NASDAQ futures are coming into Wednesday gap down after an overnight session featuring normal range and volume. Price held Tuesday range on balanced trade. At 7am MBA Mortgage Applications were better than last week, and at 8:15am ADP Employment change was better than expected.

Also on the economic docket today we have Pending home sales at 10am and crude oil inventory at 10:30am.

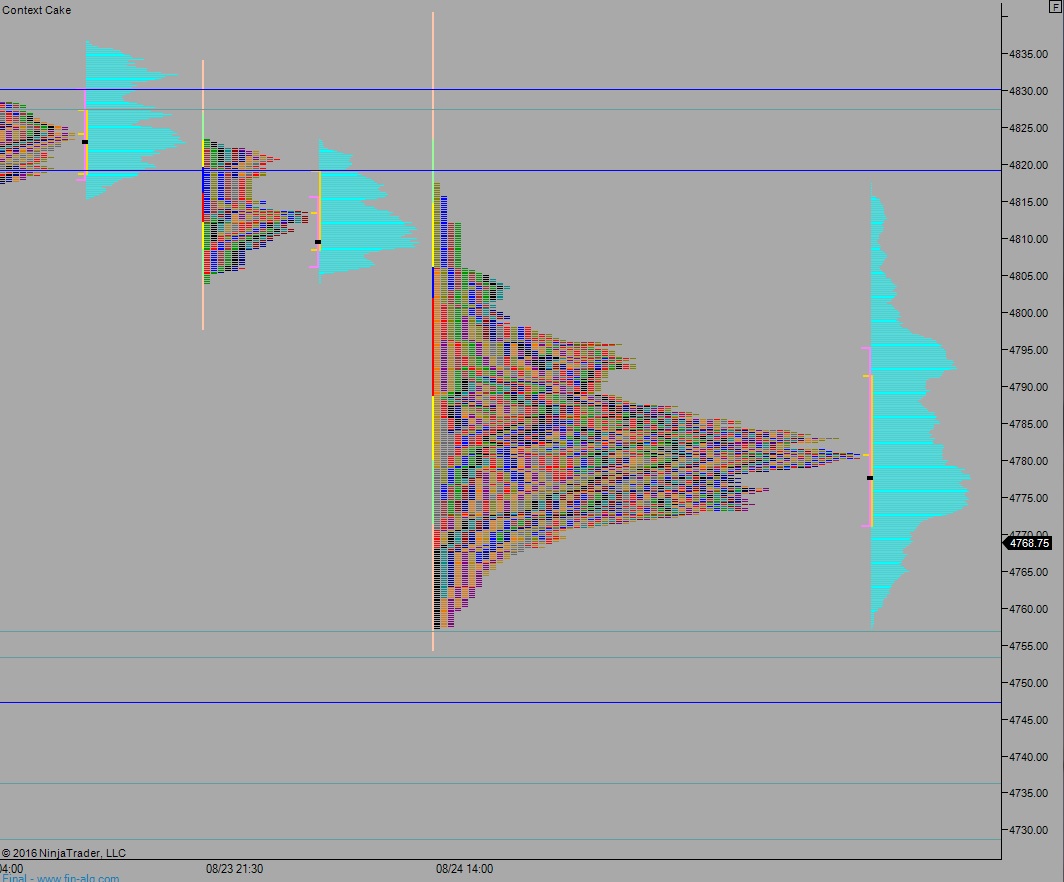

Yesterday we printed a normal variation down. Buyers drove up through the overnight inventory and quickly closed the gap down before stalling out at overnight high (to the tick) at 4798.50 and reversing. Sellers reversed the entire morning move and then printed an initiative rotation lower before responsive buyers stepped in ahead of last week’s low 4757.25.

Heading into today my primary expectation is for sellers to make a move down below yesterday’s low 4759.75 which sets up a test below last week’s low 4757.25. Look for responsive buyers up around 4753 and two way trade to ensue.

Hypo 2 buyers work into the overnight inventory and close the gap up to 4776.50 then take out overnight high 4779.50. Price chops around at the MCVPOC 4781 for the rest of the day.

Hypo 3 strong buyers push up though value, up through 4800, and seek to target 4819.25 before two way trade ensues.

Hypo 4 full on liquidation, price takes out 4753 setting up a move to target the open gap down at 4743.50.

Levels:

Volume profile, gaps, and measured moves:

Don’t think anybody is reading your hard work. They’re too busy listening for black helicopters and looking for false flags.

That’s why my levels continue to perform. I’ve done these reports for years, privately, so it’s no additional work on my behalf aside from attaching a headline/photo combo.

I know there are nuggets in those charts but must confess I don’t really understand them that well. Maybe a primer one day.

Don’t miss a day, lost without it.

Hypo 1, started buying around 4752 also naked POC from 08/04, stakes for dinner tonight.

we tested below last week’s low and the sellers vanished. Glad you’re working the edges alongside me sir.

those might go down hard unless charred.