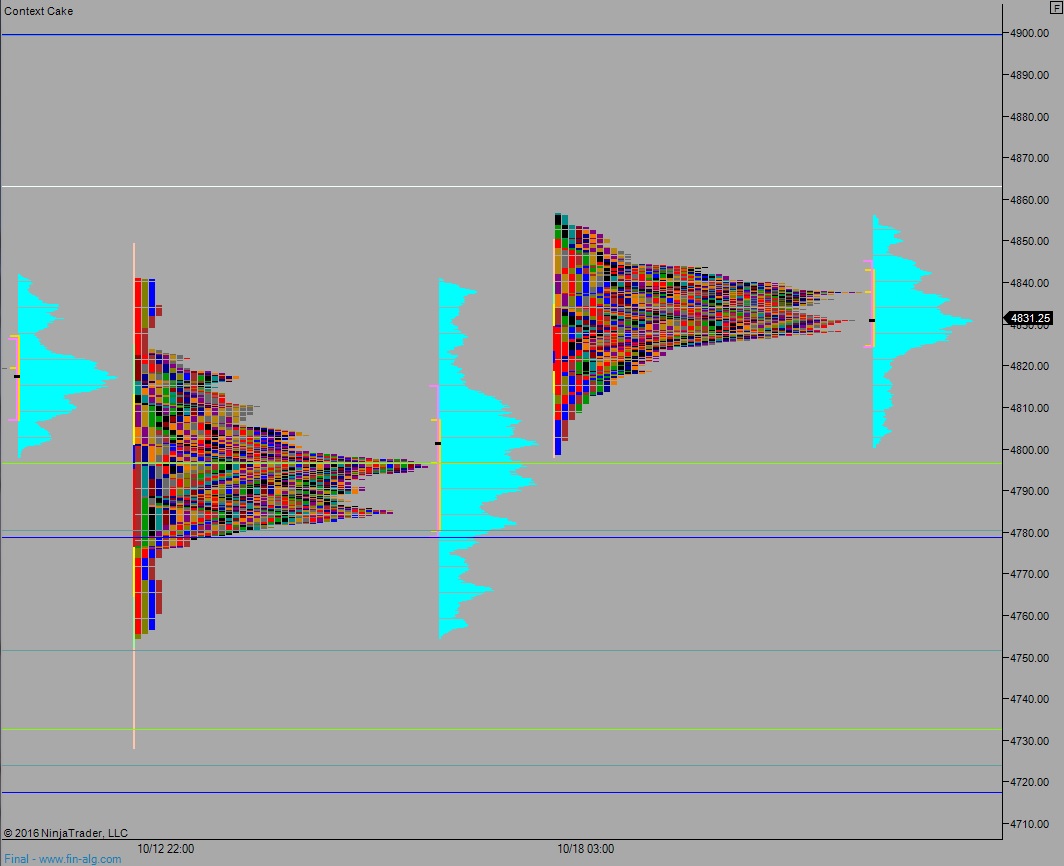

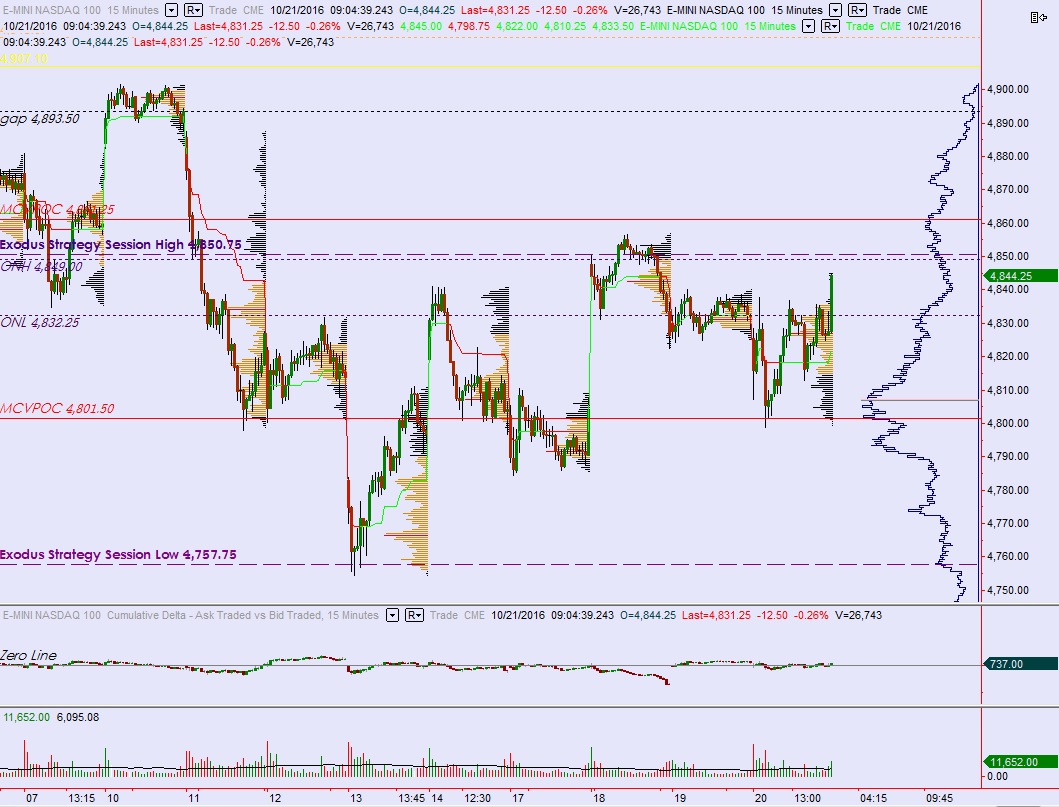

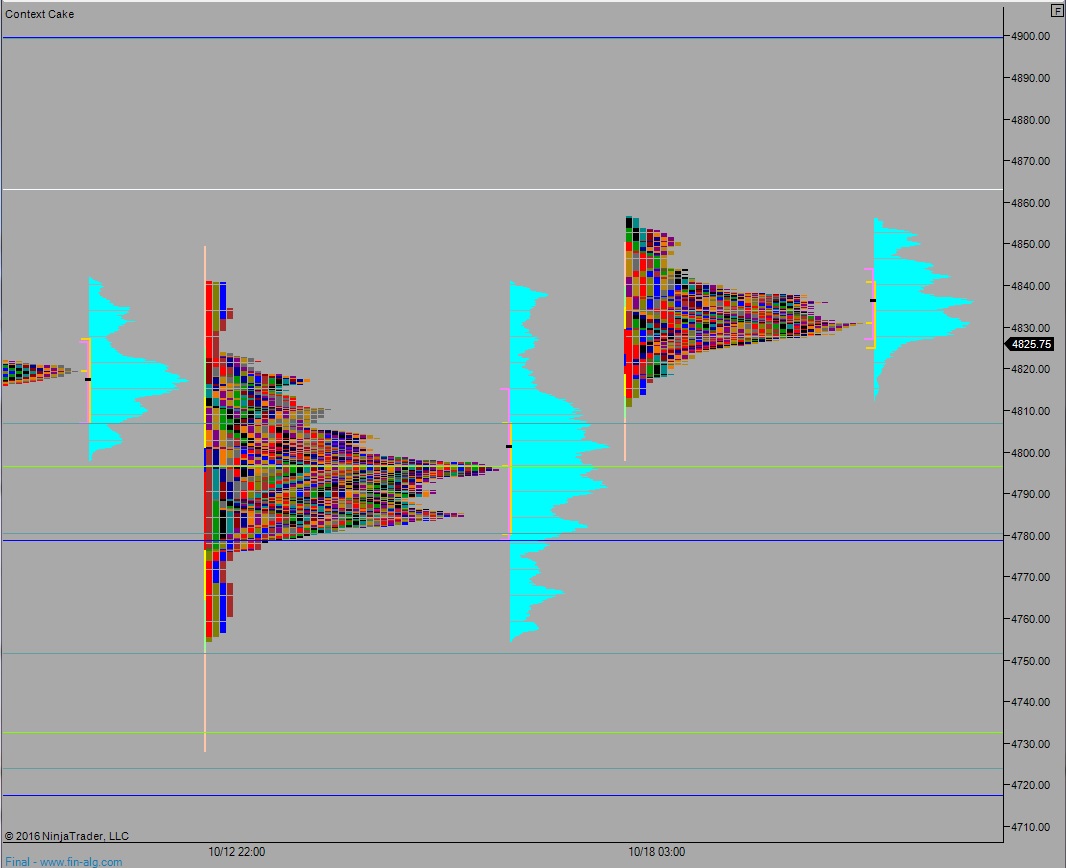

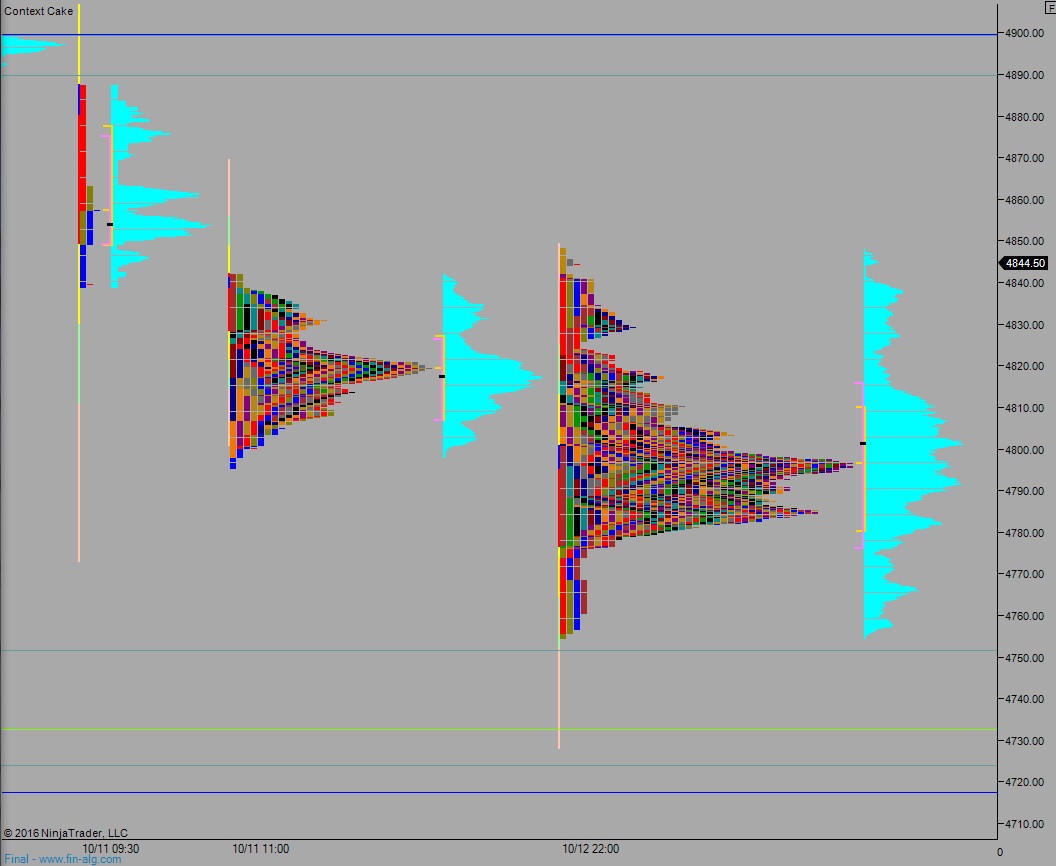

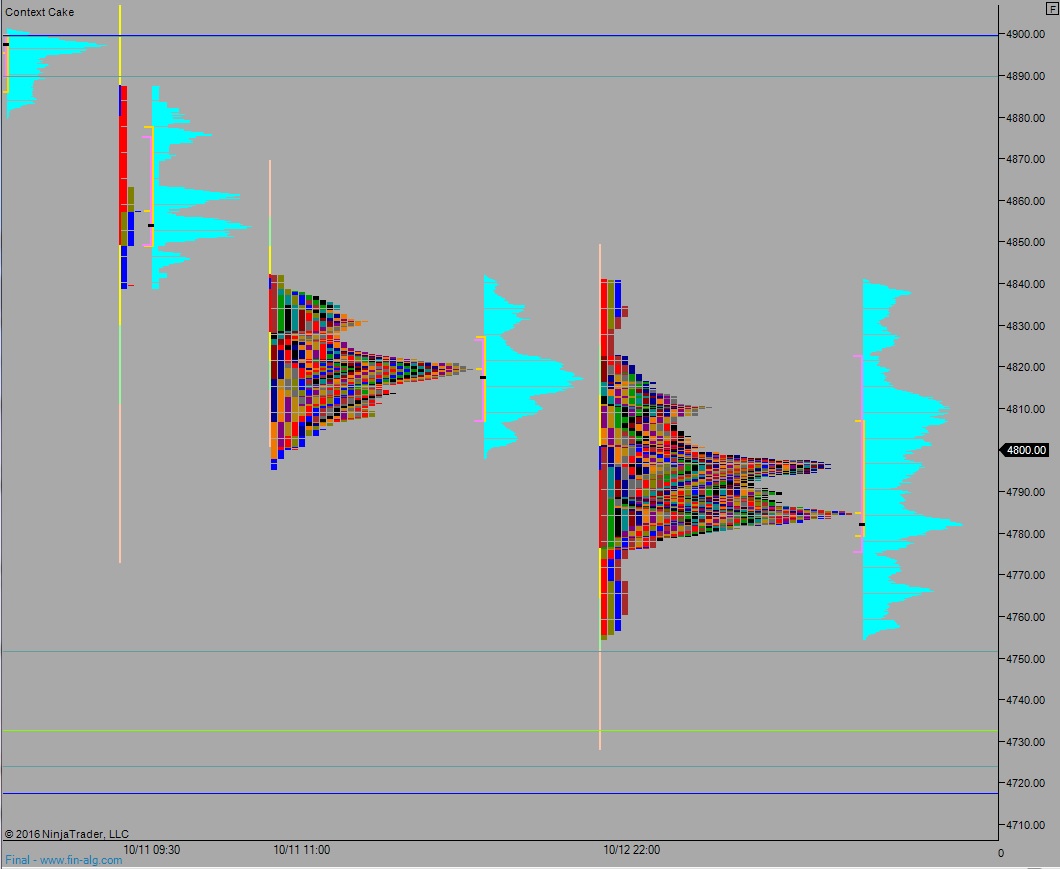

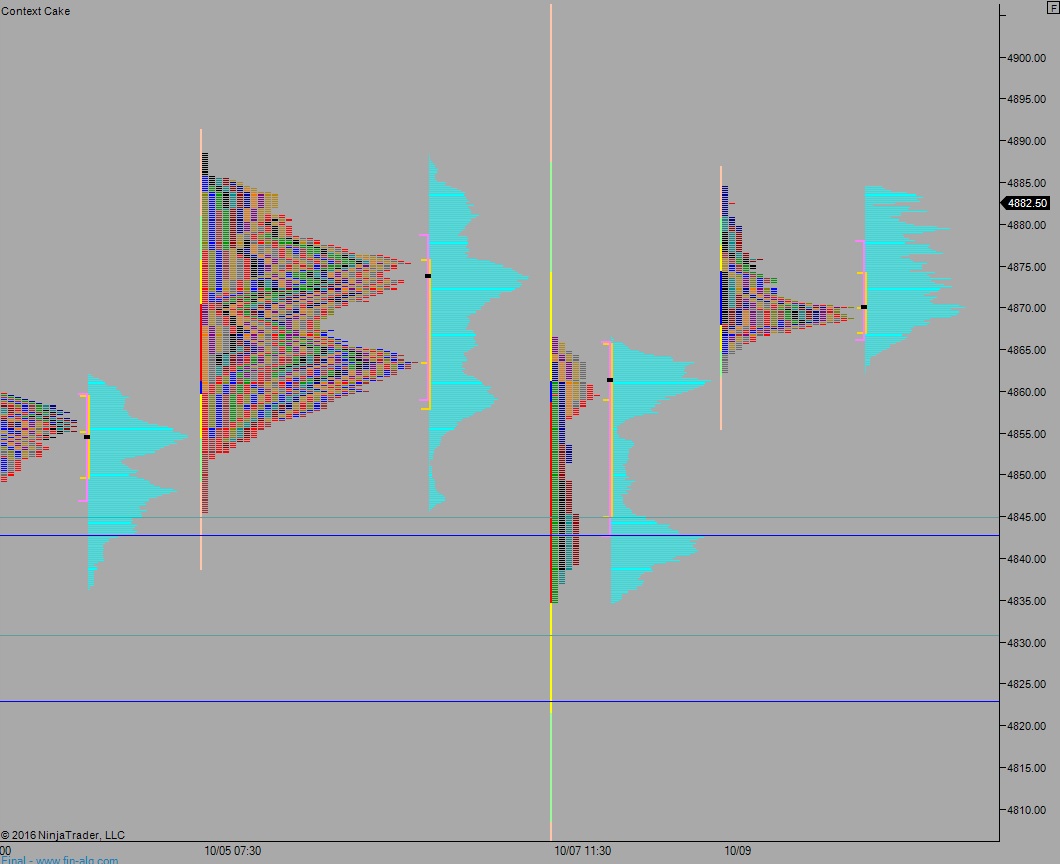

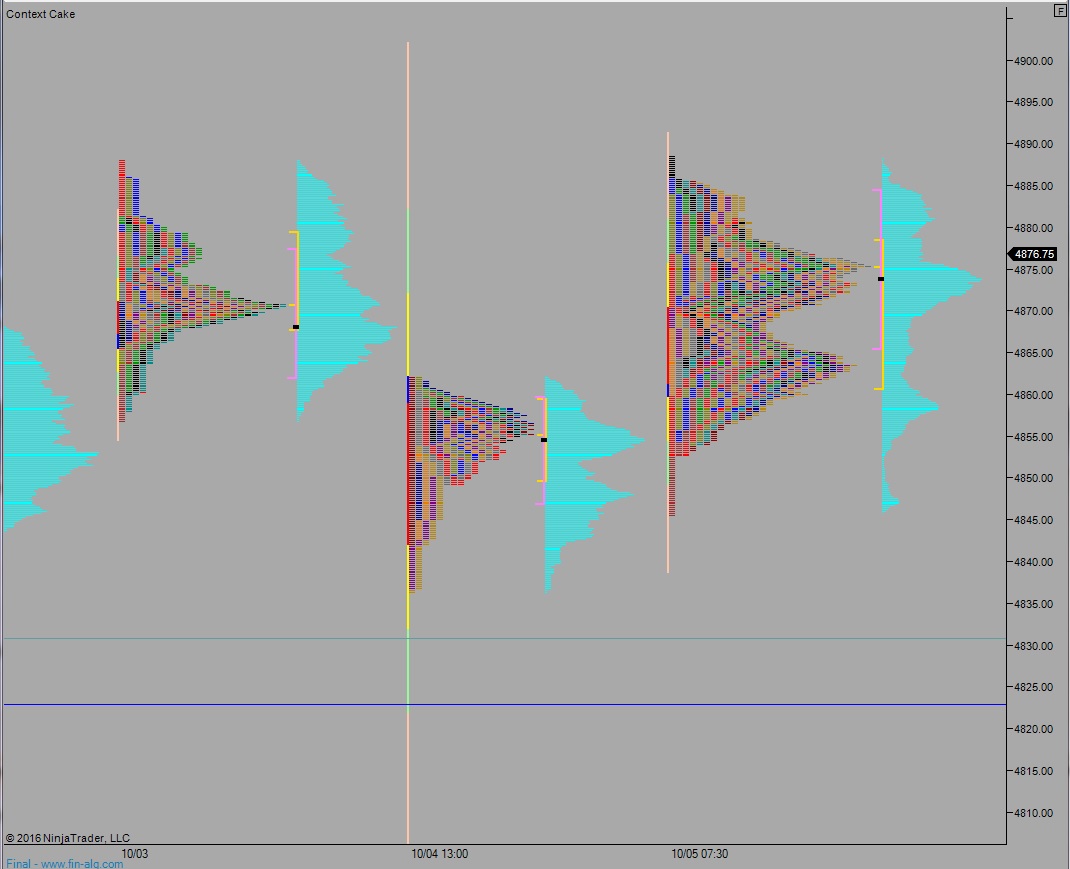

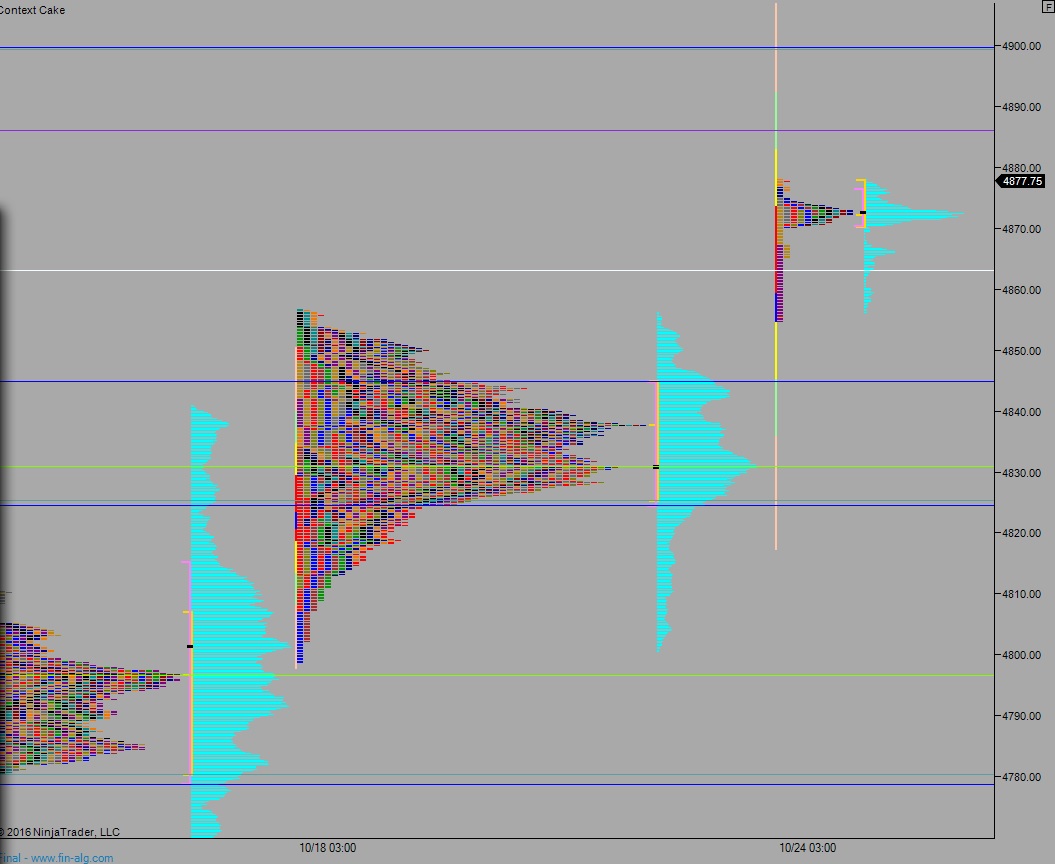

NASDAQ futures are coming into Monday gap up after an overnight session featuring normal range and volume. Price worked higher, up into single prints that stretch up to 4886.25. This ‘thin and fast’ zone is likely to be traversed quickly.

On the economic calendar today we have Market Manufacturing PMI at 9:45am and at 11:30am the US Treasury is auctioning off some 3- and 6-month T-bills.

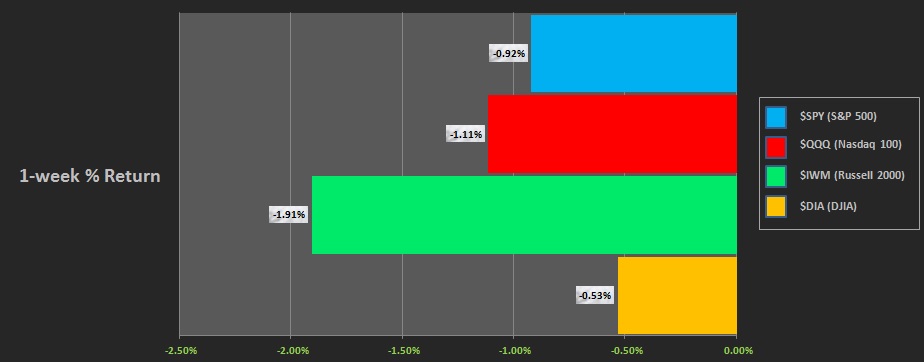

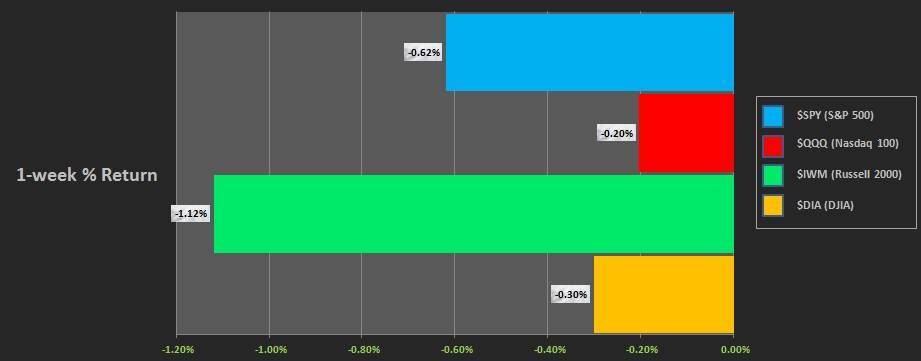

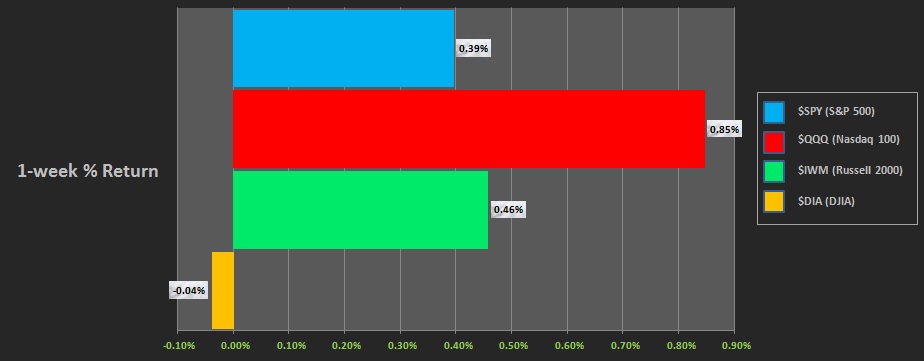

Last week the NASDAQ was strong while other indces were mixed. The Dow lagged behind and my catch up this week. Last week’s performance for each major index is below:

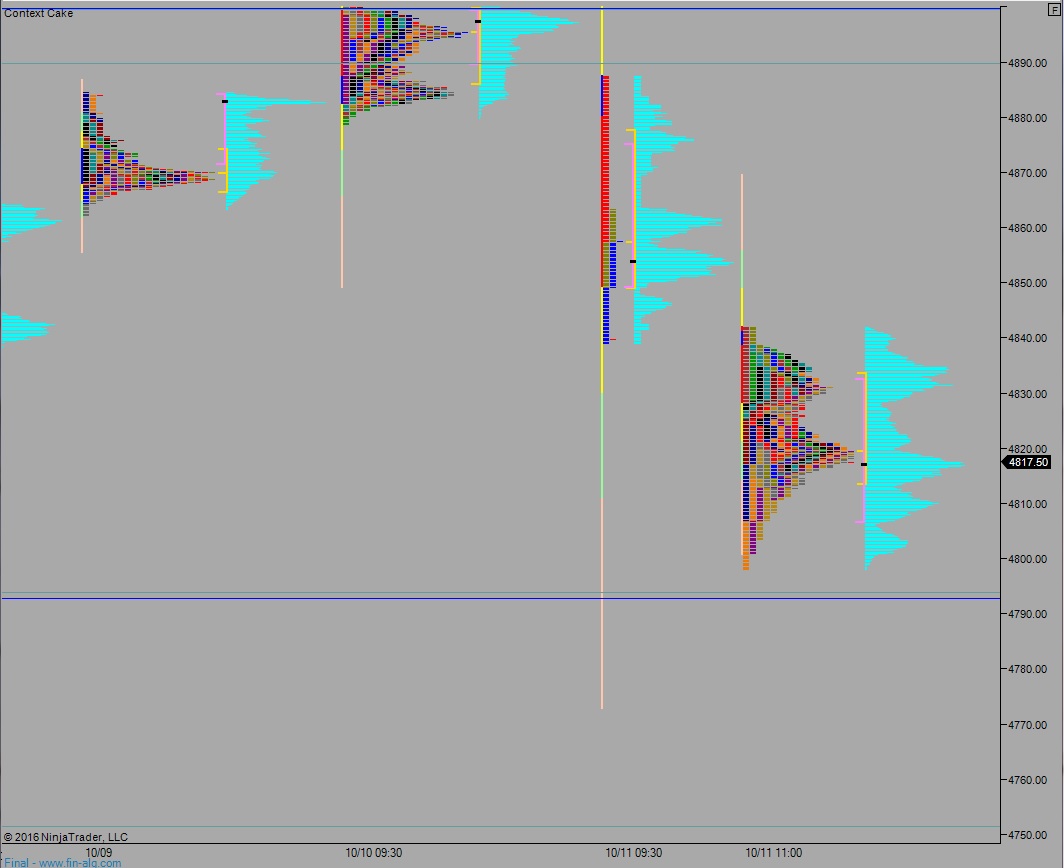

On Friday we printed a normal variation up. And early probe lower marked session low and we spent the rest of the day slowly working higher.

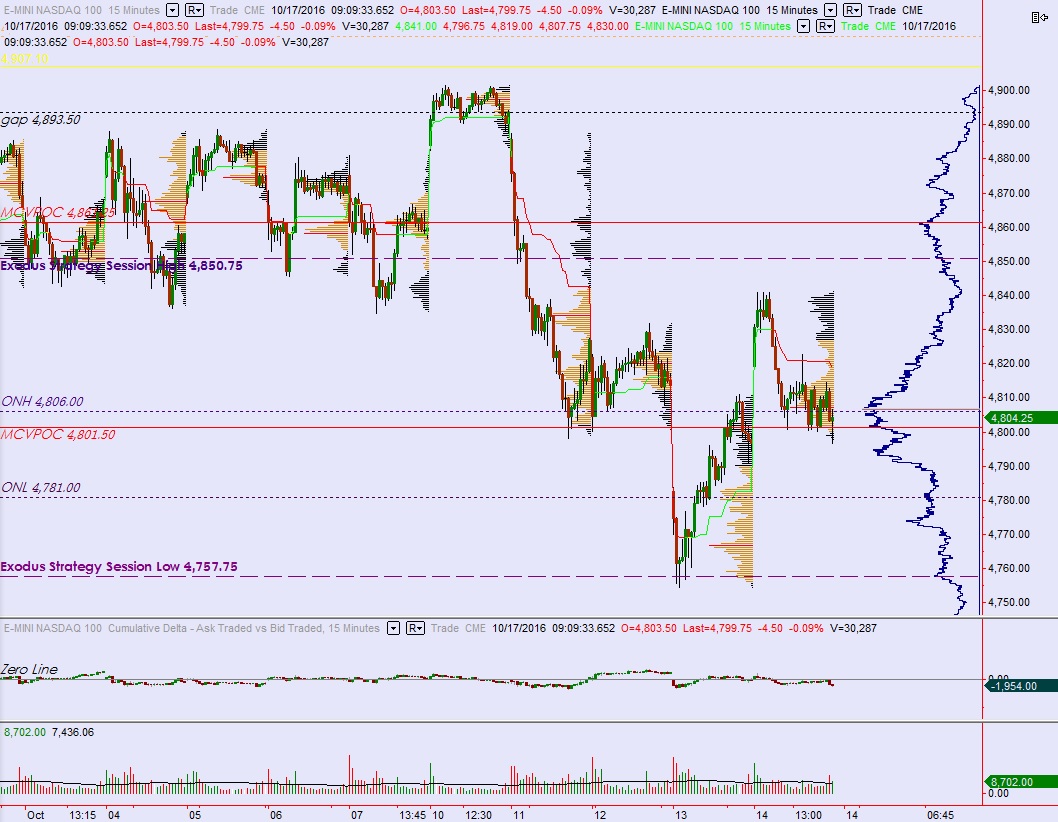

Heading into today my primary expectation is for a squeeze up to 4886 before two way trade ensues.

Hypo 2 squeeze pushes up to 4886.75 before two way trade ensues.

Hypo 3 sellers work into the overnight inventory and close the gap down to 4843.25 then take out overnight low 4842.75 before two way trade ensues.

Levels:

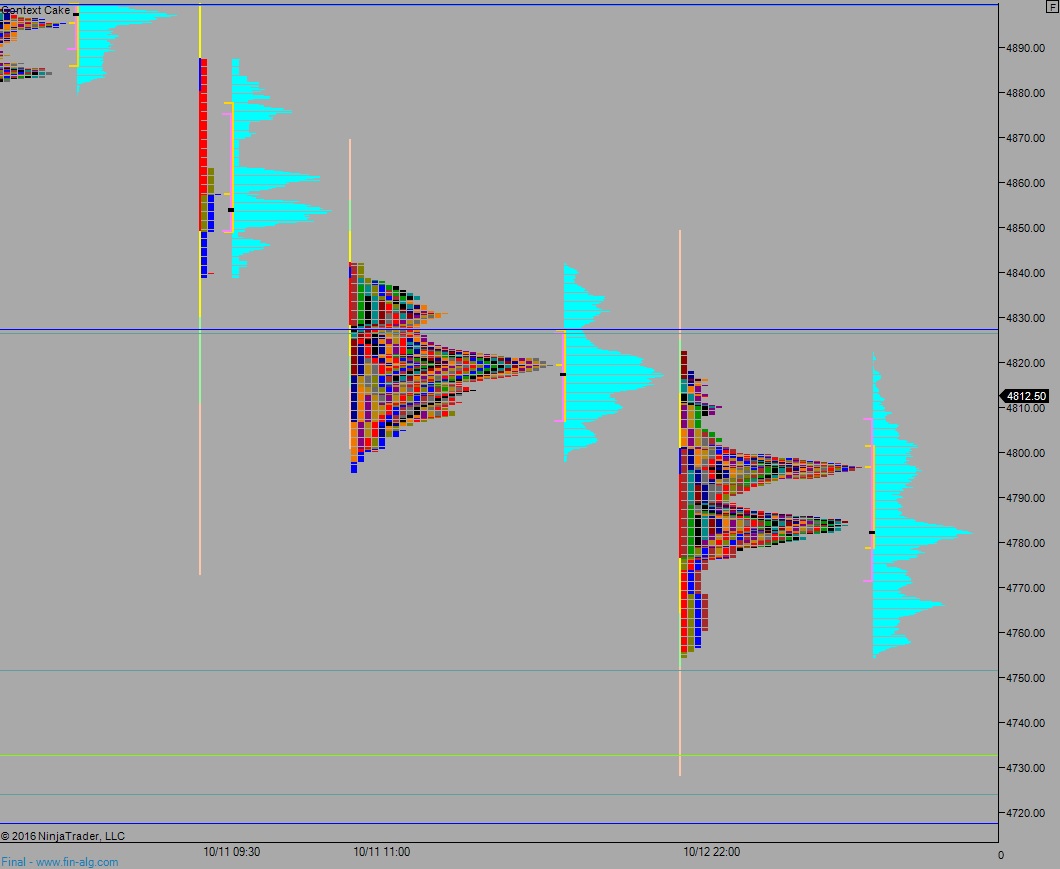

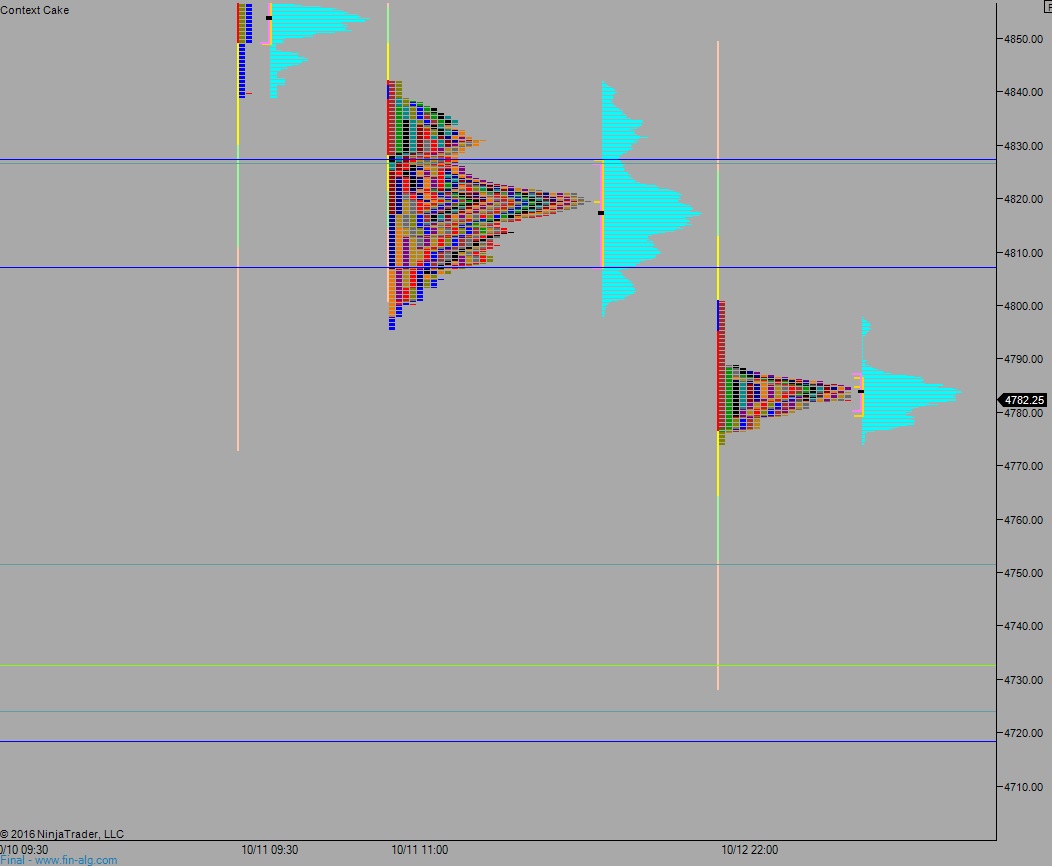

Volume profiles, gaps, and measured moves: