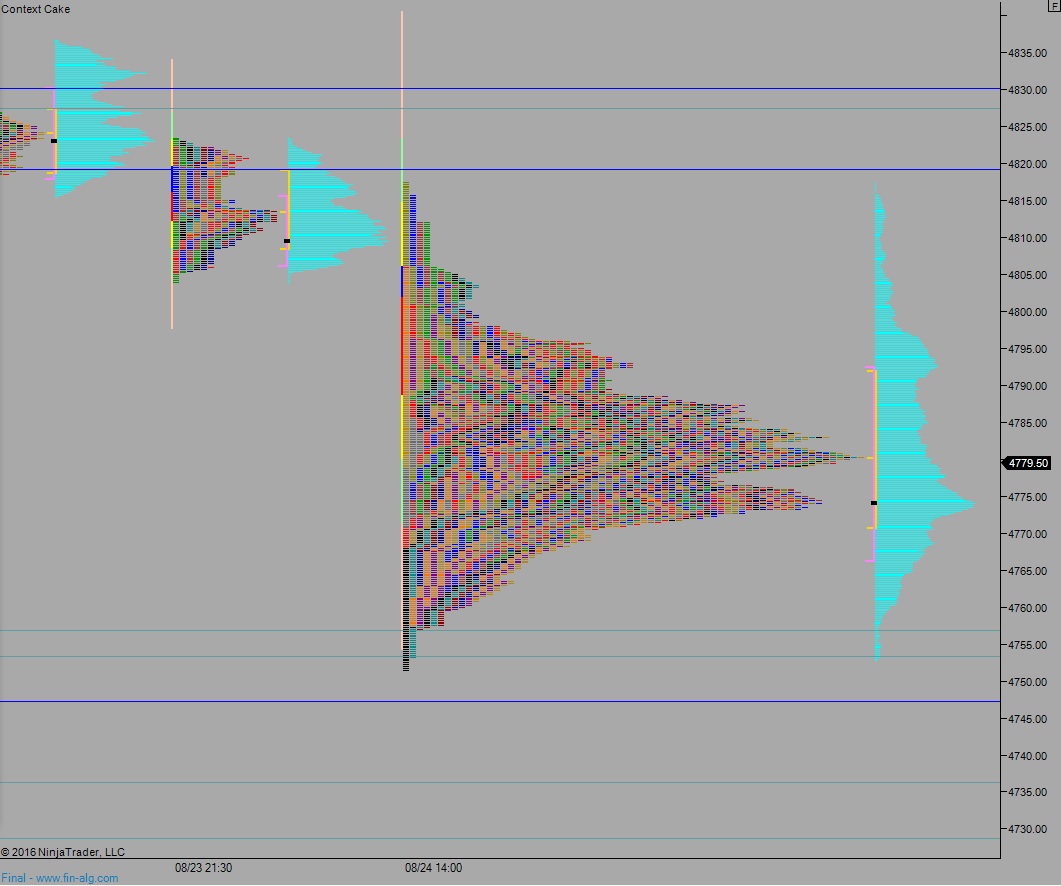

NASDAQ futures are coming into Thursday gap up after an overnight session featuring normal range and volume. Price worked higher overnight, back up to the MCVPOC at 4795 before fading most of the move. At 8:30am Initial/Continuing Jobless claims data came out mixed. However, most investors are more keen to hear tomorrow morning’s Non-farm Payroll reading.

Also on the economic docket today we have Construction Spending and ISM Manufacturing at 10am.

Yesterday we printed a normal variation down. Price opened gap down and an early 2-way auction closed the gap. Then sellers stepped in and became initiative, pushing us below last week’s low briefly. This formed an excess low and we rallied for the rest of the day–effectively keeping the market in balance.

Heading into today my primary expectation is for seller to work into the overnight inventory and close the gap down to 4775. Look for sellers to work down through overnight low 4771.75 then buyers emerge ahead of 4766 and two way trade ensues.

Hypo 2 strong sellers push down through overnigth low 4771.75 and continue lower, down through yesterday low 4751.50 to target the open gap down at 4743.50 before two way trade ensues.

Hypo 3 buyers work up through overnight high 4795.25 before two way trade ensues.

Hypo 4 strong buyers trend up through the entire balance to target 4819.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

https://youtu.be/KlDHxSGCtZ4