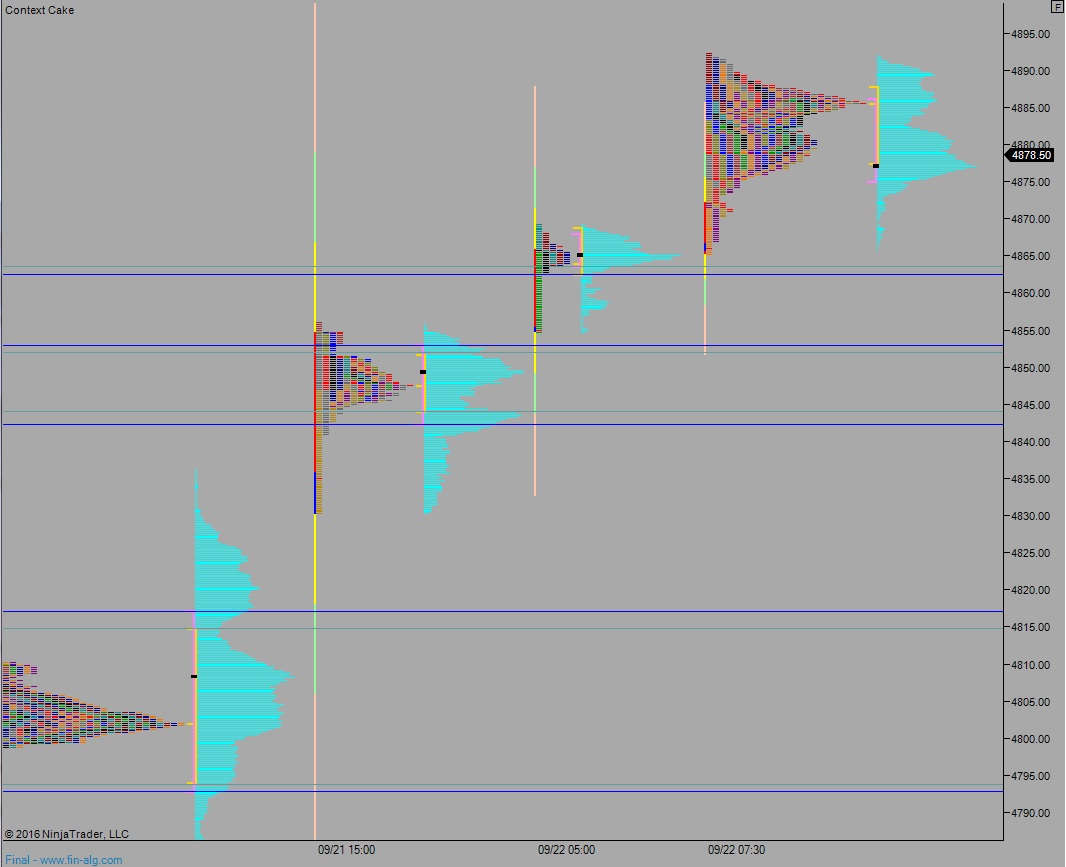

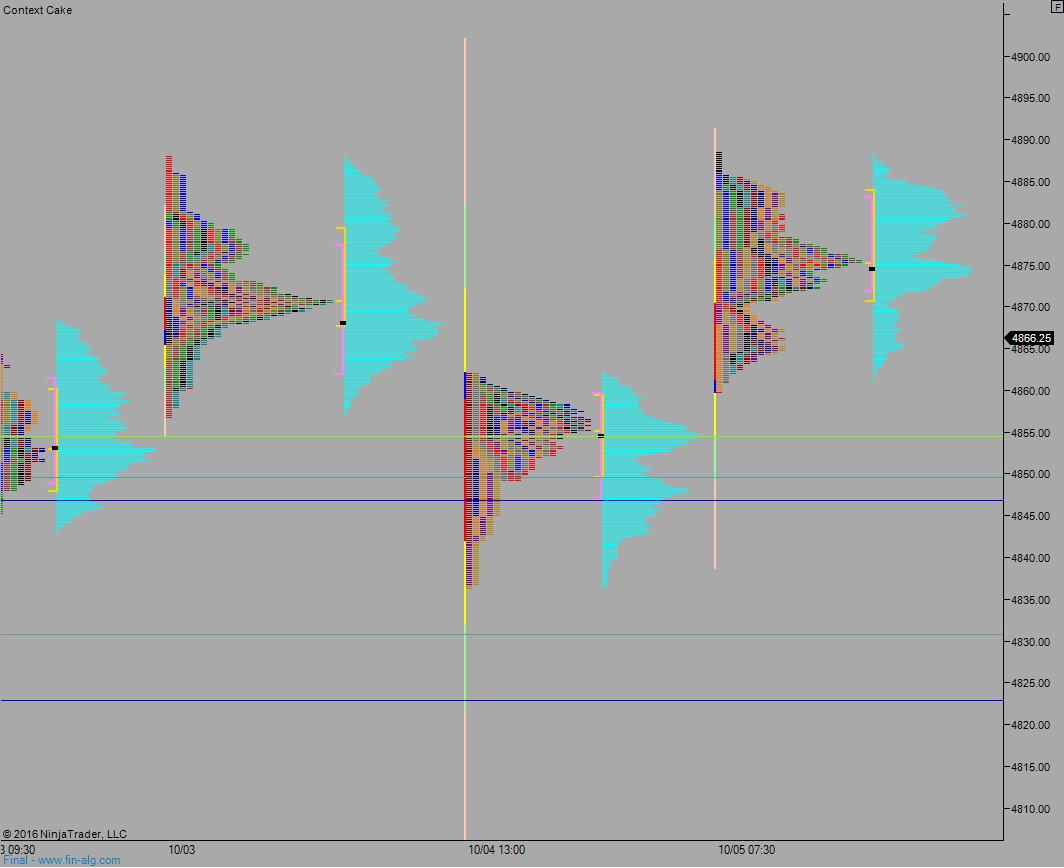

NASDAQ futures are coming into Thursday gap down after an overnight session featuring normal range and volume. Price was balanced overall on the night session but sellers managed to push down through the Wednesday low early this morning. At 8:30am initial/continuing jobless claims data came out better than expected:

USA Initial Jobless Claims for Sep 30 249.0K vs 257.0K consensus estimate. The prior reading was 254.0K.

USA Continuing Claims for Sep 23 2.06M vs 2.09M consensus estimate. The prior reading was 2.06M.

There are no other economic events on the calendar today. Tomorrow morning we hear the more important Non-farm Payroll statistics.

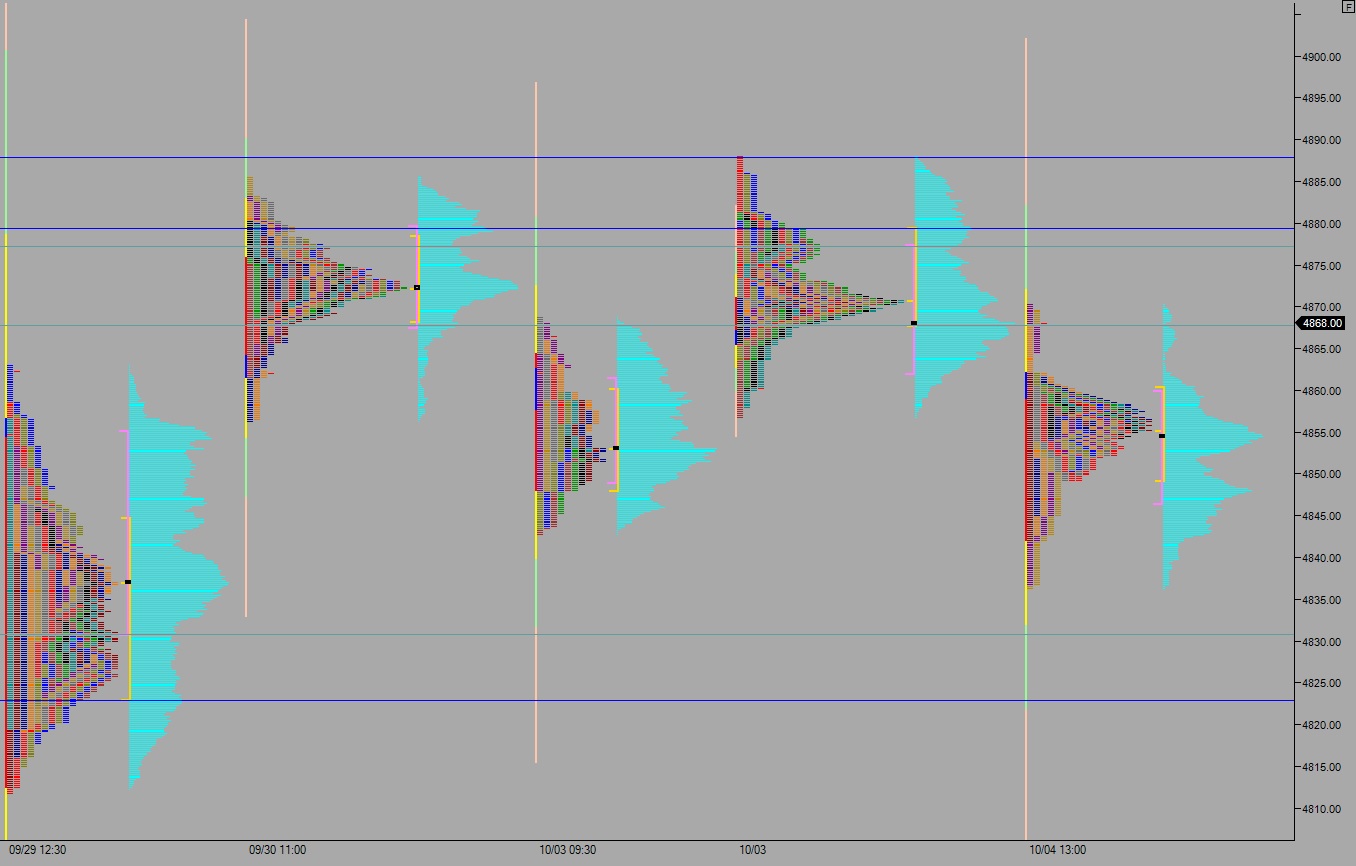

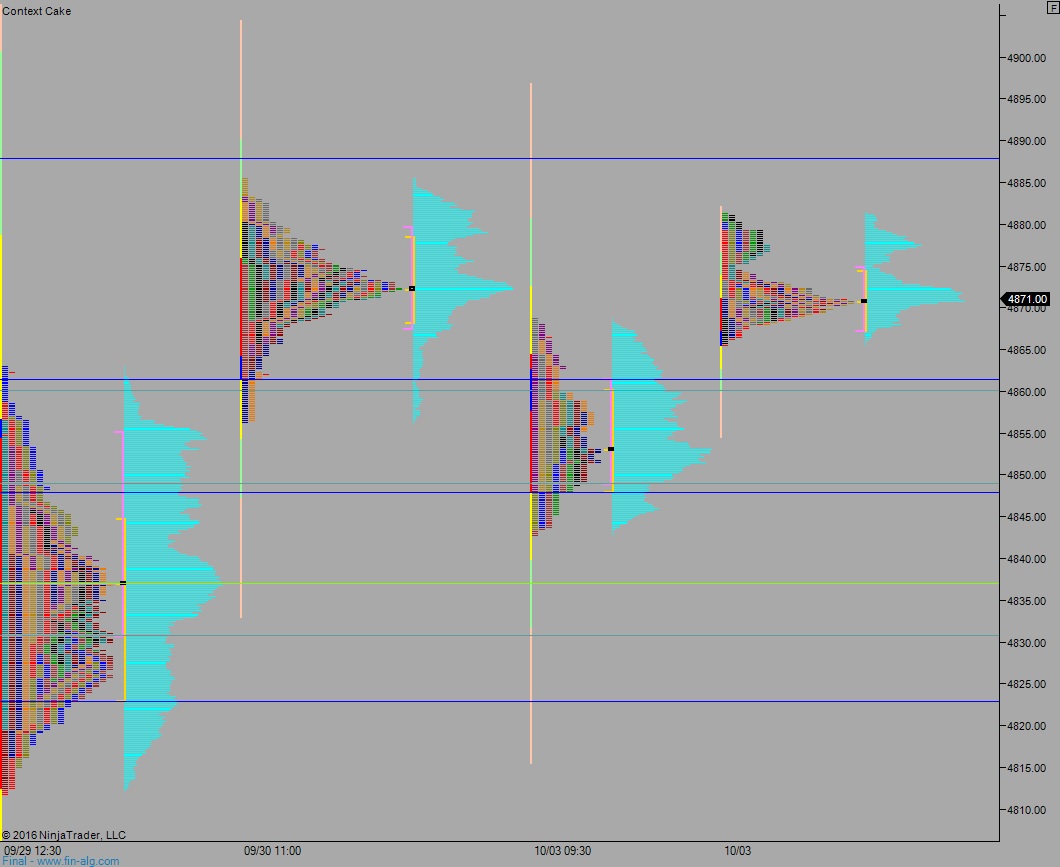

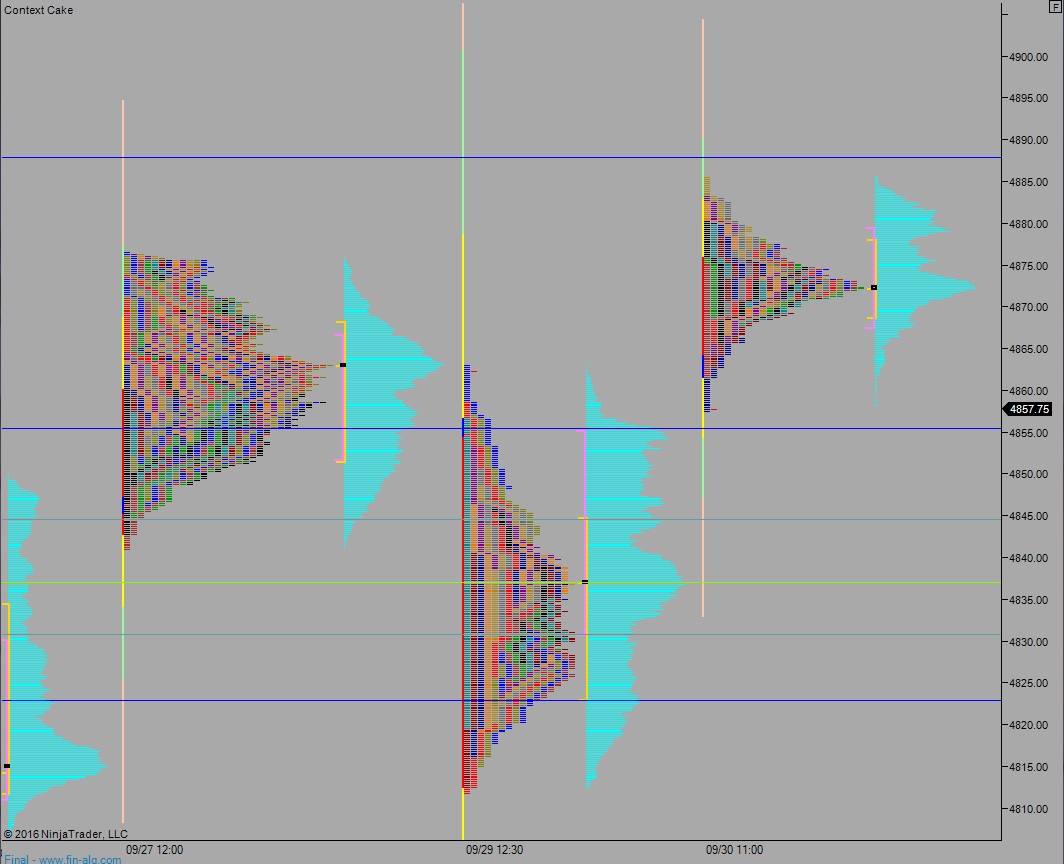

Yesterday we printed a normal variation up. price opened gap up and buyers slowly worked price higher. A responsive sellers came in ahead of the lunch hour but was eventually overrun. Buyers took out the Tuesday high by two-ticks before failing and falling back toward the daily midpoint.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 4873. This sets up a move to take out overnight high 4881 and a probe to new swing highs, up through the current weak high.

Hypo 2 sellers gap and go lower, take overnight low 4862 and close the gap down at 4858.25 before finding a strong responsive bid and continuing to work higher.

Hypo 3 strong sellers work down through 4858 to tag the high volume node at 4854.50 before two-way trade ensues.

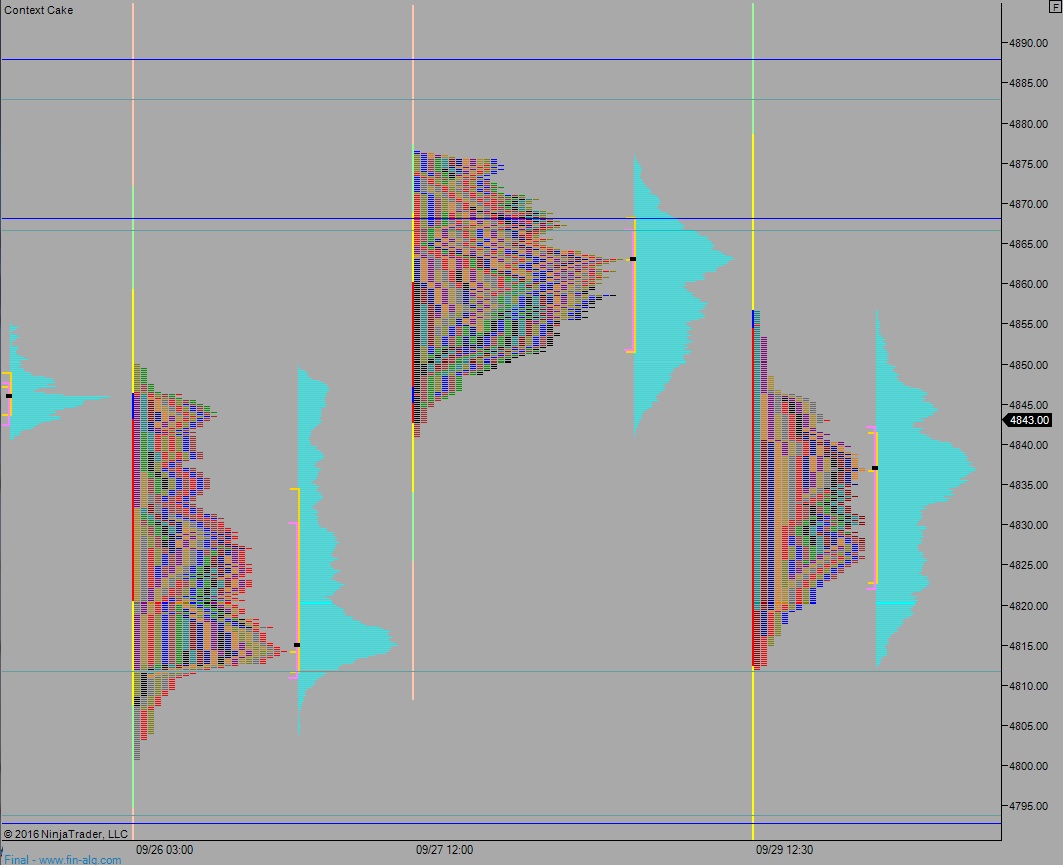

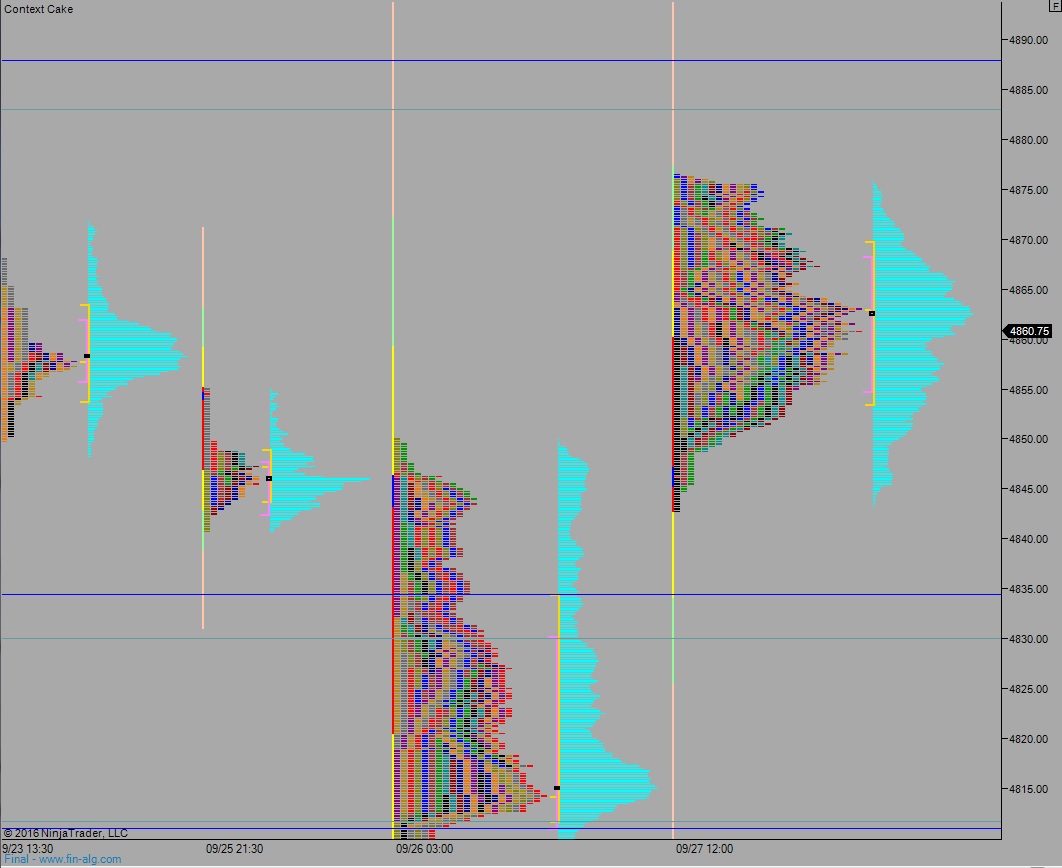

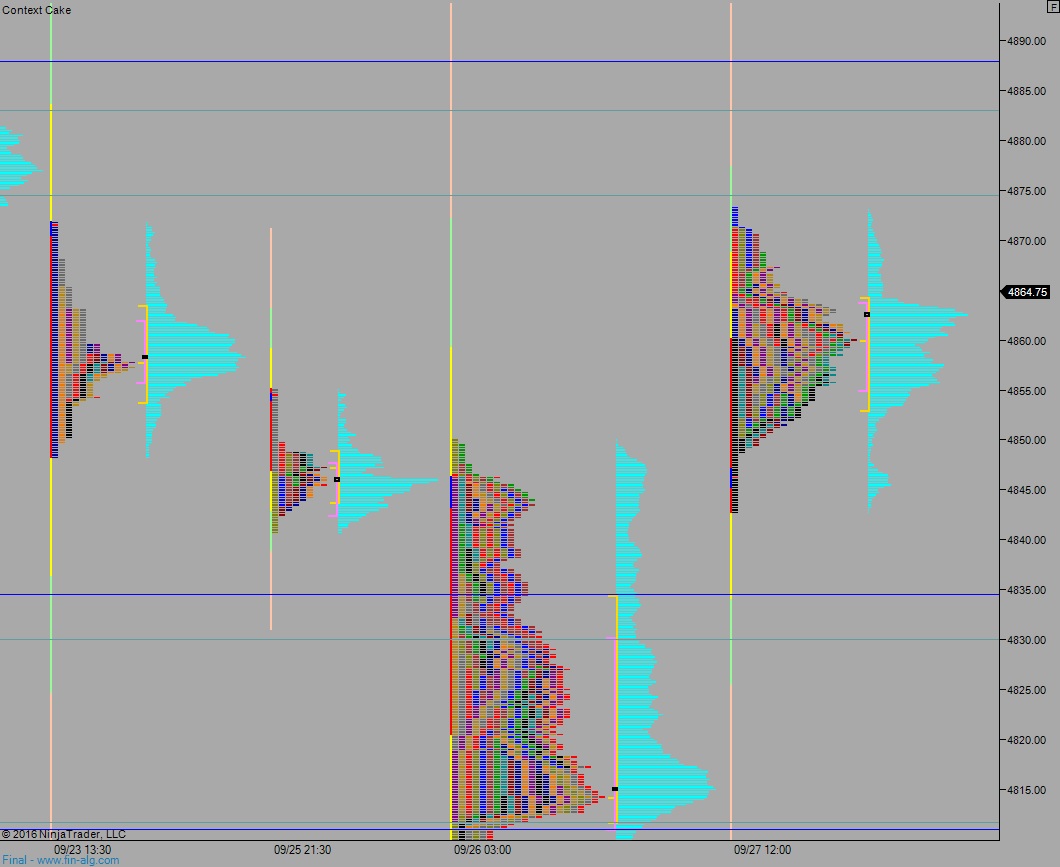

Levels:

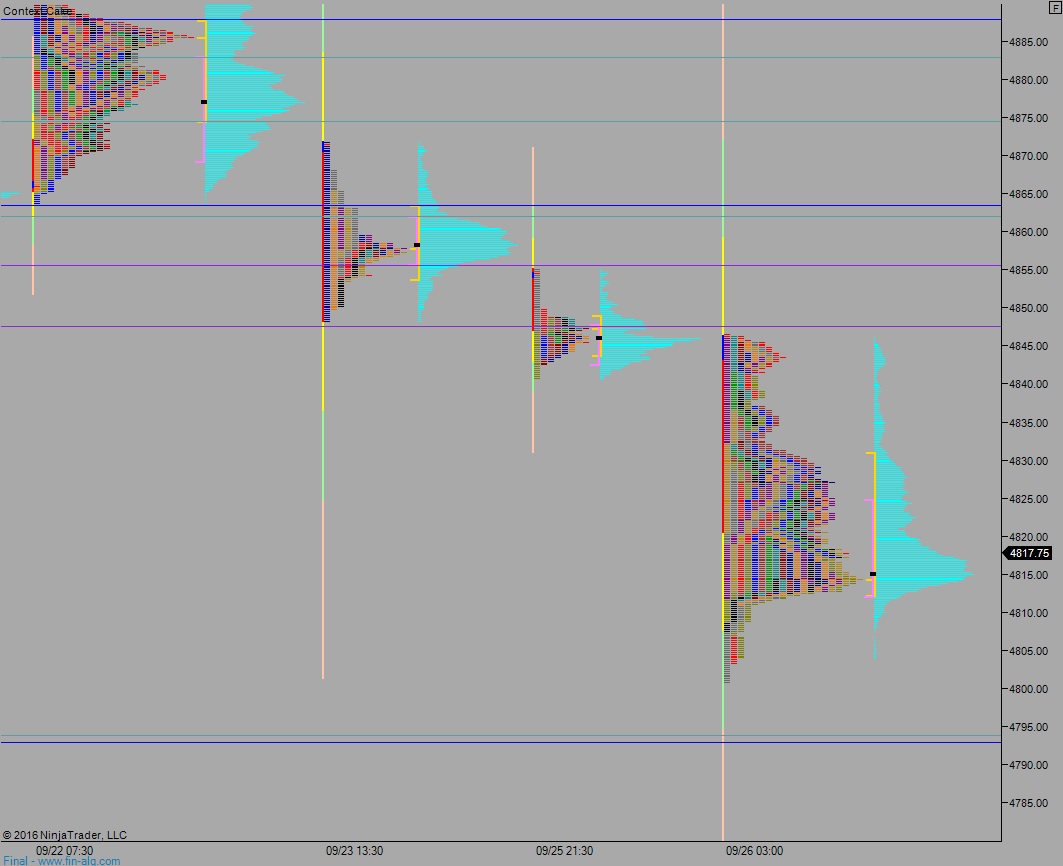

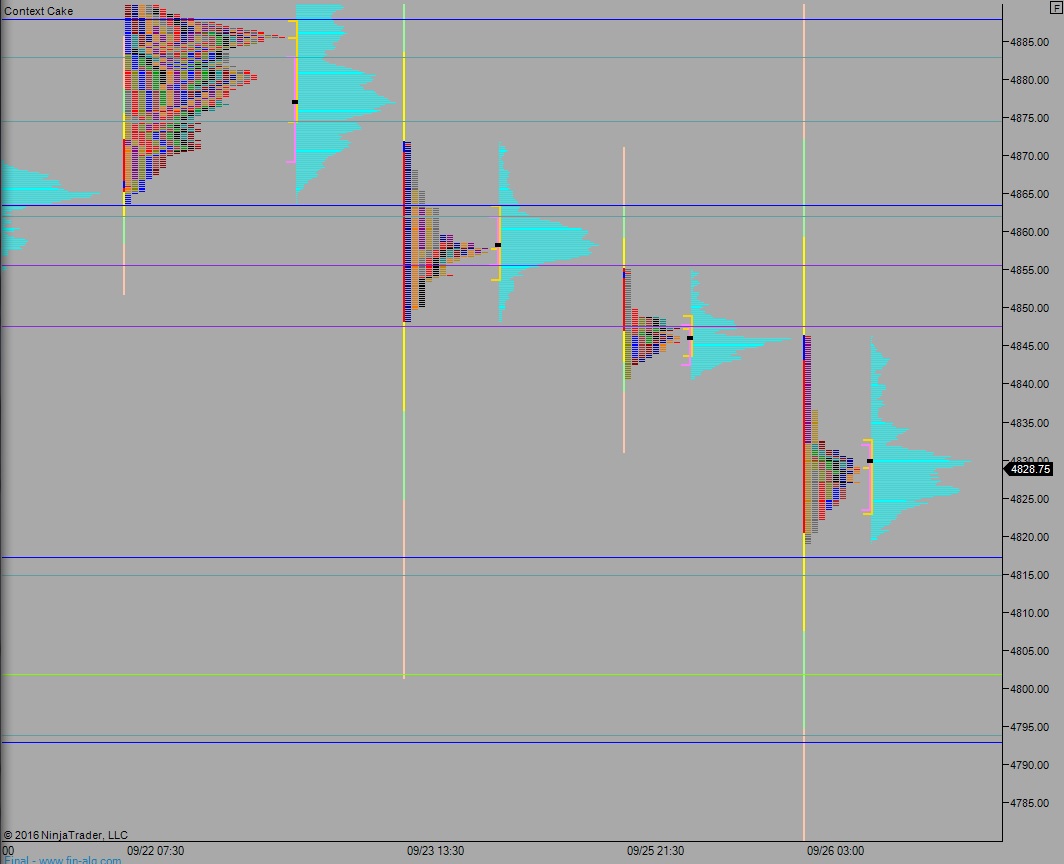

Volume profiles, gaps, and measured moves: