NASDAQ futures are coming into Wednesday gap down after an overnight session featuring normal range and volume. Price held the lower-mid of Tuesday’s range on balanced trade. At 7am MBA mortgage applications came in much lower than last week.

Also on the economic docket today we have both a 3- and 10-year Note auction at 1pm. Then at 2pm the Fed Releases Minutes from Sept. 20-21 FOMC Meeting.

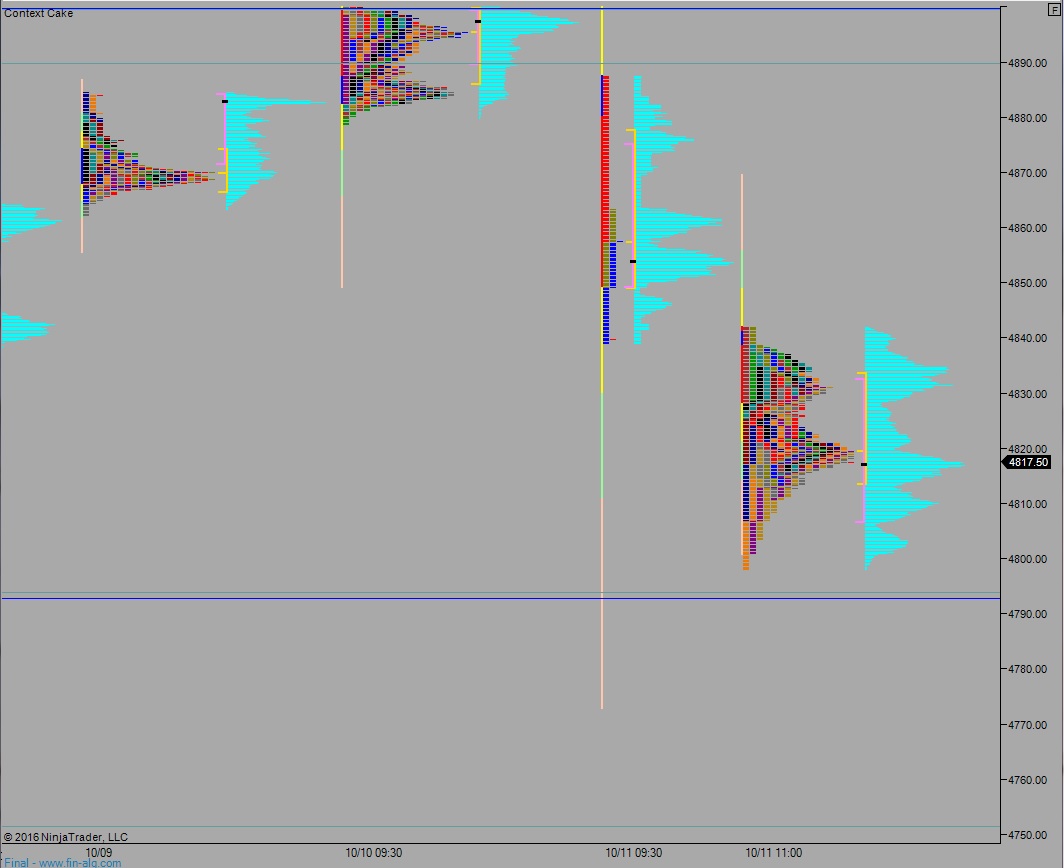

Yesterday we printed a trend down. Sellers drove price lower after opening near Monday’s low. The higher time frame actively pressed through several areas of local support, briefly pausing at the Monday gap 4859.50 before a second and third rotation lower. Responsive buyers showed up at the MCVPOC from our prior balance, down at 4801.50 before a sharp ramp higher into the bell.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 4827. Look for buyers to take out overnight high 4842 before two way trade ensues.

Hypo 2 sellers work down through overnight low 4808.50 and target 4793.75 before two way trade ensues.

Hypo 3 strong selling continues, pressing the market down to 4751.50 before two way trade ensues.

Hypo 4 strong buying pushes up through 4850 triggering a fast, v-shaped bounce back up to 4889.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: