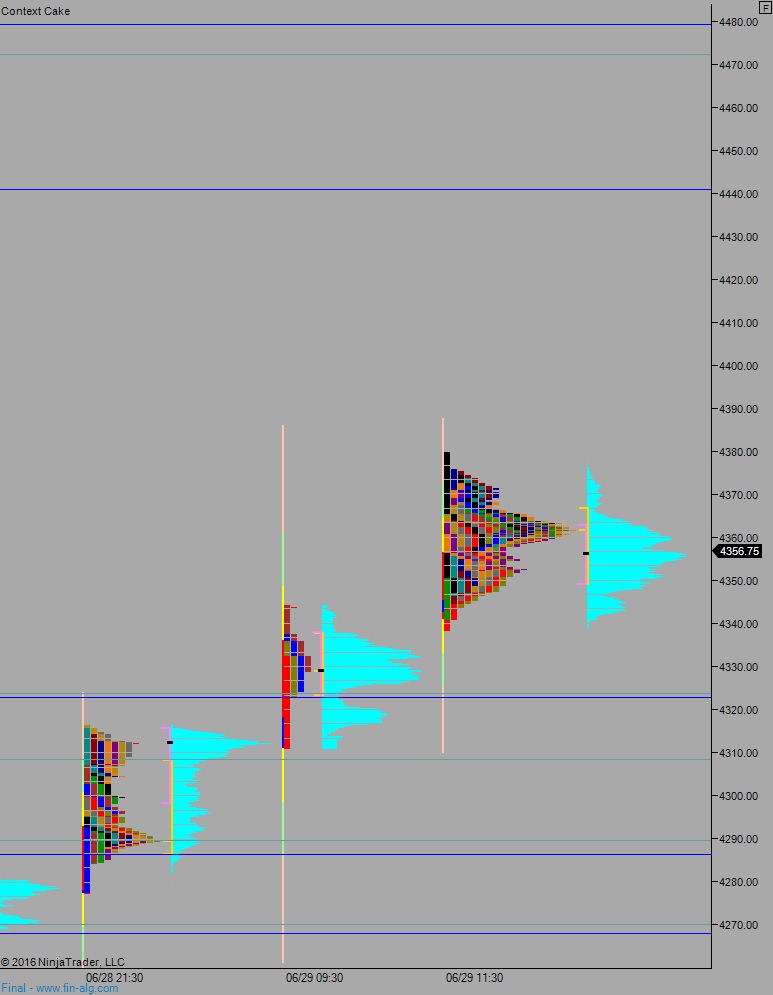

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 4362.75. From here look for a move to take out overnight high 4380 and target the open gap at 4395.75 before two way trade ensues.

Hypo 2 sellers push down off the open and take out overnight low 4388.50. Look for responsive buyers down at 4328.25, secondary support down at 4324, before two way trade to ensue.

Hypo 3 liquidation takes hold, we press down through 4322 and sustain trade below it, setting up a gap fill trade down to 4281.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

If you enjoy the content at iBankCoin, please follow us on Twitter

I am loving the east bound pic usage.