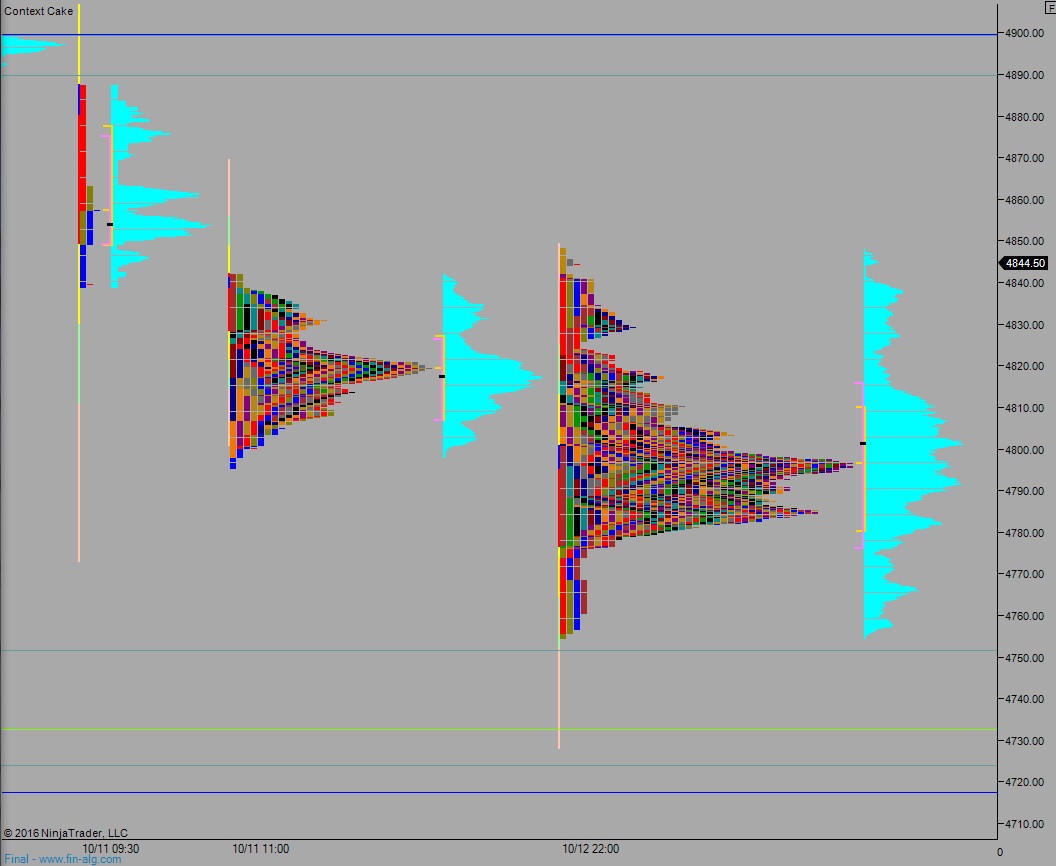

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring abnormal range on normal volume. Price steadily trended higher overnight, testing up into the conviction selling day from Tuesday of last week. At 8:30am Consumer Price Index came in below expectations, ex. food and energy.

Also on the economic calendar today we have the NAHB Housing Market Index at 10am and a 4-week T-Bill auction at 11:30am. Intel and Yahoo report earnings after market close.

Yesterday we printed a normal day. These rare prints occur when the first hour of trade is so dynamic, so OTF active, that the rest of the day cannot exceed the wide range of the initial balance. At the end of the day, after a tight balance that slowly worked toward session low, earnings from Netflix and IBM put a strong bid into the market.

Heading into today my primary expectation is for a gap and go trend up. Look for a quick move up to the MCVPOC at 4861 before sellers step in and two way trade ensues.

Hypo 2 sellers work into the overnight inventory and test last Friday’s high 4841. They push down a bit lower, but buyers step in ahead of 4816 and two way trade ensues.

Hypo 3 strong sellers work down into overnight inventory, working a gap fill down to 4804 then taking out overnight low 4799.75. Look for buyers down at 4780.50 and two way trade to ensue.

Hypo 4 stronger trend up works up to the open gap at 4893.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: