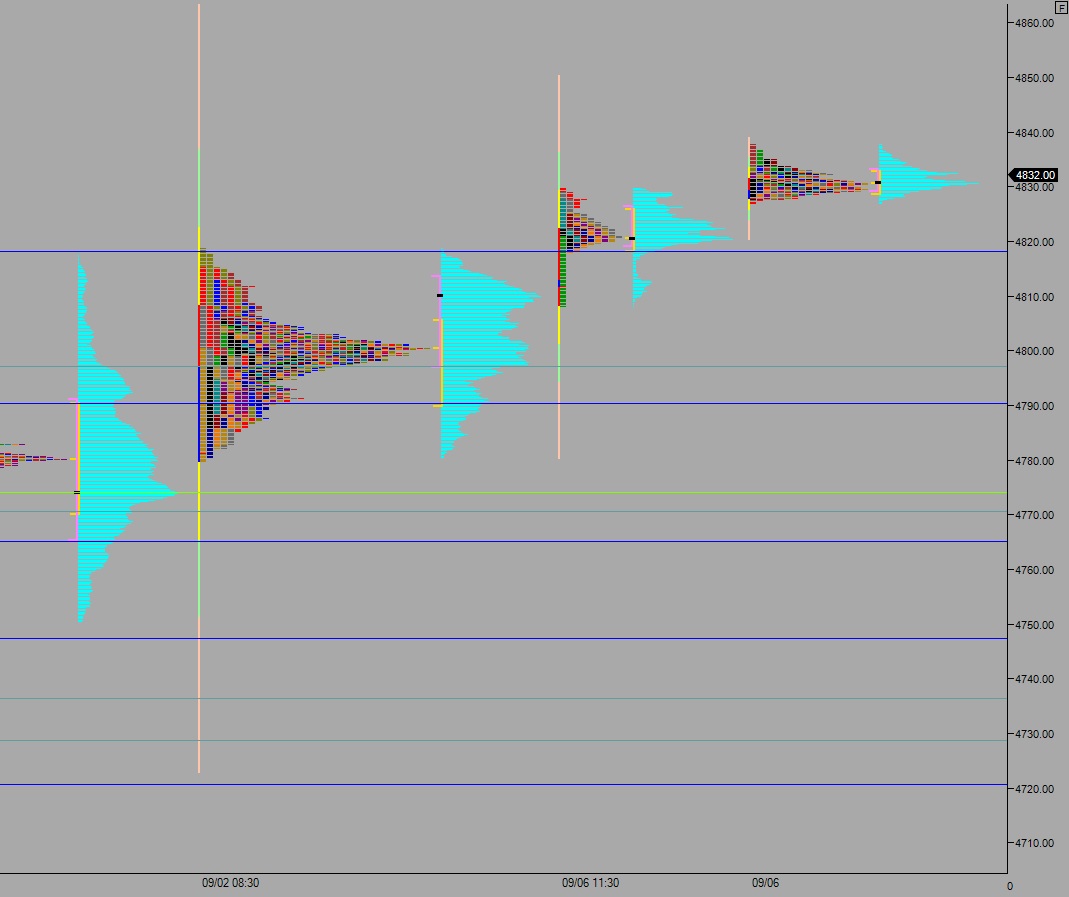

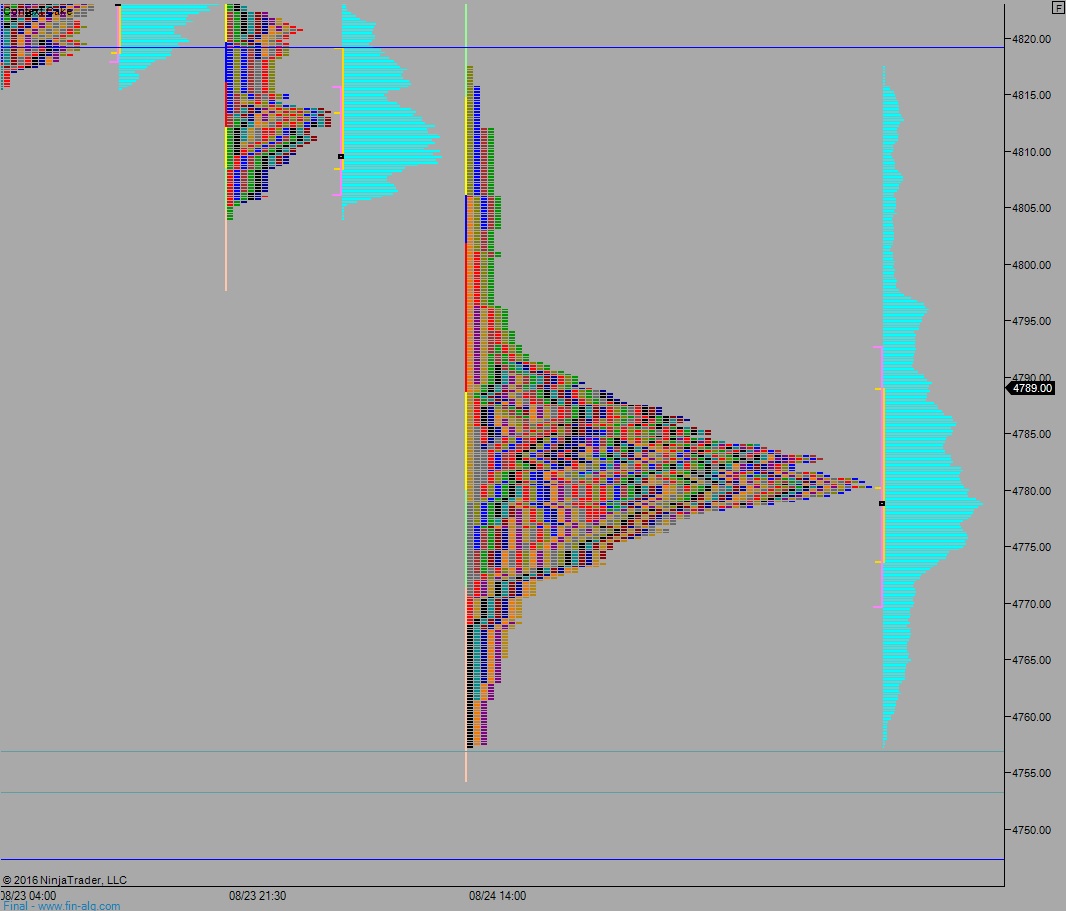

NASDAQ futures are coming into Thursday gap down after an overnight session featuring normal range and volume. Price held range during Globex but sellers started hitting the tape after a better-than-expected read of the Initial/Continuing jobless claims at 8:30am.

Also on the economic calendar today we have crude oil inventories at 11am and Consumer Credit at 3pm.

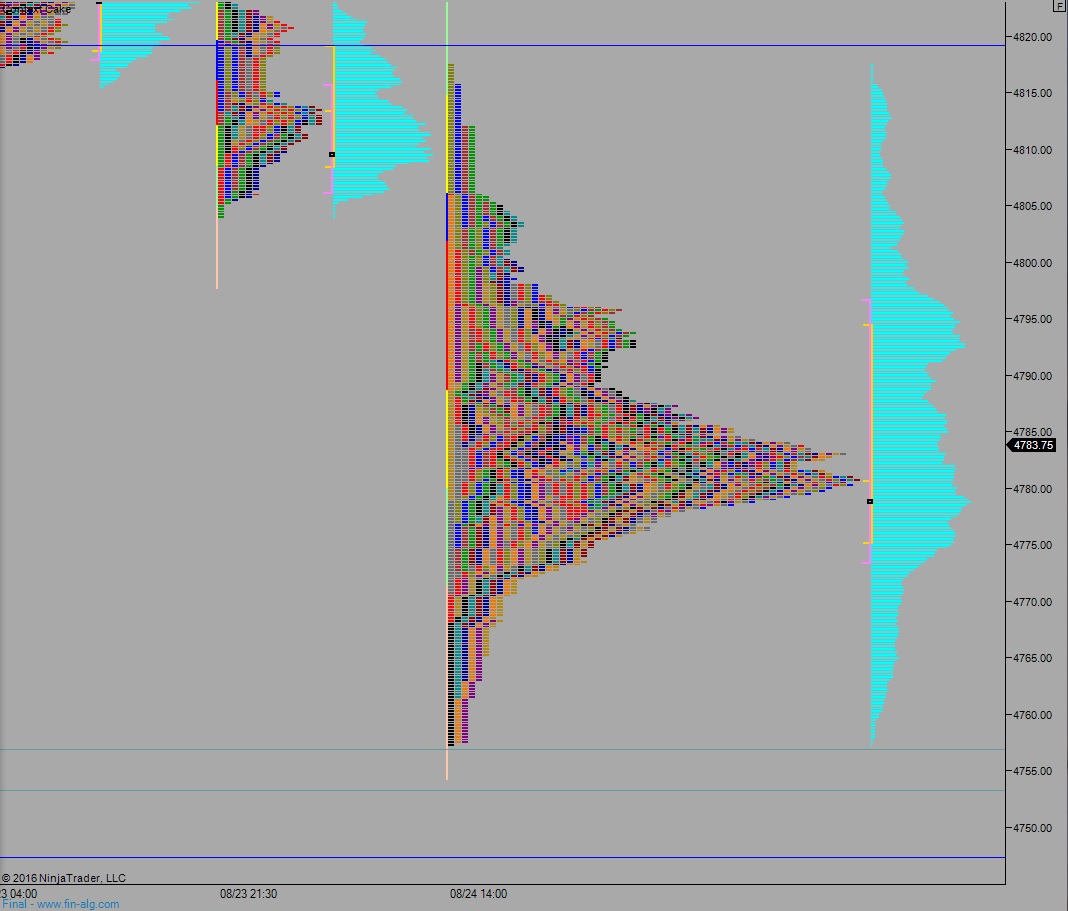

Yesterday we formed a neutral day. After opening gap up and having a two-way auction, the NASDAQ 1-ticked its IB high before falling down through the range, down near Tuesday’s midpoint before catching a bid. Then we worked back to the middle of the day’s range by the close.

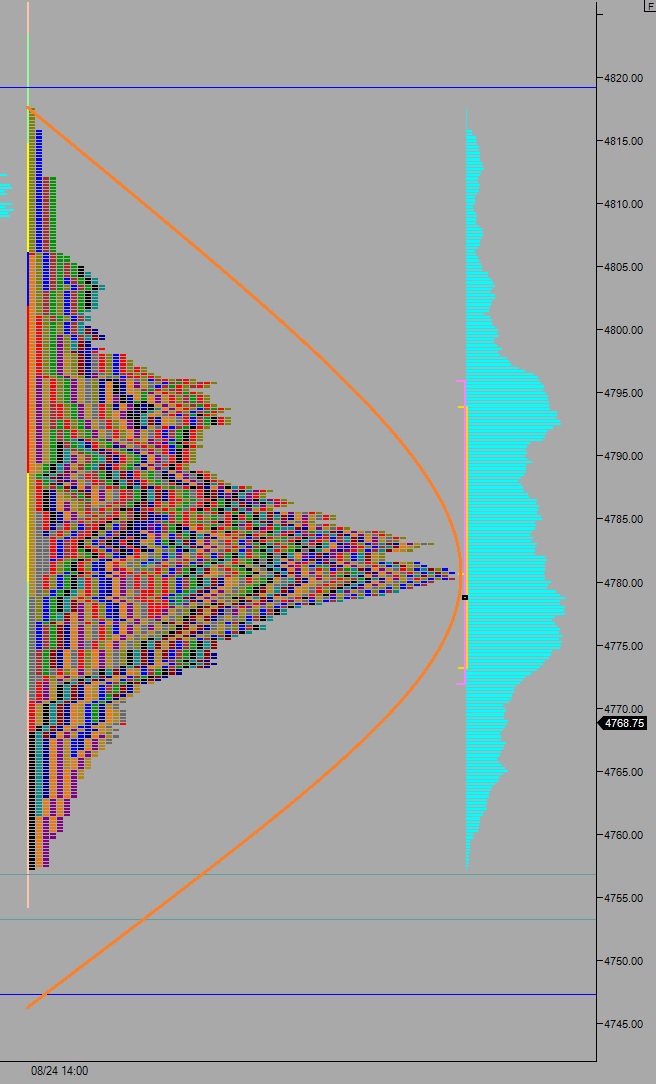

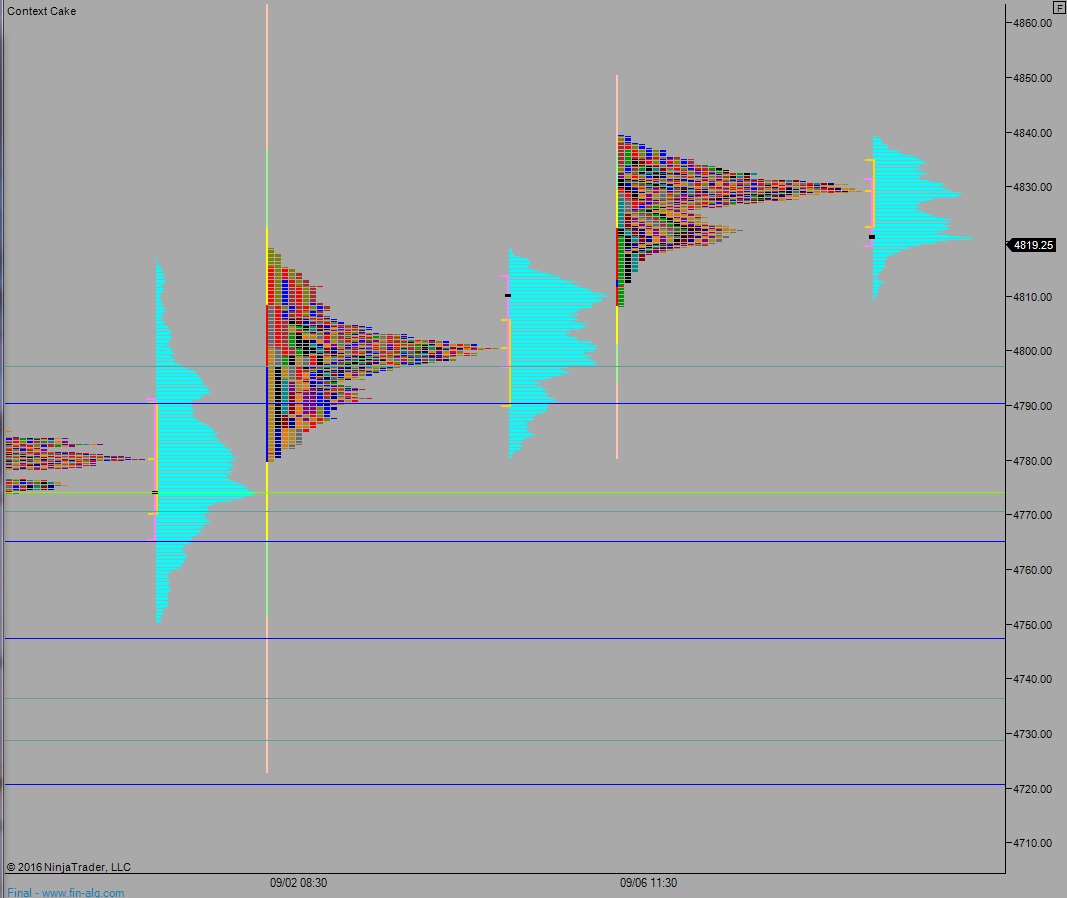

Heading into today my primary expectation is for buyers to push into the overnight inventory and close the gap up to 4829. Buyers continue higher, up through overnight high 4837 and continues marching higher. Look for sellers up near 4851.75 and two way trade to ensue.

Hypo 2 sellers defend right around the overnight gap 4829 and work lower to test down to 4800 before two way trade ensues.

Hypo 3 strong sellers push down to 4790, buyers do not defend this area and we continue lower, down to 4774 before two way trade ensues.

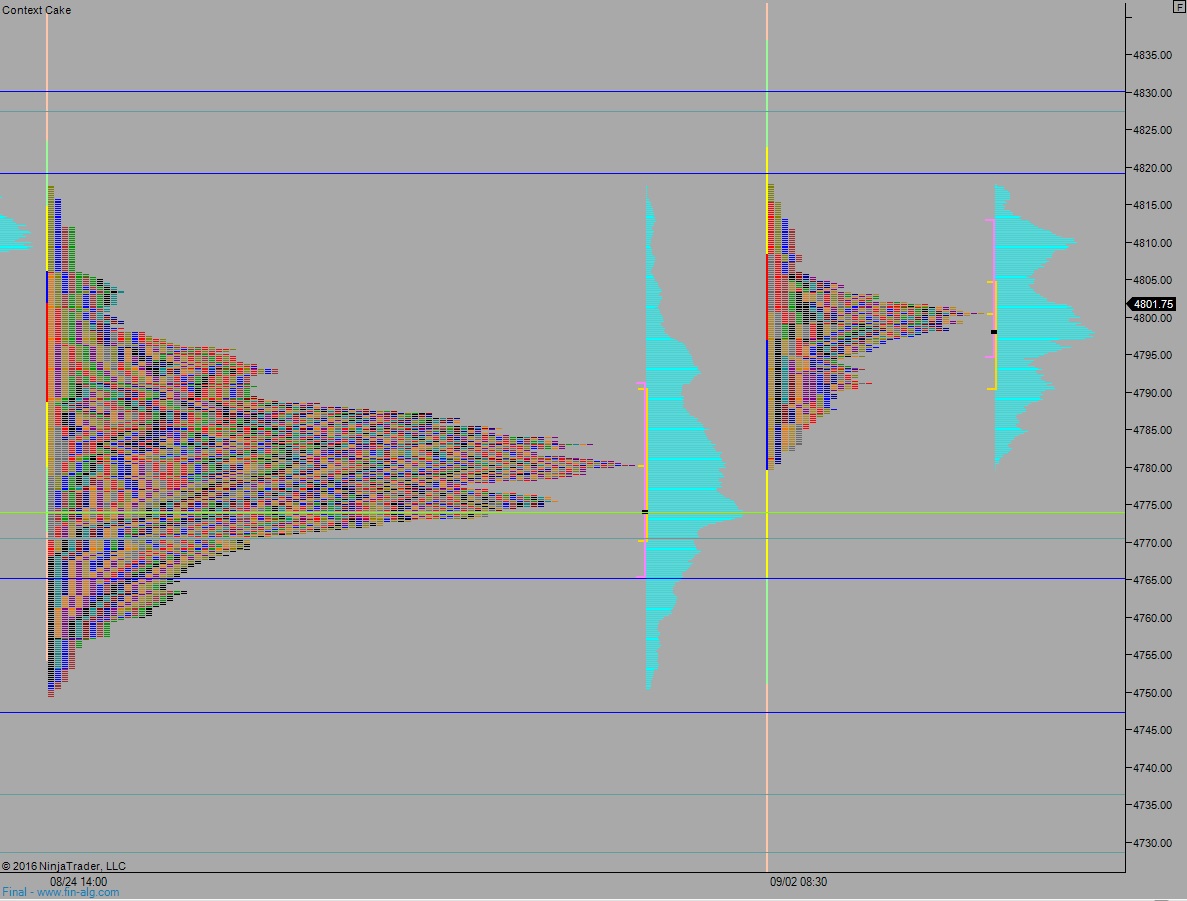

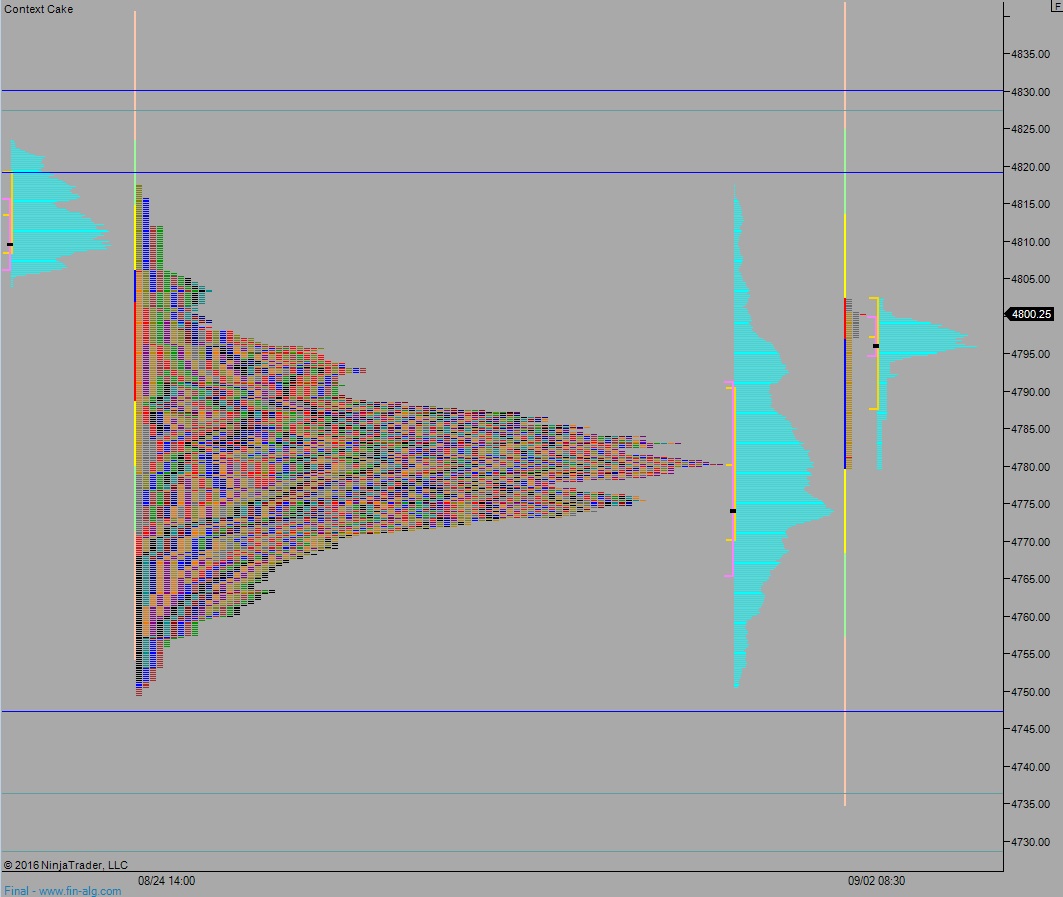

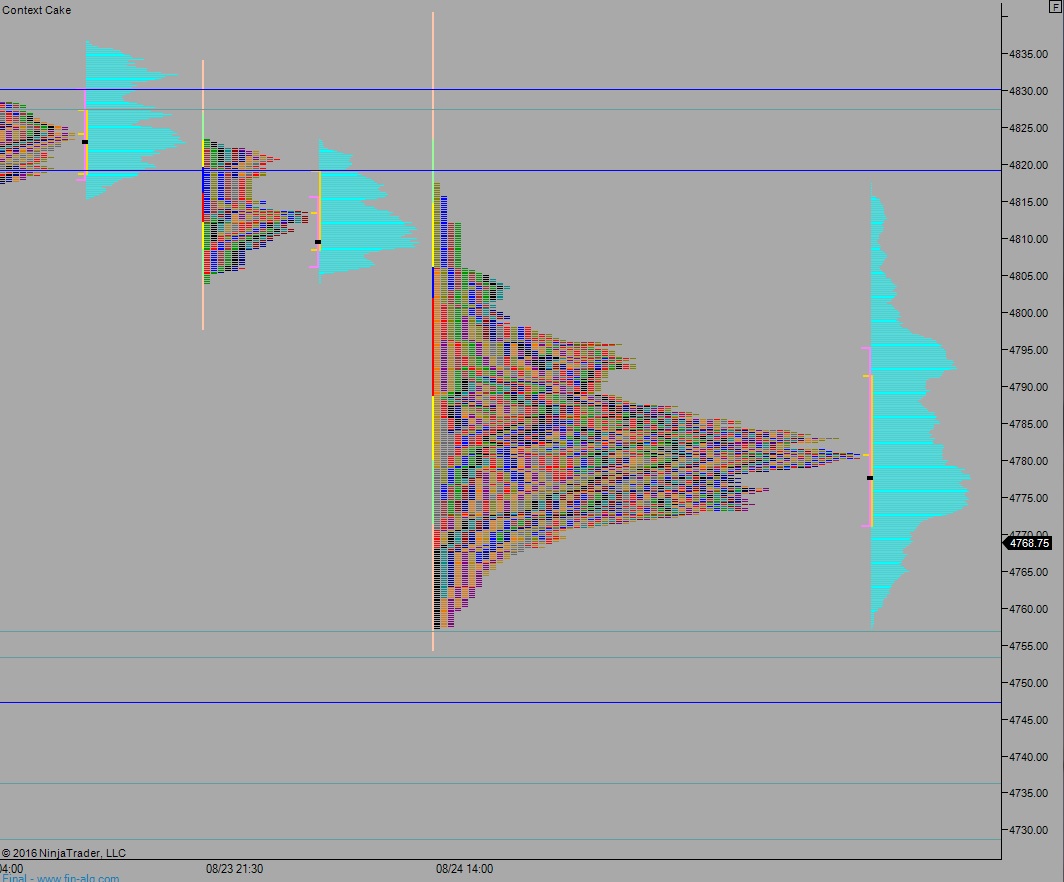

Levels:

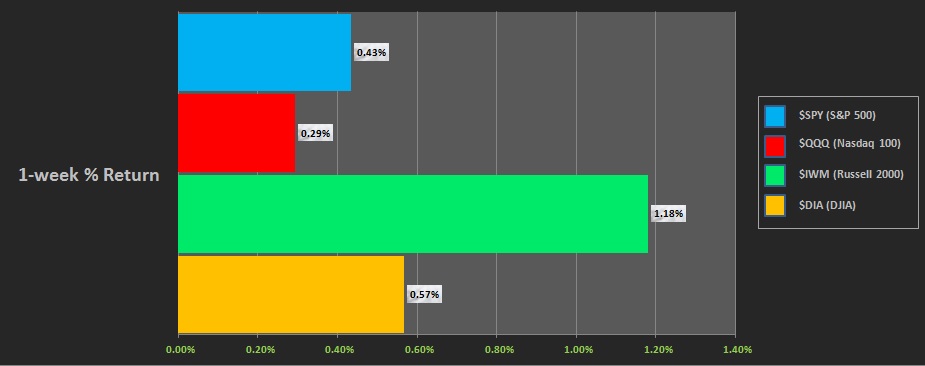

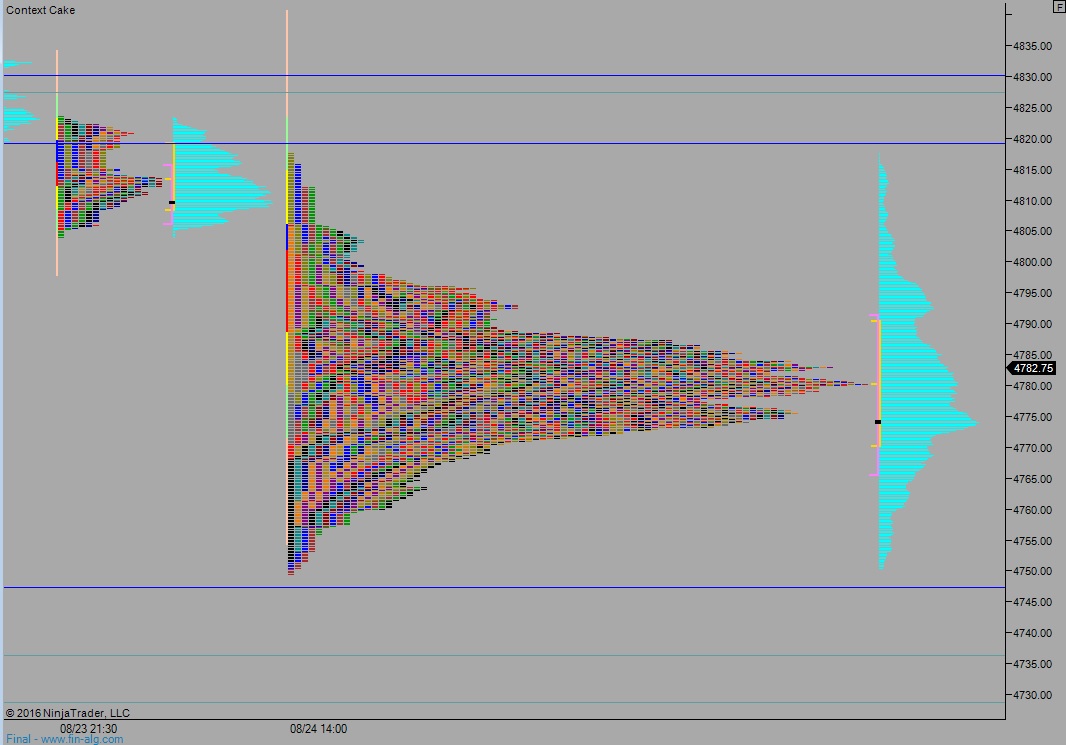

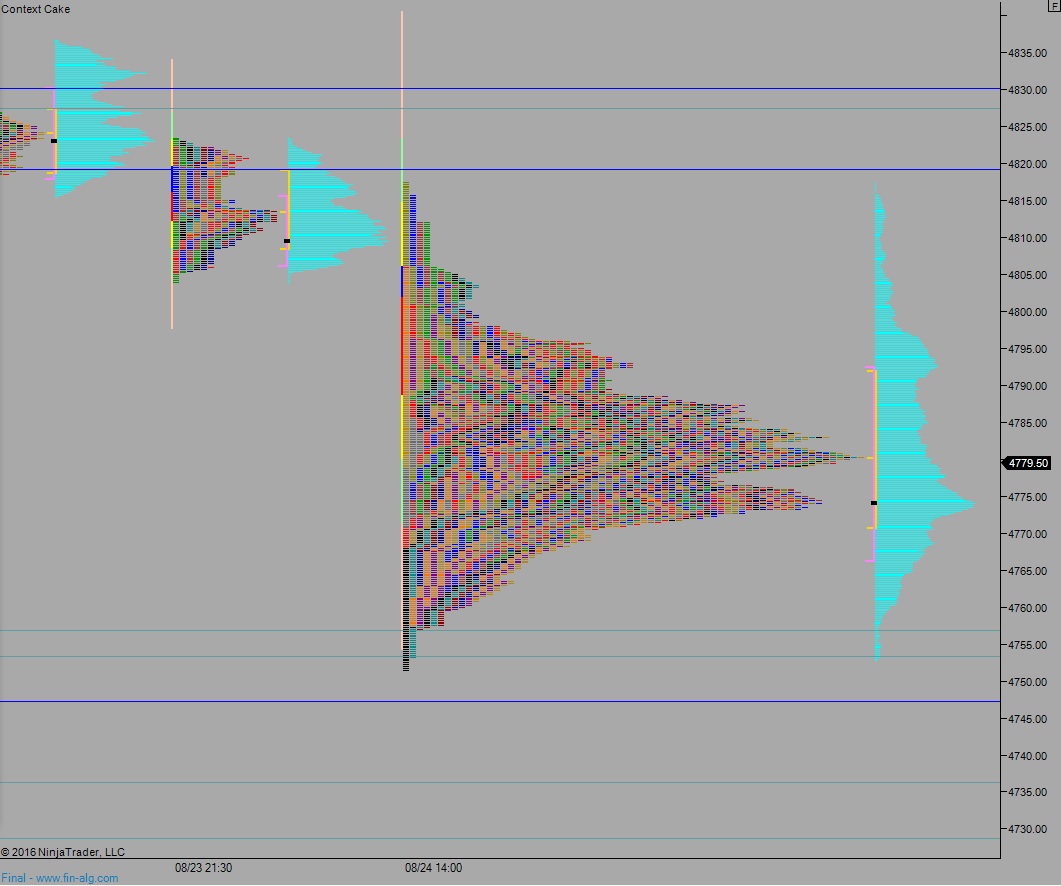

Volume profiles, gaps, and measured moves: